This document discusses strategic analysis and choice as important components of strategic management implementation. It provides an overview of strategic analysis, which involves evaluating internal strengths and external environmental factors. Key techniques for strategic analysis mentioned include ETOP (Environmental Threat and Opportunity Profile) analysis and Porter's Five Forces model. The document then covers strategic choice, which involves understanding stakeholder expectations, identifying strategic options, and selecting the optimal choice. Factors considered in strategic analysis and choice include both internal capabilities and external political, economic, technological, and competitive landscapes. Overall, the document outlines frameworks and techniques used to conduct strategic analysis that informs strategic choice and implementation.

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 4

✓ Computer Information Systems

✓ Research and Development

Key External Factors

✓ Political/Governmental/Legal

✓ Economy

✓ Technological

✓ Social/Demographic/Cultural/Environmental

✓ Competitive

✓ Techniques Used in Strategic Analysis

THE FOLLOWING DEVICES OR TECHNIQUES ARE USED IN THE PROCEDURE OF

STRATEGIC ANALYSIS & CHOICE, THEY ARE –

Strategic analysis and choice of strategies are done with the help of a number of techniques. If the

appropriate strategy is chosen, a company would become more efficient to establish sustainability in

competitive advantage and maximize firm valuation.

They are -

ENVIRONMENTAL THREAT AND OPPORTUNITY PROFILE [ETOP]

There are many techniques available for environmental appraisal (assessment), one such technique

suggested by Glueck is ETOP the preparation of ETOP involves dividing the environment into different

sectors & then analyzing the impact of each sector on the organization. The preparation of an ETOP provides

a clear picture to the strategists about which sectors & the different factors in each sector have a favorable

impact on the organization.

By the means of an ETOP, the organization knows where it ne stands with respect to its environment.

Obviously, such an understanding can be of a great help to an organizations in formulating strategies to take

advantage of the opportunities & counter the threats in its environment.

MEANING

ETOP is a device that considers environmental information & determines the relative impact of threats

& opportunities for the systematic evaluation of environmental scanning.

ETOP is an environmental analysis results in a mass of information expectations. Structuring of

environmental issues is necessary to make them meaning full of strategy related to forces in the environment.

They deal with events, trends, issues & formulation. In short, it is a technique to structure environmental

issues.

It is the process by which organizations monitor their relevant environment to identify opportunities &

threats affecting their business for p purpose of taking strategic decision.

WHY ETOP?

✓ Helps organization to identify O-T

✓ To consolidate and strengthen organization’s position

✓ Provides the strategists of which sectors have a favorable impact on the organization.

✓ Helps organization knows where its stands with respect to its environment.

✓ Helps in formulating appropriate strategy.

✓ Helps in formulating SWOT analysis.

PREPARING ETOP

✓ Dividing the environment in different sector.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-4-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 5

✓ Analyzing the impact of each sector on the organization.

✓ Subdividing each environmental sector into sub factor.

✓ Impact of each sub sector on organization in form of a statement.

ETOP, PROFILE INVOLVES:-

The profile is a technique of environment analysis was organizations make of profile of their external

environment. ETOP analysis provides information about environment threats & opportunities & their impact

on strategic opportunities for the company. The profile contains mainly 3 issues, they are-

1] Forecasting:-

Forecasting means predicting the future events & analyzing their impact on present plans business

organizations analyze the environment but applying various techniques to forecast government is used to

formulate business plans & strategies.

2] Verbal Written information:-

Verbal information is collected but hearing & written information is collected by reading articles,

journals, newspaper, newsletters etc.., common sources of information are radio, television, workforce,

outsiders. It informs changes in the environment & prepares business organization to incorporate than in their

business plans & strategies.

3] Management Information System [MIS]:-

It is a formal method of making available to management to management the accurate & timely

information necessary to facilitate the decision making proceeds & enable the organization planning, control

& operational functions to be carried out effectively. It helps in making decisions based on future

environment.

The profile involves,- Environment, Threats & Opportunities Profile

A] ENVIRONMENTAL FACTORS

It presents the impact of each environmental factor like economic, political & social on the

organization. The important factors are as follows,-

1] Economic factors:

✓ General economic condition.

✓ Rate of inflation.

✓ Interest rate/Exchange rate

2] Technological factors:

✓ Source of technology.

✓ Technological development.

✓ Impact of technology

3] Socio cultural factors:

✓ Demographic characteristics.

✓ Social attitudes.

✓ Education level, awareness, and

consciousness of rights.

4] Environmental factors:

✓ Weather change

✓ Climatic change.

✓ Demand related factors.

✓ Suppliers related factors.

5] Political factors:

✓ Political system.

✓ Political structure, its goals and stability.

✓ Government policies , degree of intervention

6] Legal factors:

✓ Policies related to licensing , monopolies.

✓ Policies related to export and import.

✓ Policies related to distribution and pricing.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-5-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 6

Sl.No FACTORS COULD INVLOVE

1 Political international trade taxation policy

2 Economic interest rates, exchange rates, national income, inflation, unemployment, Stock

Market

3 Social ageing population, attitudes to work,

income distribution

4 Technological innovation, new product development, rate of technological obsolescence

5 Environmental global warming, environmental issues

6 Legal competition law, health and safety, employment law

B] THREAT MATRIX

The threats restrain them from entering into new business lines.

C] OPPURINITY MATRIX

The opportunity of the firm indicates new lines of the business.

HIGH

LOW

HIGH

LOW

ATTRACTIVENESS

PROBABILITY OF OCCURRENCE

ATTRACTIVENESS

HIGH

HIGH

LOW

LOW

PROBABILITY OF OCCURRENCE](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-6-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 7

ETOP: PROS AND CONS or ADVANTAGES / DISADVANTAGES

Pros

✓ Help to determine the key factor of threats and opportunities.

✓ Good tool to qualify the factors related to company’s strategy.

✓ Can consider many factors for each special case.

✓ It provides a clear of which sector & subsectors have favorable impact on the organization.

✓ It helps to interpret the result of environmental analysis.

✓ The organization can assess its competitive position.

✓ Appropriate strategies can be formulated to take advantage of opportunities & counter the threat.

Cons

✓ It doesn’t show the interaction between the factors.

✓ It can’t reflect the dynamic environment.

✓ It’s a subjective analysis tool

EXAMPLE : MILLIPORE COMPANY LTD, India

ABOUT MILLIPORE

Millipore is a multinational company, high technology, Bioscience Company that provides technologies,

tools and services for the development and production of new therapeutic drugs. The company, headquartered

in Bedford, England. It serves the worldwide life science research, biotechnology and pharmaceutical

industries. In India its subsidiary company was located in Bangalore.

MILLIPORE PRODUCT LINE

Life science, Drug discovery, Sample preparations, Lab water, Process development, Bio production, &

Process monitoring.

ETOP – Profile of the company

A] Environmental factor

Sl.no Factors Nature of

Impact

Impact of each sector

1 Economic •Fluctuation in exchange rate

•Increasing rate of inflation

•Worsening economic conditions

2 Technological •Market Leaders

Strong R&D program

•Better solution providers

•New “ Intergral”-2008

3 Political No significant change.

4 Legal Following FCPA (Foreign corrupt practices act).

Strict IPR laws – No poaching

5 Socio cultural No significance change](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-7-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 8

6 Competitive Competition particularly from low priced products.

7 Demand related Downfall in demand due to low priced products.

Containment of rising healthcare cost.

8 Governmental policies No excise duty, only vat for product manufactured in

India

- up arrows indicate favorable impact

- horizontal arrows indicate a neutral impact

- Down arrows indicate unfavorable impacts

B] Threat Matrix

1} Competition particularly from low priced

products.

2} Concentration majorly on big Fishes.

1} IPR laws are not so strong in INDIA.

2} Switching over form process patent to product

patent

3} Patent law not well defined

1} Expensive products.

2} Bad rapport with customers (unsatisfied

customer).

1} Lack of geographical division (remote areas).

2} Poor dealer network.

3} Low investment in marketing.

C] Opportunity Matrix

1} Market leaders – brand value and brand

awareness.

2} Special offers with OEM’s. (Agilent).

1} Provide customized protocol support.

2} Dedicated service team. (Toll Free numbers).

1} Large installation base.

2} New low budget product lines.

1} Saturation point of market is far away

2} New markets are opening

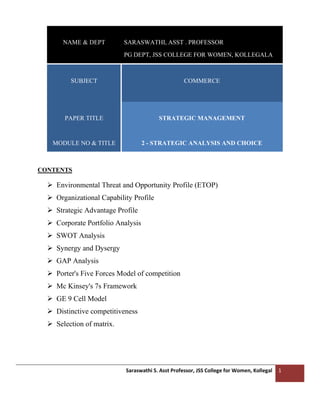

ORGANIZATIONAL CAPABILITY PROFILE [OCP]

Organizational capacity is the inherent capacity or potential of an organization to use its strength and

overcome its weakness in order to exploit opportunities and face threats its external environment. It is a

potential or capacity to perform better without capabilities resources are of no value.

Organizational capacity factors are strategic strengths and weaknesses existing in different functional

areas within an organization, which are of crucial importance to strategy formulation and implementation.

Any advantage a company has over its competitor - it can do something which they cannot or can do

better Opportunity for an organization to capitalize - low cost, Superior Quality, R&D skills etc](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-8-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 10

1] Financial capacity:

The factors relate to the availability, usages & management of funds & all allied aspects that have a

bearing on an organization’s capacity to implement its strategies.

(a) Sources of funds

(b) Usage of funds

(c) Management of funds

Some of important factors which influence the financial capacity of any organization are as follow:

✓ Factors related to usage of funds capital structure, procurement of capital, controllership, financing and

relationship with leaders, bankers and financial institutions.

✓ Factors related to management of funds financial, accounting and budgeting systems; management

control system, state of financial health, cash, inflation, credit, return and risk management; cost

reduction and control and tax planning and advantages

2] Marketing capacity

Marketing capability factors relate to the pricing, promotion and distribution of products or services,

and all the allied aspects that have a bearing on an organization's capacity and ability to implement its

strategies.

(a) Product related

(b) Price related

(c) Promotion related

(d) Integrative & Systematic

Some of the important factors which influence the marketing capacity of any organization are as follows.

✓ Product related factors: Variety, lit differentiation, mix quality, positioning, advantages, etc..

✓ Price related factors: pricing objective, policies, changes, protection, advantages, etc..

✓ Place related factors: distribution, transportation ad logistics, marketing channels , marketing

intermediaries, etc..

✓ Promotion related factors: Promotional tools, sales promotion, advertising public relations, etc.

✓ Integrative and systemic factors: marketing mix, market standing, company image, marketing

organization, marketing system, marketing management information system etc..

3] Operation capacity:

Operations capacity factors relate to the production of products or services, use of material resources

and all allied aspects that have a bearing on an organization's capacity and ability to implement its strategies.

(a) Production system

(b) Operation & Control system

(c) R&D system

Some of the important factors which influence the operations capacity of an organization are as follows:

✓ Production system: capacity, location, layout product or service design, work systems, degree of

automation, extent of vertical integration, etc..

✓ Operations and control system: aggregate production planning, material supply, inventory, cost and

quality control, maintenance systems and procedures etc..

4] Personal capacity:

Personal capacity factors relate to the existence and use of human resources and skill, and all

organization’s capacity and ability to implement its strategies.

(a) Personnel system

(b) Organization & employee characteristics](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-10-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 11

(c) Industrial Relations

Some of the important factors which influence the personal capacity of any organization are as follows.

✓ The personal system: systems for manpower planning, selection, development, compensation,

communication and appraisal, position of the personnel department within the organization, procedures

and standards etc..

✓ Organizational and employees characteristics: Corporate image, quality of managers, staff and

workers perception about and image of the organization as an employer, availability of developmental

opportunities for employees, working conditions, etc..

✓ Industrial relations: union management relationship, collective bargaining, safety, welfare and

security, employee satisfaction and morale, etc..

5] Information management capacity:

Information management capacity factor relate to the design and management of the flow of

information from outside into, and within an organization for the purpose of decision-making and all allied

aspects that have a hearing on an organizations capacity and ability to compliment its strategies.

(a) General Management Systems

(b) External Relations

(c) Organization climate

Some of the important factors which influence the Information management capacity of any organization are

as follows.

✓ Acquisition and retention of information

✓ Processing and synthesis of information

✓ Retrieval and usage of information

✓ Transmission and dissemination

6] General Management capacity:

General management capacity relates to the integration, coordination and direction of the functional

capabilities towards common goals and all allied aspects that have a bearing on an organization capacity and

ability to implement its strategies.

Some of the important factors which influence the general management capacity of any organization are as

follows.

✓ General management system

✓ General managers

✓ External relationship

PROFILE OF OCP

The OCP is drawn in the form of a chart, the strategists are required to systematically assess the

various functional areas & subjectively assign values to different functional capacity factored & sub factor as

long a scale ranging from values of -5 to +5.

You to draft the profile, 1st

identify the capability that are important to your customer & that

differentiates you from competitors & then incorporate them in a presentation or document.

1] Customer focus:-

Your capability profile must incorporate the information customers & prospects need, when

they are evaluating your company as a potential supplier or business partnered customers need to know about

your current capability current capability & your future direction. They want to know that you have the

technical expertise & market understanding to supply quality products that meet their performance

requirement.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-11-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 12

2] People:-

The skills & knowledge of your people represent an important part of your organizational

capability. Describe the qualifications & experience of key staff, together with any outstanding achievement

such as awards for innovation, involvement with industry associations or leadership in a particular discipline,

the skills of your business partners also contribute to your capability.

3] Resources:-

Many other assets contribute to your organizational capability, including patents, products

manufacturing facilities, information systems & distribution network. Those assets differentiate you from

competitors, particularly if they are hard to match, customize the assets to your customers needs a customer

with sites in a number of different countries.

4] Stability:-

Stability is an important aspect of organizational capacity, you can build confidence in your

customers by demonstrating that you have a stable management team capable of managing your business

effectively.

METHODS & TECHNIQUES

Inclusive, long term:

✓ Financial Analysis - Ratio Analysis, EVA, ABC

✓ Key factor rating - Rating of different factors through different questions

✓ Value chain analysis

✓ VRIO framework

✓ BCG, GE Matrix , PIMS, McKinsey7S

✓ Balanced Scorecard

✓ Competitive Advantage Profile

✓ Strategic Advantage profile

✓ Internal Factor Analysis Summary

[A] FINANCIAL ANALYSIS

✓ Ratio Analysis

✓ Economic value added[ EVA]

o NOPAT (Net Operating Profit After Tax)

o WACC (Weighted Average Cost Of Capital )

✓ Activity Based Costing[ABC]

o activity in Value chain

o specific activities

[B] VRIO FRAMEWORK

A resource is an asset, skill, competency or knowledge controlled by the corporation. A resource is

strength if it provides competitive advantage e.g. patents, brand name, economies of scale, idea-driven,

standardized mass production. It is an analytical technique brilliant for the evaluation of company’s resources &

thus the competitive advantage.

e.g. patents, brand name,

✓ Value: Does it provide competitive advantage?

✓ Rarity: Do other competitors possess it?

✓ Imitability: Is it costly for others to reproduce?

✓ Organization: Is the firm organized to exploit the resource?](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-12-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 13

VRIO - STEPS

1. Identify: firms resources- S&W.

2. Combine: firm’s strength into specific capabilities.

3. Appraise- profit potential, sustainable competitive advantage, ability to convert it to a profitable

proposition

4. Select strategy - firm’s resources& capability relative to external opportunity.

5. Identify: resource gaps and invest in upgrading weaknesses

[C] PIMS {BCG, GE Matrix, McKinsey7S – Refer below}

The Profit Impact of Market Strategies (PIMS) is a comprehensive, long-term study of the performance

of strategic business units (SBUs) in thousands of companies in all major industries.

The PIMS project began at General Electric in the mid-1960s. It was continued at Harvard University in

the early 1970s, and then was taken over by the Strategic Planning Institute (SPI) in 1975. Since then, SPI

researchers and consultants have continued working on the development and application of PIMS data.

According to the SPI, the PIMS database is- "a collection of statistically documented experiences drawn

from thousands of businesses, designed to help understand what kinds of strategies (e.g. quality, pricing,

vertical integration, innovation, advertising) work best in what kinds of business environments.

The data constitute a key resource for such critical management tasks as evaluating business

performance, analyzing new business opportunities, evaluating and reality testing new strategies, and screening

business portfolios.”

The main function of PIMS is to highlight the relationship between a business's key strategic decisions

and its results.

Analyzed correctly, the data can help managers gain a better understanding of their business

environment, identify critical factors in improving the position of their company, and develop strategies that

will enable them to create a sustainable advantage.

PIMS principles are taught in business schools, and the data are widely used in academic research. As a

result, PIMS has influenced business strategy in companies around the world

TOWS Matrix or Analysis

A TOWS analysis involves the same basic process of listing strengths, weaknesses, opportunities and

threats as a SWOT analysis, but with a TOWS analysis, threats and opportunities are examined first and

weaknesses and strengths are examined last. After creating a list of threats, opportunistic, weaknesses and

strengths, managers examine ways the company can take advantage of opportunities and minimize threats by

exploiting strengths and overcoming weaknesses.

[D] BALANCED SCORECARD

It has been proposed & popularized by Robert. S. Kaplan & David. P. Norton. It is a performance tool

which “provides executives with a comprehensive framework that translates a company’s strategic objectives

into a coherent set of performance measures”

The scorecard consists of 4 different perspective performance measures such as,-

✓ Financial perspective

✓ Customer perspective

✓ Internal business perspective

✓ Innovation & learning perspective](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-13-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 14

(1) Financial perspective

✓ Return on capital employed

✓ Cash flow

✓ Project profitability

✓ Profit forecast reliability

✓ Sales backlog

(2) Customer perspective

✓ Pricing index

✓ Customer satisfaction index

✓ Customer ranking survey

✓ Market share

(3) Internal business perspective

✓ Hours with customers on tender

success rate

✓ Rework

✓ Safety incident index

✓ Project performance index

✓ Project close out cycle

(4) Innovation & learning perspective

✓ % revenue from new services

✓ Rate of improvement index

✓ Staff attitude survey

✓ Employee suggestions

✓ Revenue per employee

PROBLEMS OF BALANCED SCORE CARD SOLVES

✓ Unclarified vision & strategy

✓ Non – alignment of long term & short term goals

✓ Measurement issues

✓ Communication gap

✓ Excessive focus on financial parameters

✓ Non availability of feedback

[E] COMPETITIVE ADVANTAGE PROFILE

The competitive profile matrix is a strategic analysis that allows you to compare your company to your

competitors, in such a way as to reveal your relative strengths & weaknesses. Inform your strategic decision

making. It compares a company & its rivals. The matrix reveals strengths & weaknesses for each company, &

critical success factors show areas of success or areas for improvement.

A superiority gained by an organization when it can provide the same value as its competitors but at a

lower price, or can charge higher prices by providing greater value through differentiation. Competitive

advantage results from matching core competencies to the opportunities. It is the reason behind loyalty, & why

you prefer one product or service over another.

There are 3 different types of competitive advantages that companies can actually use.

✓ Cost differentiation

✓ Product/Service differentiation

✓ Niche strategies

Advantages Disadvantages

✓ Forces organization to look ahead

✓ Improved fit with the environment

✓ Better use of resources

✓ Provides a direction/ vision

✓ Helps monitor progress

✓ Ensures goal congruence

✓ It can be time consuming & expensive

✓ It may be difficult in rapidly changing

markets

✓ It can become a straight jacket

✓ Some unplanned for opportunities

maybe missed

✓ It can become bureaucratic

✓ It is less relevant in a crisis.

[F] STRATEGIC ADVANTAGE PROFILE {Refer below}](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-14-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 15

[G] INTERNAL FACTOR ANALYSIS SUMMARY

It means Internal Factor Evaluation matrix, is a popular strategic management tool for auditing or

evaluating major internal strengths & internal weaknesses in functional areas of an organization or a business. It

also provides a basis for identifying or evaluating relationships among those areas.

An internal analysis is an exploration of your organizations competency, cost position & competitive viability in

the market place. Conducting an internal analysis often incorporates measures that provide useful information

about your organizations a SWOT analysis.

EXAMPLES OF ORGANIZATIONAL CAPABILITY PROFILE

1] Financial Capability

Bajaj - Cash Management

LIC - Centralized payment, decentralized collection

Reliance - high investor confidence

Escorts - Amicable relation with FIS (world's top-ranked technology provider to the banking industry)

2] Marketing Capability

Hindustan Lever - Distribution Channel

IDBI/ICICI Bank -Wide variety of products

Tata - Company / Product Image

3] Operations Capability

Lakshmi machine works - absorb imported technology

Balmer & Lawrie - R&D - New specialty chemicals

4] Personnel Capability

Apollo tyres - Industrial relations problem

5] General management capability

Malayalam Manaroma - largest selling newspaper

Unchallenged leadership - Unified, stable Best edited & most professionally produced

STRATEGIC ADVANTAGE PROFILE [SAP]

It is also known as SAP. It shows strength & weaknesses of an organization. Preparation of SAP is

very similar process to the ETOP.

SAP is a summary statement which provides an overview of the advantages & disadvantages in key

areas likely to affect future operations of a firm. It is a total for making systematic evaluation of strategic

advantage factors which are significant for the company in its environment.

SAP is the technique of analyzing the internal factor of the organization by preparing a critical picture

of different capacity factors. It is a relative strength of the company over its competitors.

Every firm has strategic advantage and disadvantages for,

Example

Large firm have financial strength but they tent to move slowly, compared to smaller firms, and often

cannot react to change quickly. No firm is equally strong in all its functions. In other words, every firm has

strength as well as weakness.

The strategists must be aware of the strategic advantages or strengths of the firm to be able to choose

of the best opportunity for the firm. On the other hand they must regularly analyze their strategic

disadvantages or weaknesses in order to face environmental threats effectively.

Example](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-15-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 16

The strategist should look to see if the firm is stronger in these factors than its competitors. When a

firm is strong in the market, it has a strategic advantage in launching new products or services & increasing

market share of present products & services.

There are generally 5 functional areas in most of the organizations. These areas are:-

✓ Marketing and Distribution

✓ R & D and Engineering

✓ Production and Operations management

✓ Corporate resources and personnel

✓ Finance and Accounting

1] Strategic advantage factors: Marketing and Distribution

1. Efficient and effective market research system

2. The product service mix: quality of product and service and service

3. Strong new - product and new- service leadership

4. Patent protection (or equivalent legal protection for life)

5. Positive feeling about the firm and its products and services on the part of the ultimate consumer

6. Efficient and effective packaging of products (or the equivalent for service)

7. Effective pricing strategy for products and services

8. Efficient and effective marketing promotion activities other than advertising

9. Efficient and effective service after purchase

10. Efficient and effective channel of distribution and geographical coverage, including internal efforts.

2] Strategic advantage factors: R & D and Engineering

1. Basic research capabilities within the firm

2. Excellence in product design

3. Excellence in process design and improvement

4. Superior packaging development being created

5. Improvement in the use of old or new materials

6. Ability to meet design goals and customer requirements

7. Trained and experienced technicians and scientists

8. Work environment suited to creativity and innovation

9. Well – equipped laboratories and testing facilities

3] Production and Operations management

4] Corporate resources and personnel [ 3, 4 & 5 refer OCP]

5] Finance and Accounting

DIFFERENT APPROACHES

The different approaches are there to develop as competitive advantage. In each of these approaches

the principal point is to avoid doing the same thing as the competition on the same bottle ground. So the

analyst needs to decide which of these approaches might be pursued to develop a sustainable distinctive

competence.

1] Key Success Factors (KFS):-

It is to compete based on existing strengths. The form can gain strategic advantage if it focuses

resources on one crucial point.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-16-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 17

2] Avoids head – on competition:-

The 2nd

approach is still based on existing strengths but avoids head on competition. The firm

must look at its own strength which are different or superior to that of the competition & exploit this relative

superiority to the fullest.

Ex- makes use of the technology; sales network & so on of those of its products which are not directly

competing with the products of competitors.

3] Unconventional Approach:-

To compute directly with a competitor, it is used for well established, stagnant industry. It may

be needed to upset the key factors for success that the competitor has used to build on advantage. The starting

point is to challenge accepted assumption about the way business is done & gain a novel advantage by

creating new success factors.

4] Means of Innovations:-

It can obtain by means of innovation which open new markets or result in new products. This

approach avoids head on competition but requires the firm to find new & creative strengths. Innovation often

involves market segmentation & finding new ways of satisfying the customer’s utility function.

PROFILE OF SAP

It shows in way of chart of each organizations strength & weaknesses on the basis of its different

factors. Here we prepare a profile about hoe our company is superior in comparison to other companies. Here

we are looking at the environmental aspects & preparing the strategy which can relate our strengths to our

opportunities. It enables us to focus on our competencies (strengths) & how to use them.

FUNCTIONAL AREA CORE FACTORS ( + ) or ( - )

Production & operation Good production facilities

Old plant & machinery

( + )

( - )

Personal factors Young & motivated force

Poor union relation

( + )

( - )

Finance & Accounting Tax holiday

Costly finance

( + )

( - )

Marketing operations Effective communication mix

Costly employees

Rich experiences in market

( + )

( - )

( + )

R & D & Engineering No design protection

Well developed laboratory

Highly qualified research staff

( - )

( + )

( + )

Organization system High tech MIS

Effective delegation & decentralization

No. MBE

( + )

( + )

( - )

EXAMPLE OF SAP

A picture of the more critical areas which can have a relationship of the strategic posture of the firm in

future of TATA DOCOMO

CAPABILITY

FACTORS

NATURE OF

IMPACT

COMPETITIVE STRENGTH / WEAKNESS

Marketing 1st

to launch 1paise/per second & applicable for both postpaid

& prepaid. Leveraging Tata indicom’s distribution channels.

Launched popular advertisement campaign “Keep it Simple

Silly” & hired Ranbir Kapoor as brand mascot.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-17-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 19

BALANCING THE PORTFOLIO

Balancing the portfolio means that he different products or businesses in the portfolio have to be

balanced with respect to 4 basic aspects-

✓ Profitability

✓ Cash flow

✓ Growth

✓ Risk

This analysis can be done by any of the following technologies, they are –

1] BCG MATRIX

2] GE 9 CELL MATRIX

[A] BCG MATRIX [BOSTON CONSULTING GROUP]

BCG means Boston Consulting Group, Matrix is developed by Bruce Henderson of the Boston

Consulting Group in the early 1970’s. It is also called as the “Growth Share Matrix”. This is the most popular &

simplest matrix to describe the corporation’s portfolio of businesses or products.

According to this technique, business or products are classified as low or high performance depending

upon their market growth rate & relative market share.

The BCG matrix helps to determine priorities in a portfolio in a product portfolio. Its basic purpose is to

invest where there is growth from which the firm can benefit, & divest those businesses that have low market &

low growth prospects.

✓ Enhances multi-divisional firm in formulating strategies

✓ Autonomous divisions = business portfolio

✓ Divisions may compete in different industries

✓ Focus on market-share position & industry growth rate

To understand the Boston Matrix you need to understand how market share & market growth

interrelated. Each of the products or business units is plotted on a two dimensional matrix consisting of -

✓ Relative Market Share (RMS)

✓ Market Growth Rate (MGR)

1] Market Share

Market share is the percentage of the total market that is being serviced by your company measured

either in the revenue terms or unit volume terms. It is ratio of the market share of the concerned product or

business unit in the industry divided by the share of the market leader. The higher your market share, the higher

proportion of the market you control.

Business Unit Sales this year

RMS = --------------------------------------

Leading rival sales this year

2] Market Growth Rate

Market Growth is used as a measure of a market’s attractiveness. It is the percentage of market growth,

by which sales of a particular product or business unit has increased. Markets experiencing high growth are

ones where the total market share available is expanding & there is plenty of opportunity for everyone to make

money.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-19-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 24

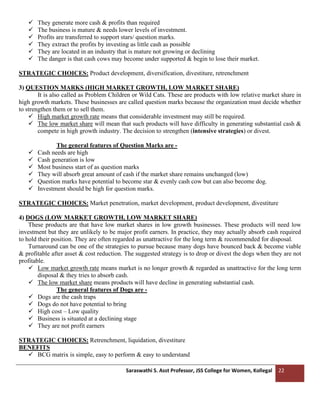

[B] GE 9 CELL MODEL

GE means General Electric nine cell matrix. This matrix was developed in 1970’s by General Electric

Company with the assistance of the consulting firm, Mckinsey & Co, USA. This is also called GE

multifactor portfolio matrix or Directional policy matrix. The GE matrix has been developed to overcome the

obvious limitations of BCG matrix.

It is a tool used in brand marketing & product management to decide what products to add to the

portfolio. It identifies the optimum business portfolio as one that fits perfectly to the company’s strengths &

helps to explore the most attractive industry sectors or markets.

It identifies the optimum business portfolio as one that fits perfectly to the company’s strengths &

helps to explore the most attractive industry sectors or markets. The objective of the analysis is to position

each SBU on the chart depending on the SBU’s strength & the attractiveness of the industry sector or market

on which it is focused.

This matrix consists of nine cells [3*3] matrix used to perform business portfolio analysis as a step in

the strategic planning process & is based on 2 key variables:

✓ Business strength

✓ Industry attractiveness

1] Business strength:-

It is a competitive strength replaces market share as the dimension by which the competitive position

of each SBU is assessed.

The business strength is measured by considering such factors as:

Relative market share, Profit margins, Ability to compete on price & quality, Knowledge of customer

& market, Competitive strengths & weaknesses, Technological capacity, Caliber of management, Brand

image, Corporate image, Production capacity, R&D performance, Promotional effectiveness etc.,

2] Industry attractiveness:-

It replaces market growth as the dimension of industry attractiveness & includes a boarder range of

factor other than just the market growth rate.

The business strength is measured by considering such factors as:

Market size & growth rate, Industry profit margin, Competitive intensity, Economics of scale,

Technology, Social, environment, legal & human aspects, Current size of market, Market structure & market

rivalry, Demand variability, Global opportunities etc.,

SPOTLIGHT STRATEGY

The 9 cells of the GE matrix represent various degrees of industry attractiveness (high, medium & low)

& business strength (strong, average & weak). After plotting each product line or business unit on the nine cell

matrix, strategic choices are made depending on their position in the matrix.

GE matrix is also called “Spotlight” strategy matrix because the 3 zones are like Green, Yellow & red

of Traffic lights.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-24-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 25

1] Green – Grow

It indicates invest / expand. If the product falls in green zone, the business strength is strong & industry

is at least medium in attractiveness, the strategic decision should be to expand, to invest & to grow.

2] Yellow – Hold

It indicates select / earn. If the product falls in yellow zone, the business strength is low but industry

attractiveness is high, it needs caution & managerial discretion for making the strategic choice.

3] Red – Harvest

It indicates divest / harvest. If the product falls in the red zone, the business strength is average or weak

& attractiveness is also low or medium, the appropriate strategy should be divestment.

High Medium Low

LEADER TRY HARDER DOUBLE OR

QUIT

GROWTH PROCEED

WITH CARE

PHASED

WITHDRAWAL

CASH

GENERATOR

PHASED

WITHDRAWAL

DIVESTMENT

BUSINESS STRENGTH](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-25-320.jpg)

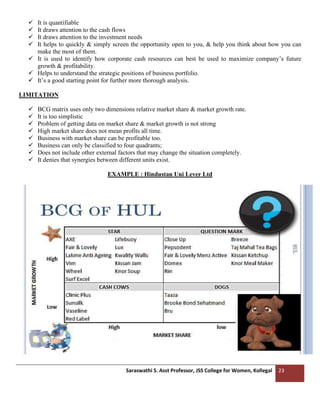

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 27

MARKET ATTRACTIVENESS

HIGH MEDIUM LOW

COMPETITIVE

STRENGTH

HIGH

MEDIUM

LOW

SWIFT

OMNI

BALENO

A - STAR

ALTO

SWIFT

DEZIRE

WAGAN

R

VERSA

SX4

MARKET ATTRACTIVENESS BUSINESS STRENGTH

✓ Size

✓ Growth

✓ Competitive rivalry

✓ Profit levels

✓ Ability to differentiate

✓ Cyclicality

✓ Market diversity

✓ Structure

✓ Market share

✓ Size/ scale

✓ Quality

✓ Technology

✓ Cost base

✓ Brand strength

✓ Customer loyalty

✓ Image, people

SWOT ANALYSIS

INTRODUCTION

A scan of the internal & external environment is an important part of strategic planning process.

Environmental factors internal to the firm usually can be classified as strengths [S] or weakness [W] & those

external to the firm can be classified as opportunities [O] or threats [T]. Such analysis of the strategic

environment is referred to as a SWOT analysis.

It involves the collection & portrayal of information about internal & external factors which have or may

be have, an impact on business.

MEANING

SWOT analysis is a strategic planning method used to evaluate the Strengths, Weaknesses,

Opportunities, and Threats involved in a business. It involves specifying the objective of the business and

identifying the internal and external factors that are favorable and unfavorable to achieve that objective.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-27-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 28

Technique is credited to Albert Humphrey, who lends a research project at Stanford University in 1960’s &

1970’s.

It is a non-financial planning tool. It links the analysis in terms of advantages and disadvantages; and the

internal and external business environment (in a matrix format). The Strengths and Weaknesses are defined by

measures such as market share, loyal customers, level of customer satisfaction and product quality.

Opportunities are new potential areas for business in the future, such as new markets, or new conditions in

existing markets. Threats describe how the competition, new technology, or other factors in the business

environment may affect the business's development.

A technique that enables a group or individual to move from everyday problems and traditional

strategies to a fresh prospective. SWOT analysis looks at your strengths and weaknesses, and the opportunities

and threats your business faces.

The SWOT Analysis framework is a very important and useful tool to use in marketing Management

and other business applications. As a basic tool its mastery is a fundamental requirement for the marketer,

entrepreneur or business person. A clear understanding of SWOT is required for business majors.

It is used as framework for organizing & using data & information gained from situation analysis of

internal & external environment.

AIM OF SWOT ANALYSIS

✓ To help decision makers share & compare ideas

✓ To bring a clearer common purpose & understanding of factors for success

✓ To organize important factors linked to success & failure in the business world

✓ To provide linearity to decision making process allowing complex ideas to be presented systematically.

WHO NEEDS SWOT ANALYSIS?

They are -

1] JOB HOLDER

✓ When supervisor has issues with work output

✓ Assigned to a new job

✓ New financial year – fresh targets

✓ Job holder seeks to improve performance on the job

2] BUSINESS

✓ When the team has not met its targets

✓ Customer service can be better

✓ Launching a new business unit to pursue a new business

✓ New team leader is appointed

3] COMPANY

✓ When revenue, cost & expense targets are not being achieved

✓ Market share is declining

✓ Industry conditions are unfavorable

✓ Launching a new business venture

THREE STAGES OF A SWOT ANALYSIS

1. Identify.

2. Draw conclusions.

3. Translate into strategic action.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-28-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 30

SWOT MATRIX

1] STRENGTH

The factors that give an edge for the company over it’s competition. It may contribute includes the

availability of resources & their performance ability. It maintenance of persistent market growth & the ability to

produce or enter new markets.

2] WEAKNESSES

The factors that can be harmful if used against the firm by its competitors. The organization weaknesses

are established through failures, losses & the incapability to respond to market changes. Analysis of weaknesses

will determine the management strategy to develop & implement the remedial measures.

3] OPPORTUNITIES

The favorable situations which an bring a competitive advantage opportunities are normally ample.

However, a plan needs to be developed to use these opportunities efficiently & at the appropriate time.

4] THREATS

The unfavorable situations which can negatively affect the business. The threats occur from economic,

social, political or technological reasons. Technological advancements may render the organization technology

as obsolete.

The SWOT matrix identifies the Strength, Weaknesses, Threats & Opportunities of a business firm. This

formation can be used by the company in many ways in evolving its options for the future. In genral, the

company should attempt to:-

✓ Build its strength

✓ Reverse its weaknesses](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-30-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 32

EXTERNAL

✓ Innovation

OPPOTUNITIES

✓ Stock investments

✓ Jobs moving up

THREATS

✓ Copy cat products

✓ Market share – PC’s

✓ Too board

✓ Steve jobs health

SYNERGY AND DYSERGY

SYNERGISTIC EFFECTS

Synergistic effects may be negative or positive we can say it either synergy or dysergy based on its

effect an idea that is greater or lesser or lesser than that sum common parts. It helps to develop competencies.

Synergistic effects – 2+ 2 = 5 (or 3?)

2 or more strengths –Synergy

2 or more weaknesses – Dysergy

Ex:

Samsung mobiles – good product range, reasonable price, good promotion & good distribution

Ambassador – poor product range & substandard promotion.

SYNERGY [ 2 + 2 = 5 ]

According to American Heritage Dictionary, the Term “Synergy” is derived from the Greek word

“SUNERGOS”, meaning “Working together” or “joint work”

Synergy is the creation of a greater than simple than simple sum of its parts. A dynamic state in which

combined action is formed over the difference of individual component actions. It also called as “positive

synergy”.

Synergy means behavior of whole system unpredicted by the behavior of heir parts taken separately”. It

is a concept that the whole is greater than the sum of the parts.

Synergy is the interaction of multiple elements in a system to produce an effect different from or greater

than the sum of their individual’s effects.

Synergy definition:

Interaction of elements that when combined produce a total effect that is greater than the sum of the

individual elements This equation is showing us that if you combine something with another factor the final

outcome will be much bigger & more significant.

EX:

Working together

Combined action + Operation

= Greater advantage

This assumes that the collective advantage to be gained by joining forces is greater than the separate

existence of each organization.

The basic concept of synergy can be explained through this mathematical formula; 2+2=5

The 2+2=5 effect means that operating independently; each subsystem can produce only 2 units of

output. However, by combining their efforts & working together effectively, the 2 subsystems can produce 5

units of output.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-32-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 35

✓ Operating synergy ✓ Potential for new joint products.

DYSERGY [ 2 + 2 = 3]

It is also called as negative synergy & it is opposite of synergy. These are the combined negative attitude

or results. These are the combined negative attitude or results. The idea that combined parts have properties that

are more or less than the sum of the parts it is called called as dysergy, learning synergy to mean only beneficial

effects.

2+2=3 (two plus two is equal to three) less than the sum of the parts, the negative sum of version &

leaving synergy to mean only beneficial effects.

Not all synergy is positive. The combined negative attitudes & argue over small things of dissatisfied

group members can add up to greater trouble than any of the members could have caused individually in any

organizations. Mostly sick companies suffer from this negative synergy.

Negative synergy

It means the combination of efforts results in less output; it can result from due to following reasons,

✓ Inefficient committees

✓ Business units that lack strategic fit &

✓ From other poorly functioning joint efforts.

Negative synergy occurs in groups, committees, & other joint efforts for a number of reasons. Groups

commonly experience negative synergy because group decisions are often reached more than individual

decisions. Negative synergy can also occur in group decisions if an individual is allowed to dominate &

control the group decision.

The combination of people or business does not necessarily that it will lead to better outcomes,

it can also resulting lack of harmony or coordination which can lead to negative synergy. Downsizing &

the divestment / cutback of businesses are the part of negative synergy.

GAP ANALYSIS

The evaluation of the difference between a desired outcome and an actual outcome, this difference is

called a gap. In the management literature “GAP Analysis is the comparison of actual performance with

potential performance”. Thus it identifies gap b/w the optimized allocation & integration of the inputs

(resources) & the current allocation level.

GAP analysis in a formal study of what a business is doing currently and where it wants to go in the

future. This reveals areas that can be improved. Gap analysis involves determining, documenting &

approving the variance b/w business requirements & current capabilities. It is a technique of determining the

steps taken to move from the current state to desired future state.

Strategic gap analysis attempts to determine what a company should do differently to achieve a

particular goal by looking at the time frame, management, budget and other factors to determine where

shortcomings lay. After conducting this analysis, the company should develop an implementation plan to

eliminate the gaps.

GAP analysis provides foundation for measuring investment of time, money and Human resources

required to achieve particular outcome. Gap analysis naturally flow from Benchmarking & form other

assessment.

Once the general expectation of performance in the industry in understand it is possible to compare

that expectation with the company’s current level of performance. This comparison becomes the gap

analysis. Such analysis can be performed at strategic or operational level of an organization.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-35-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 36

Gap Analysis has also been used as means of classifying how well a product or solution meets a

targeted need or set of requirements. In this case, “GAP” can be used as a ranking of “Good”, “Average” &

“Poor”.

GAP Analysis. Good, Average & Poor

GAP analysis can identify gaps in the market. Thus comparing forecast to desired profits to reveals the

planning Gap. This represents a goal for new activities in general & new products in particular.

The planning Gap can be divided into 3 main elements-

1] Usage Gap:

It is the gap b/w the total potential for the market & actual current usage by all consumer in the market.

It is most important for brand leaders.

2]Existing Usage:

It makes up the total current market from which market shares, for examples are calculated. It usually

derives from marketing research most accurately from panel research, but also from adhoc work.

Usage Gap = Market potential – Existing usage.

3]Product Gap:

It also called as segment or positioning gap. It is the part of the market a particular origination is

excluded from because of the product or service characteristics. This may be because the market is

segmented & the organization does not have offerings in some segments, in a way that effectively excludes

certain potential consumer because competitive offerings are much better placed for these consumers.

The product gap may be the main element of the planning gap where an organization can be

product inputs hence the emphasis on the importance of correct positioning.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-36-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 38

9th Step: Accept the feedback of the GAP analysis process. As, this helps in proper reviewing of additional

GAP’s if any.

10th Step: Monitor and report the progress achieved.

ADVANTAGES

✓It is a diagnostic tool, to improve the performance of the organization.

✓This can also be used to compare the results of the past and future states.

DISADVANTAGES

✓The desired state becomes unrealistic at certain times.

✓The external environment is overlooked.

DIFFERENT METHODS TO CONDUCT GAP ANALYSIS

There are mainly 4 types, they are:-

✓ SERVQUAL

✓ ISO 9001:2000

✓ SAGA(Self Assessment Gap Analysis)

✓ Two Dimensional Analysis

1] SERVQUAL

This Method of GAP Analysis consists of set of Questions Divided in Five categories.

WHAT DO WE DO WITH THIS SURVEY?

Administer the survey to customer and the company. The results will show difference in perceptions between

✓Customers

✓Employees

✓Management

Assurance

Empathy](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-38-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 39

2] ISO 9001:2000

ISO (International Organization for Standardization) is the world's largest developer and publisher of

International Standards. Identifying the GAPS with reference to the Standards provided by ISO and

Finding out solutions To Fill them. The ISO 9000 family of standards relate to quality management systems.

3] SAGA(Self Assessment Gap Analysis)

Rather than sending out a survey as in SERVQUAL, SAGA is a process used to take a close look at an

organization’s operations. In SAGA a Company/Process/Approach is Analysed using the Baldrige criteria

and the Gaps are found out.

What is Baldrige Criteria?

Recipients are selected based on achievement & improvement in 7 areas, known as the Baldrige

criteria for performance excellence. Leadership: how upper management leads the organisation, & how the

organization leads within the community.

4] Two Dimensional Gap Analysis

The maintenance of biodiversity requires a wise combination of protection, management, and

restoration of habitats at several scales. The solution lies in integration of natural and social sciences in the

form of two-dimensional gap analysis, as an efficient tool for biodiversity policies.

APPLICATIONS WHERE THE GAP ANALYSIS ARE USED

It is used in many areas such as.,

✓Production Industry

✓Sales Forecast

✓Fiscal policies

✓Performance of an individual & HRM

✓Quality assurance & Cost control

✓Financial performance

✓Market competitiveness & Management skills

EXAMPLE FOR GAP ANALYSIS

A] If a small mom and pop restaurant wanted to become a top tourist destination but currently only

served locals, a strategic gap analysis would look at the changes required for the restaurant to meet its goals.

These changes might include relocating to an area with more tourists, altering the menu to appeal to out-of-

town visitors, hiring more staff so the restaurant's hours become more convenient for travelers, and so on.

The analysis would also determine how to make these changes happen. If a business doesn't know where it

stands in relation to its goals, it is not likely to achieve them.

B] A telecom company performs a gap analysis to understand why a number of orders have been

delivered late to customers. They map out the current process and identify manual steps, redundant work,

overly complex dependences, bottlenecks, technology pain points and process risk and document them as

gaps, The Gap analysis also produces an optimized target state process that cuts days from order

provisioning time, reduces cost and mitigates risks.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-39-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 40

PORTER'S FIVE FORCES MODEL OF COMPETITION

Michael E. Porter. Born in 1947. He is the Professors in Harvard Business School. Porter's introduced

the 5 Forces Model. He has Written 18 books & over 125 Articles. He is called as “Guru of modern day

business strategy”.

The Five Forces model of Porter is an outside-in business unit strategy tool that is used to make an

analysis of the attractiveness (value...) of an industry structure. It captures the key elements of industry

competition. It is one of the most recognized frameworks for the analysis of business strategy. It is used as

theoretical framework derived from Industrial Organization [IO] economics to derive five forces which

determine the competitive intensity & therefore attractiveness of a market.

This theoretical framework is based on 5 forces, describes the attributes of an attractive industry &

thus suggests when opportunities will be greater & threats are less, in these of industries.

✓ Attractiveness in this context refers to overall industry profitability & also reflects upon the

profitability of the firm under analysis.

✓ An “Unattractive” industry is one where the combination of forces acts to drive down overall

profitability.

✓ A “Very Unattractive” industry would be one approaching “pure competition”, from the perspective of

pure industrial economics theory.

Porter’s model is based on the insight that a corporate strategy should meet the opportunities & threats

in the organizations external environment. This model supports analysis of the driving forces in an industry.

It helps to decide how to influence or to exploit particular characteristics of their industry.

IMPORTANCE OF 5 FORCES

✓ What strategy to use?

✓ Basic knowledge of business strategy & forces that influence the decision making

✓ Industry analysis [Industry relevance, Industry players, Industry structure, Future changes]

✓ Strategize [Competitive advantage, Cost advantage, Market dominance, New product development,

Contraction / Diversification, Price leadership, Global, Re-engineering, Downsizing, De-layering,

Restructuring.

✓ Measure and monitor strategy effectiveness

The purpose of Five-Forces Analysis

The five forces are environmental forces that impact on a company’s ability to compete in a

given market.

The purpose of five-force analysis is to diagnose the principal competitive pressures in a

market and assess how strong and important each one is.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-40-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 41

[1] Threat of New Entrants

This force determines how easy it is to enter a particular industry. If an industry it is a profitable are

few barriers to enter, rivalry soon intensifies. When more organization compete for same market shares, profit

start to fall. It is essential existing organization to create high barriers to enter to deter new entrants.

The easier it is for new companies to enter the industry, the more cutthroat competition there will be.

Factors that can limit the threat of new entrants are:

✓ Economies of Scale

✓ Product Differentiation

✓ Capital Requirements

✓ Customer Switching Costs

✓ Access to Distribution Channels

✓ Government Policy

✓ Expected Retaliation

[2] Bargaining Power of Suppliers

The term suppliers comprise all sources for inputs that are needed in order to provide goods &

services. The bargaining power of supplier is also described as the market of inputs. Suppliers of raw material,

components, labor, and services to the firm can be a source of power over the firm when there are few

substitutes. If you’re making biscuits and there is only one person who sells flour, you have no alternative but

to buy it from them. Supplier may refuse to work with the firm or charge excessively high prices for unique

resources. Suppliers are likely to be powerful if:

✓ Supplier industry is dominated by a few firms

✓ Suppliers’ products have few substitutes

✓ Buyer is not an important customer to supplier

✓ Suppliers’ product is an important input to buyers’ product

✓ Suppliers’ products are differentiated

✓ Suppliers’ products have high switching costs](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-41-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 42

[3] Bargaining Power of Buyers

The bargaining power of customers determines how much customers can impose pressure on margins

& volumes. The bargaining power of customer of is also described as the market of outputs. The ability of

customer to put them firm under pressure, which also affects the customer’s sensitivity to price changes. Firms

can take to measures to reduce buyer power, such as implementing a loyalty program. The buyer power is high

if the buyer has many alternatives. The buyer power is low if they act independently. Their power is likely to

be high. Buyer groups are likely to be powerful if:

✓ Buyers are concentrated Purchase accounts for a significant fraction of supplier’s sales

✓ Products are undifferentiated

✓ Buyers face few switching costs

✓ Buyer presents a credible threat of backward integration

✓ Buyer has full information

[4] Threat of Substitute Products

Threats of Substitute in the Porter’s theory actually mean goods and services that do similar functions.

When there is one product successful, it also leads to the creation of other products that can perform the

same functions as the product of the same industry. The existence of product outside of the realm of the

common product boundaries increase the propensity of customer to switch to attractiveness.

✓ Keys to evaluate substitute products:

✓ Products with improving

✓ price/performance tradeoffs

✓ relative to present industry products

[5] Rivalry Among Existing Competitors

For most industries the intensity of competitive rivalry is the major determinant of the competitiveness

of the industry. Intense rivalry often plays out in the following ways:

✓ Using price competition

✓ Staging advertising battles

✓ Making new product introductions

✓ Increasing consumer warranties or service

Occurs when a firm is pressured or sees an opportunity

✓ Price competition often leaves the entire industry worse off

✓ Advertising battles may increase total industry demand, but may be costly to smaller competitors

ADVANTAGES

✓ To create a defendable position in an industry, in order to cope successfully with competitive

forces.

✓ It provides as Cost leadership (low cost advantage)

✓ It creates differentiation in market or product

✓ The model is strong tool for competitive analysis at industry level.

✓ It provides useful input for performing a SWOT analysis.

DISADVANTAGES

✓ Inside-out strategy is ignored (core competence)

✓ It does not cope with synergies and interdependencies of large corporations](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-42-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 43

✓ The environments which are characterized by rapid, it requires more flexible, dynamic or emergent

approaches

✓ Sometimes it may be possible to create completely new markets instead of selecting from existing

ones (blue ocean strategy) [blue ocean strategy: - it refers to a market for a product where there is

no competition or very less competition.

EXAMPLE COCO COLA

[1] New entrants: New “look-a-like” manufacturers

[2] Substitute products: Fashionable new drinks, milk drinks, coffee, beer, .

[3] Suppliers: Price and availability of ingredients on world market, Quality speed safety, traceability,

flexibility of supply chain.

[4] Buyers/consumers: High as a result of intense competition both among branded and unbranded

products. Combined purchase power of shops, bars, supermarkets, soda shop, vending machine,

restaurants & food stores, convenience store.

[5] Traditional competition: Prices of Pepsi, local brands, Market share, Promotional actions of

competition

MC KINSEY'S 7’S FRAMEWORK

It was first mentioned in “The Art of Japanese Management” by Richard Pascal & Anthony Athos in

1981. They have been investigating how Japanese Industry has been so successful. At around the same time

that Tom Peters & Robert Waterman were exploring what made a company excellent. The 7s model was born

at a meeting of these four authors. It was introduced in Mckinsey’s company

HOW TO USE THE MODEL

✓ You can use the 7S model to help analyze the current situation (Point A), a proposed future

situation (Point B) and to identify gaps and inconsistencies between them.

✓ It's then a question of adjusting and tuning the elements of the 7S model to ensure that your

organization works effectively and well once you reach the desired endpoint.

The 7-s framework of McKinney’s is the value based management model that describes 7 factors to

organize a company in a holistic and effective way. Together these factors determine the way in which the

corporation operates. Large or small, the strategies are all interdependent, so if you fail to pay proper

attention to one of them, this may affect all others as well.

The most common uses of the frame work are:

✓ To facilitate organizational framework

✓ Examine the likely effects of structure of future changes within a company

✓ To identify how each area may change in future

✓ To facilitate the merger of an organisation.

✓ Organizational Analysis Tool

✓ Monitor Changes in the Internal Situation of the Organization

✓ It’s a management model that describes 7 factors to organize a company in an holistic & effective way.

✓ Together these factors determine the way in which a corporation operates.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-43-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 44

✓ Managers should take into account all 7 of these factors, to be sure of successful implementation of a

strategy.

✓ It is used b/w each of the S’s one can identify strengths & weaknesses of an organisation.

REASONS WHY TO USE

THE 7S FRAMEWORK

The model is most often used as a tool to assess and monitor changes in the internal situation of an

organization.

THE 7S ELEMENTS

The seven interdependent factors are categorized as either "hard" or "soft" elements.

A] Hard Elements:

"Hard" elements are easier to define or identify Management can directly influence them.

These are,-

✓ Strategy

✓ Structure &

✓ Systems

B] Soft Elements:

"Soft" elements, on the other hand, can be more difficult to describe. They are less tangible and more

influenced by culture. These soft elements are as important as the hard elements if the organization is going to

be successful.

These are,-

✓ Shared Values,

✓ Skills,

✓ Style &

✓ Staff](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-44-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 45

[1] Strategy:

Purpose of the business and the way the organization seeks to enhance its competitive advantage. The

plan devised to maintain and build competitive advantage over the competition.

[2] Systems:

The daily activities and procedures that staff members engage in to get the job done.

[3] Structure:

The way the organization is structured and its units related to each other and who reports to whom.

[4] Shared Values:

These are also called as "super ordinate goals" when the model was first developed. These are the core

values of the company that are evidenced in the corporate culture and the general work ethic. Values and

beliefs of the company what an organization wants to achieve, what its purpose, vision, mission, central

beliefs & attitude.

[5] Skills:

The actual skills and competencies of the employees working for the company

[6] Style:

The style of leadership adopted.

[7] Staff:

The company's people resources and how they are developed, trained and motivated

OBJECTIVES / ADVANTAGES

✓ Improve the performance of A company

✓ Examine the likely effects of future changes within A company](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-45-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 46

✓ Align departments and processes during A merger or acquisition

✓ Determine how best to implement A proposed strategy

DISADVANTAGES

✓ What type of analysis is this? Or what is the action triggered after putting your organization into this

drill?

✓ Does this give you real guidelines as to how to proceed further, after the analysis is completed?

✓ Do we treat this as a guideline or checklist and proceed with using other techniques to formulate

further steps?

✓ There are been other techniques in vogue which have to be used arrive at actionable points.

✓ The above seems abstract list of generic elements in any organization, to improve the each business

process, such as marketing, finance, manufacturing etc.

EXAMPLE : INFOSYS

It Was Co-founded In 1981. It is an Indian Multinational Corporation that provides Business

Consulting, information Technology, software Engineering and Outsourcing Services. It is the Third Largest

India Based It Services Company By 2014 Revenues and The Fifth Largest Employer. The Market

Capitalization Is $31.11 Billion Making It India’s Fifth Largest Publicly Traded Company.

The 7’s elements are:-

[1] STRATEGY:

✓ What is the strategy?

✓ How to intend to achieve the objectives?

✓ How to deal with competitive pressure?

✓ How are changes in customer demands dealt with?

✓ How is strategy adjusted for environmental issues?

STRATEGY FOLLOWED BY INFOSYS:

✓ Client focused strategy to achieve growth

✓ Increase business from existing and new clients

✓ Expand geographically

✓ Enhance solution set

✓ Develop deep industry knowledge

✓ Enhance brand visibility

✓ Pursue alliances and strategic acquisitions

[2] ORGANISATION STRUCTURE:

✓ How is the company/team divided?

✓ What is the hierarchy?

✓ How do various departments coordinate activities?

✓ How do the team members organize and align themselves?

✓ Is decision making and controlling centralized or decentralized?

ORGANISATION STRUCTURE AT INFOSYS:

✓ Adopted a free organization devoid of hierarchies.

✓ Everyone is known as associates of his position in the company.

✓ Software development is undertaken through teams and the constitution of teams is based on the

principle of flexibility.](https://image.slidesharecdn.com/s-221124172756-7e1947d4/85/S-Mgt-unit-2-pdf-46-320.jpg)

![Saraswathi S. Asst Professor, JSS College for Women, Kollegal 47

[3] STAFF:

“Staff” refers to the number and type of personnel within the organization and how companies develop

employees and shape basic values.

✓ Vast human capital, 1,65,000 + employees.

✓ Emphasis on selecting the right candidate.

✓ Spends about 2.65% of its revenue on up gradation of employees skills.

✓ Build a fulfilling career in consulting, technology & outsourcing.

[4] SYSTEMS:

Defines the flow of activities involved in the daily operation of business, including its core processes

and its support systems.

[5] SHARED VALUES:

Shared Values are the commonly held beliefs, mind-sets and assumptions that shape how an

organisation behaves, also known as the “Corporate Culture”.

[6] STYLE:

Cultural style and behavior of organization.

✓ How participative is the management style?

✓ How effective is the leadership?

✓ Do employees tend to be cooperative or competitive?

✓ Are there real teams functioning within the organization or are they just nominal groups?

[7] SKILLS:

✓ Dominant attributes that exist in the organization.

✓ What are the strongest skills represented within the company?

✓ Are there any skills gaps?

✓ What is the company known for doing well?

✓ Do the current employees have the ability to do the job?

DISTINCTIVE COMPETITIVENESS

It is a set of unique capabilities that certain firms process allowing them to make inroads into desired

markets & to gain advantage over the competition; generally, it is an activity that a firm performs better than

its competition. To define a firm’s distinctive competitiveness, management must complete an assessment of

both internal & external corporate environments. When management finds an internal strength & both meets

market needs & gives the firm a comparative advantage in the market place, that strength is the firm’s

Distinctive competence. Defining & building distinctive competence,- to define a company’s distinctive

competence, managers often follow a particular process.

✓They identify the strengths & weaknesses in the given market place

✓They analysis specific market needs & look for comparative advantages that they have over the

competition.

Distinctive competencies are the combination of the best practices and technical skills that increase the