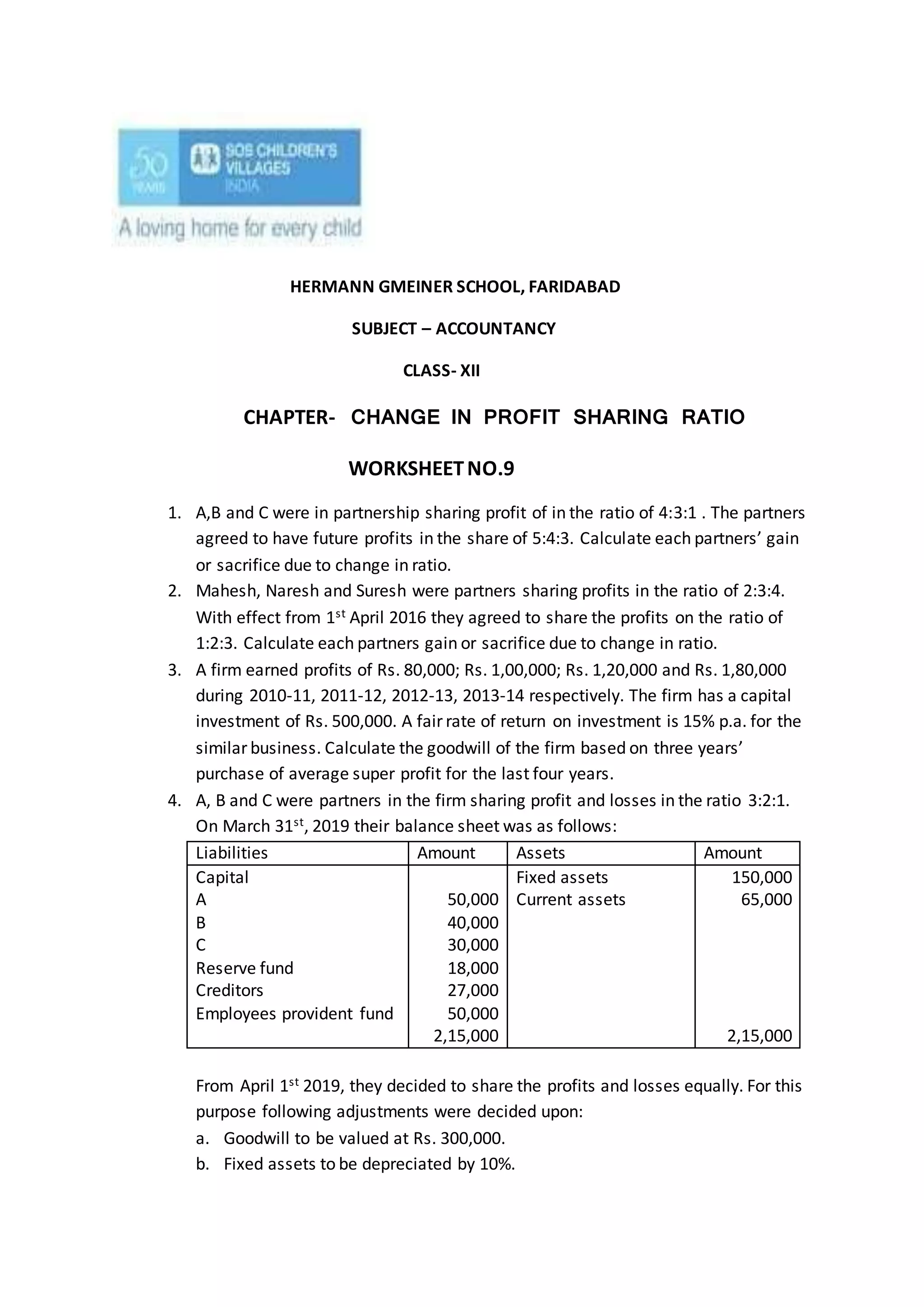

This document contains 5 problems related to changes in profit sharing ratios for partnerships. The problems involve calculating partner gains or sacrifices when ratios change, valuing goodwill of a firm based on super profits, making journal entries for adjustments to partner capital accounts and asset values when ratios change, and preparing revaluation accounts and a balance sheet after ratios change.