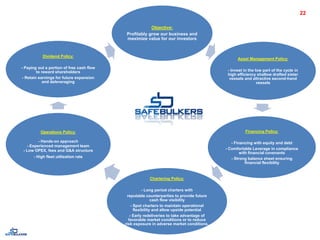

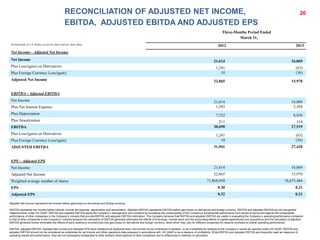

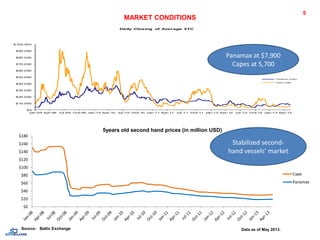

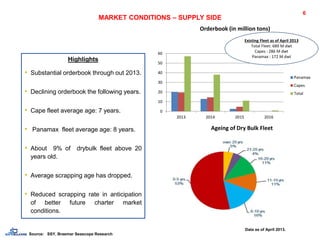

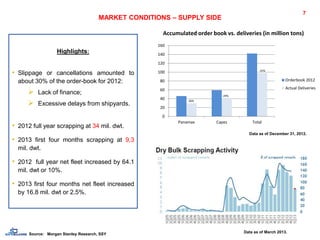

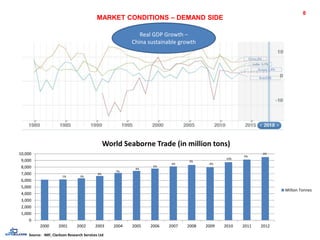

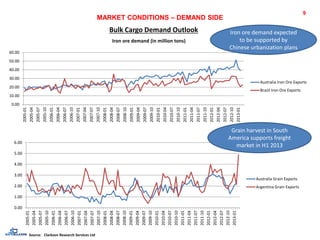

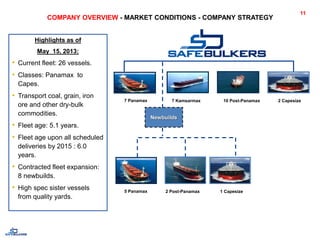

This document provides a summary of Safe Bulkers' 2013 first quarter financial results and industry conditions. It notes that Safe Bulkers currently has a fleet of 26 vessels transporting dry bulk commodities on both long-term charters and in the spot market. The document reviews positive market conditions including growing iron ore and grain demand and a stabilizing secondhand vessel market. It also summarizes Safe Bulkers' strategy of opportunistic fleet expansion and maintaining low operating expenses.

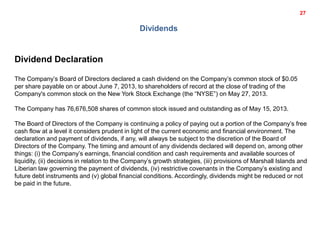

![DIVIDEND POLICY

The Board of Directors of the

Company is continuing a policy of

paying out a portion of the

Company’s free cash flow at a

level it considers prudent in light

of the current economic and

financial environment.

The declaration and payment of

dividends, if any, will always be

subject to the discretion of the

Board of Directors of the

Company. The timing and amount

of any dividends declared will

depend on, among other things:

(i) the Company’s earnings,

financial condition and cash

requirements and available

sources of liquidity,

(ii) decisions in relation to the

Company’s growth strategies,

(iii) provisions of Marshall Islands

and Liberian law governing the

payment of dividends,

(iv) restrictive covenants in the

Company’s existing and future

debt instruments and

(v) global financial conditions.

Accordingly, dividends might be

reduced or not be paid in the

future.

0.82

0.72

0.22

1.14

1.07

0.410.42

0.58

0.37

0.33

0.47

0.41

0.270.28

0.33

0.300.28

0.27

0.42

0.21

0.146

0.475

0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15

0.050.05 0.05

0.0

0.2

0.4

0.6

0.8

1.0

1.2

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

Q4

2009

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

Q2

2011

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

EPS[$] Dividendpershare [$]

21

20 consecutive

quarterly dividends](https://image.slidesharecdn.com/safebulkersq12013resultspresentation-130517002821-phpapp02/85/Safe-Bulkers-Q1-2013-results-presentation-21-320.jpg)