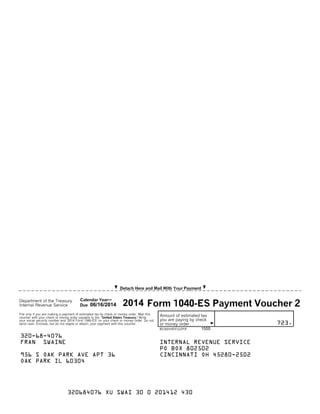

Fran Swaine owes $2,941 in federal income taxes for 2013 according to her tax return. The document provides instructions on mailing her signed Form 1040 tax return along with a check for $2,941 to the IRS by the April 15, 2014 deadline. It also includes estimated tax payment vouchers for 2014 that should not be sent with her 2013 return. Finally, the instructions note that she can still choose to e-file her 2013 return instead of mailing it.