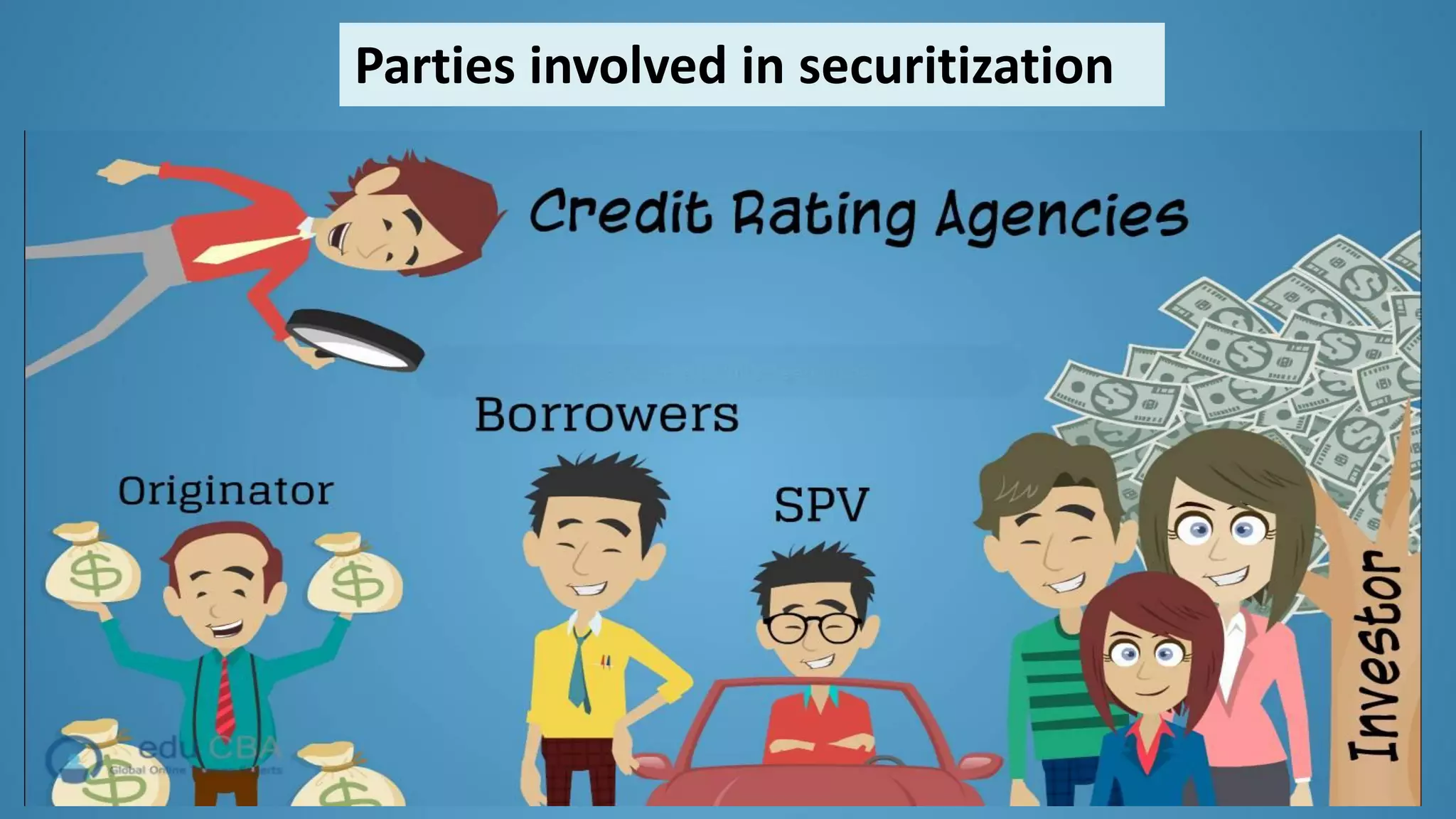

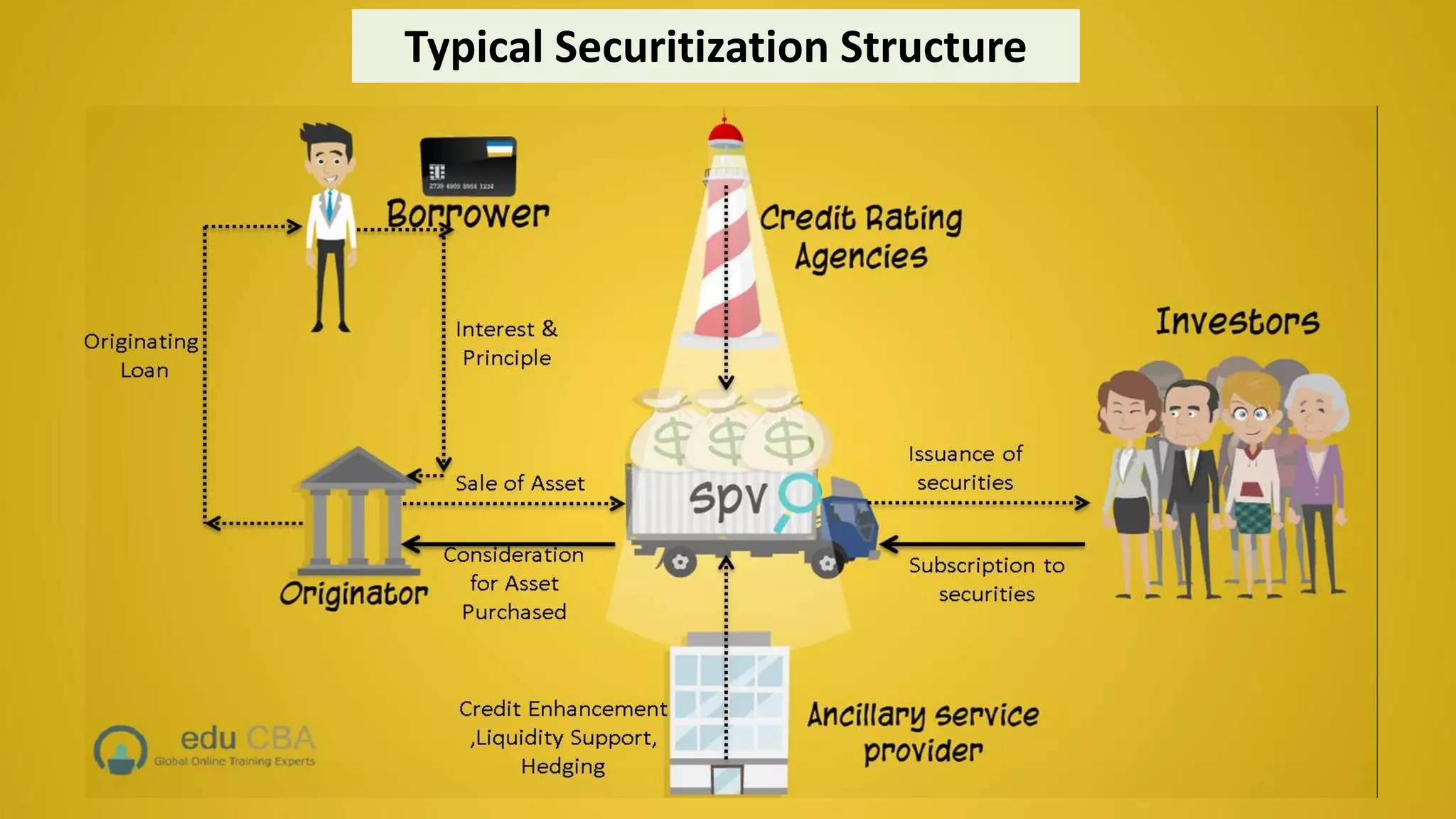

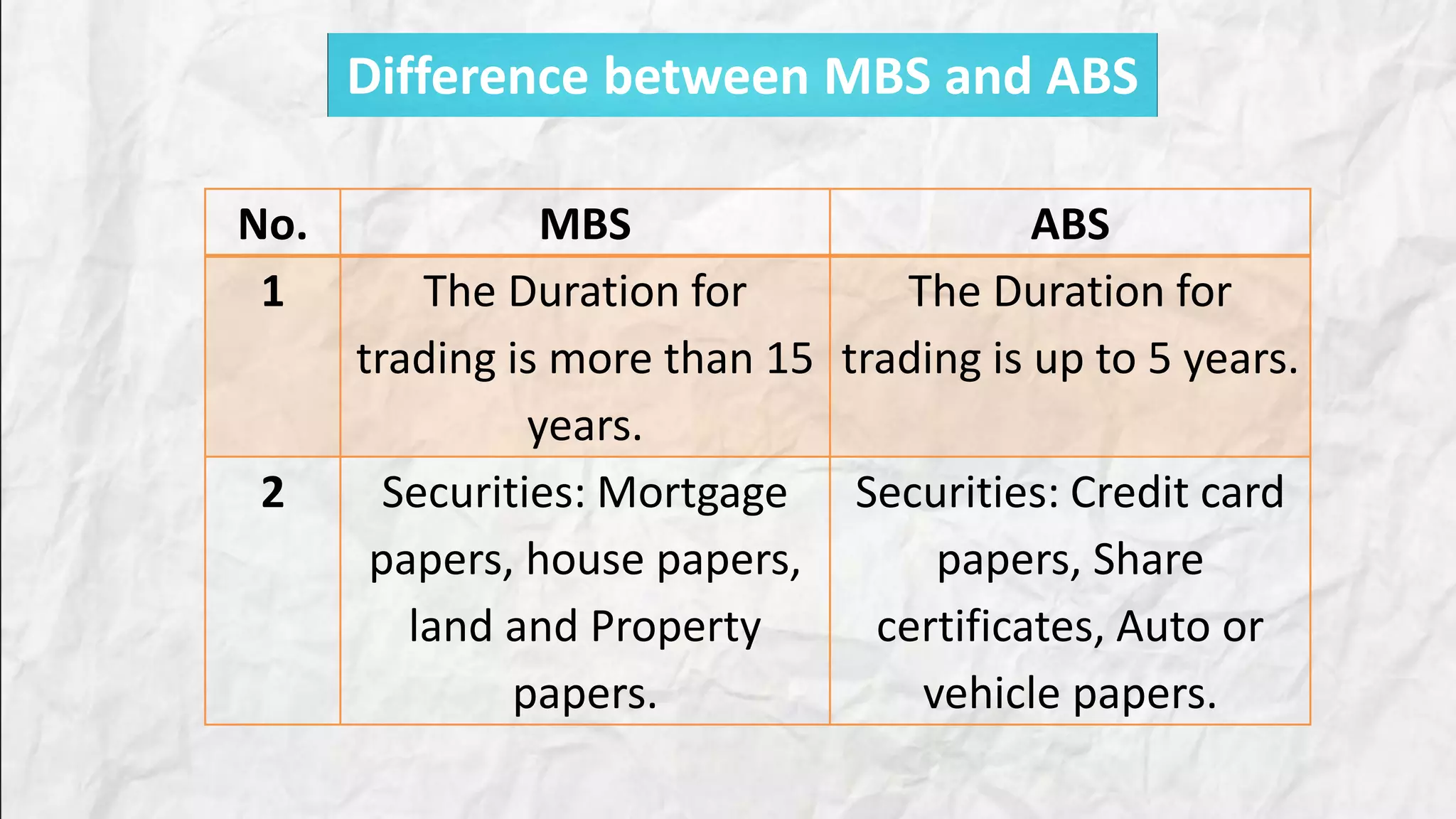

Securitization is the process of converting receivables from financial assets like mortgage loans into marketable securities. It involves packaging loans and receivables into asset-backed securities (ABS), collateralized debt obligations (CDO), and mortgage-backed securities (MBS). Key differences between MBS and ABS include their trading durations and the types of receivables backing them.