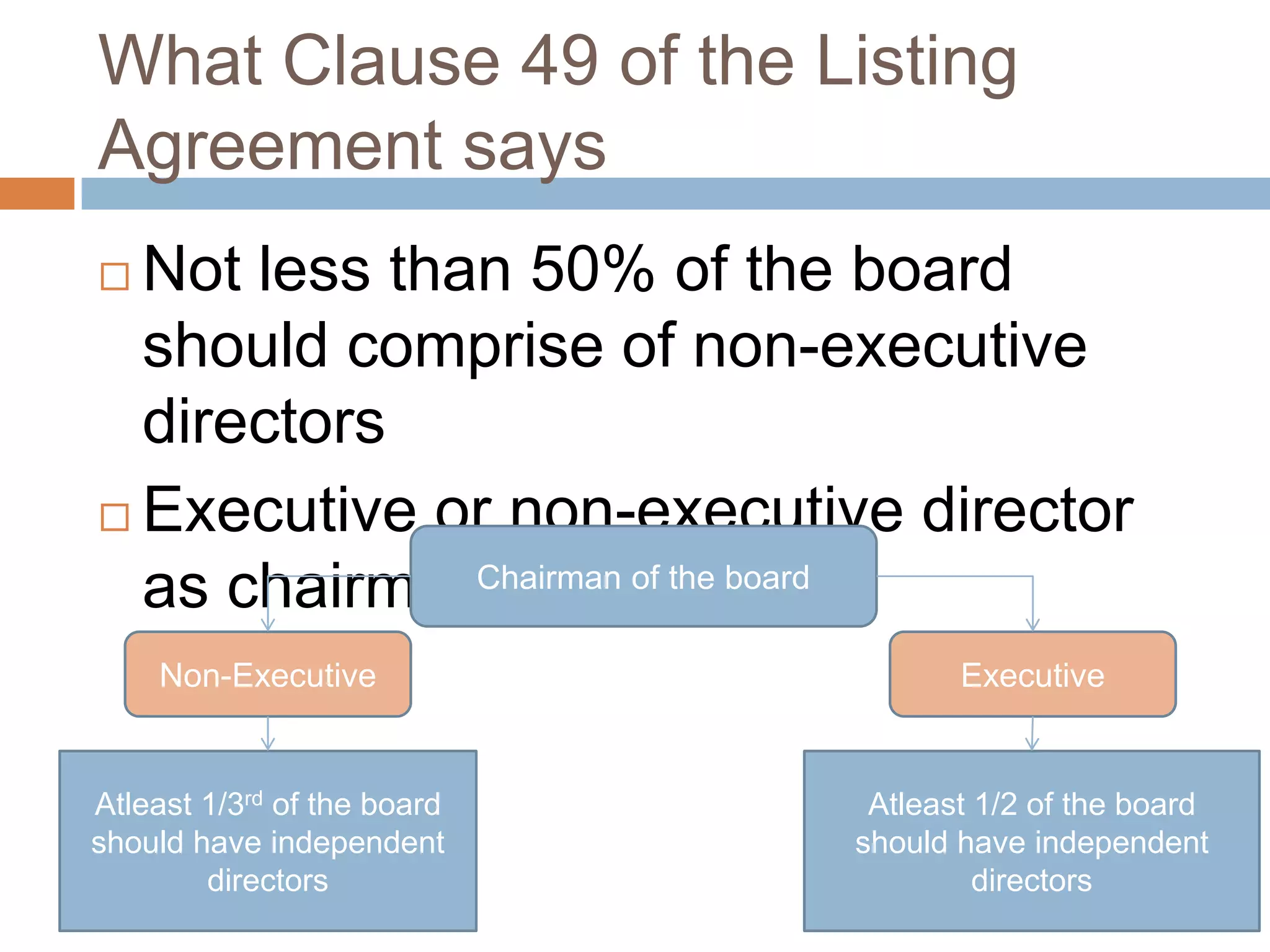

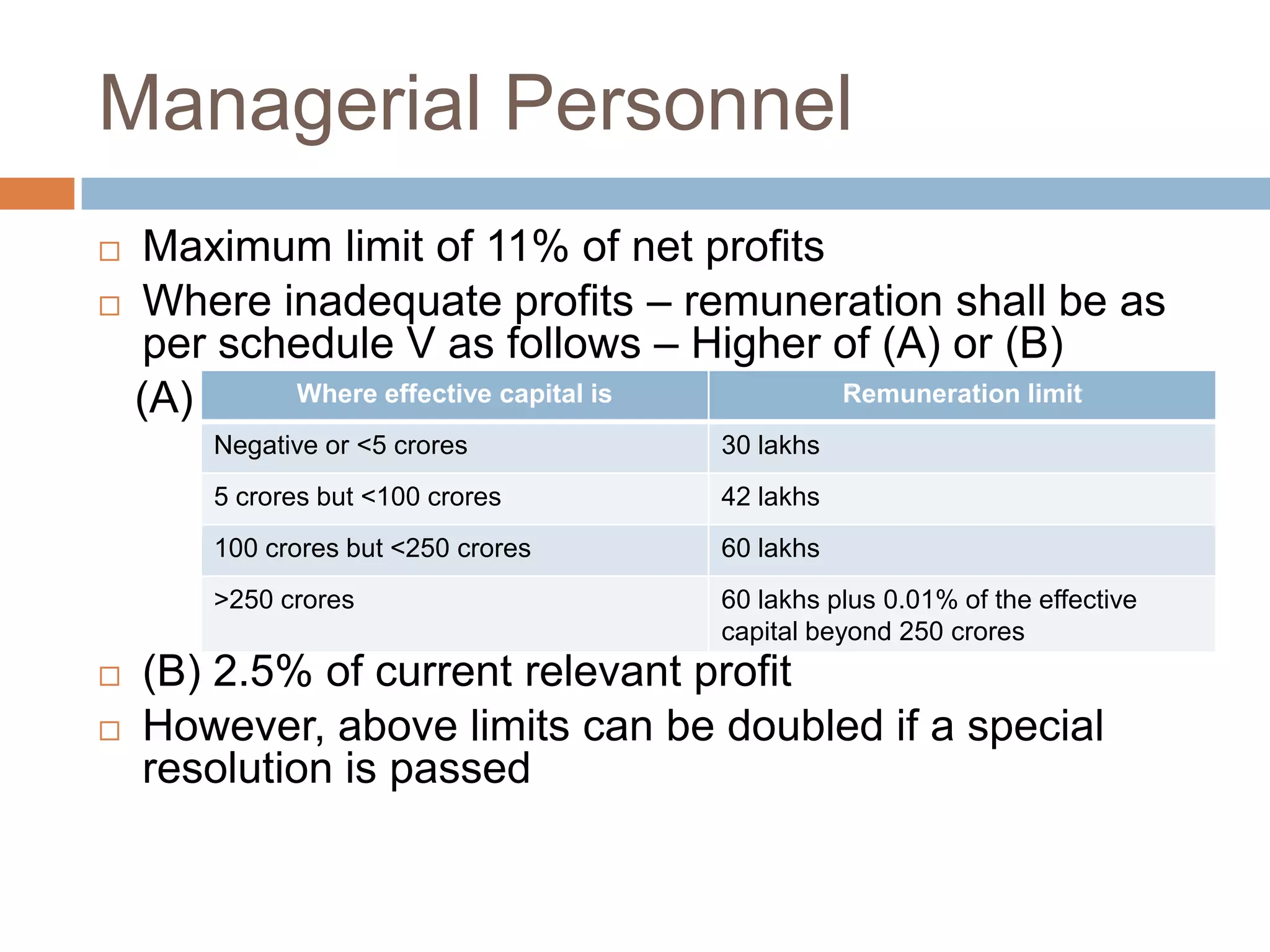

The document discusses the evolution of independent directors and corporate governance norms in India from various committee reports. It outlines the roles and responsibilities of independent directors, board of directors, and managerial personnel as per the Companies Act. Key points include minimum number of independent directors required, their selection process, remuneration, and liabilities. It also summarizes provisions around director qualifications, meetings, and remuneration of managerial personnel.