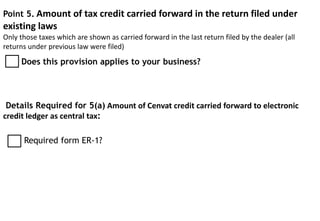

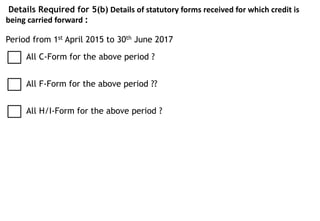

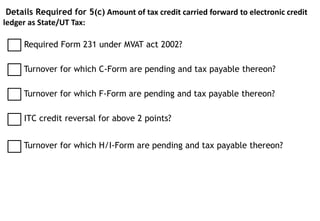

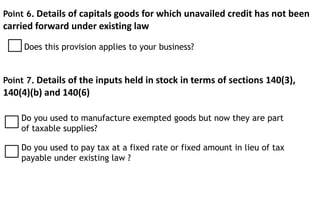

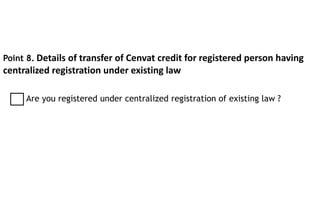

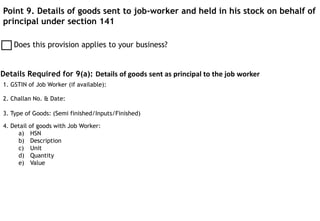

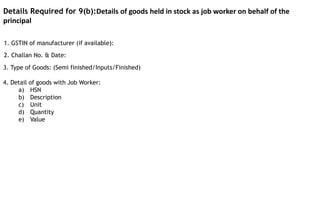

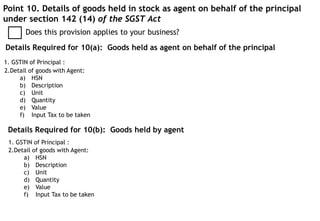

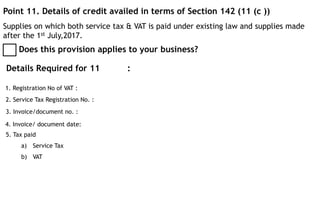

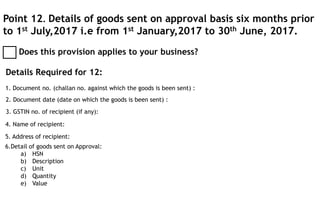

The document is a checklist for GST compliance and reporting prepared by R G N L and Co., Chartered Accountants, aimed at helping businesses manage their tax credits and compliance requirements. It outlines specific points needing detailed information related to carried forward tax credits, inputs in stock, and goods sent to job-workers, among others, from various periods. The checklist serves as guidance for businesses to ensure proper documentation and compliance with GST regulations.