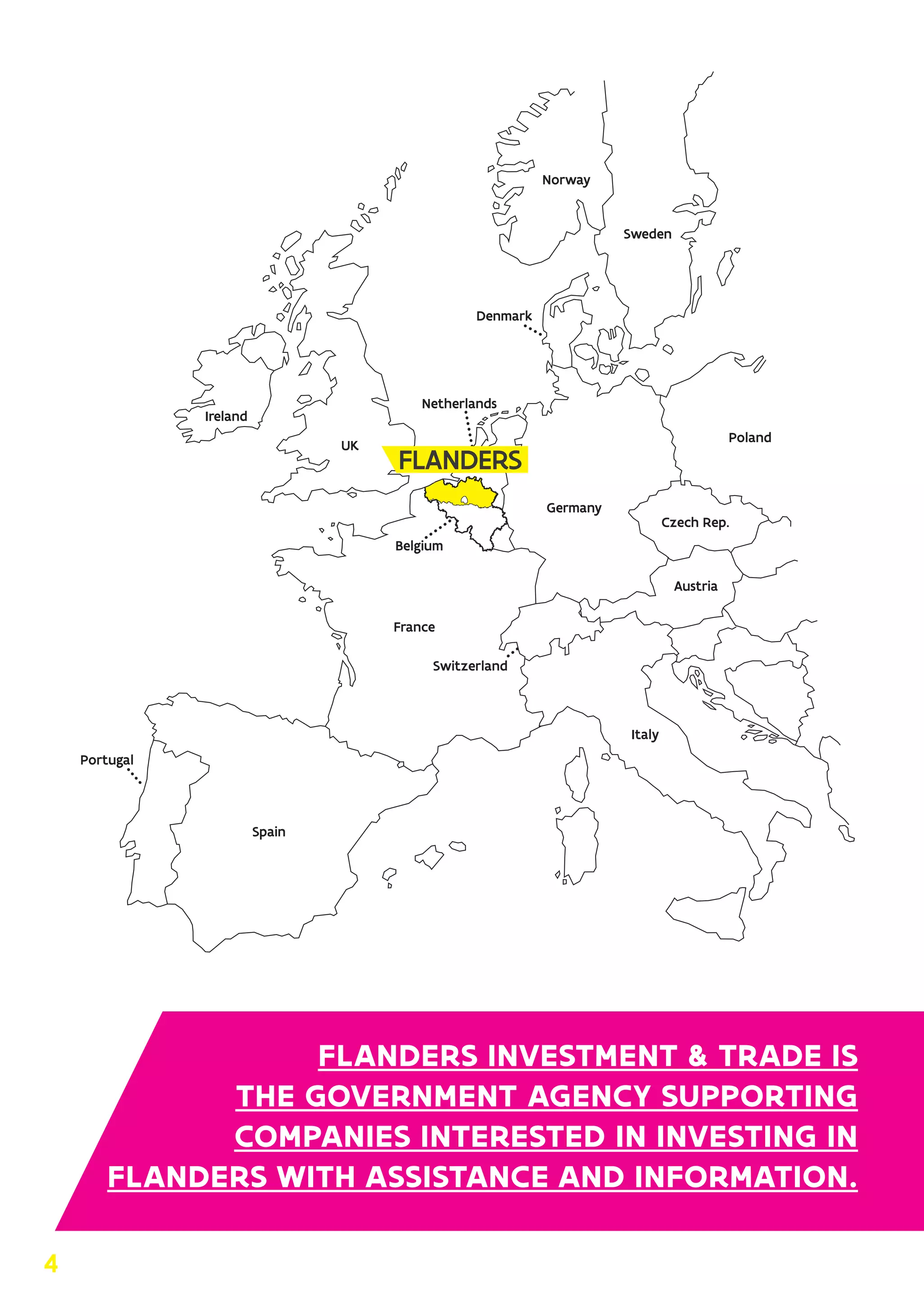

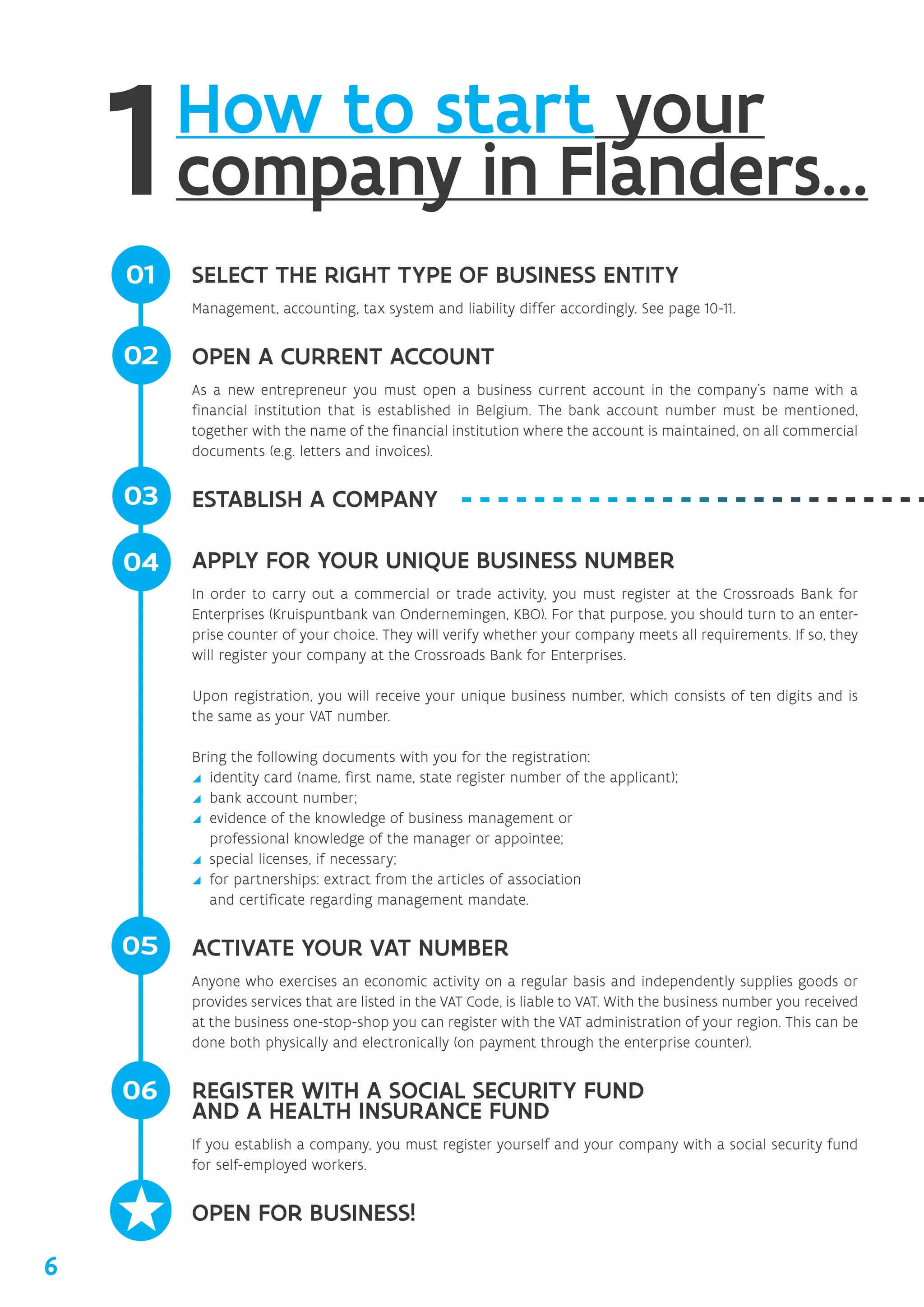

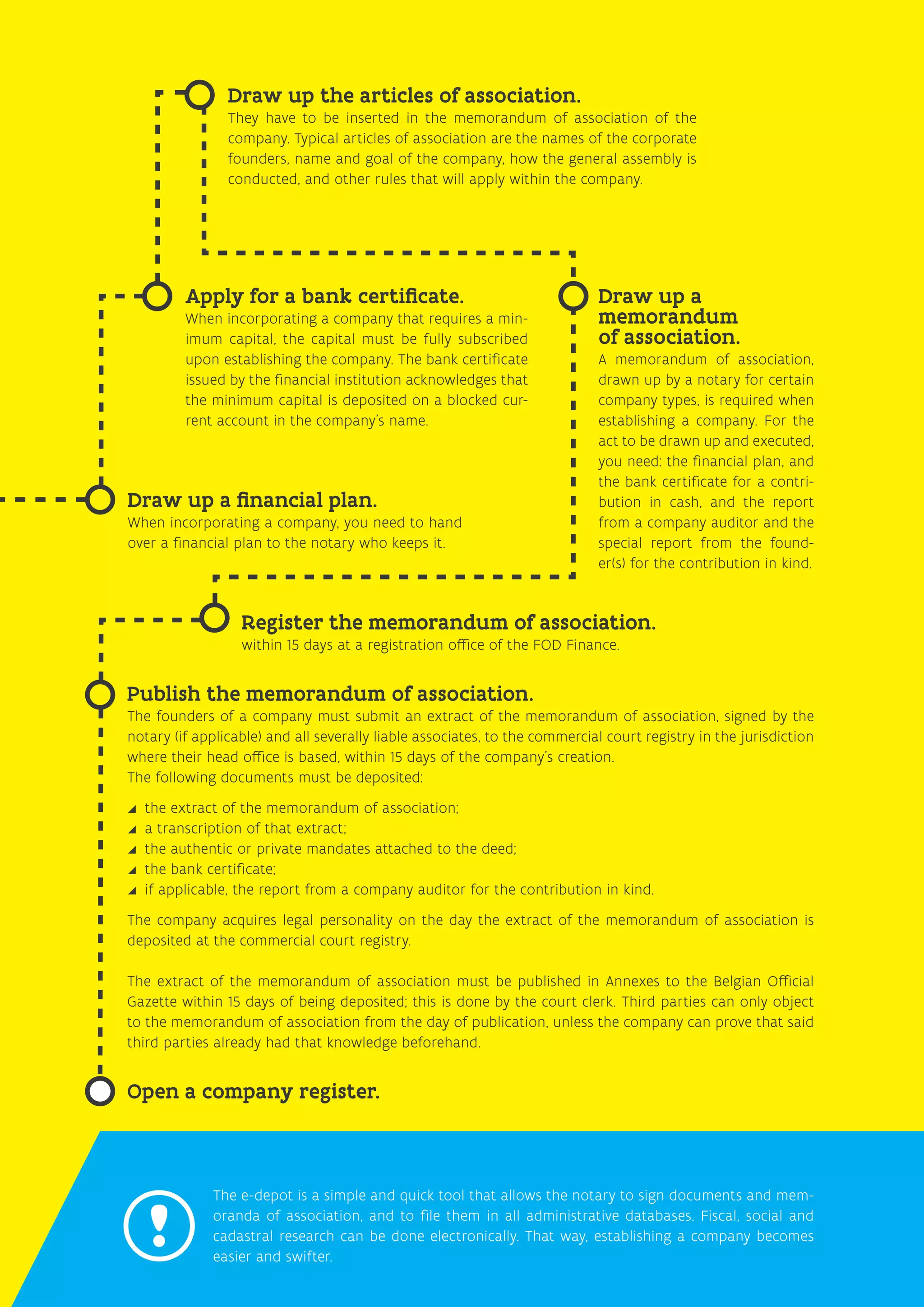

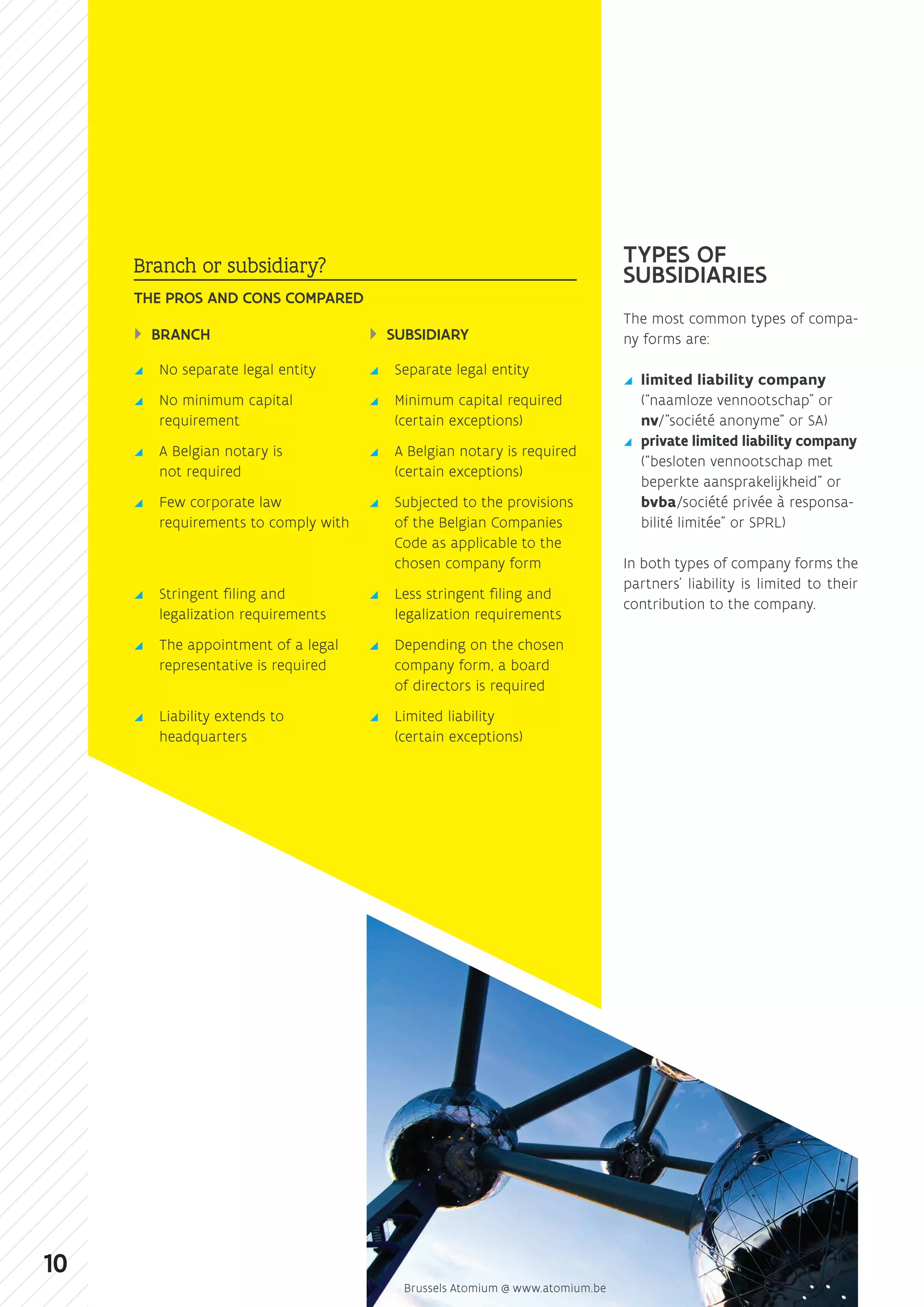

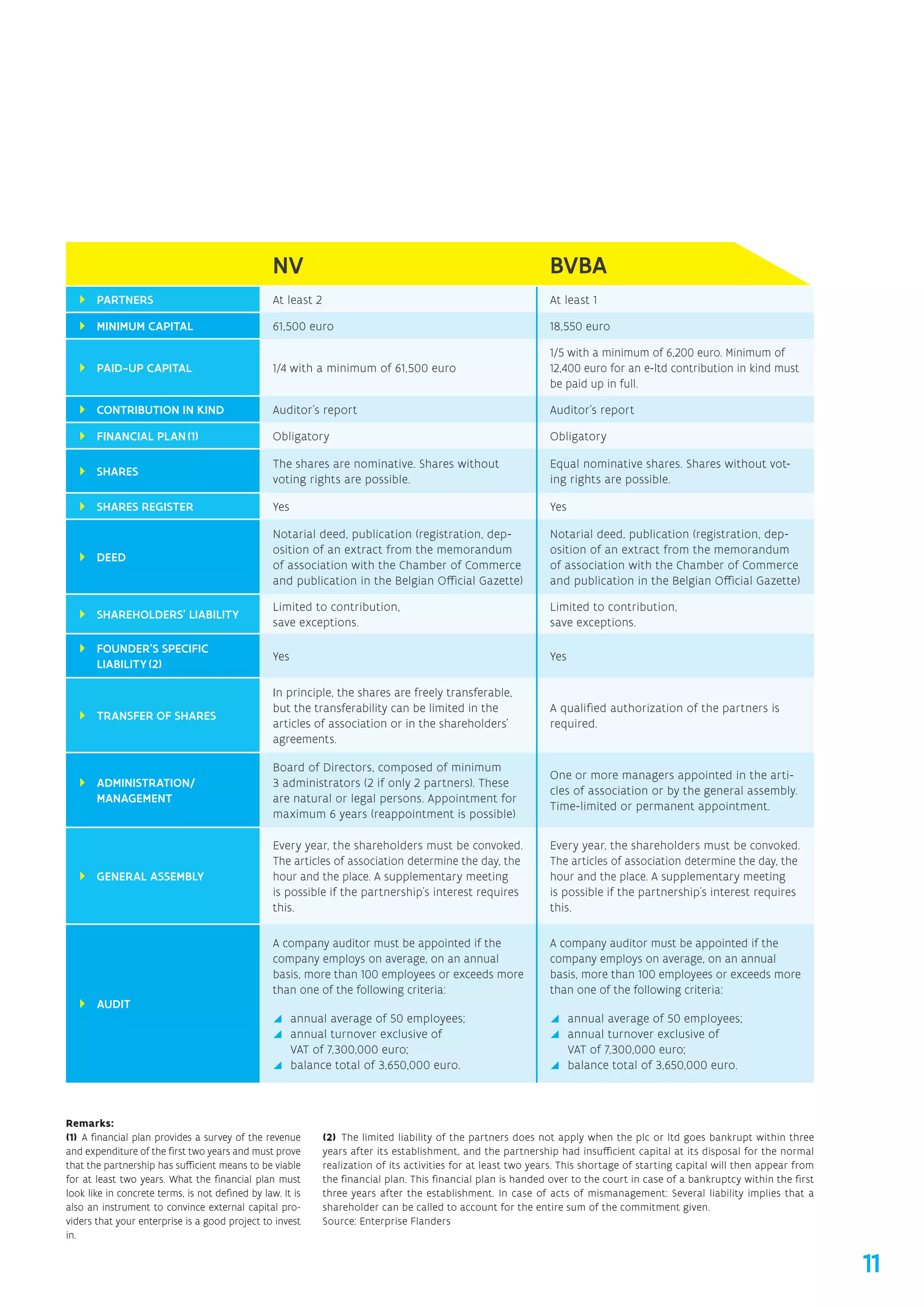

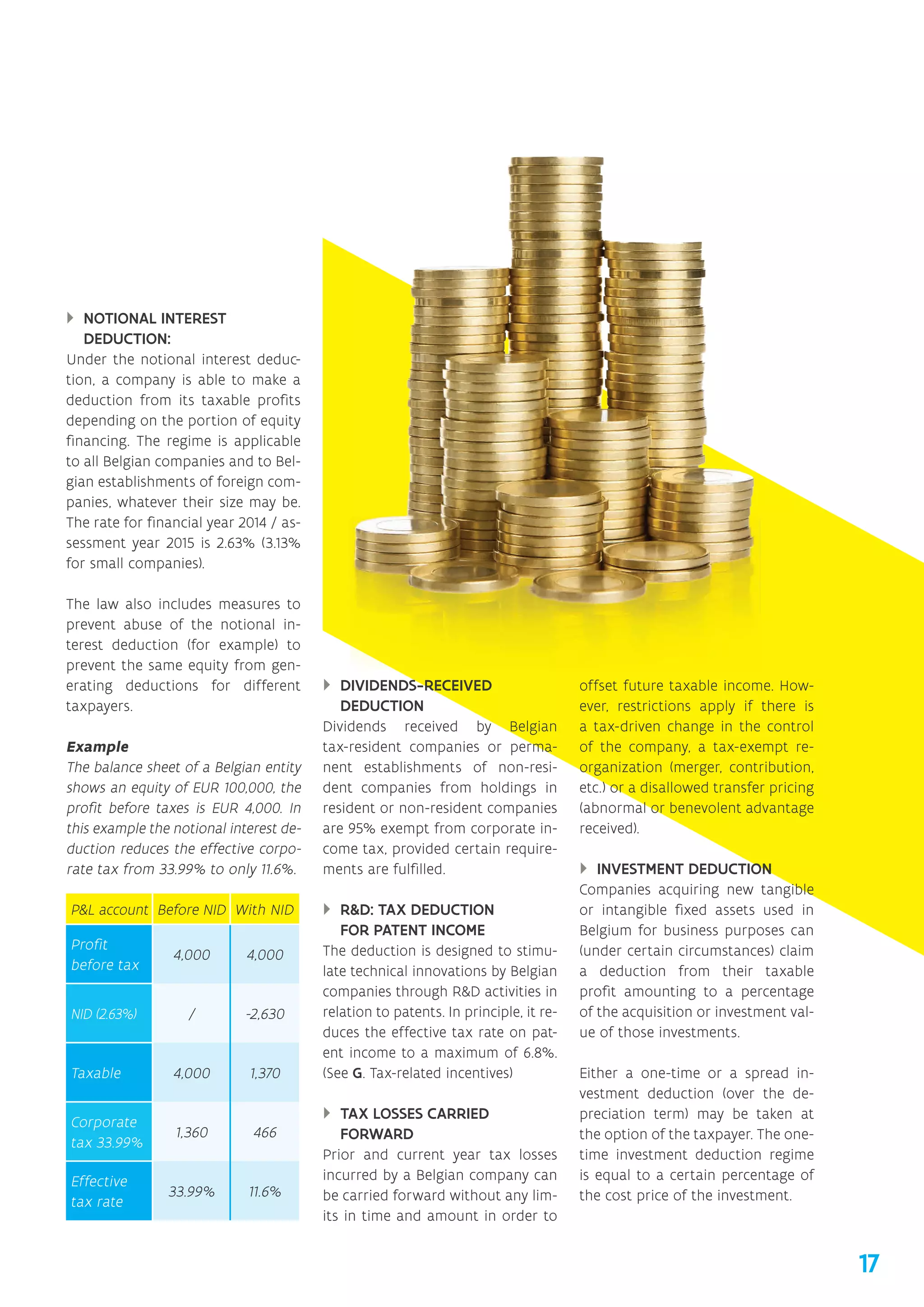

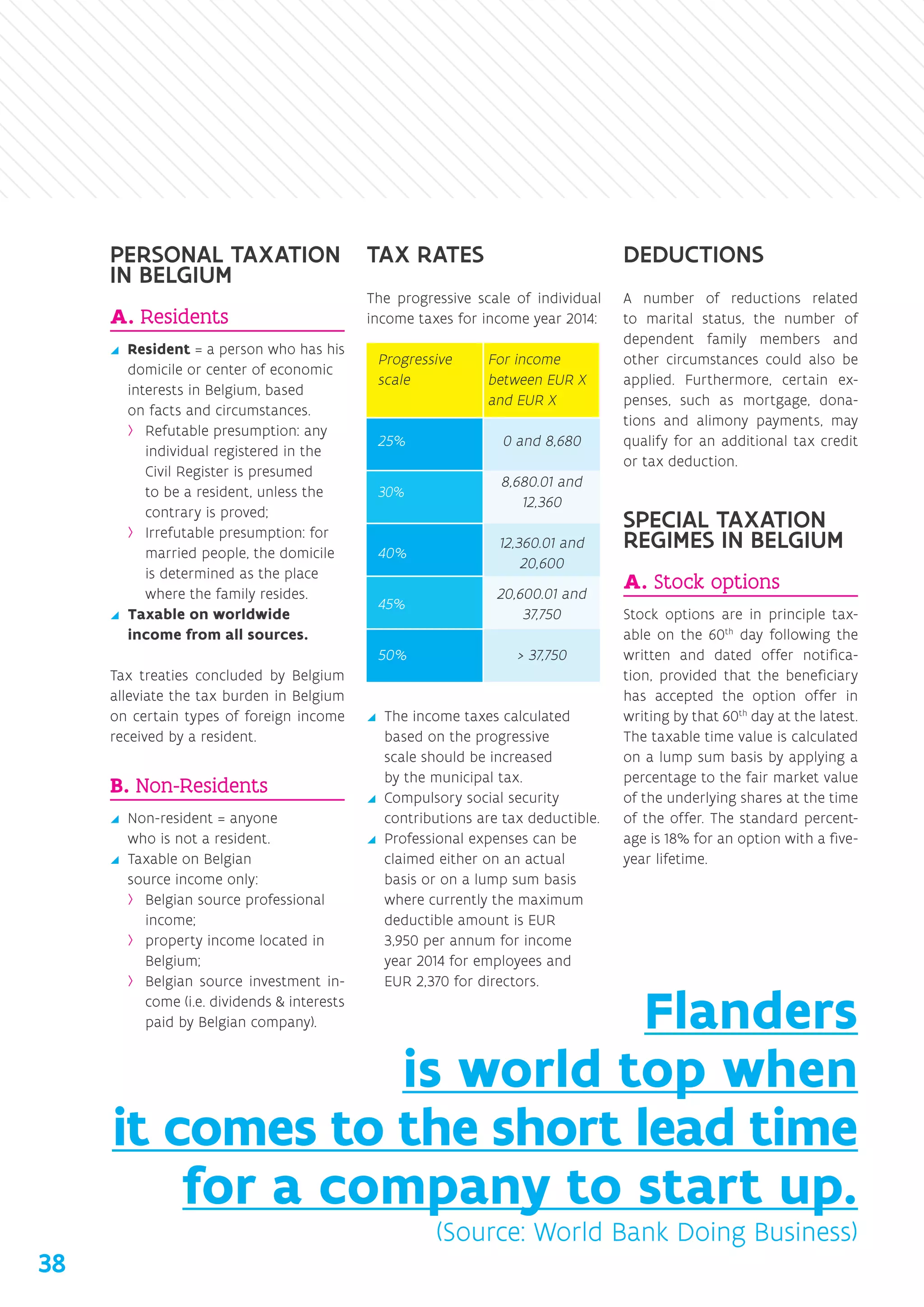

The document is a comprehensive guide for foreign investors looking to establish a company in Flanders, Belgium, detailing the legal, tax, and regulatory environment. It provides essential steps for setting up a business, including selecting the right business entity, obtaining necessary permits, and understanding taxation and workforce requirements. Flanders Investment & Trade is identified as the supportive agency that offers guidance and resources throughout the investment process.