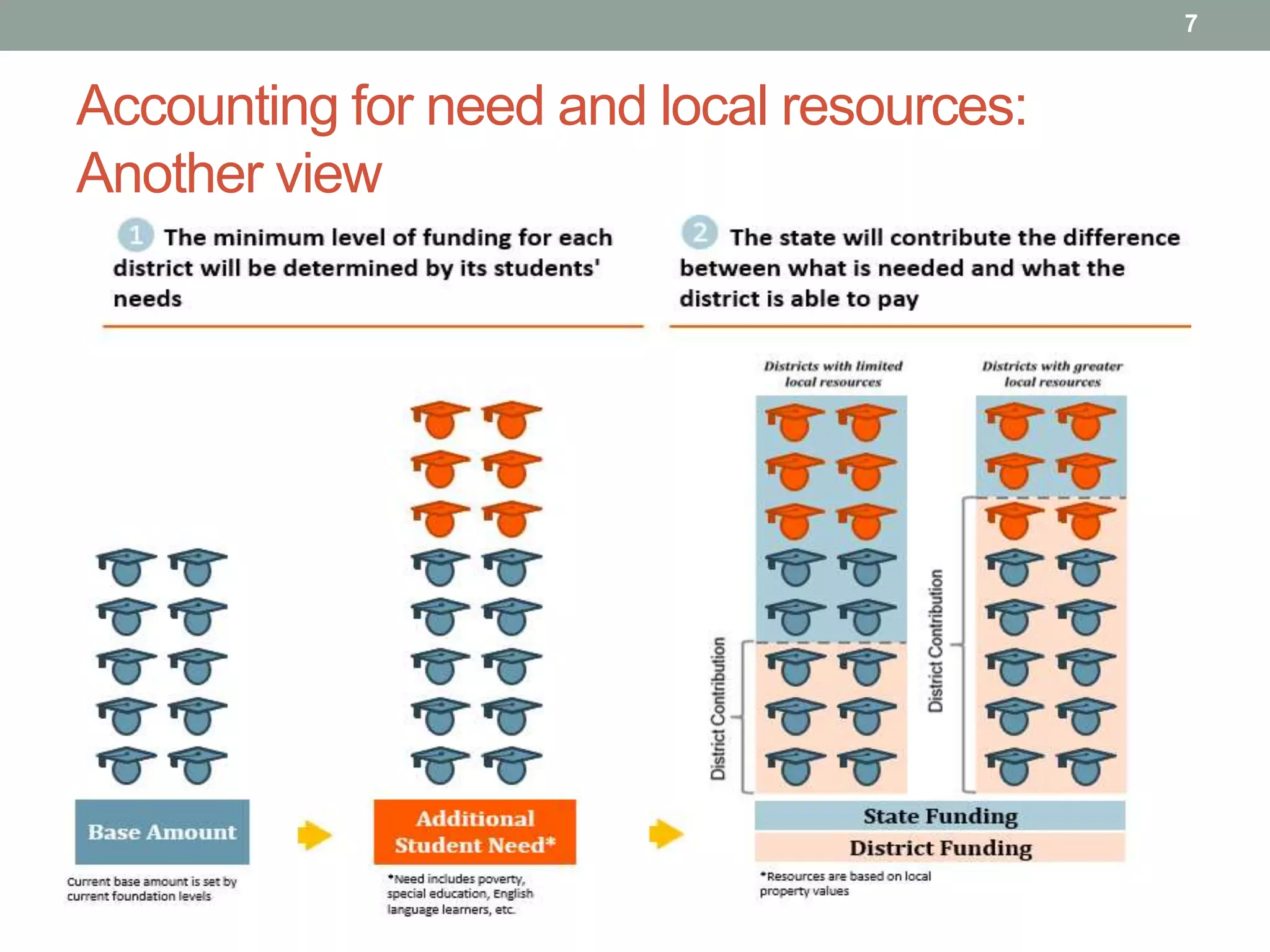

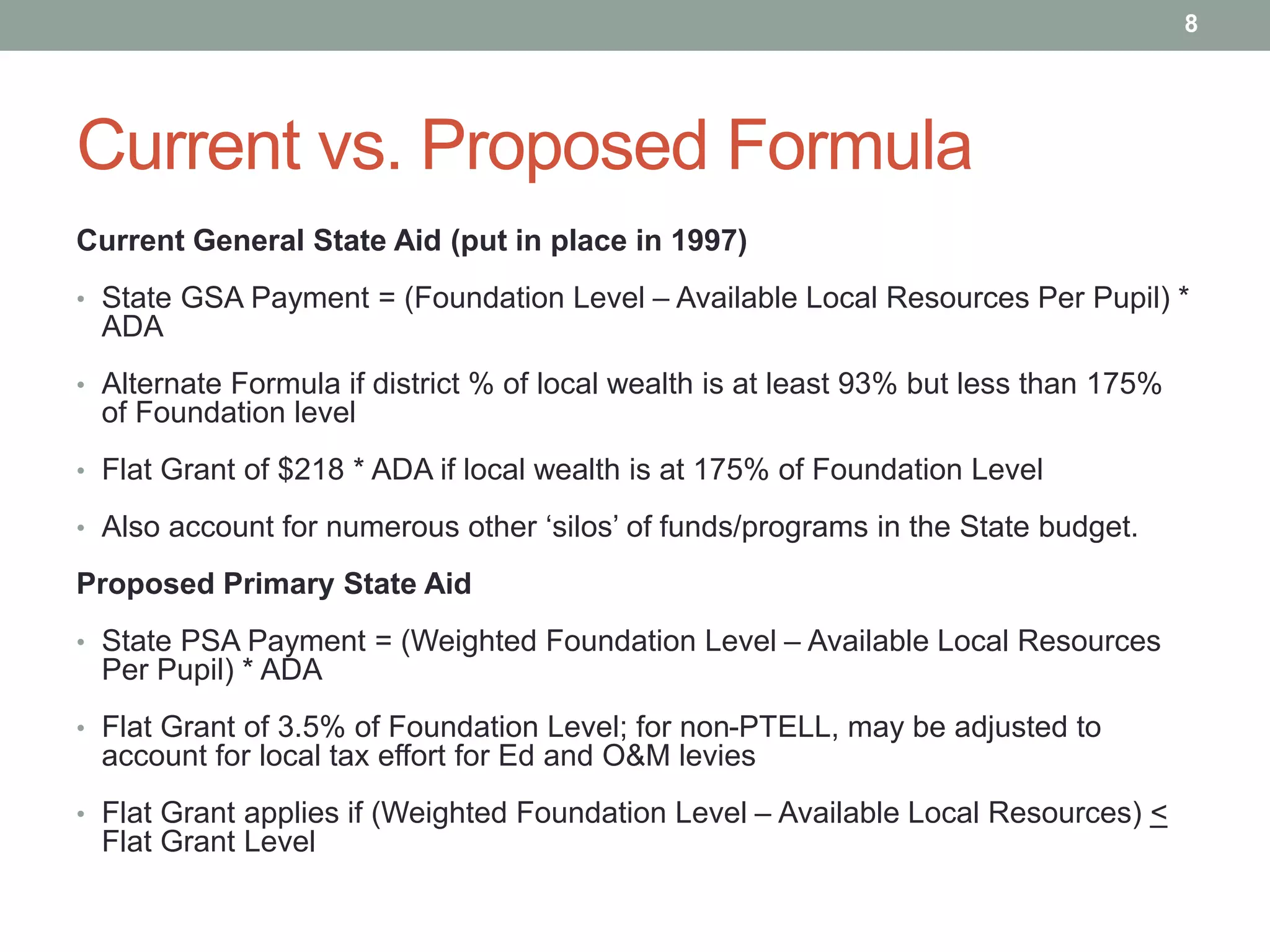

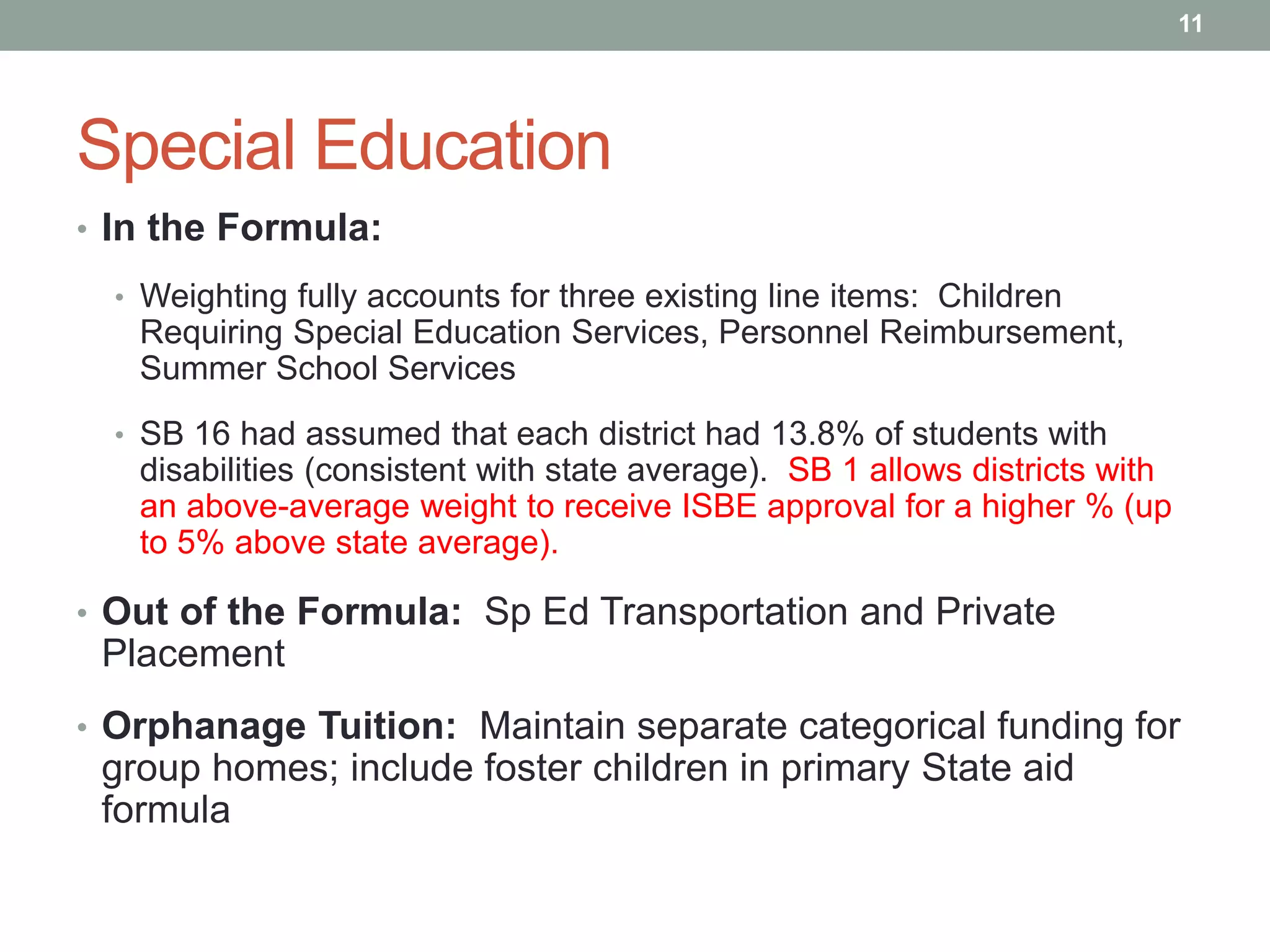

This document summarizes Senate Bill 1, the School Funding Reform Act of 2015 in Illinois. The bill aims to create a more equitable school funding system that accounts for student need and local resources. It proposes consolidating multiple state funding streams into a single, weighted funding formula that considers factors like low-income status, English language learners, special education, and regional costs. The bill also includes provisions for oversight, accountability, a funding increase from the state, and further review of the new system.