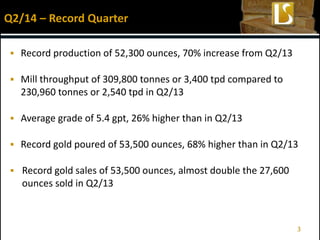

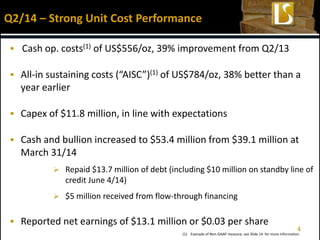

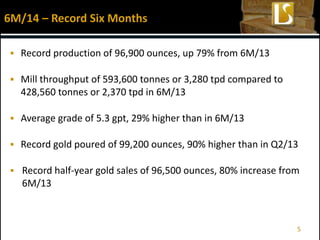

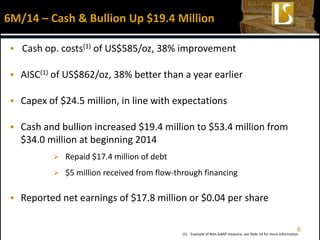

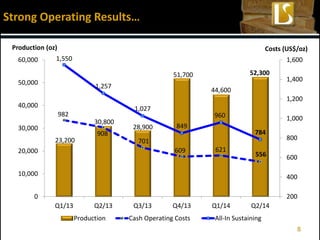

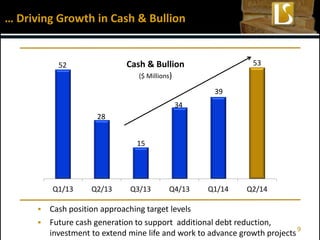

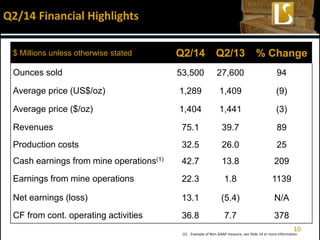

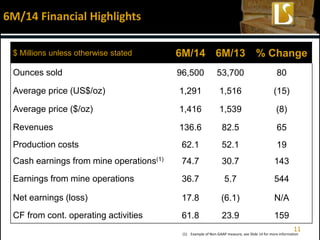

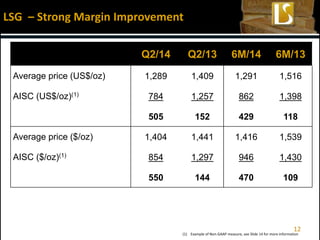

Lake Shore Gold reported record production and financial results for the second quarter and first half of 2014. Production in Q2 2014 reached a record 52,300 ounces, a 70% increase over the prior year quarter. Cash costs and all-in sustaining costs saw significant improvements of 39% and 38%, respectively, compared to Q2 2013. The company also reported record cash flow from operations and increased its cash position to $53.4 million.