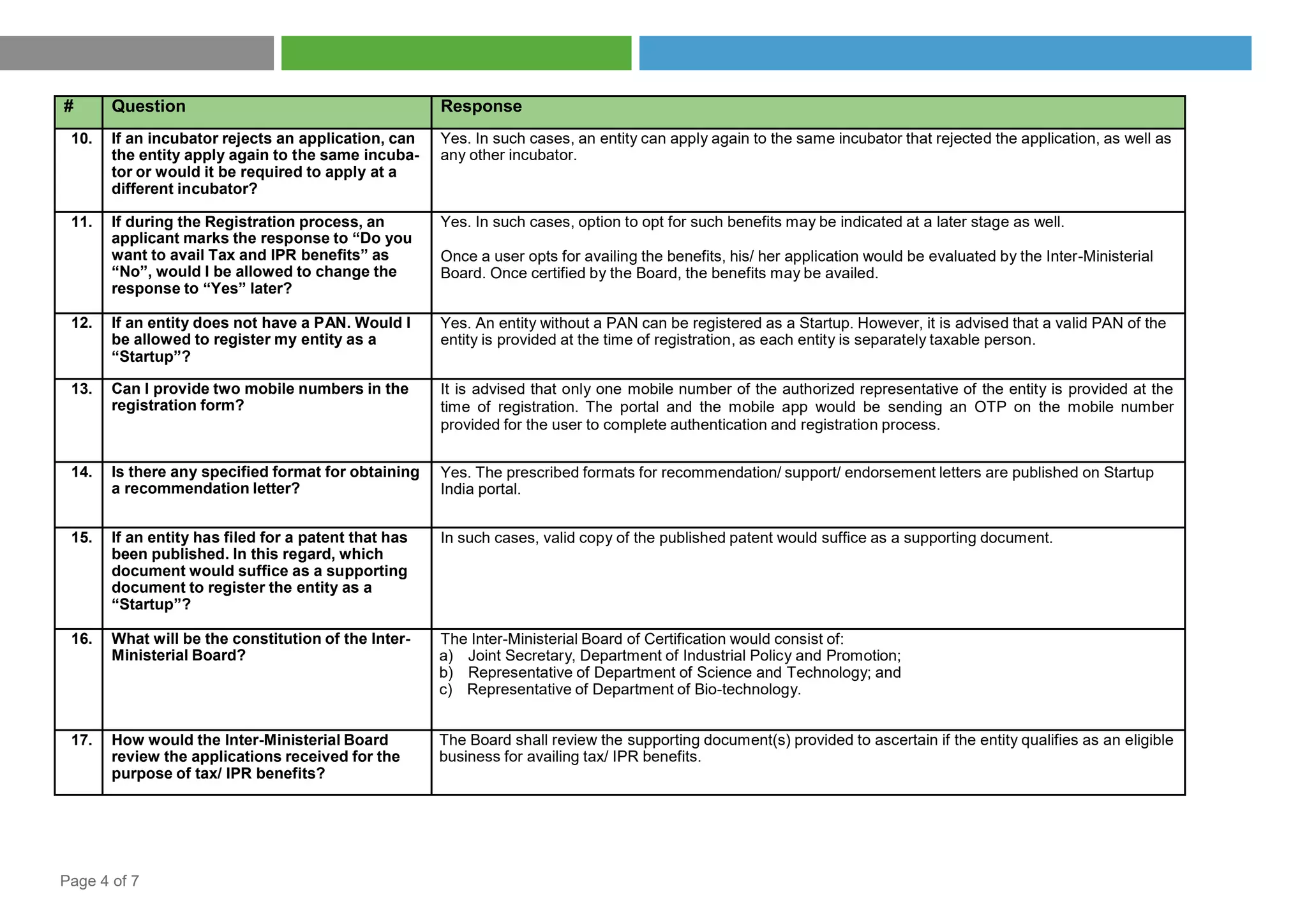

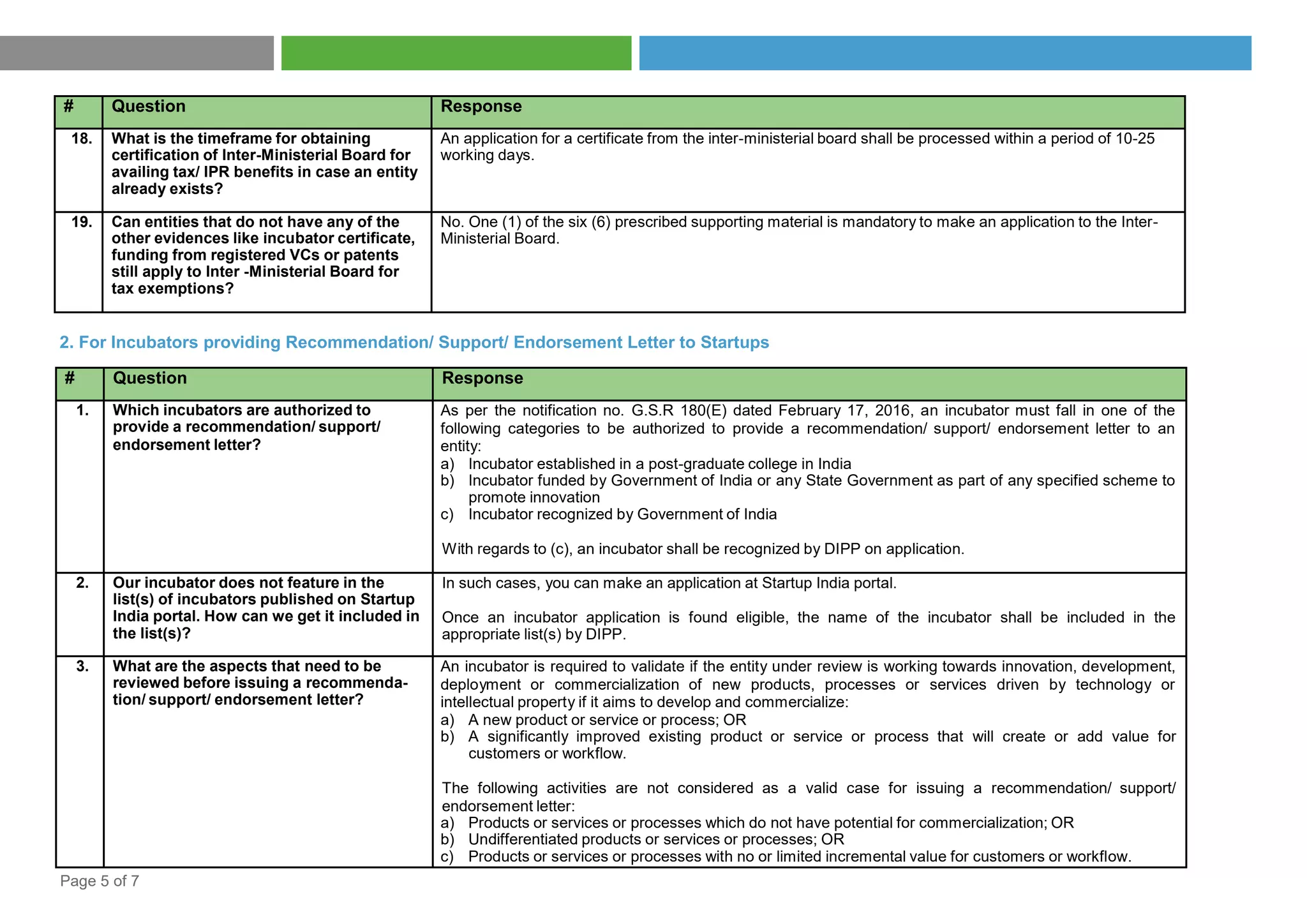

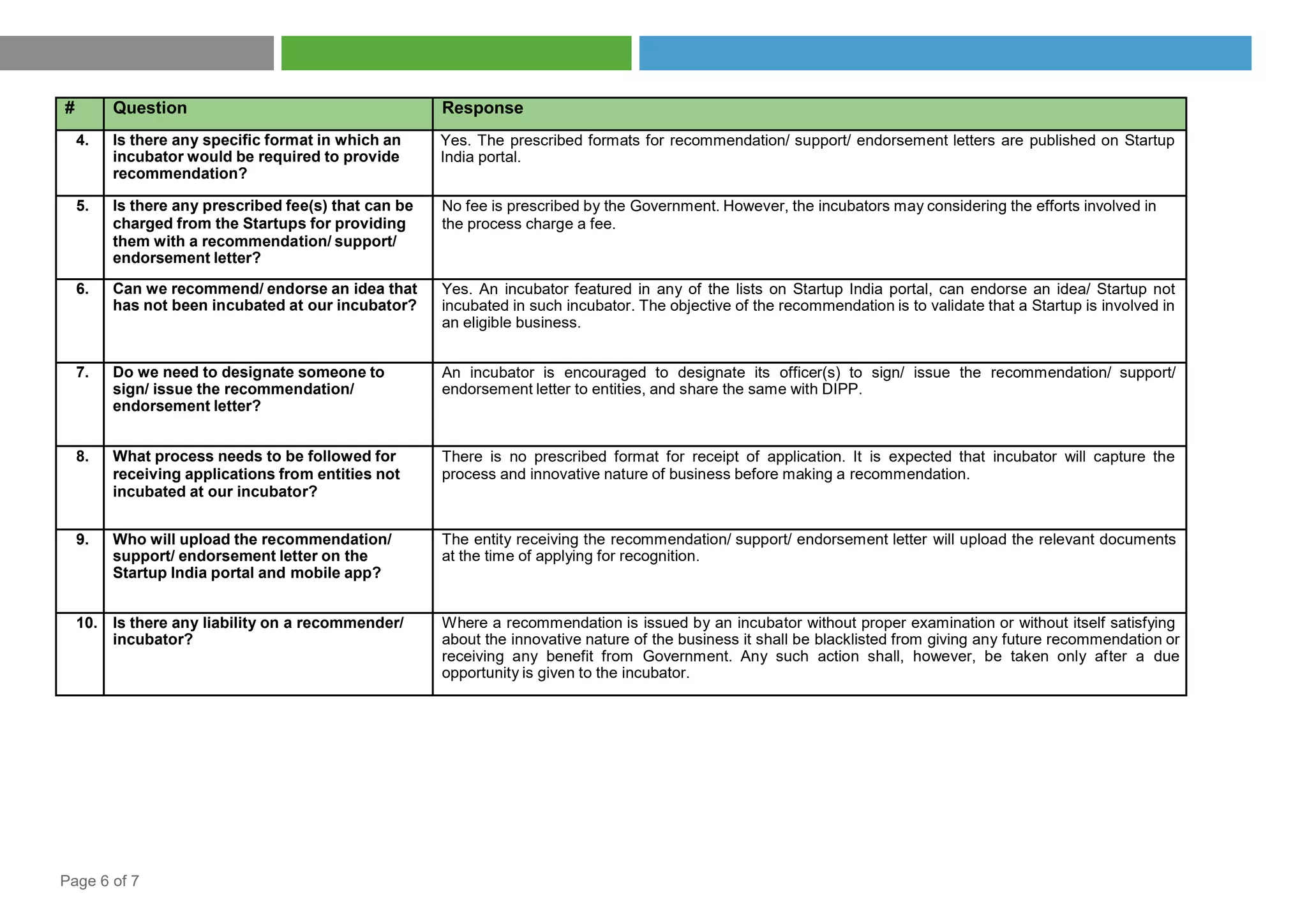

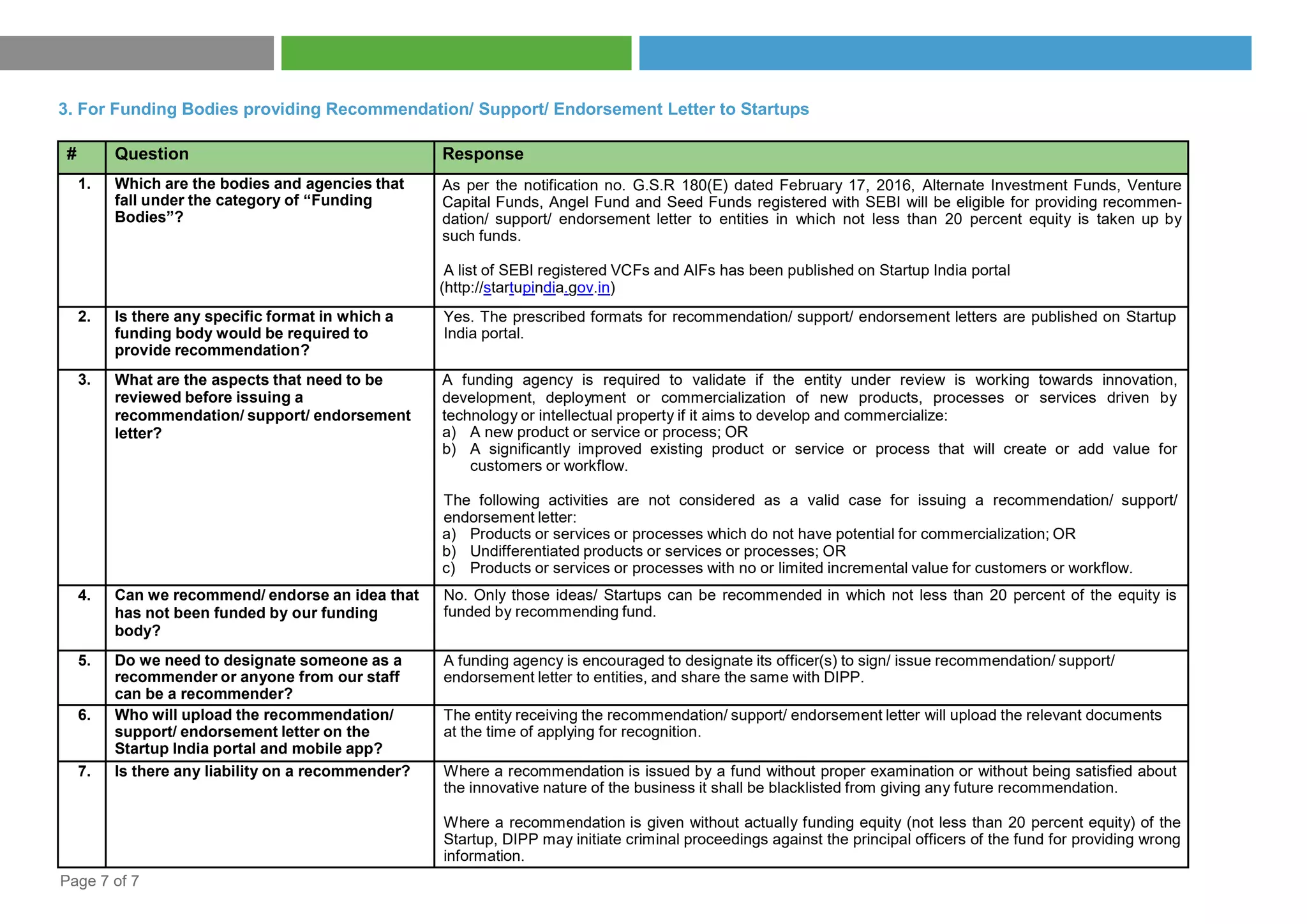

The Startup India initiative, launched by the Prime Minister of India on January 16, 2016, includes a newly established portal and mobile app aimed at creating a supportive ecosystem for startups. The portal provides information on incubators, funding agencies, and offers a simple process for startups to gain recognition and avail benefits under government schemes. The document outlines key features of the portal, the recognition process, and frequently asked questions regarding eligibility and applications for support.