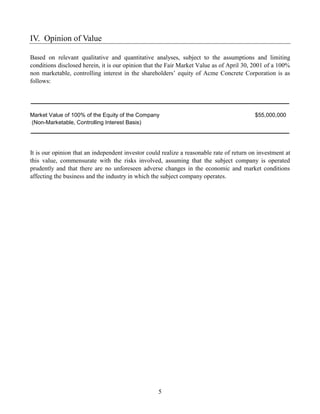

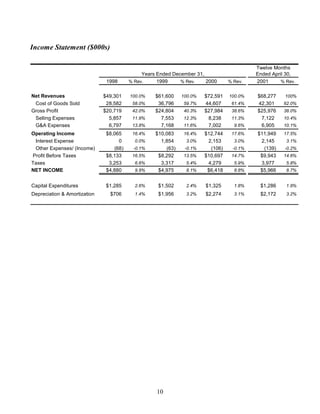

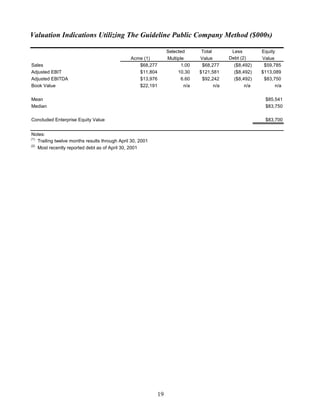

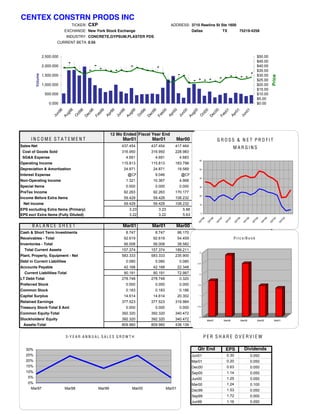

This document provides a valuation analysis of Acme Concrete Corporation as of April 30, 2001. It summarizes the company and industry, outlines the valuation methodology, and concludes that the fair market value of a 100% controlling interest in the company's equity is $55,000,000. The valuation utilizes the adjusted net asset value method, guideline public company method, guideline transaction method, and capitalization of earnings method to determine value.