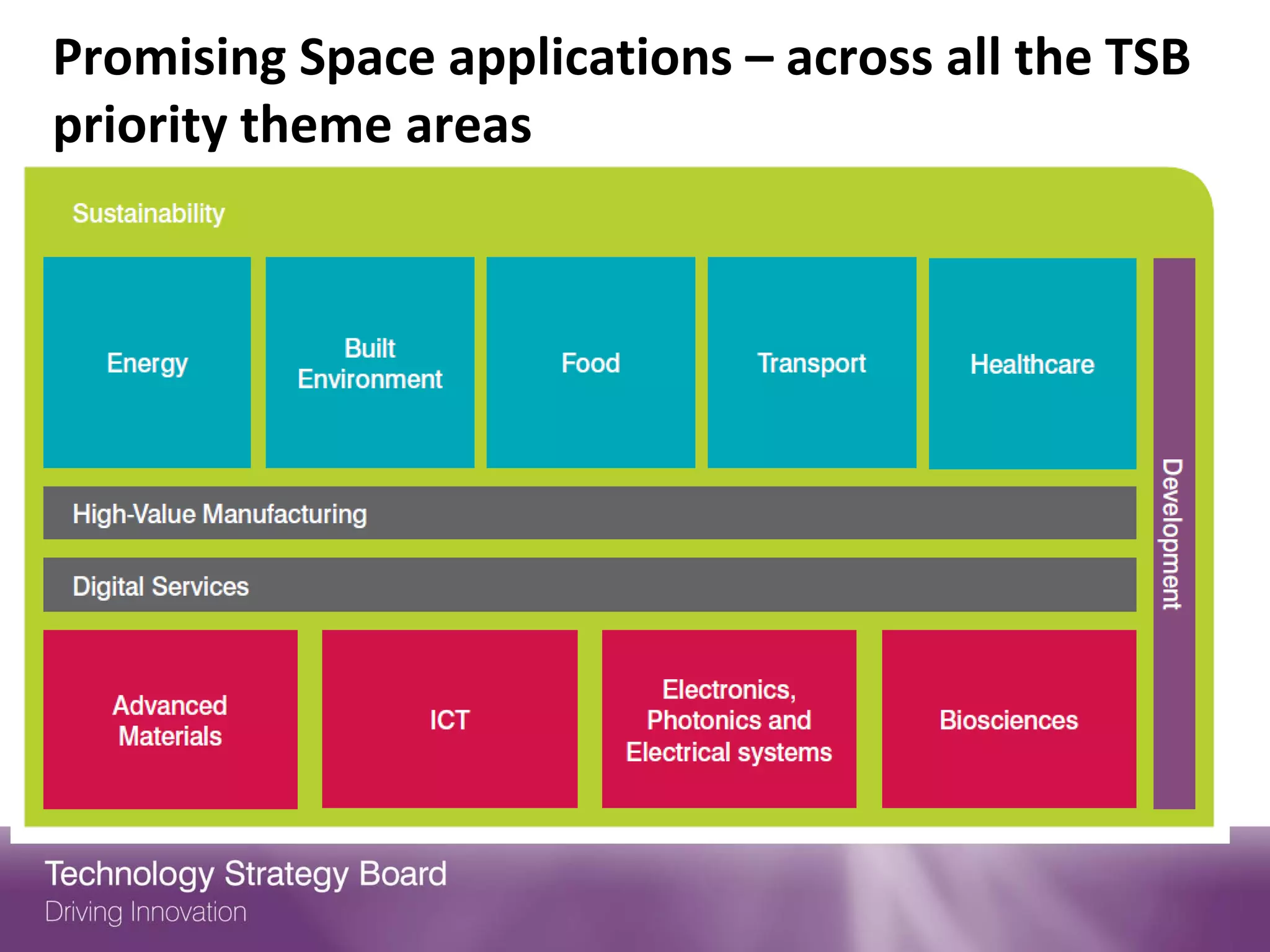

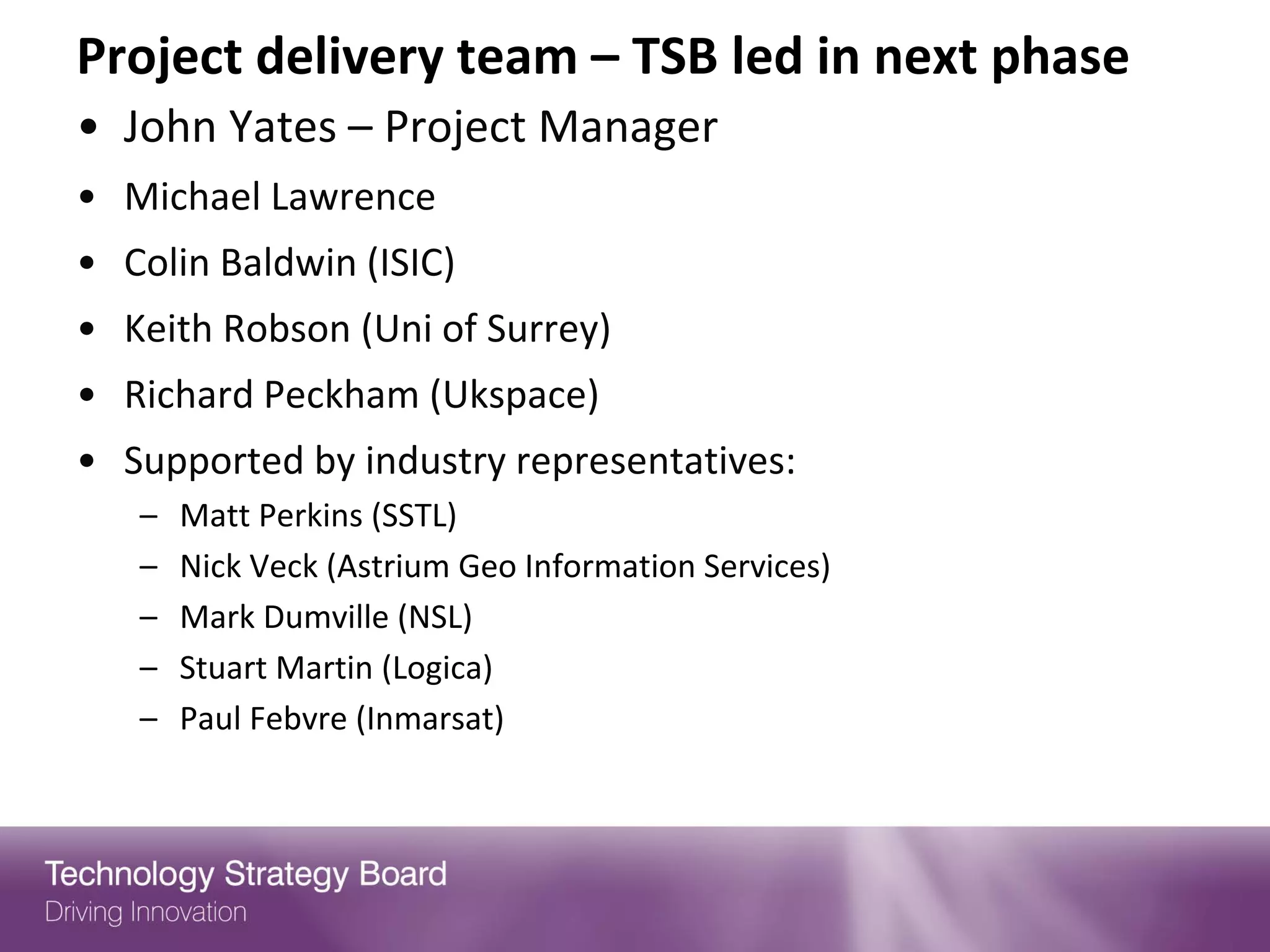

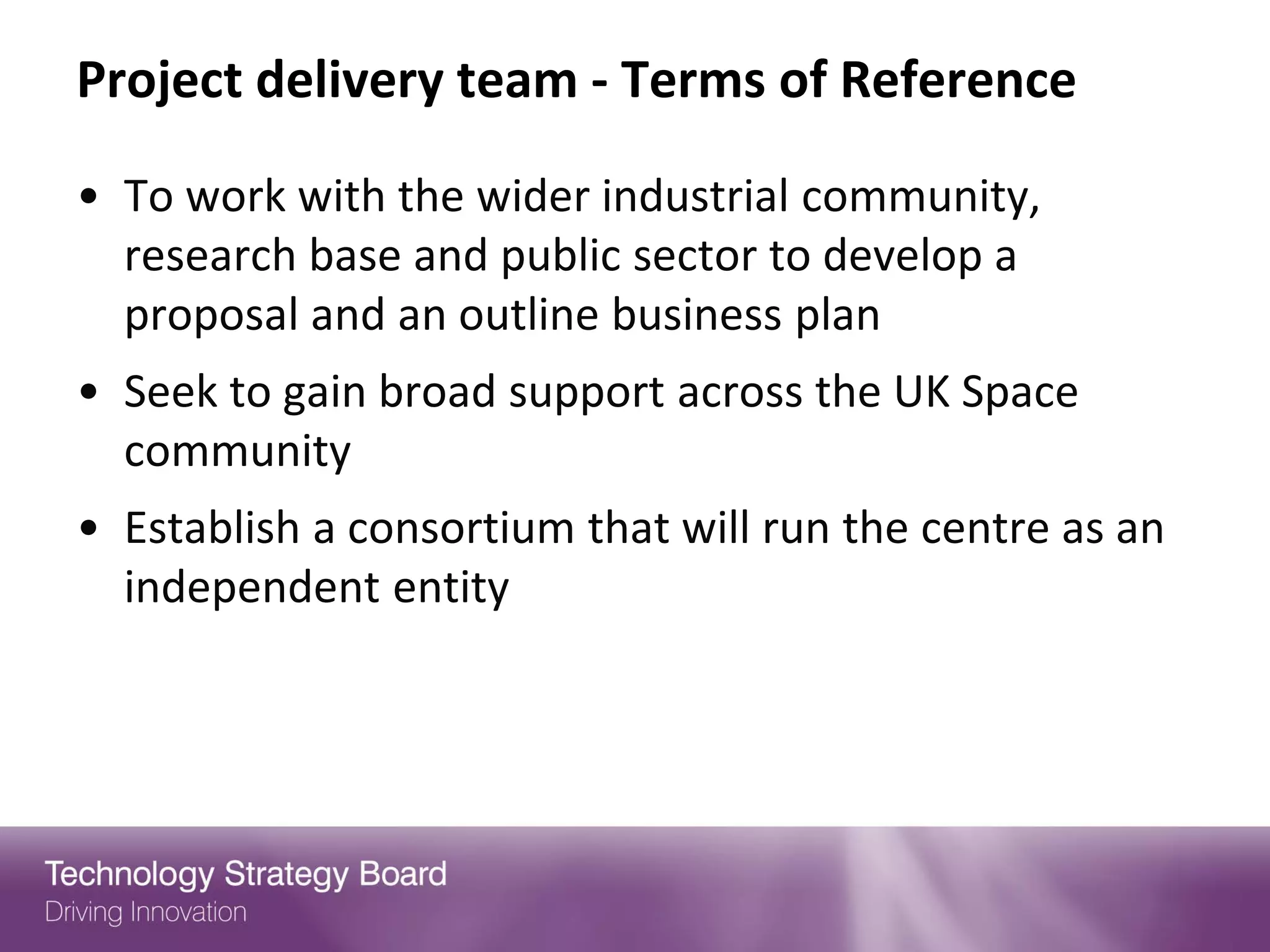

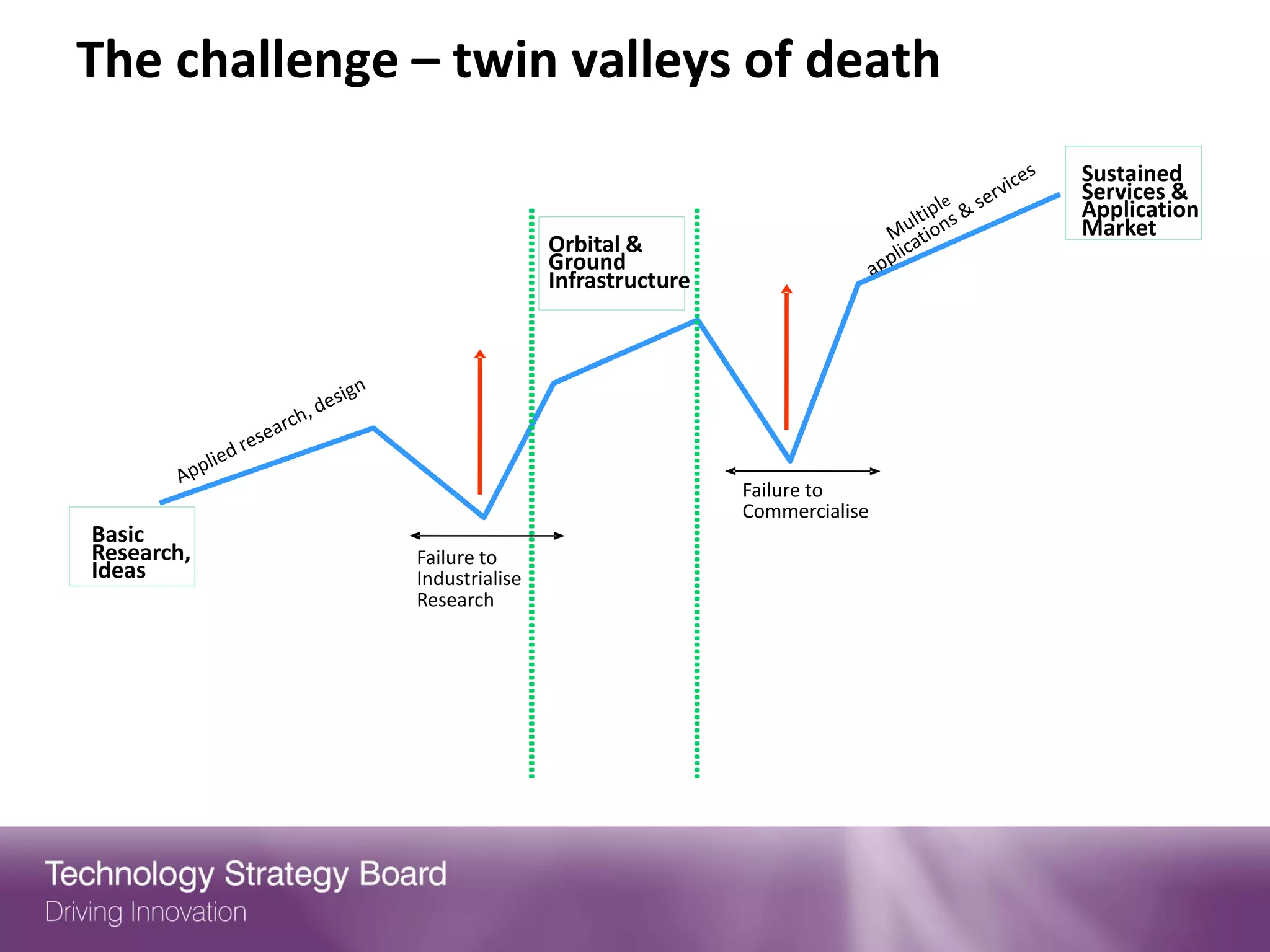

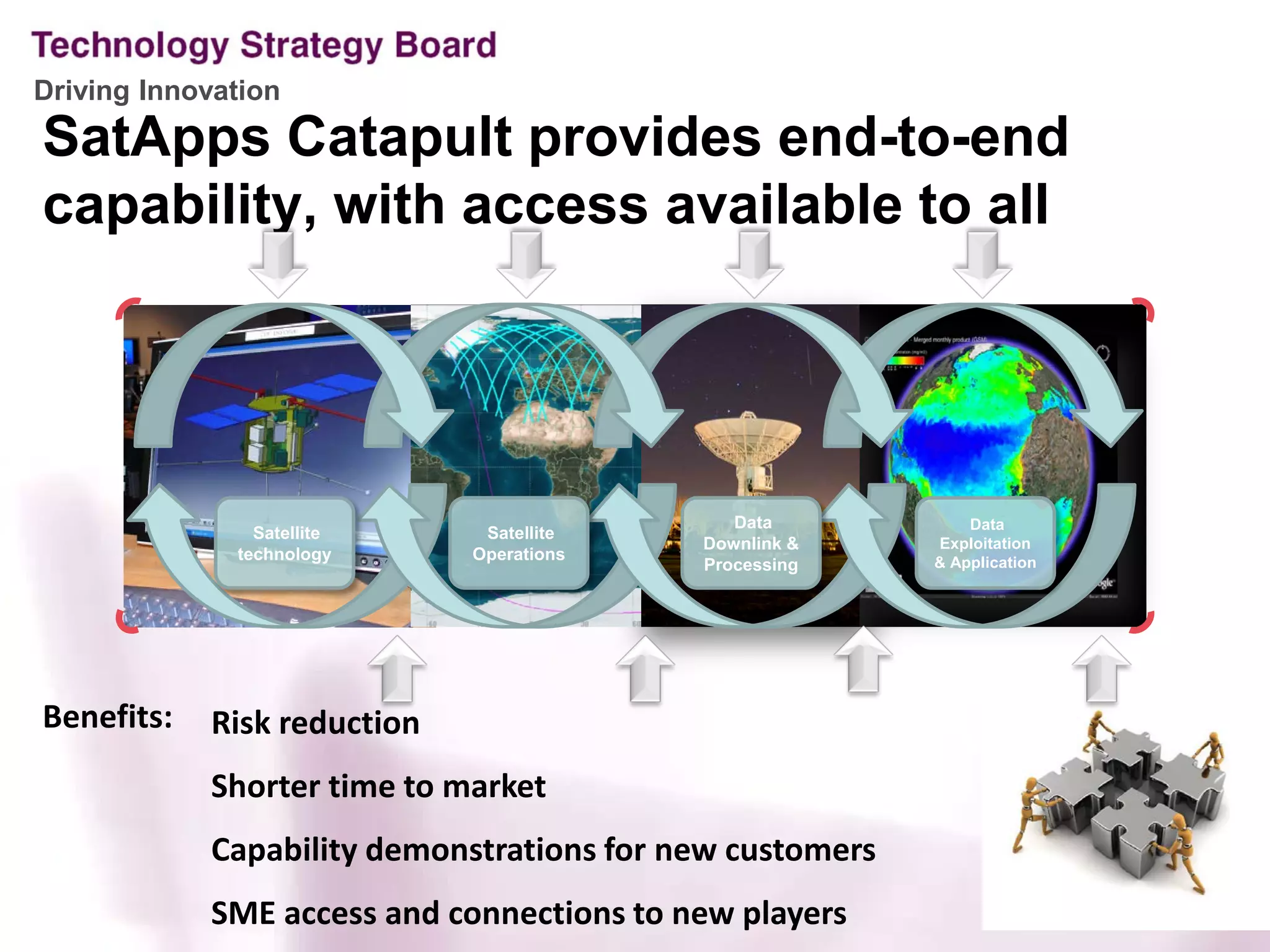

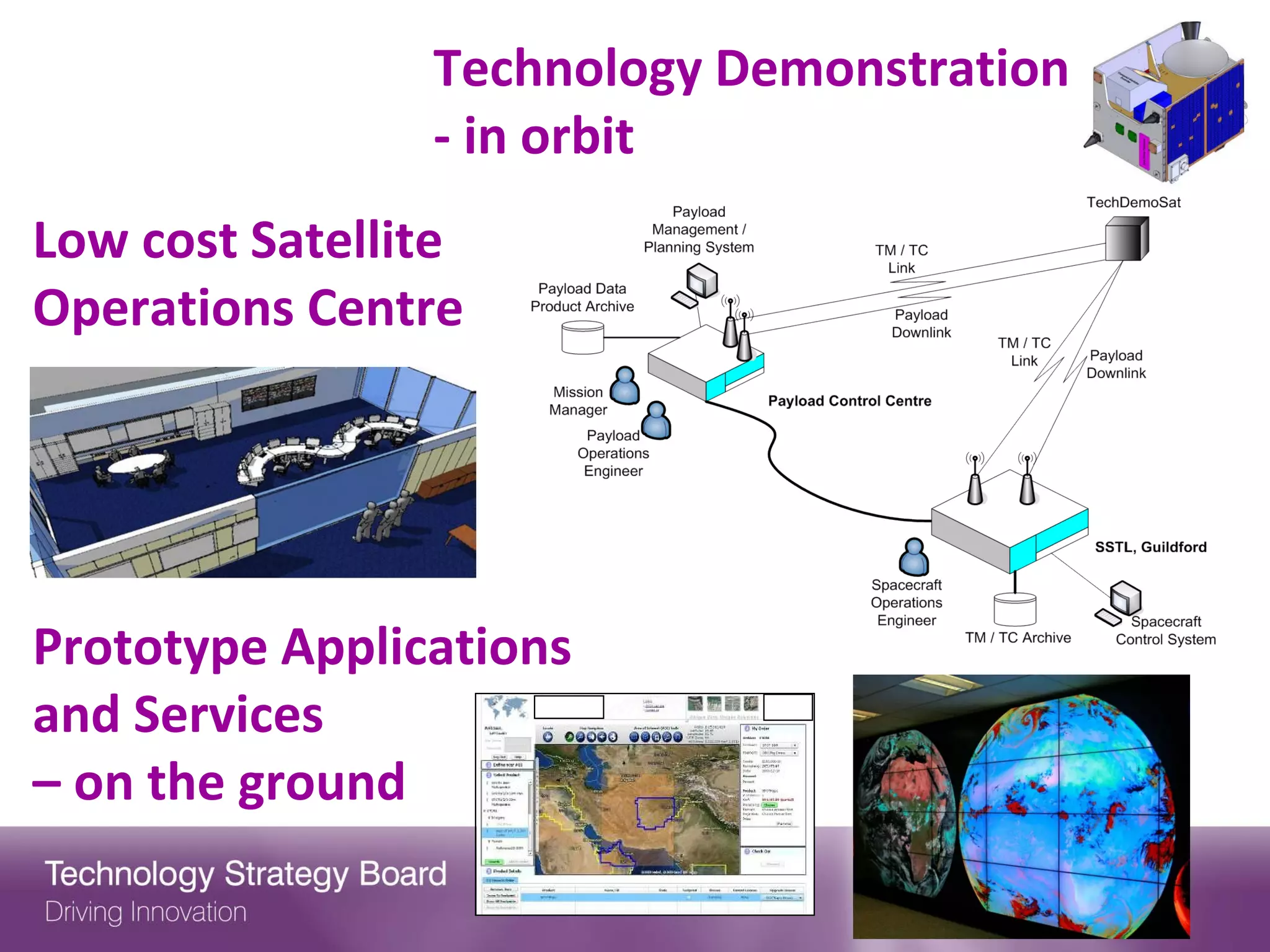

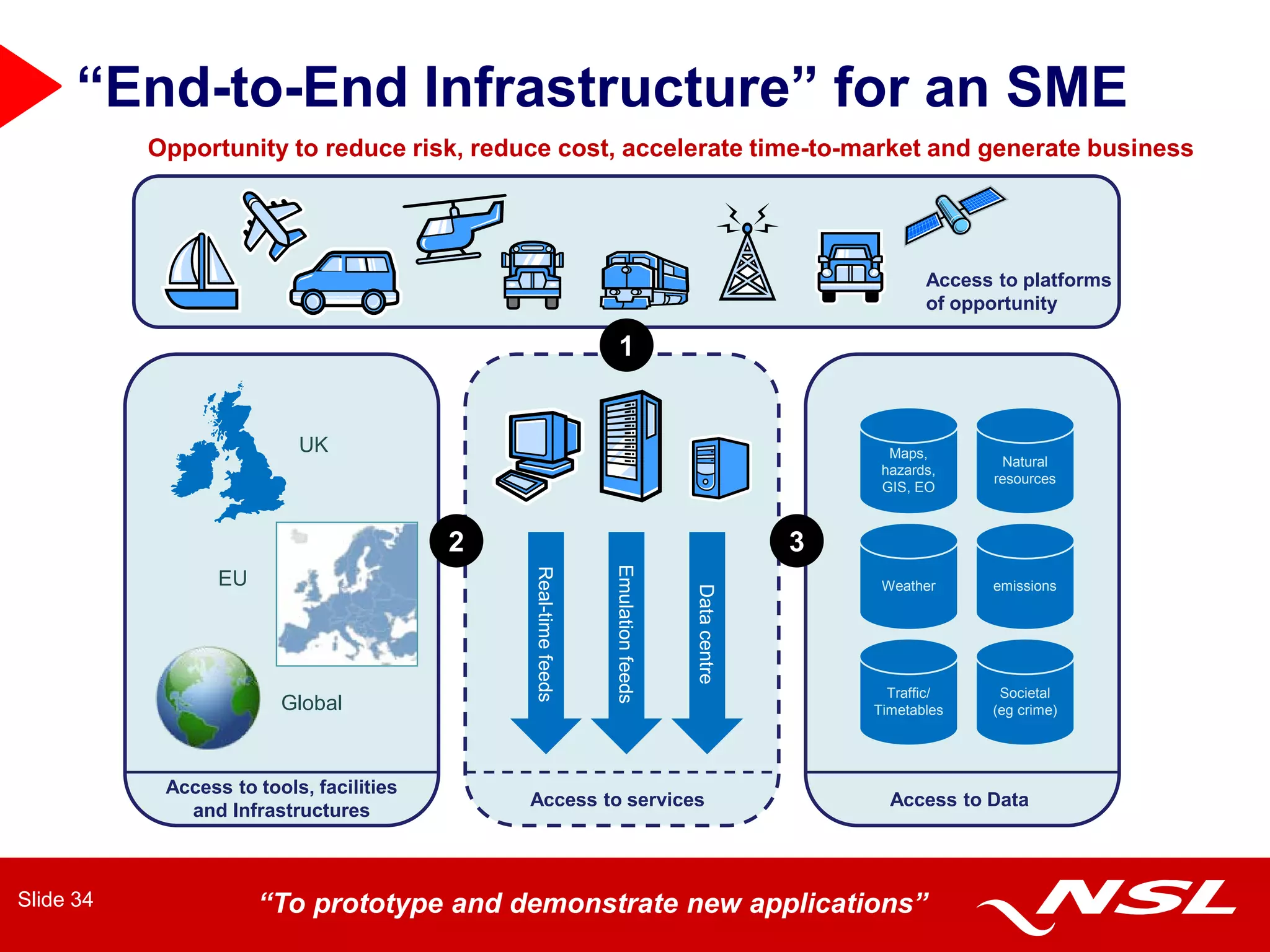

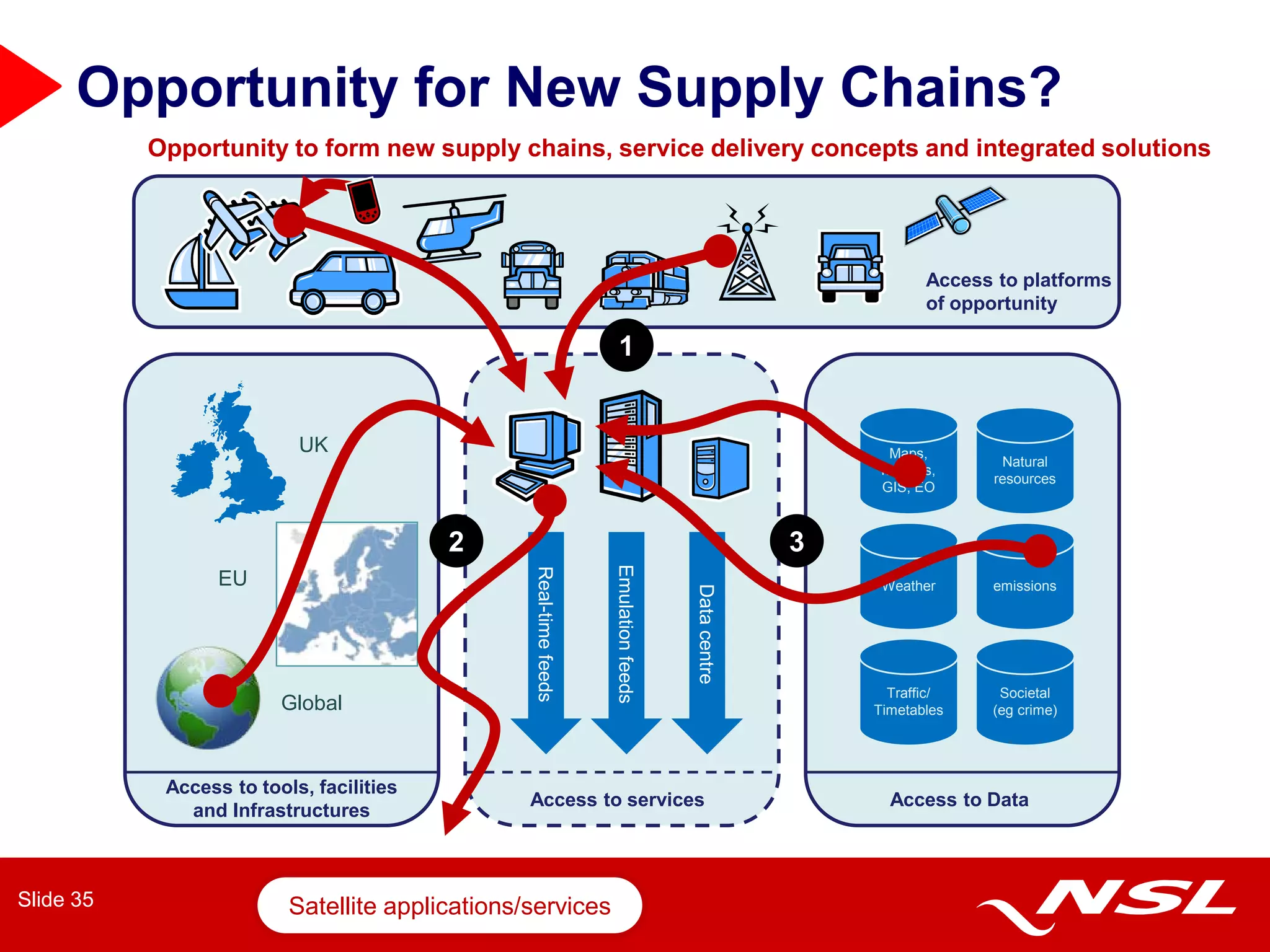

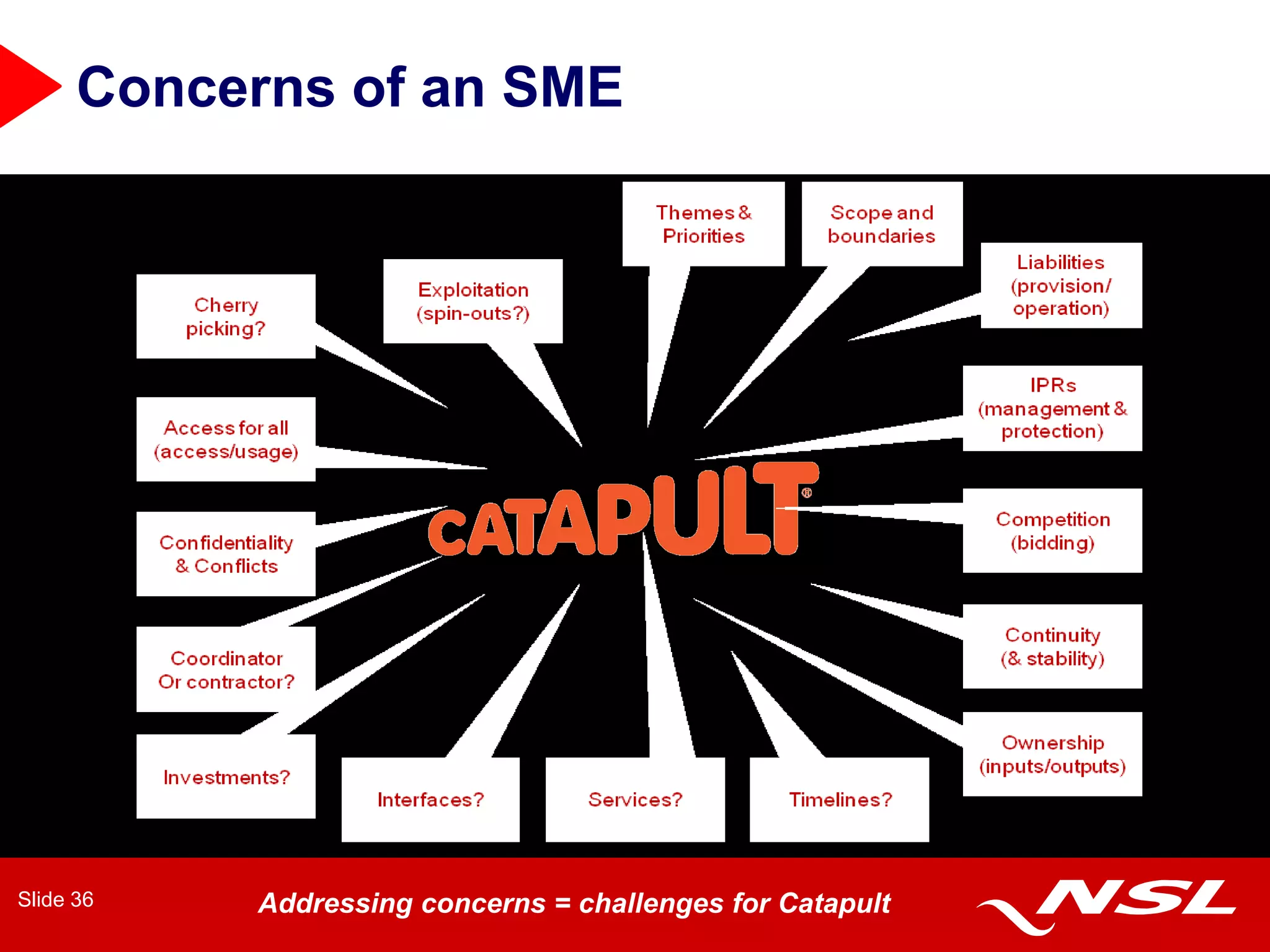

The document details the Satellite Applications Catapult Centre's public sector workshop held on February 3, 2012, focusing on the role of satellite applications in driving economic growth and technological innovation in the UK. It emphasizes the need for collaboration between industry, research, and the public sector to capture opportunities in the global space market, estimated to reach £400 billion by 2030. The Catapult Centre aims to provide infrastructure and expertise for developing new applications that leverage satellite technologies across various sectors.