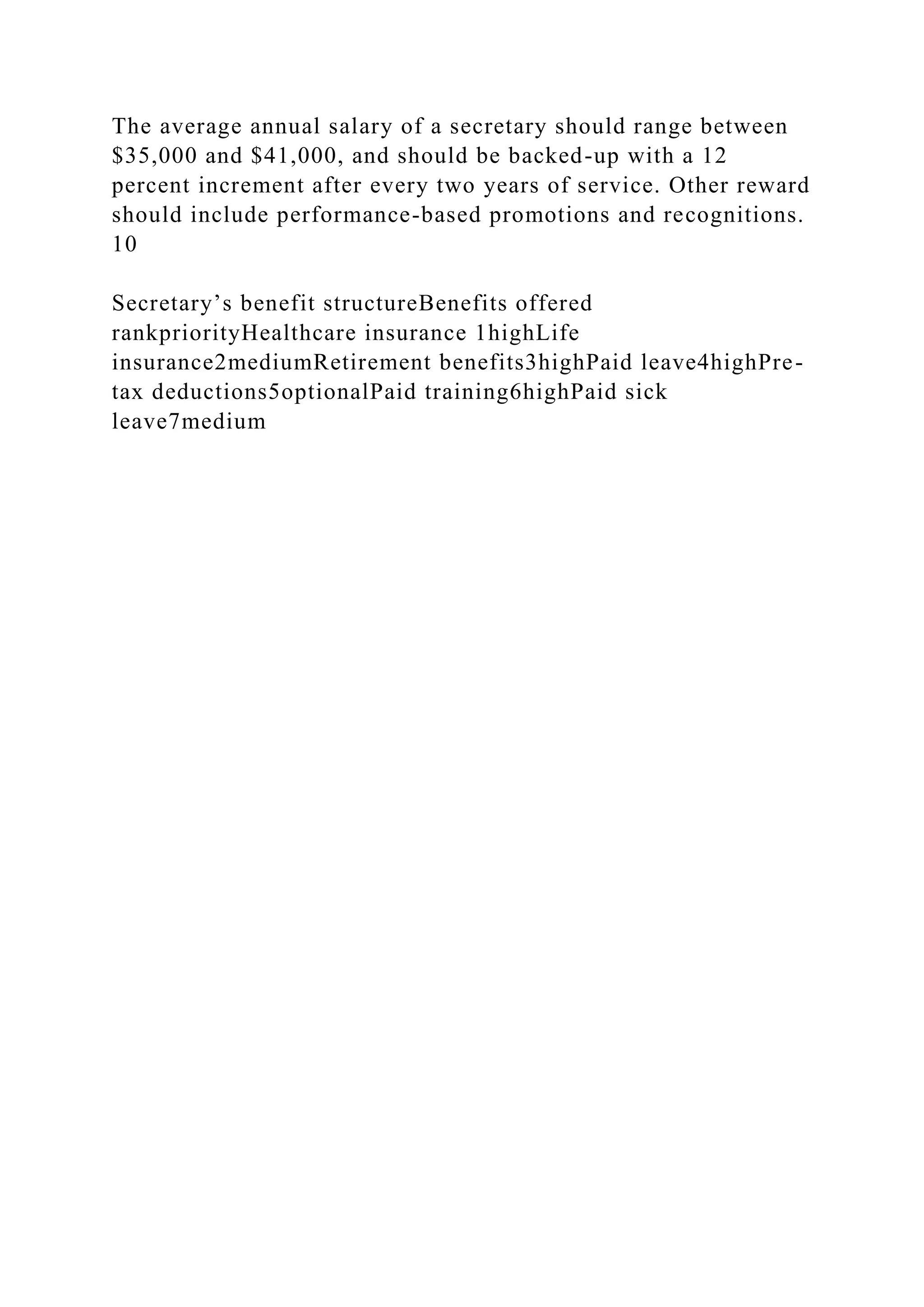

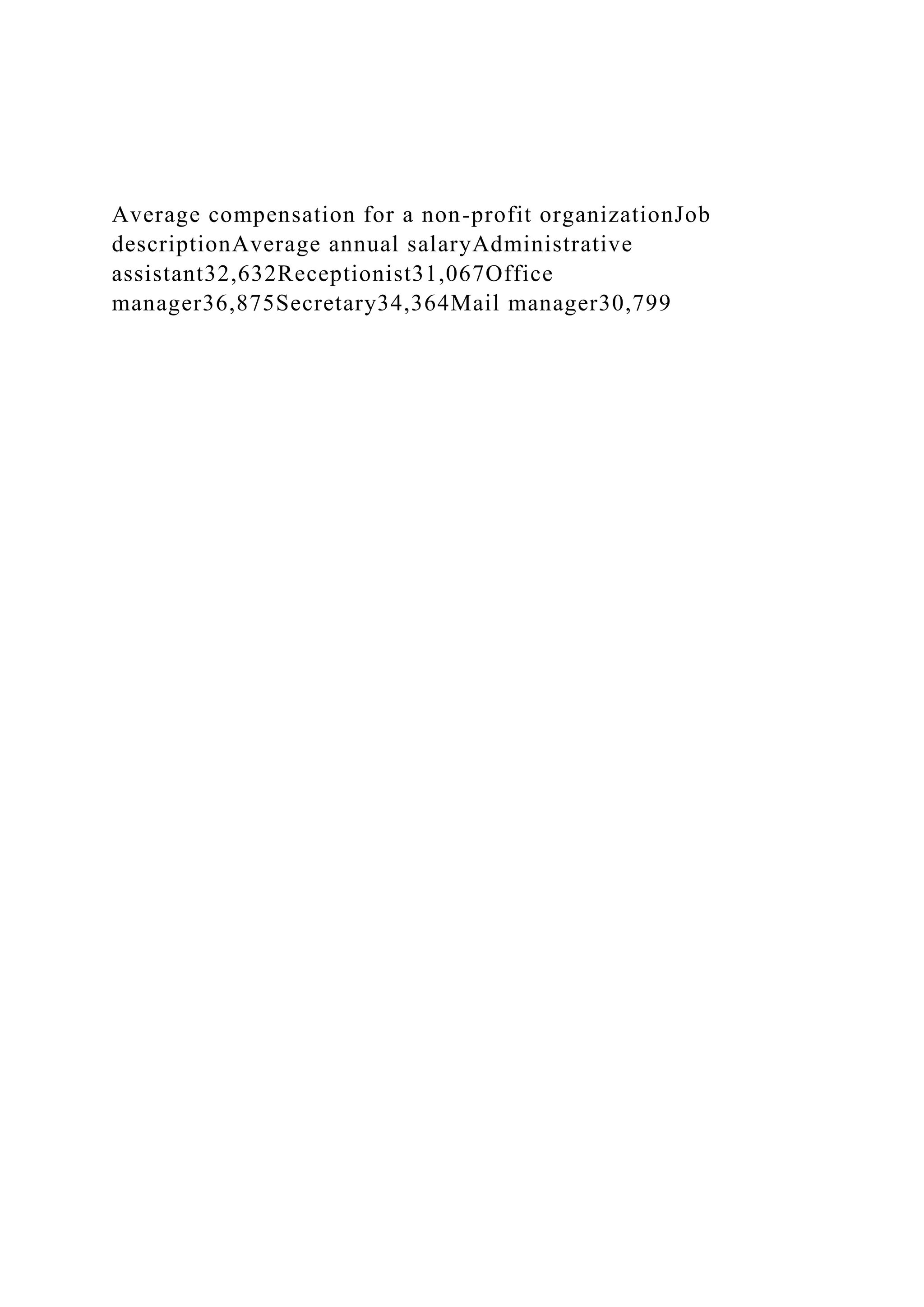

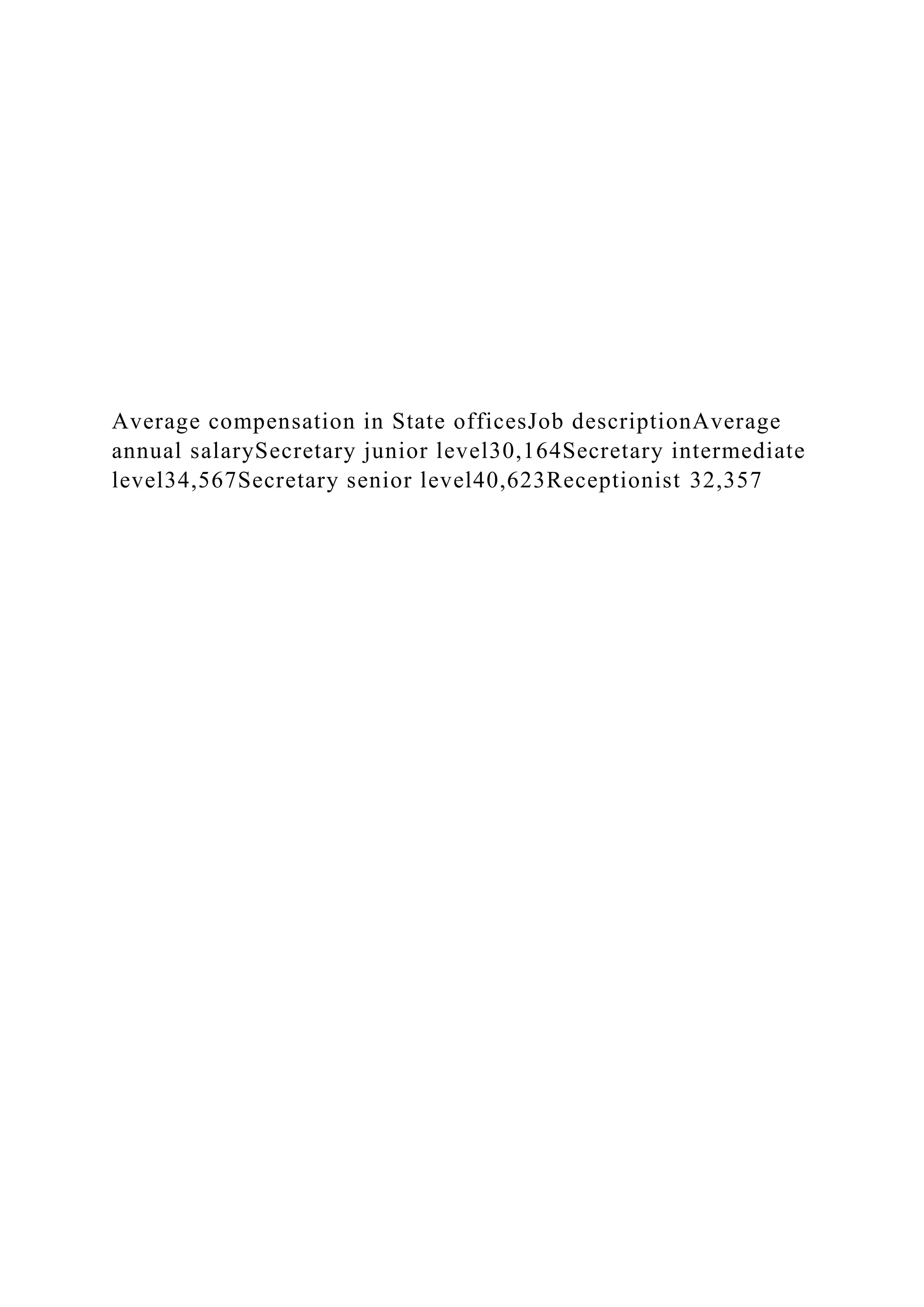

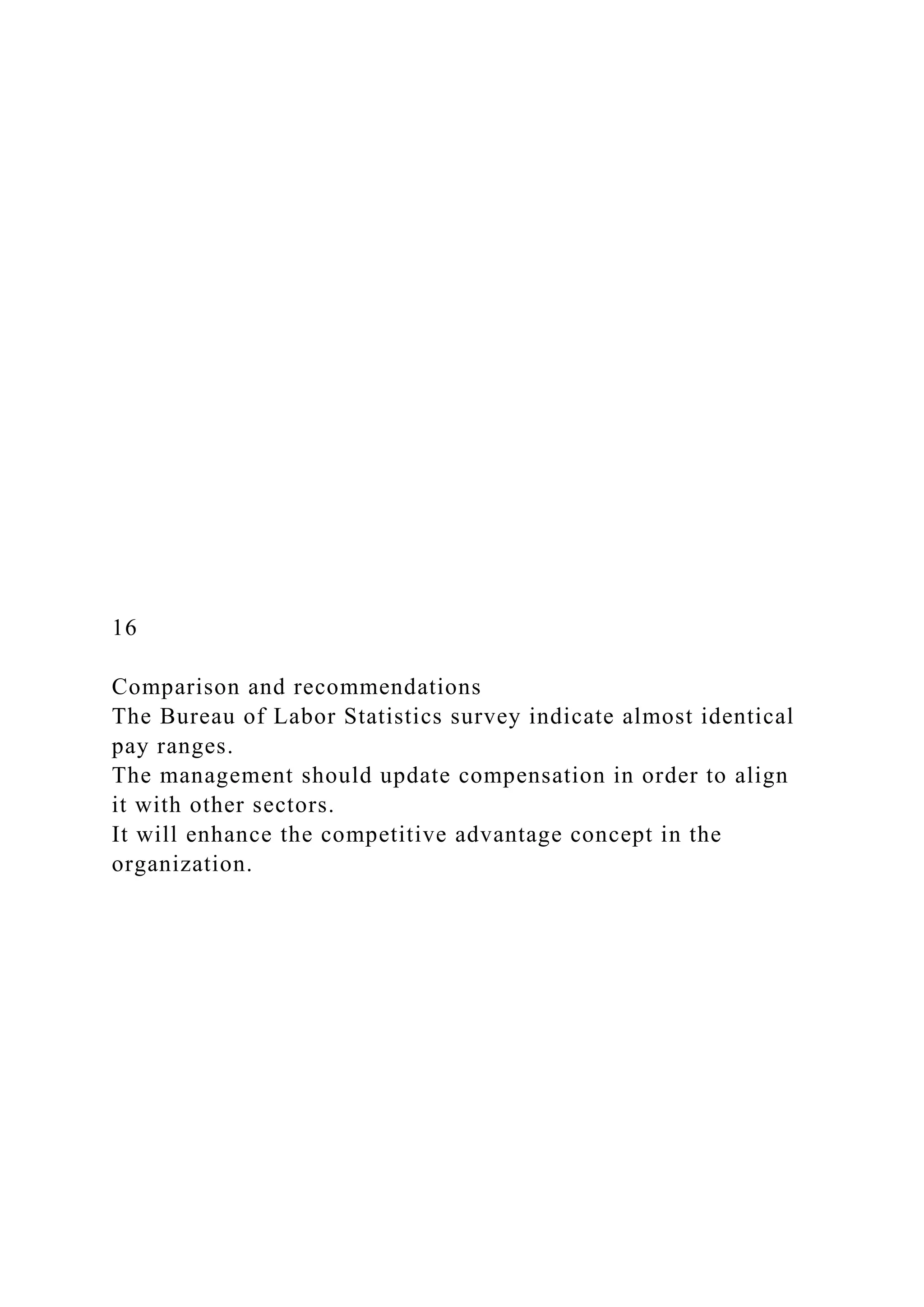

The document discusses the importance of a comprehensive employee compensation and benefits package for secretaries in medium-sized organizations, highlighting the need for competitive salaries, retirement benefits, bonuses, and healthcare plans to attract and retain talent. It emphasizes that annual salaried positions are preferred over hourly wages, offering job security and various benefits. Additionally, the document outlines strategies for developing an effective compensation scheme that includes performance-based incentives and compliance with labor regulations.