Embed presentation

Download as PPSX, PPTX

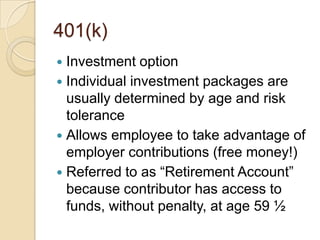

This document provides an overview of basic savings and investment options for beginners looking to start planning for their financial future. It outlines savings accounts, certificates of deposit, and 401(k) retirement accounts, explaining what each is, how they work, and their benefits. The key points are that savings accounts are simple with few limitations but earn little interest, CDs offer higher returns but require locking funds away for a set term, and 401(k)s allow investing with potential employer contributions for retirement savings.