Two Prices for Oil Benefit US Companies and Economy

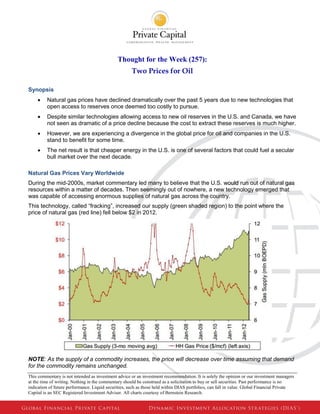

- 1. This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion or our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future performance. Liquid securities, such as those held within DIAS portfolios, can fall in value. Global Financial Private Capital is an SEC Registered Investment Adviser. All charts courtesy of Bernstein Research. Thought for the Week (257): Two Prices for Oil Synopsis Natural gas prices have declined dramatically over the past 5 years due to new technologies that open access to reserves once deemed too costly to pursue. Despite similar technologies allowing access to new oil reserves in the U.S. and Canada, we have not seen as dramatic of a price decline because the cost to extract these reserves is much higher. However, we are experiencing a divergence in the global price for oil and companies in the U.S. stand to benefit for some time. The net result is that cheaper energy in the U.S. is one of several factors that could fuel a secular bull market over the next decade. Natural Gas Prices Vary Worldwide During the mid-2000s, market commentary led many to believe that the U.S. would run out of natural gas resources within a matter of decades. Then seemingly out of nowhere, a new technology emerged that was capable of accessing enormous supplies of natural gas across the country. This technology, called “fracking”, increased our supply (green shaded region) to the point where the price of natural gas (red line) fell below $2 in 2012. NOTE: As the supply of a commodity increases, the price will decrease over time assuming that demand for the commodity remains unchanged.

- 2. This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion or our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future performance. Liquid securities, such as those held within DIAS portfolios, can fall in value. Global Financial Private Capital is an SEC Registered Investment Adviser. All charts courtesy of Bernstein Research. Although the U.S. has profited from cheaper natural gas, the rest of the world has realized little benefit from our supply increases because there is no world price for natural gas. The commodity is very difficult to transport so prices are local to the region in which the gas in extracted. For example, natural gas is cheap in the U.S. but quite expensive in Japan. In fact, in many regions of the world, natural gas is even burned into the air at drill sites simply because drillers realize no economic value from capturing, transporting, and selling the gas! Oil is Quite Different The two most important types of crude oil are American West Texas Intermediate (WTI) and Brent North Sea Oil (Brent). WTI is known as the U.S. price for oil and is considered to be very high quality oil which can be used for refining a large portion of gasoline demand. Brent oil comes from 15 different oil fields in the North Sea (just north of mainland Europe) and is almost as high quality as WTI. These two prices for oil effectively set a world price for oil and moved in lockstep for decades. Unlike natural gas, oil is easily shipped across the globe in tankers and hence, the price for oil was the consistent for most of the developed world – until recently. The chart below tells a fascinating story. The black line represents the price of Brent oil, the green line is the price for WTI, and the green shaded region is the production of oil in the U.S. Since 2010, the production of oil in the U.S. has increased dramatically which has caused the relationship between Brent and WTI to diverge by a substantial amount. This divergence, or spread, between Brent and WTI has widened for several reasons. One reason in particular involves a city in Oklahoma, named Cushing, where WTI oil is being delivered from: 1. Canada: Over the past few years, Canadian oil sands have become a vast resource for oil and the reserves are currently being transported to Cushing.

- 3. This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion or our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future performance. Liquid securities, such as those held within DIAS portfolios, can fall in value. Global Financial Private Capital is an SEC Registered Investment Adviser. All charts courtesy of Bernstein Research. 2. Fracking for Oil: Similar to how fracking has increased the supply of natural gas, new oil reserves are coming online here in the U.S., which are also being sent to Cushing. Since there is no sufficient infrastructure in the U.S. to export this extra oil, the supply has been building rapidly in Cushing, OK. The net effect has driven the price of WTI oil down and those companies with the ability to access oil from Cushing and have it delivered economically have benefitted. On the other hand, Brent has risen due to production declines in the North Sea (lower supply means higher prices) and more direct exposure to unrests in the Middle East. We believe that the net result of these factors will be a permanent spread between Brent and WTI oil - two world prices for oil instead of just one. NOTE: You may be asking why the price of oil has not declined at the same rate as natural gas had years ago, despite an increase in supply. While fracking for natural gas is inexpensive, the technology behind fracking for oil, along with the complexity of accessing oil in these Canadian oil sands, is considerably more expensive which maintains a price floor. If the price of oil were to go too low, then companies would not be able to profit from these extraction processes. Why Does All of This Matter? We believe that we are at the beginning of a secular bull market that could persist for over a decade and a key component to our thesis involves cheap domestic energy. Although we could list countless benefits to our economy from this energy revolution, the three most important are: 1. Cost/Competitive Advantage: At one point last year, the spread between Brent and WTI exceeded $25, meaning companies purchasing WTI oil were paying 25% less vs. those purchasing Brent for the same product. The benefit here is two-fold: a. Increased Sales: By maintaining lower input costs, companies here can compete more effectively. Think about how companies in China for years have been able to offer products at a lower price due to cheaper labor. The same principle applies here – companies with access to cheaper oil can price products more competitively. b. Higher Company Earnings: Companies with decreasing input costs can widen margins which increase earnings-per-share (EPS). 2. Job Creation: The energy is below our feet and we will need additional skilled labor to bring it to the surface. Job creation is one of the most powerful drivers of a strong economy because approximately 70% of our gross domestic product (GDP) consists of consumer spending. 3. Energy Independence: We believe that the idea of energy independence for the U.S. could become a reality in the next 15-20 years given these advances in technology. There is certainly much controversy surrounding the future of energy in the U.S. However, as companies continue their migration to cheaper sources of energy, as many utilities have already moved from coal to cheaper natural gas to fuel power plants, we believe that our economy will greatly benefit along the way.