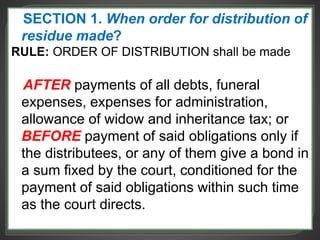

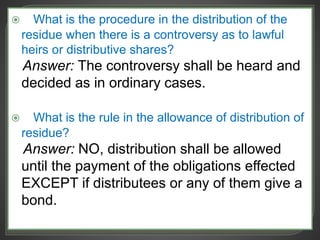

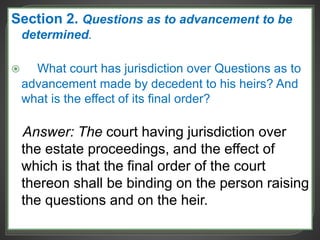

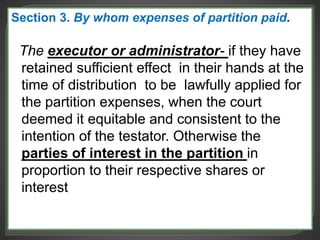

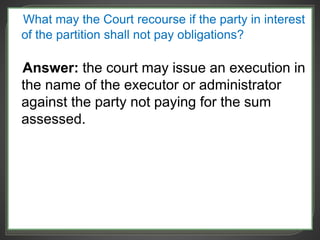

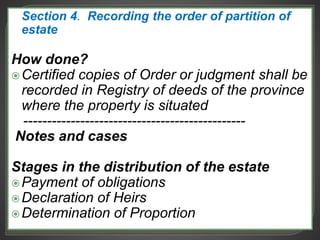

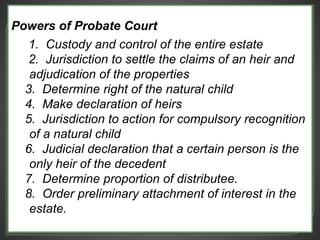

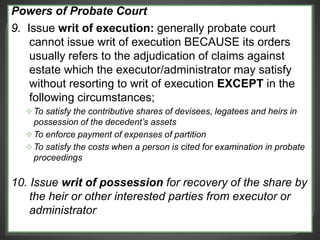

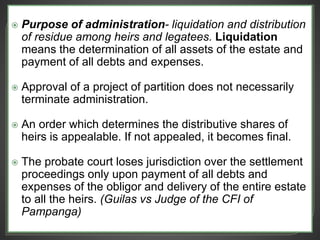

The document discusses the procedures for distributing the residue of an estate. It states that distribution shall be made after paying all debts, expenses, taxes, and allowances, unless distributees post a bond to cover those obligations. It also discusses the probate court's powers to determine heirs, claims, and distributees' shares. The final order of the probate court on questions such as advancements to heirs is binding.