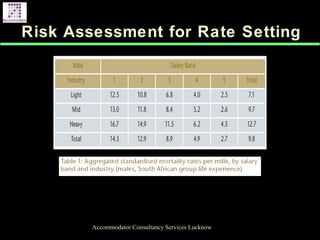

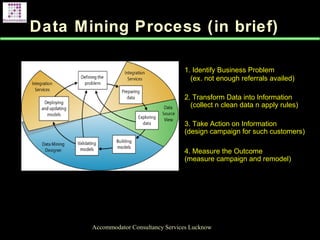

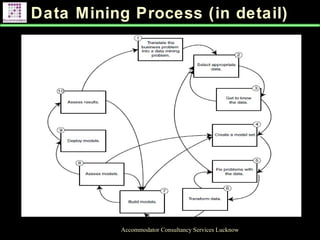

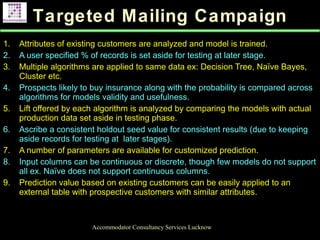

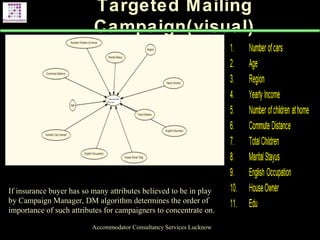

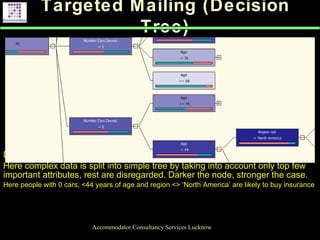

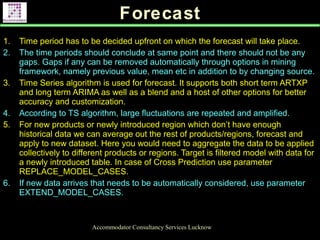

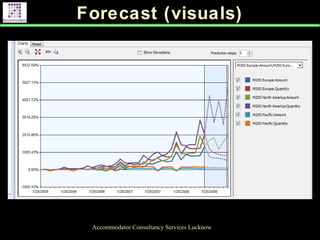

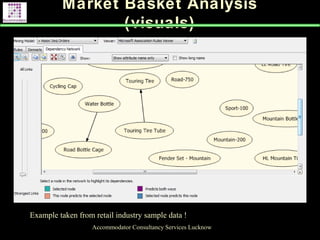

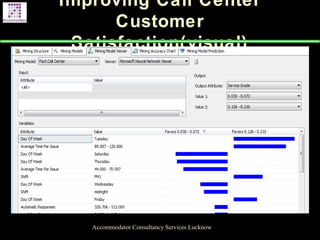

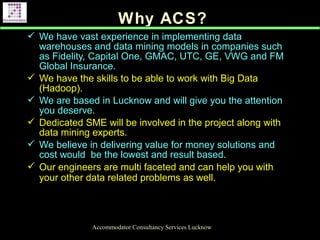

This document provides an overview of how data mining can be used in the life insurance industry. It begins with definitions of data mining and data warehousing. It then lists 11 proven uses of data mining for life insurance companies, including rate setting, acquiring new customers, retaining customers, developing new products, and evaluating agent performance. For each use, it provides more details on how data mining techniques can be applied. It also discusses the data mining process and provides examples of how data mining has been used for targeted marketing campaigns, sales forecasting, market basket analysis, and call center improvements. Visual examples are included to illustrate some of the data mining methods. The document is a proposal from Accommodator Consultancy Services for providing data mining services