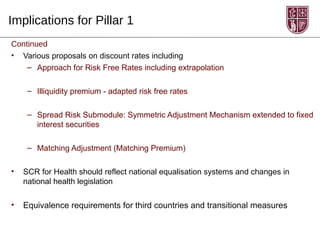

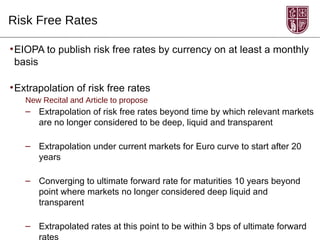

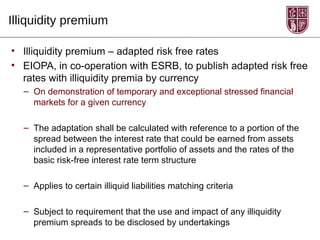

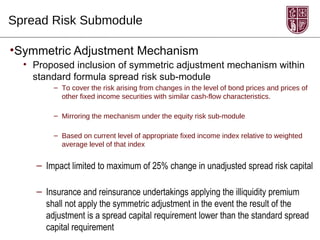

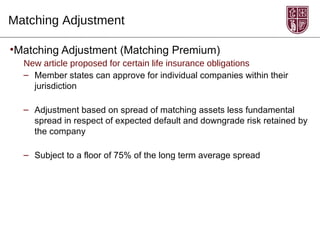

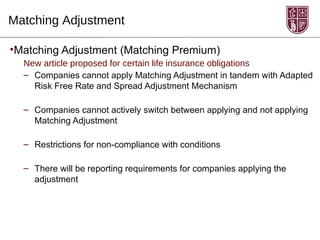

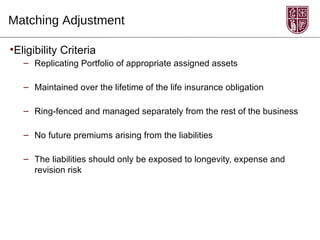

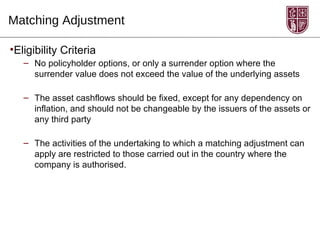

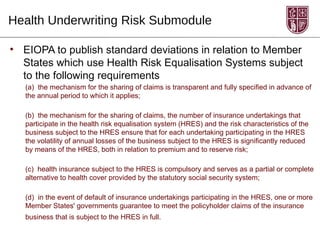

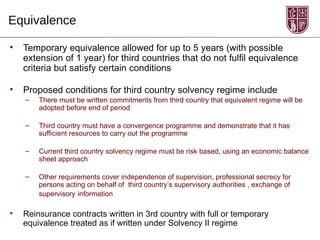

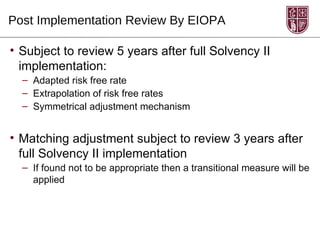

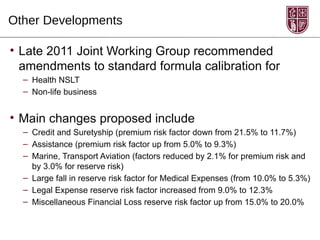

The document discusses the latest developments regarding Solvency II Pillar 1, highlighting key implications from the European Parliament's report on the omnibus II directive, including changes to risk-free rates, illiquidity premiums, and various adjustments for health underwriting risks. Key topics include new capital requirements for counterparty default risk, symmetric adjustment mechanisms for spread risk, and eligibility criteria for matching adjustments in life insurance obligations. Additionally, it outlines transitional measures for third country equivalence and reviews to be conducted post-implementation of Solvency II.