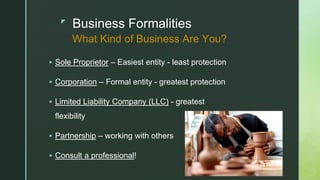

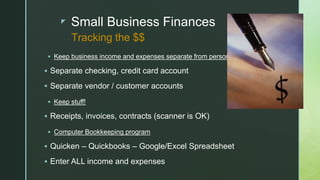

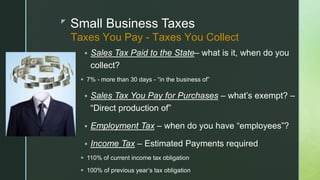

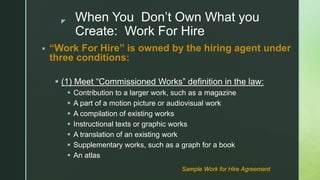

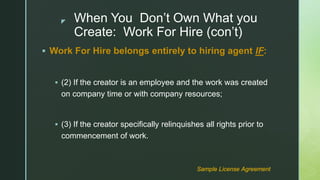

This document provides information on developing a small creative business. It discusses why becoming a business is beneficial, such as for making money, staying organized, and gaining credibility. It outlines topics small creative business owners should understand like business plans, legal structures, accounting, taxes, contracts, and intellectual property. The document emphasizes the importance of treating creative work like a business and having the necessary paperwork and compliance. It provides advice on growing the business through financing, hiring employees or collaborating with other artists. Resources for small businesses are also listed.