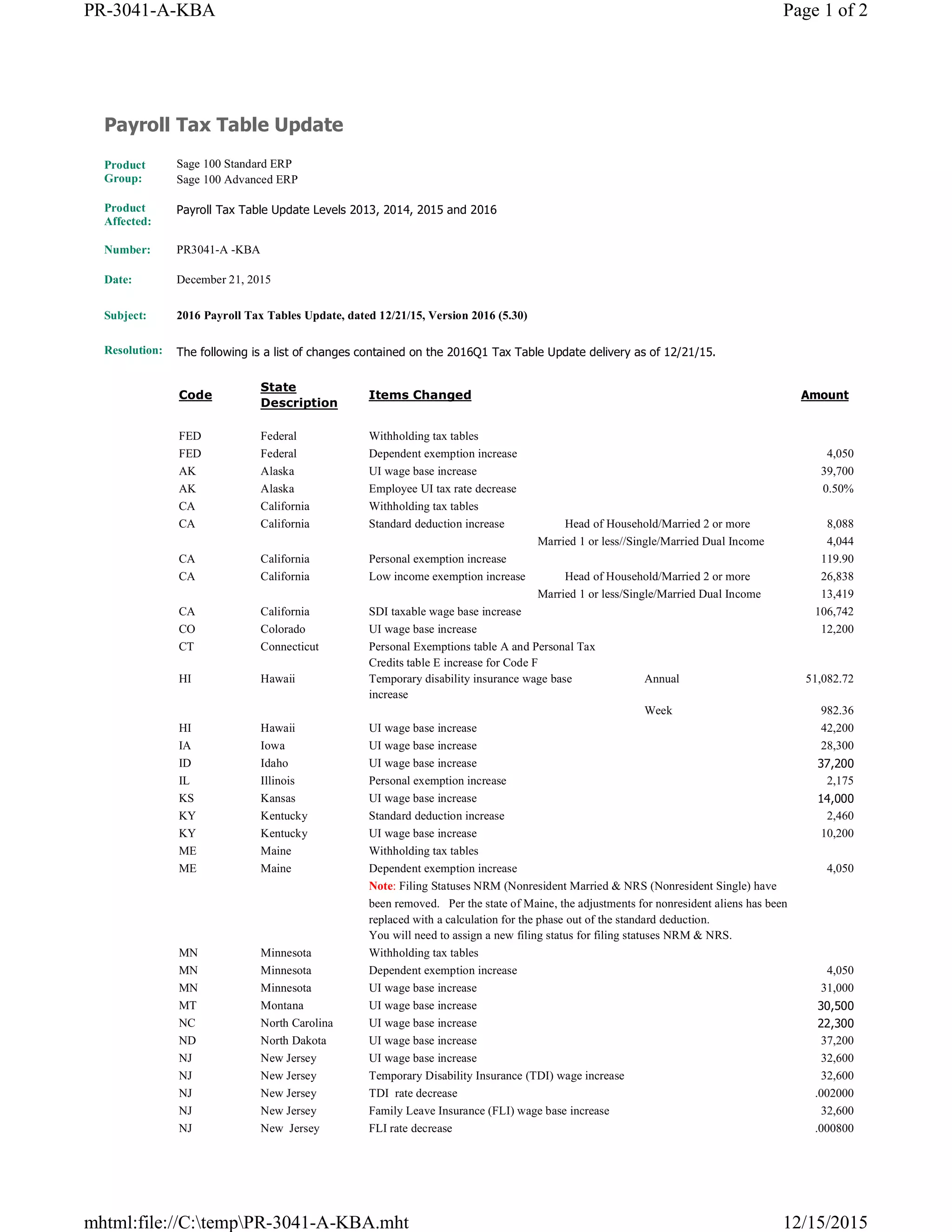

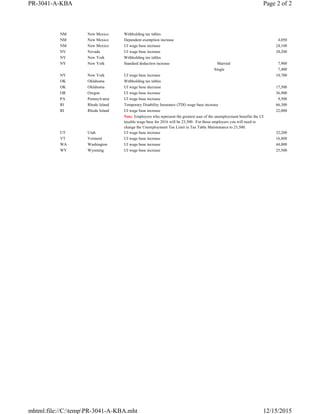

The document outlines the updates to payroll tax tables for the years 2013 to 2016 as of December 21, 2015, detailing changes in various states' tax codes and rates. Significant adjustments include increases in federal withholding tax tables, state unemployment insurance wage bases, and personal exemptions across multiple states. Specific mention is made of changes affecting states such as California, New York, and New Jersey, among others.