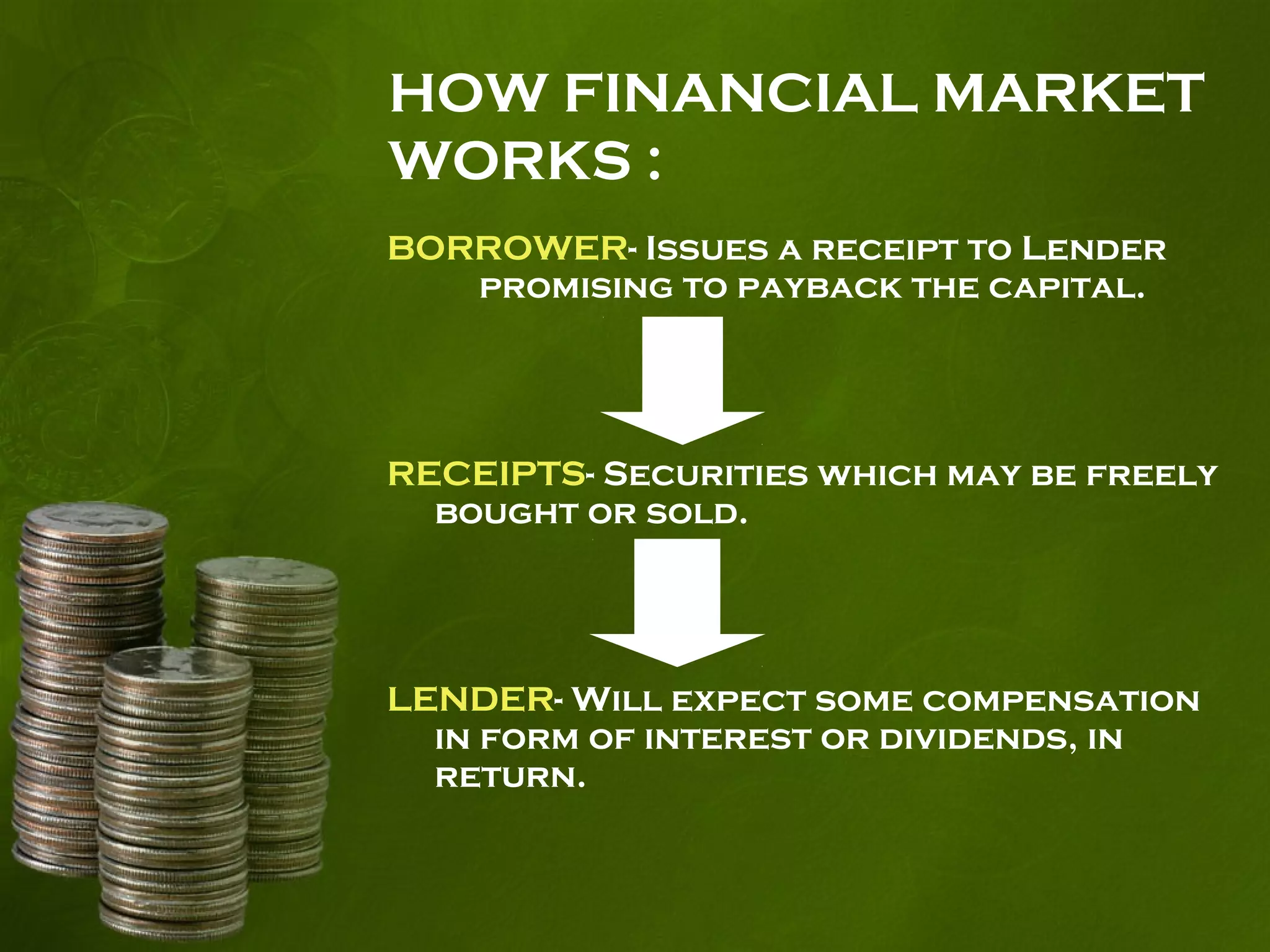

The document provides an overview of financial markets, explaining their mechanisms, purposes, and types, including capital, commodity, and foreign exchange markets. It highlights the importance of intermediaries like banks in raising capital and facilitating transactions between borrowers and lenders. Financial markets enhance business liquidity, improve international trade, and are essential for economic stability.