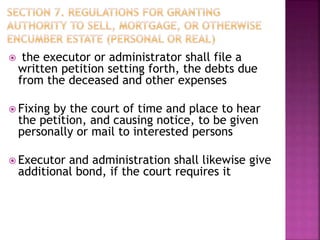

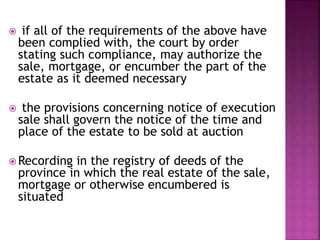

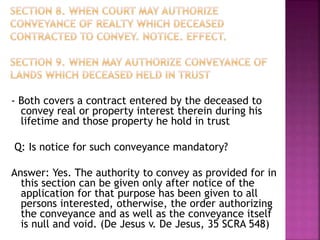

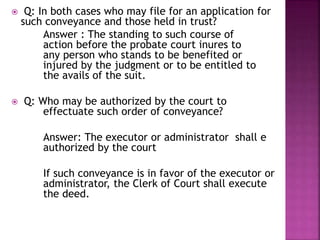

- The document discusses the rules regarding the sale, mortgage, or encumbrance of a decedent's estate under Philippine probate law.

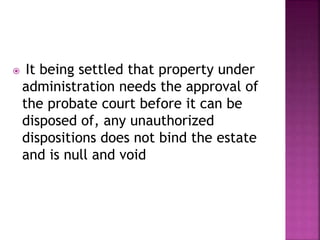

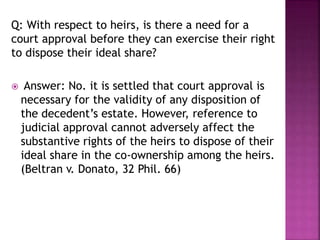

- It states that court approval is required for any disposition of property under administration, and failure to provide notice to interested parties makes any such transaction void.

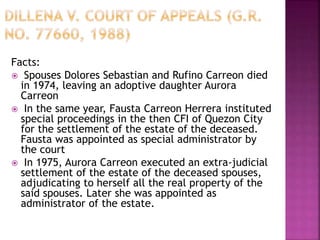

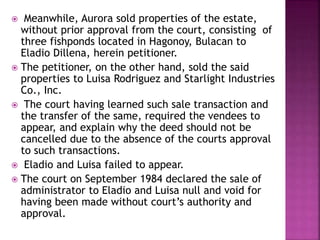

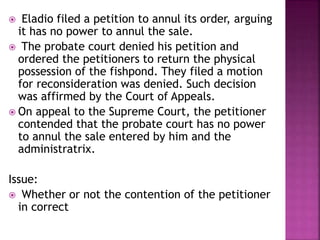

- It also addresses a specific case where an administratrix sold estate property without court authorization, which the Supreme Court upheld the probate court's power to annul as a null and void transaction.