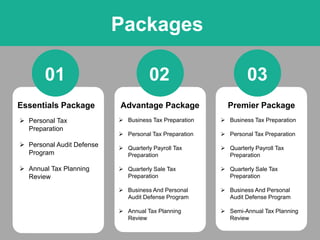

J.S. Tax Corporation offers tailored tax packages for small businesses, including services like tax preparation, audit defense, and tax planning reviews. Their packages range from essentials to premier services, catering to businesses at different stages of development. They prioritize helping businesses pay less tax and invite consultation for customized tax strategies.