Embed presentation

Download as PDF, PPTX

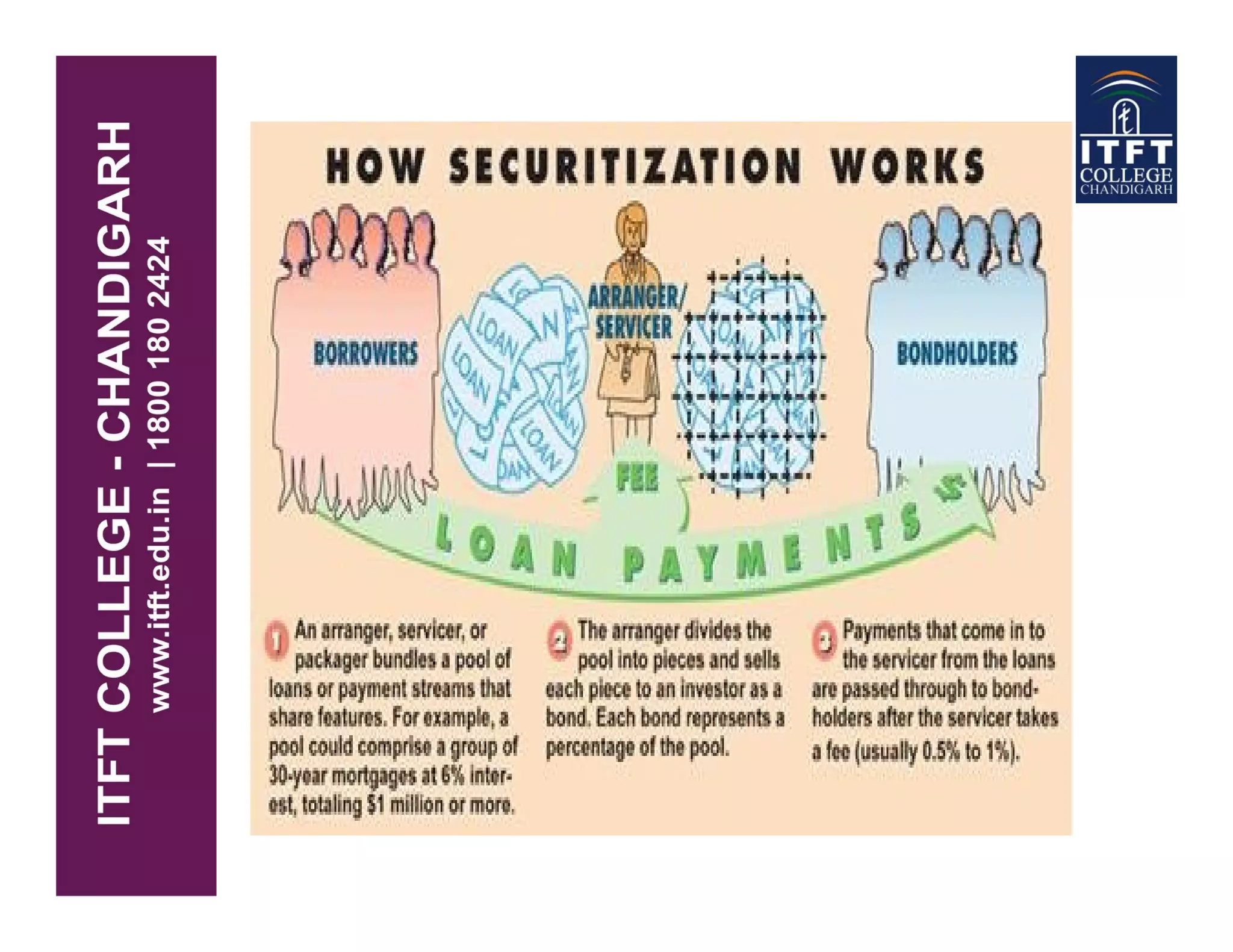

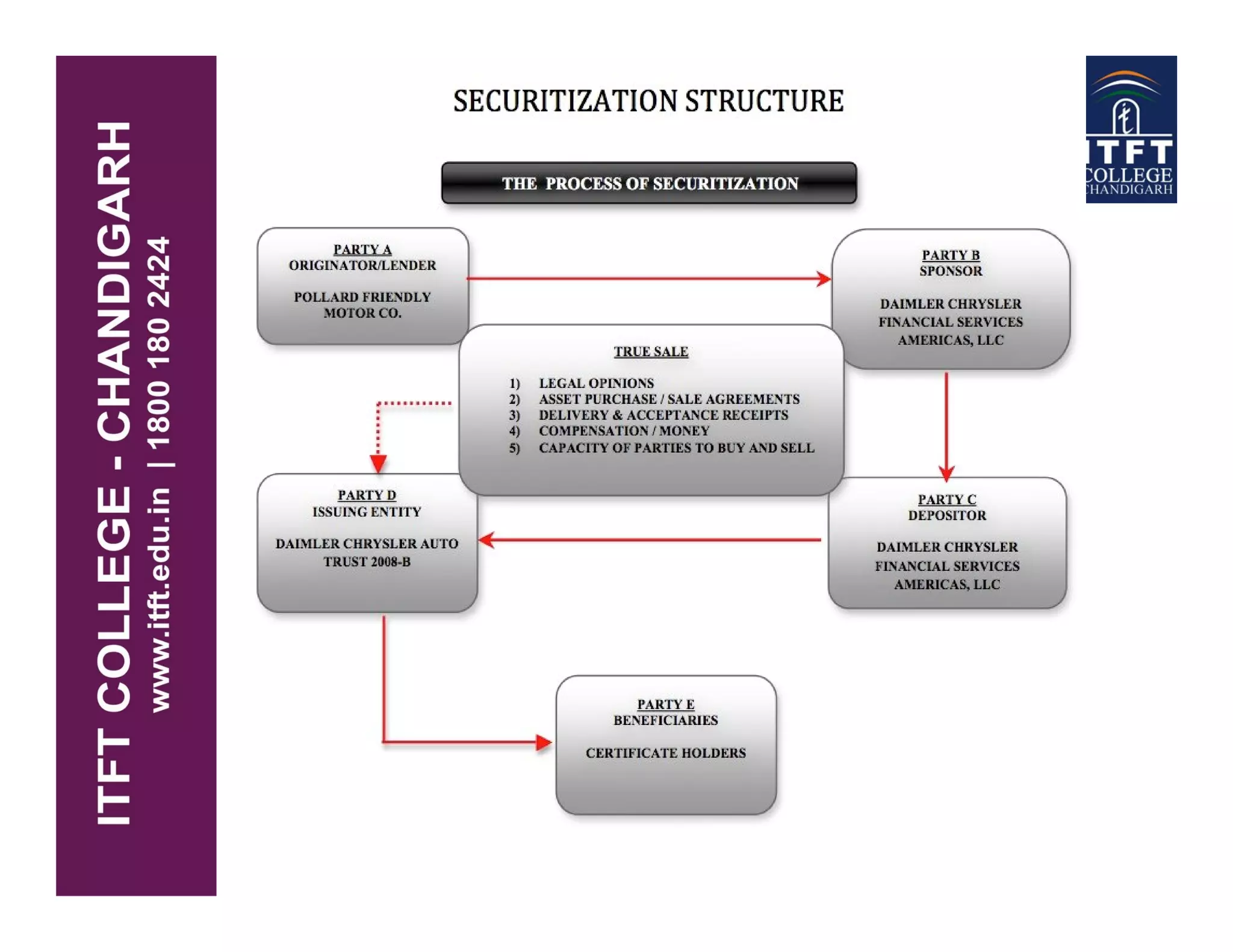

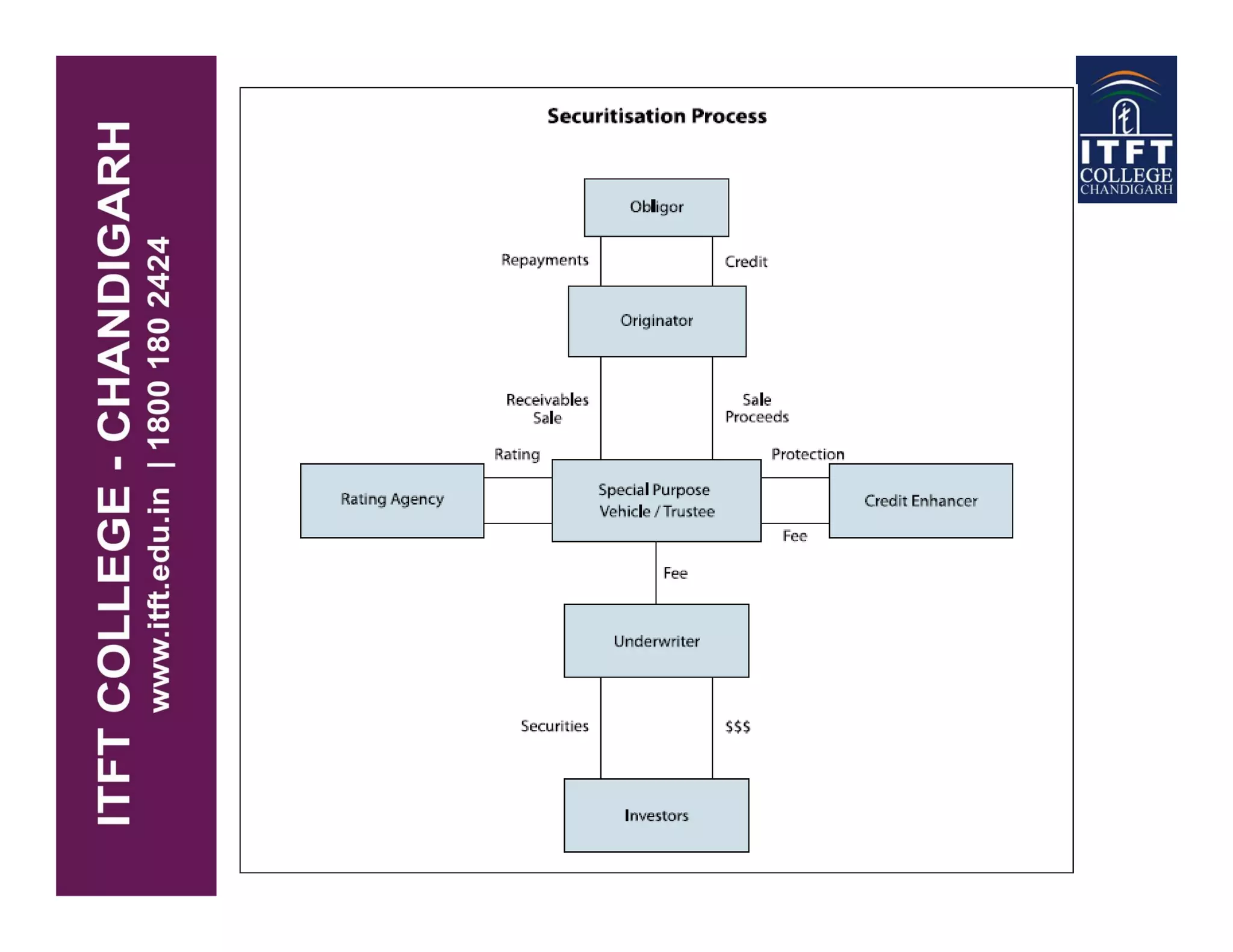

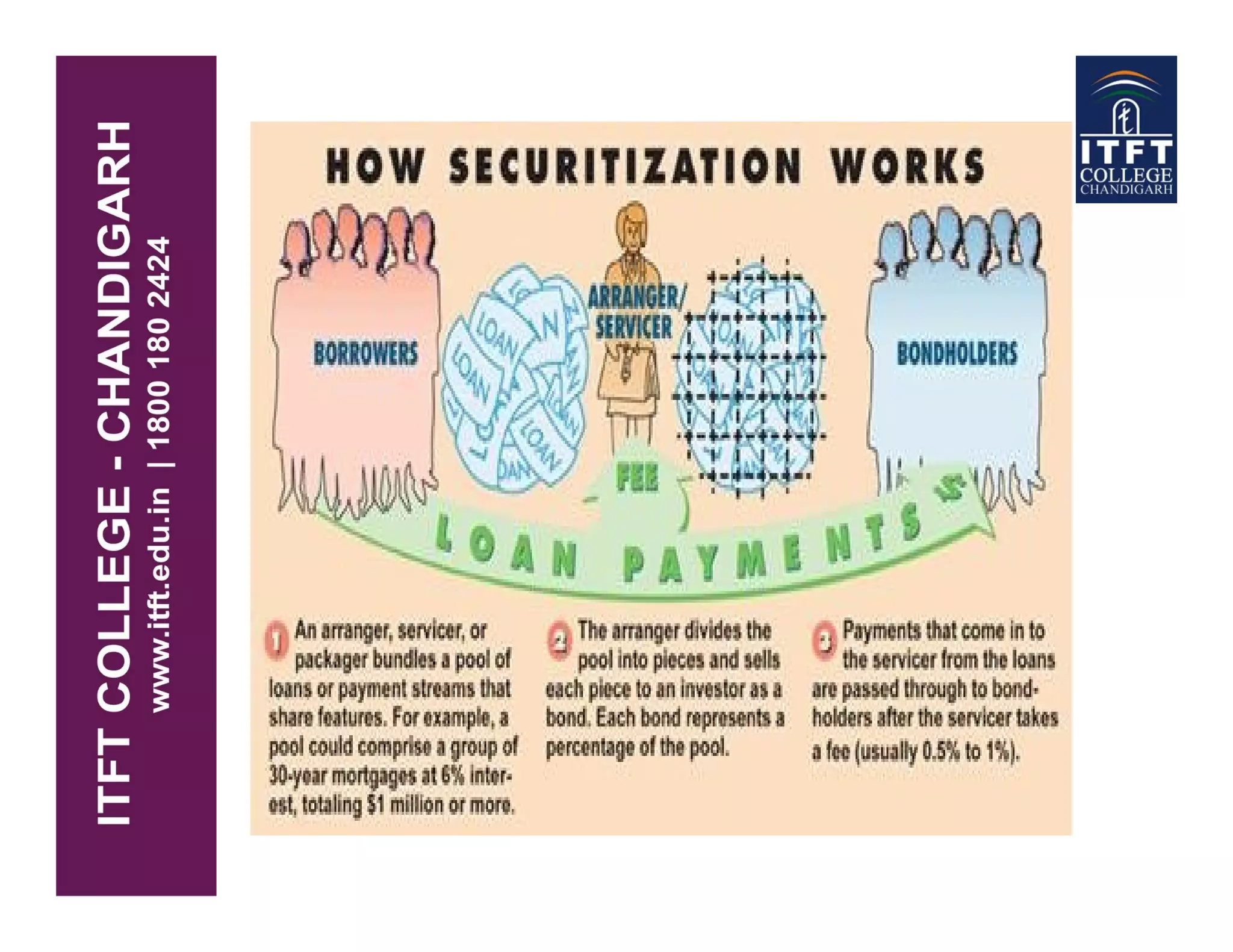

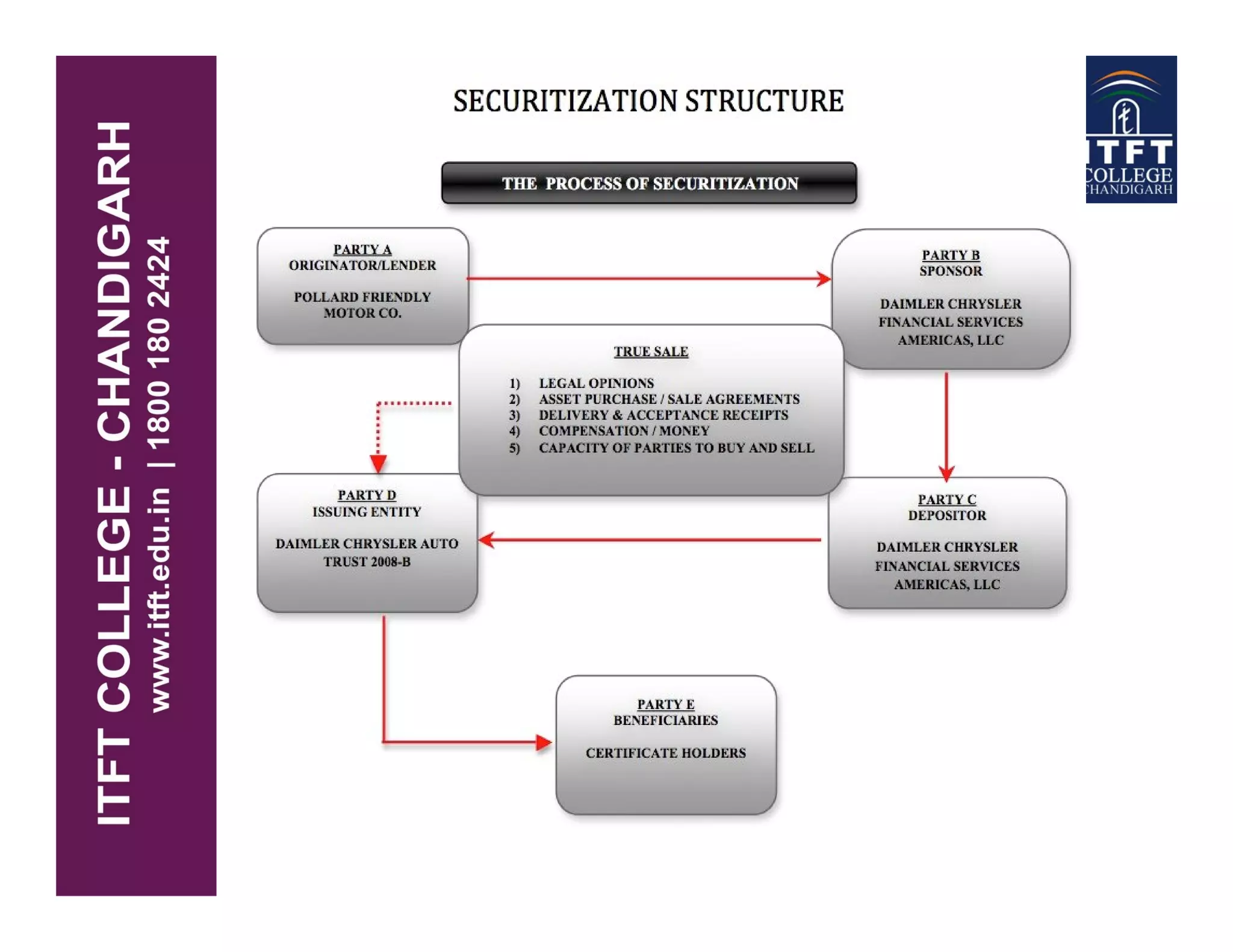

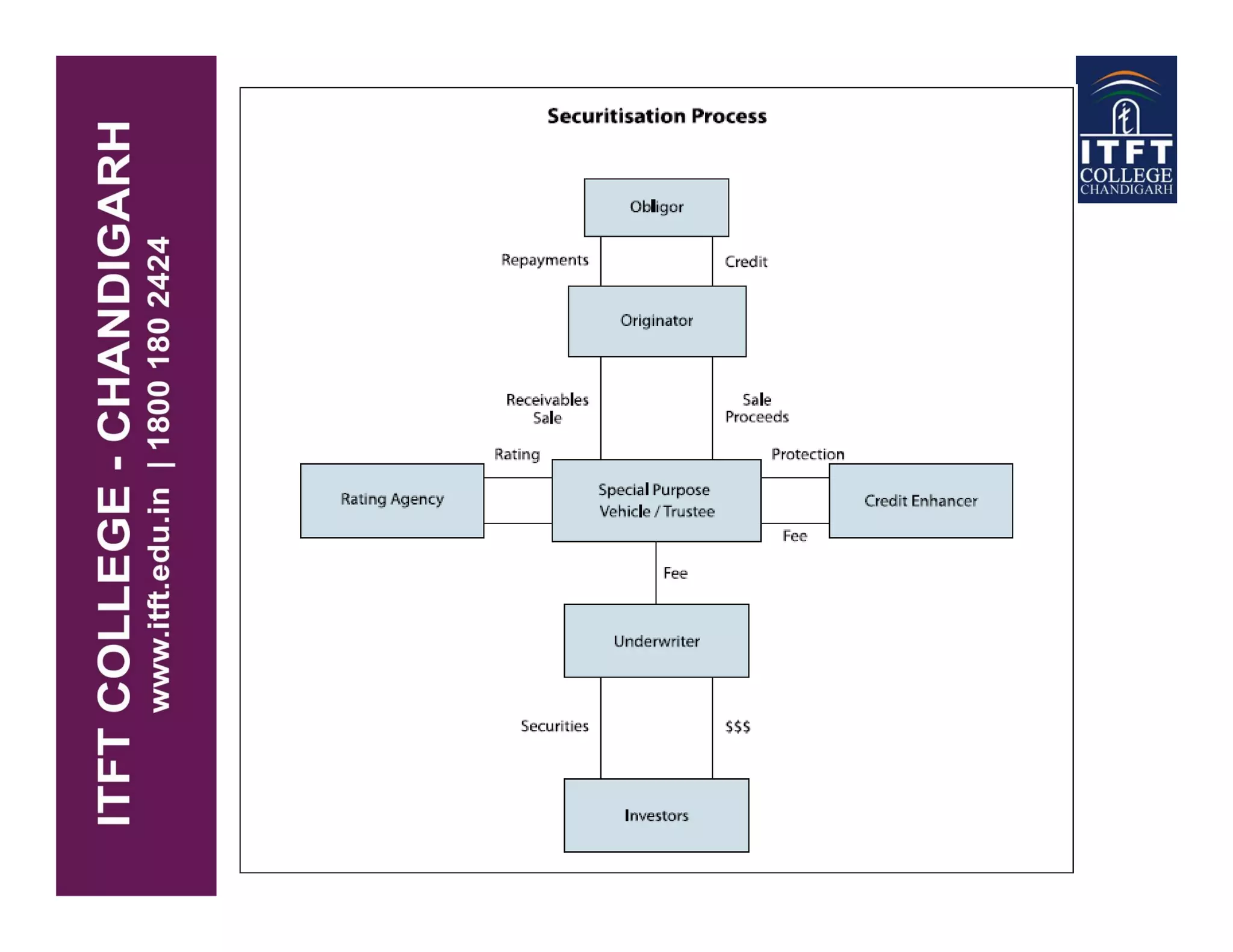

Securitization is the process of transforming illiquid assets like mortgages into marketable securities. This is done by pooling cash-flow producing assets and packaging their value as securities to sell to institutional investors. Securitization allows whole loan lenders to sell loans in the secondary mortgage market. A mortgage loan is secured by real property through a mortgage note and granting of a mortgage.