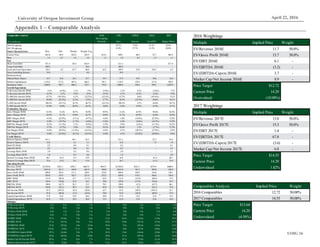

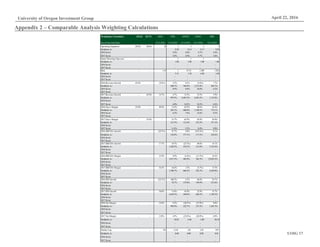

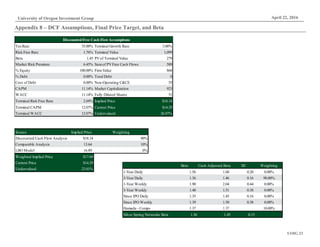

Silver Spring Networks is a leader in the Internet of Things space focused on smart metering and grid infrastructure. They have the leading smart grid networking platform due to their innovation. Their upcoming 5th generation platform will allow them to expand into new areas like smart cities and offer more services to drive recurring revenue. Recent large deals in India and with Con Edison show their ability to expand internationally where grid development is needed. They are rated Outperform with a price target above the current stock price, recommending investors buy the stock.