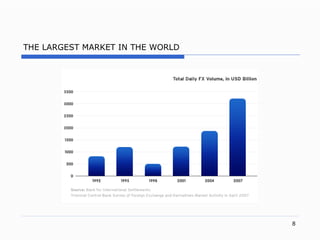

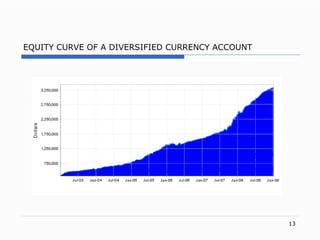

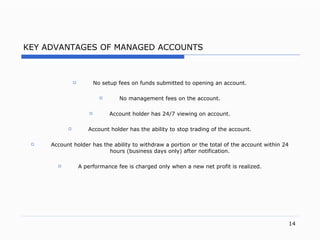

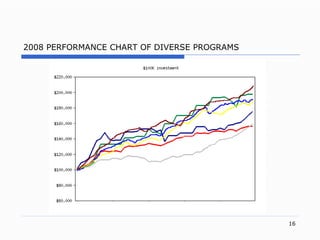

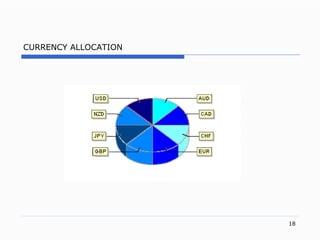

Market Treasury Systems specializes in active currency trading management, offering diverse strategies to generate high performance for both private and corporate clients. Their proprietary trading platforms facilitate risk management and allow for dynamic adjustments in real-time, enhancing portfolio diversification and performance. They emphasize transparency, with clients having complete control and access to their investment accounts at all times.