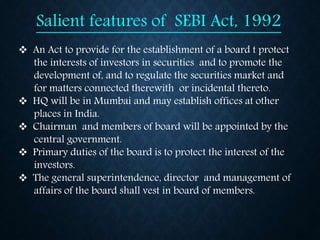

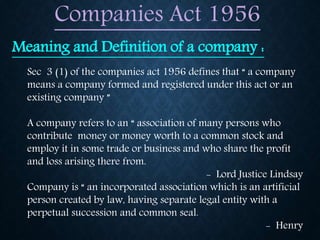

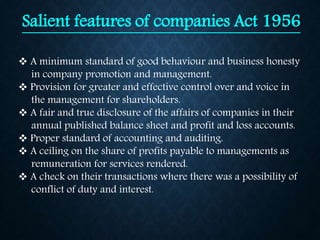

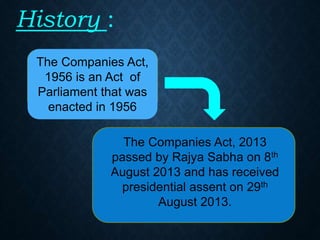

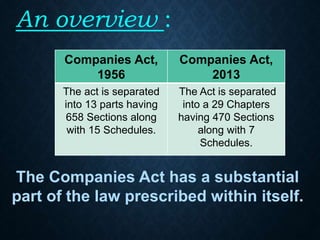

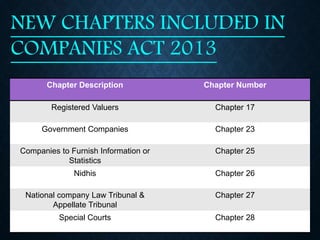

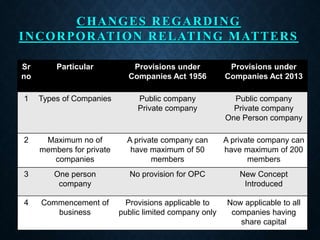

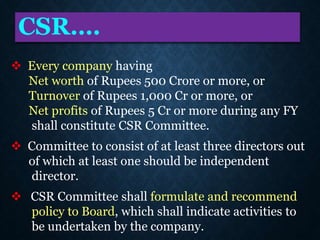

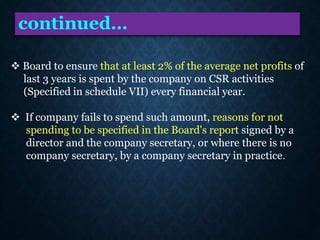

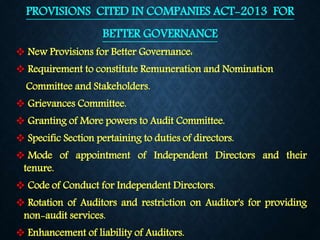

The document discusses key aspects of securities markets such as primary and secondary markets, the role of the Securities and Exchange Board of India (SEBI) in regulating markets, important provisions of SEBI Act 1992 and the Companies Act 1956. It also compares the Companies Act 1956 to the new Companies Act 2013, highlighting changes introduced around types of companies, corporate social responsibility requirements, and provisions for better corporate governance.