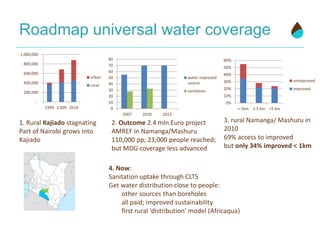

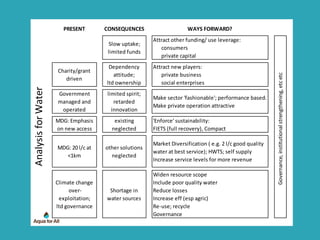

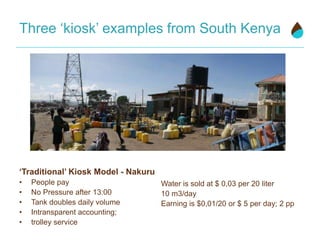

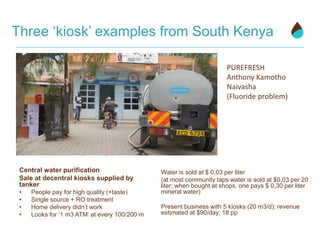

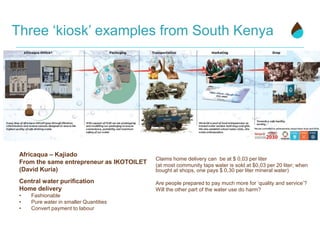

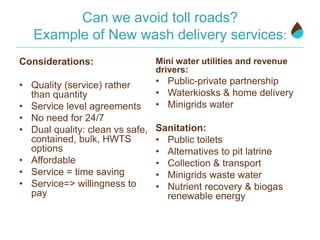

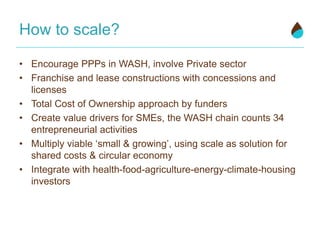

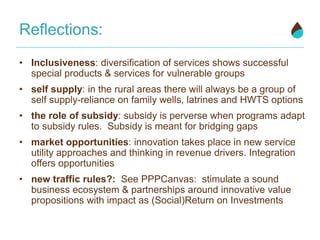

This document discusses accelerating universal water coverage in Kajiado County, Kenya from the current pace which would not achieve full access until 2131. It notes that one organization invested millions of Euros over 15 years but made limited progress towards goals. The document then outlines several mini case studies of innovative water distribution models using water kiosks and home delivery. It discusses challenges around funding, sustainability, and innovation and proposes ways to scale up promising concepts through public-private partnerships and new financing approaches.