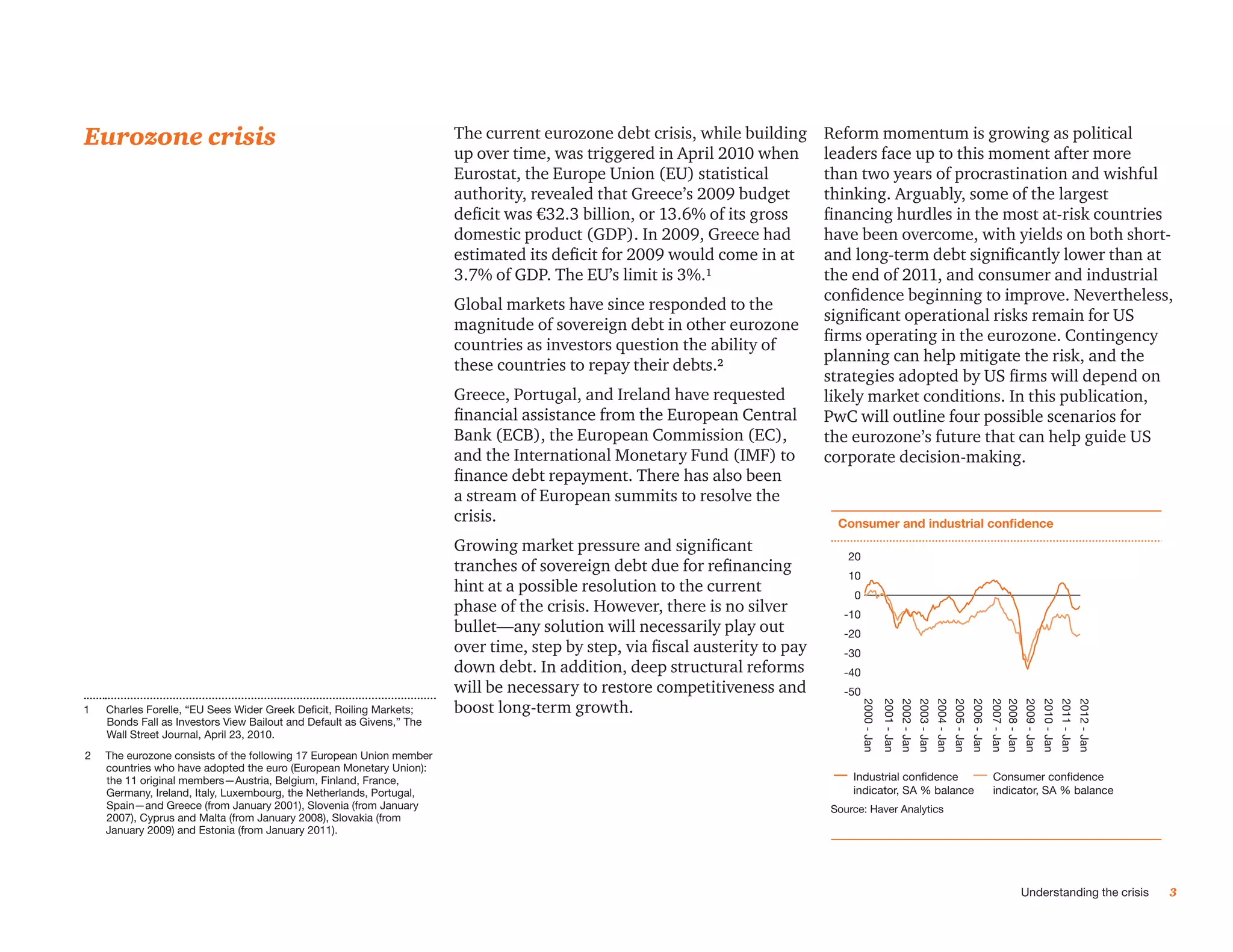

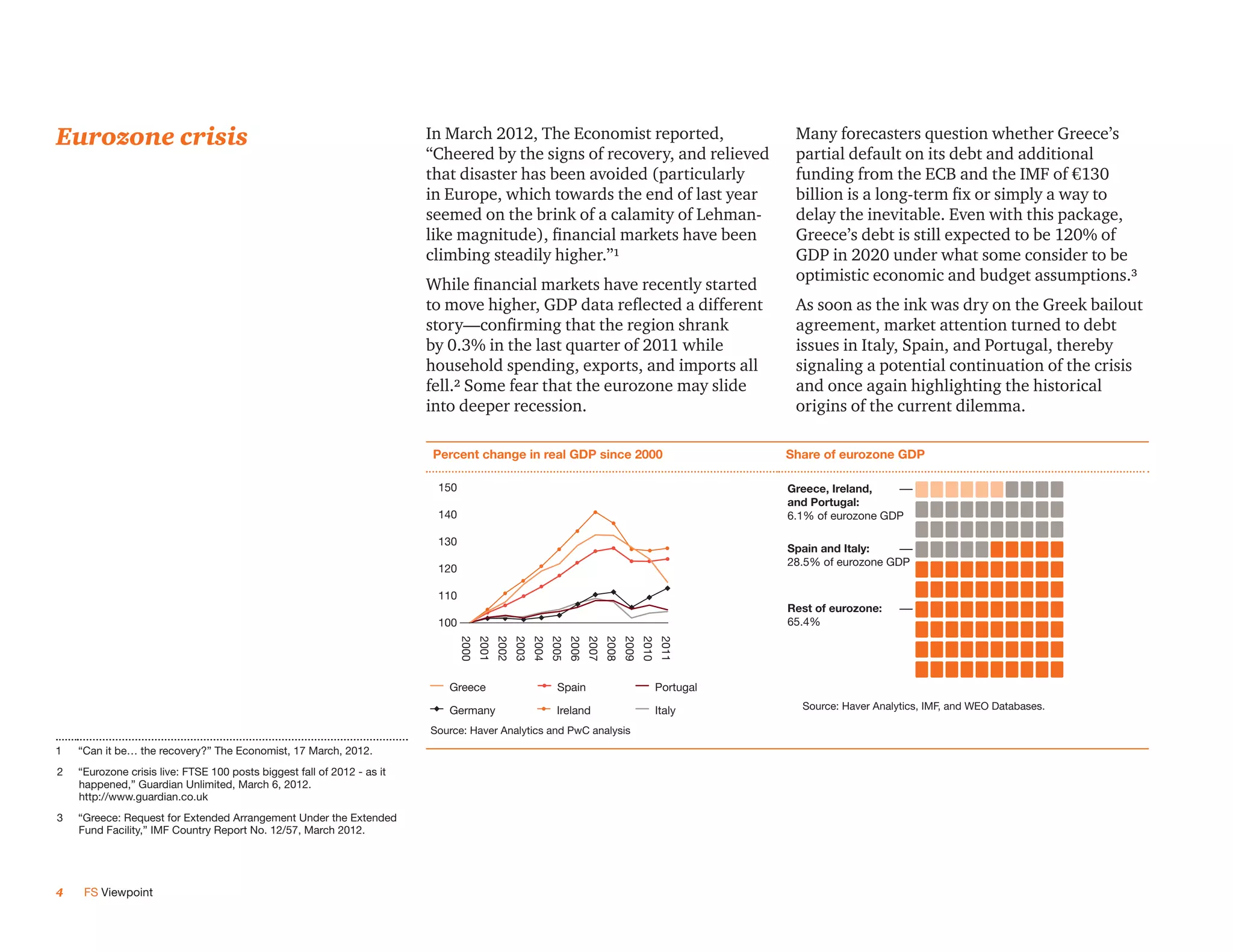

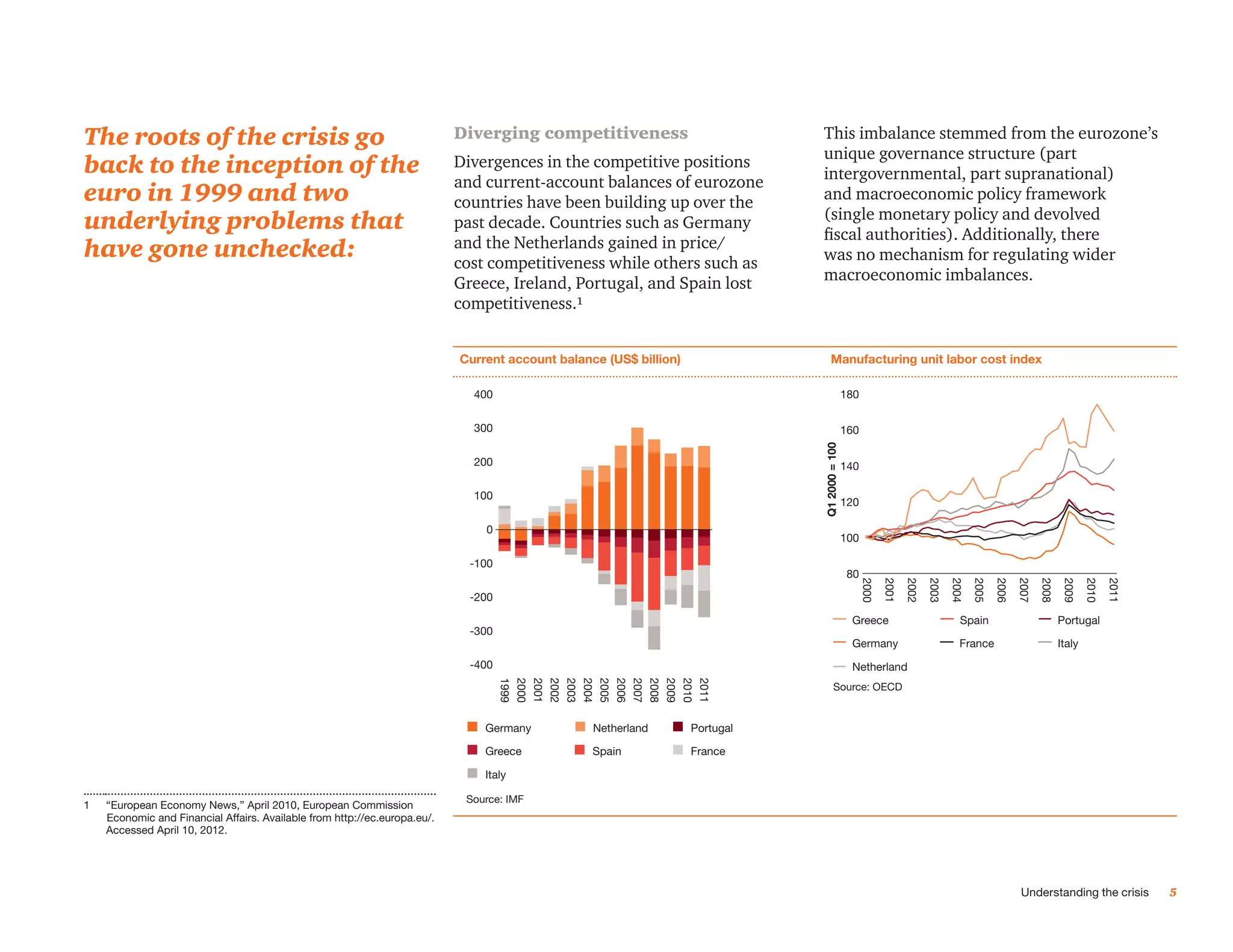

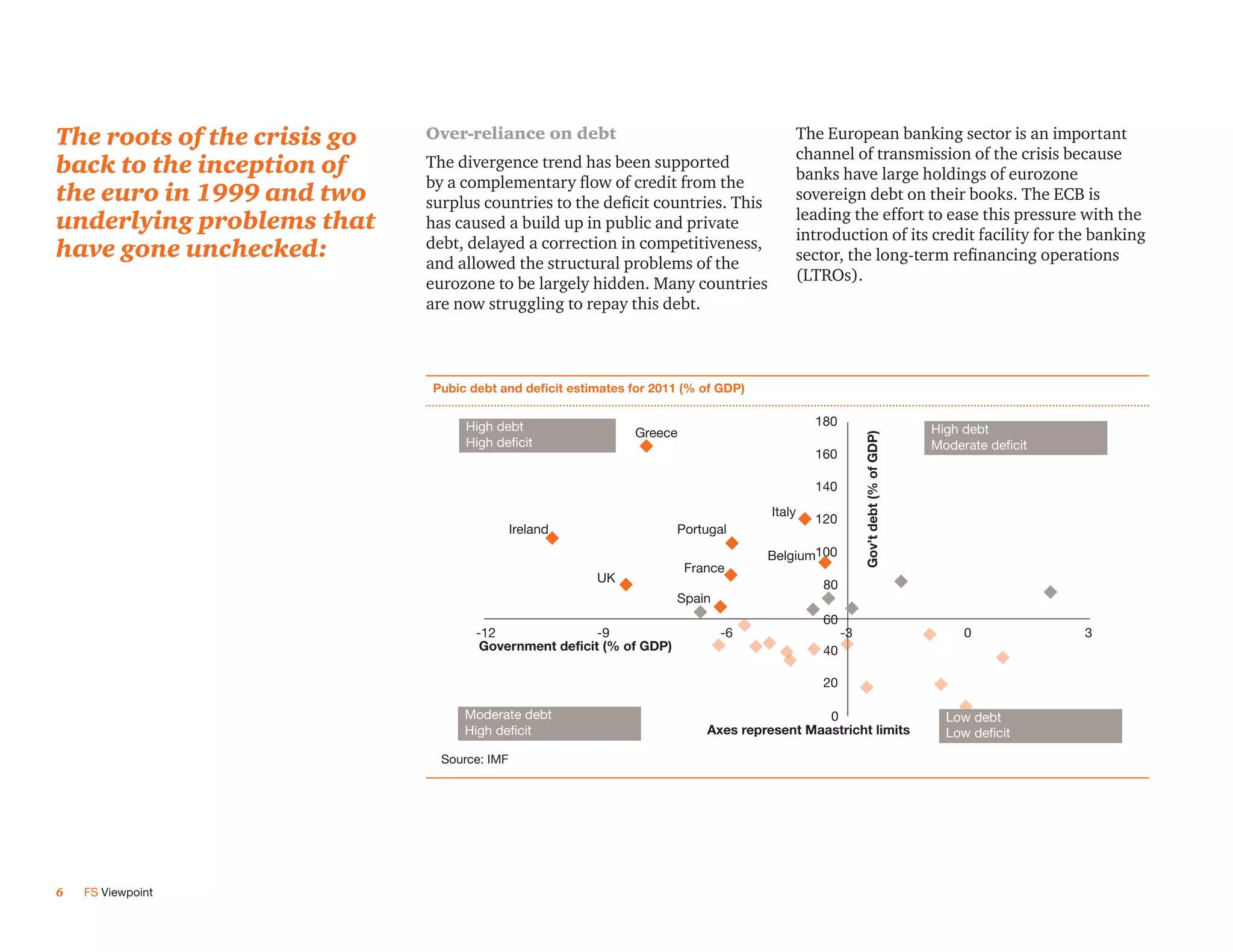

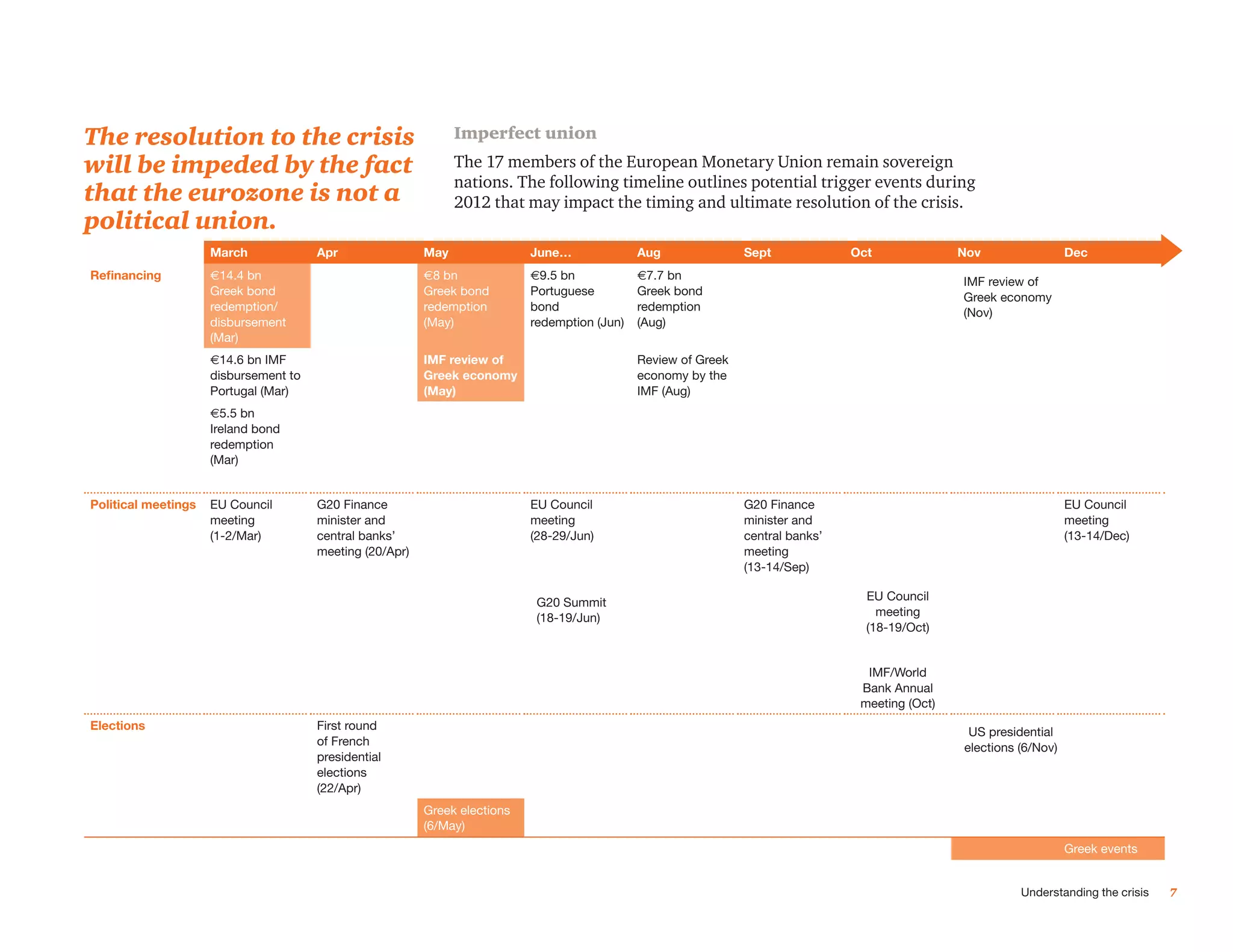

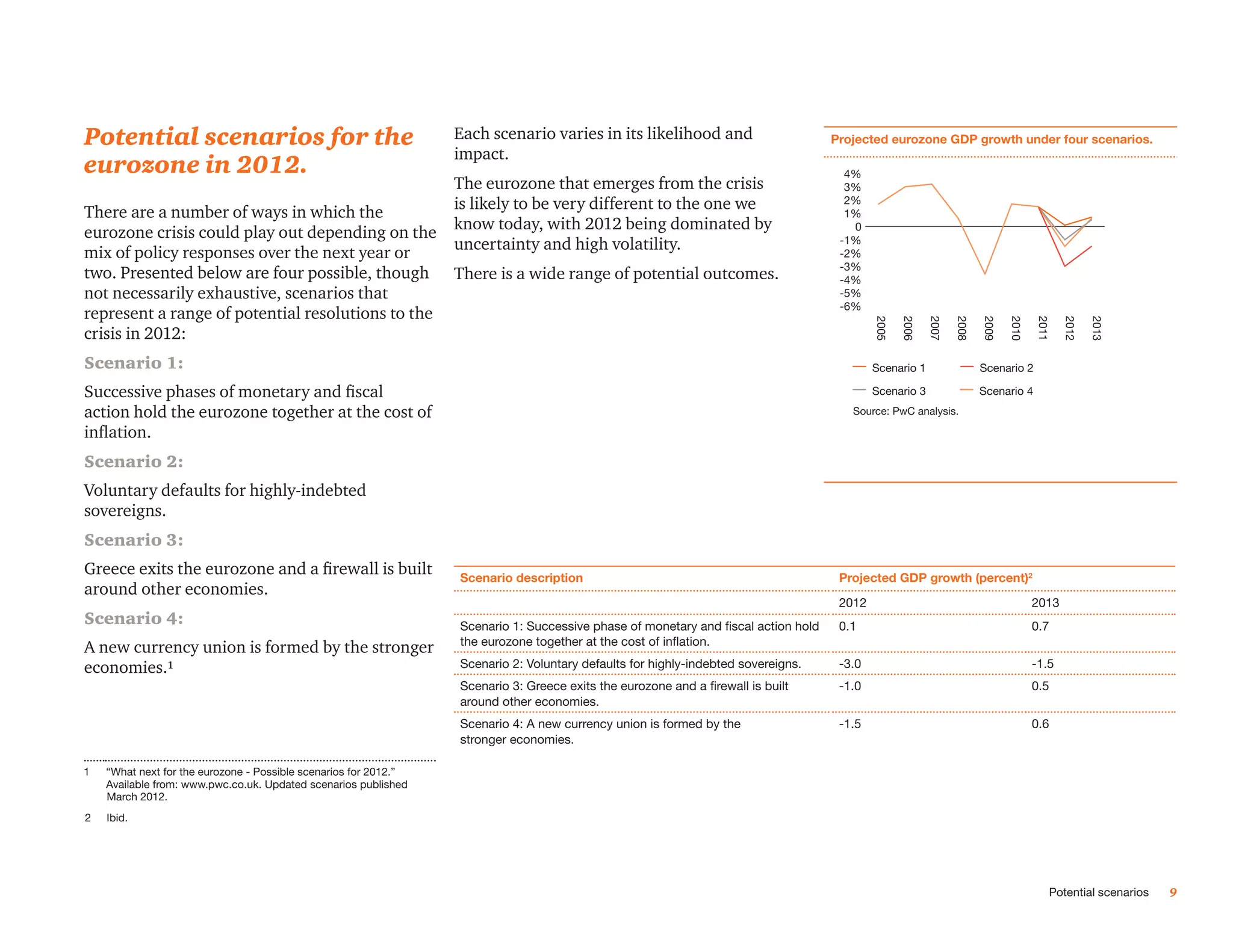

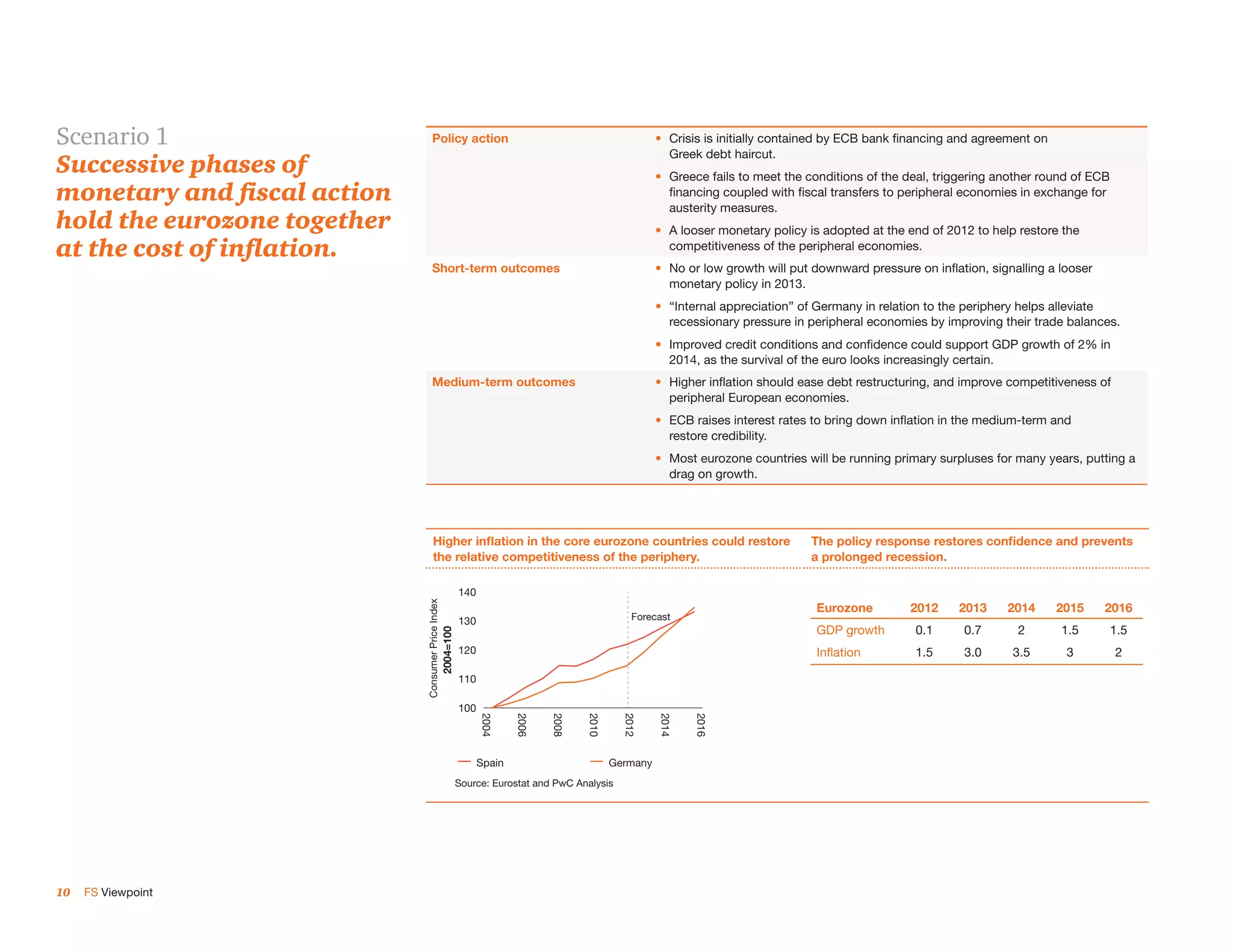

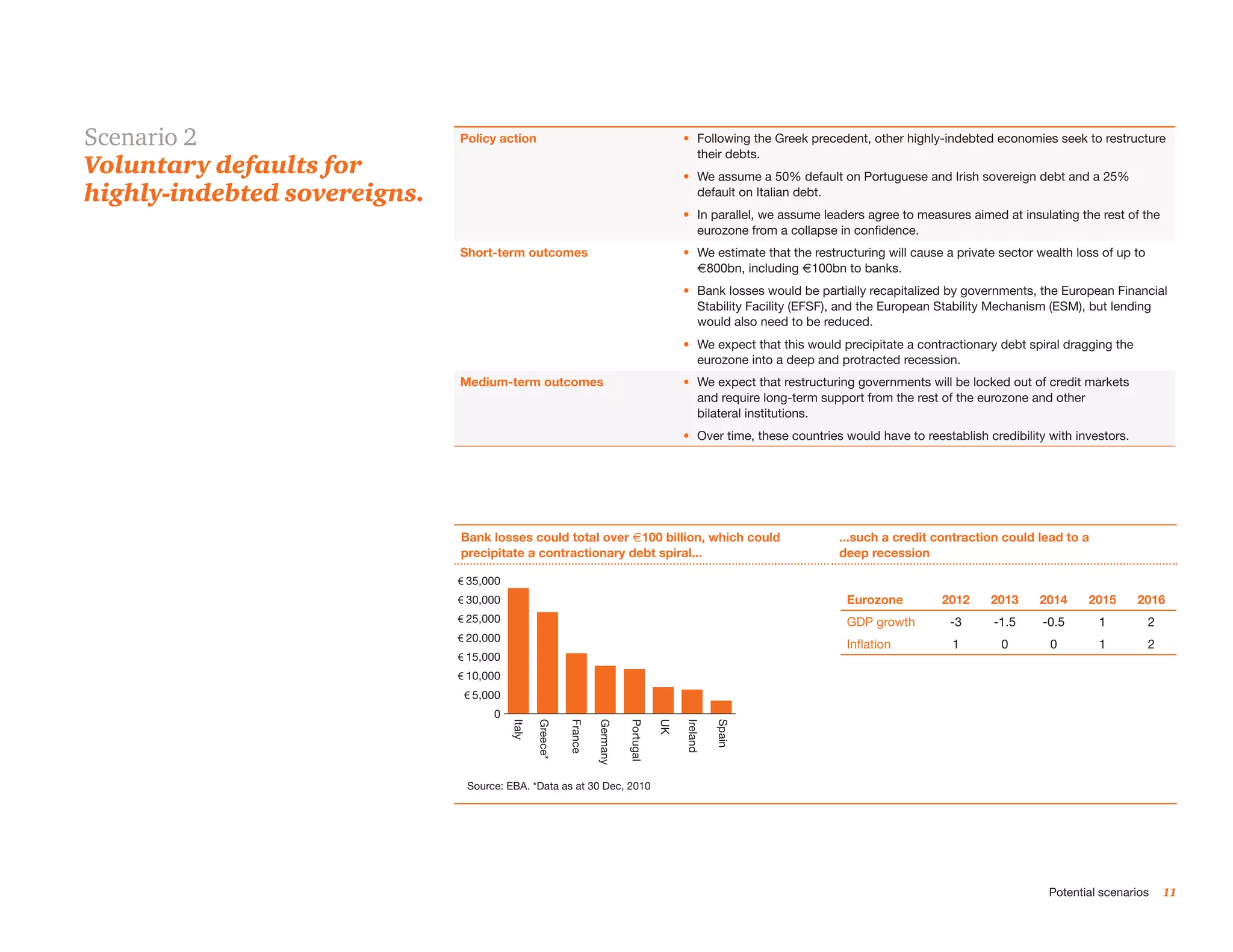

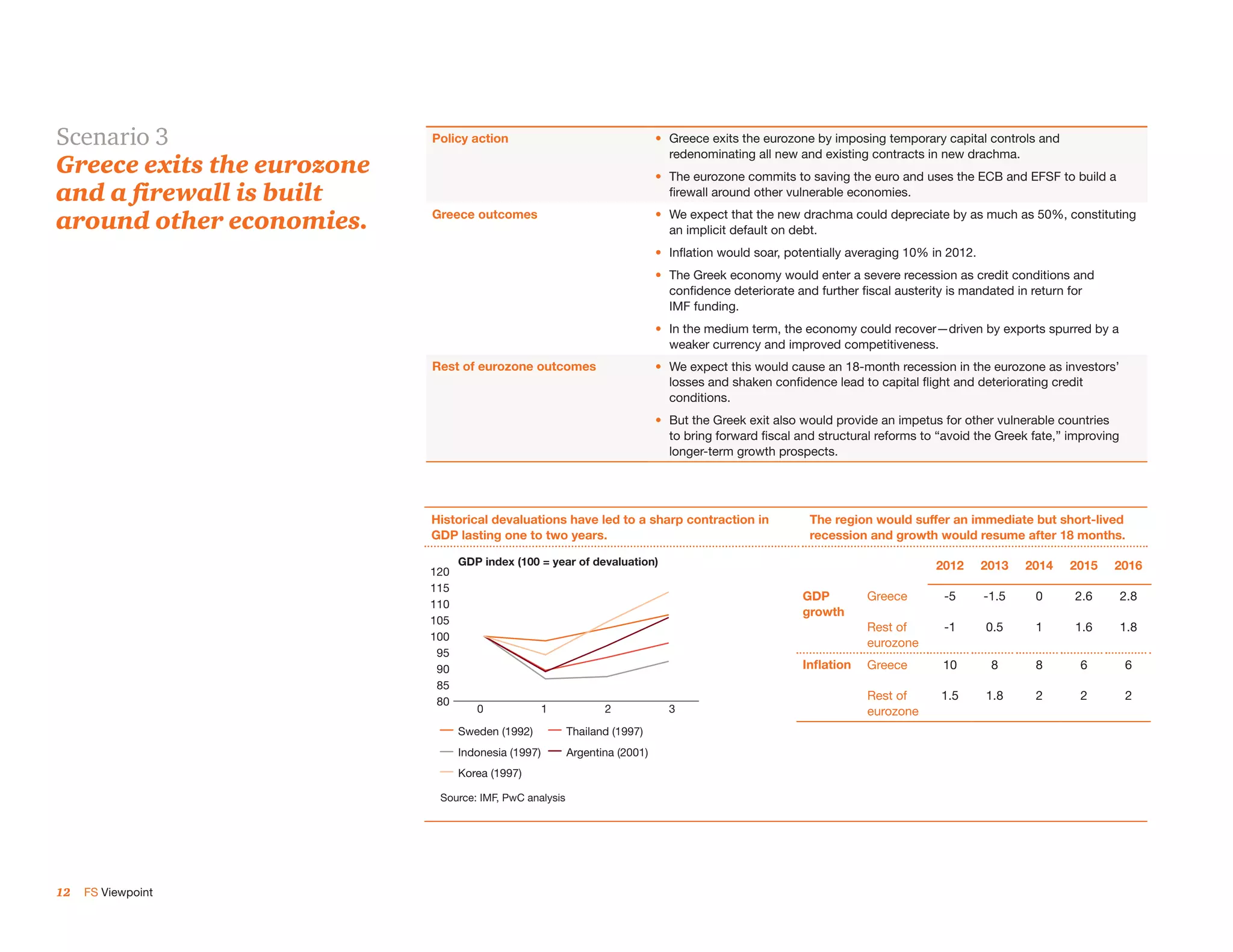

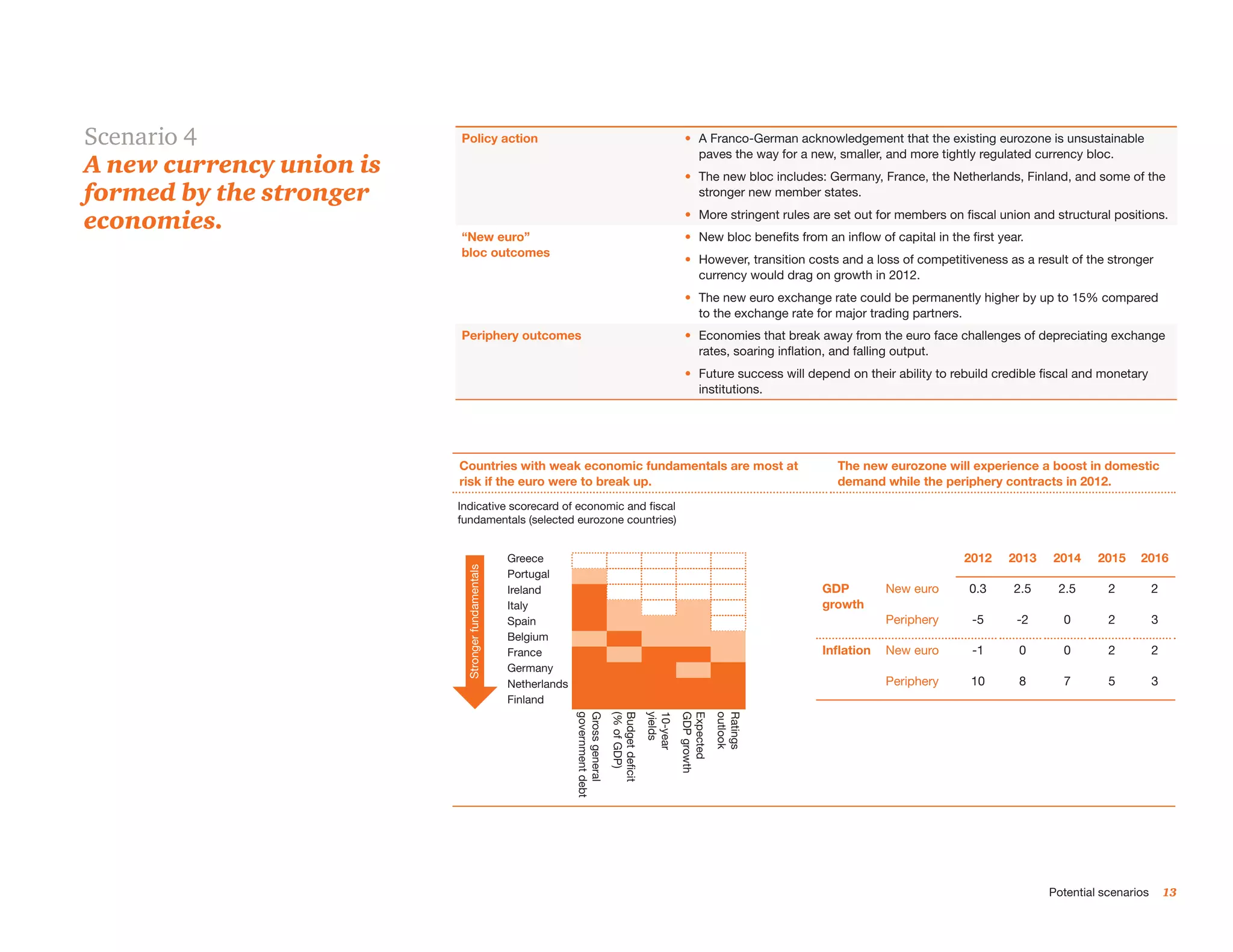

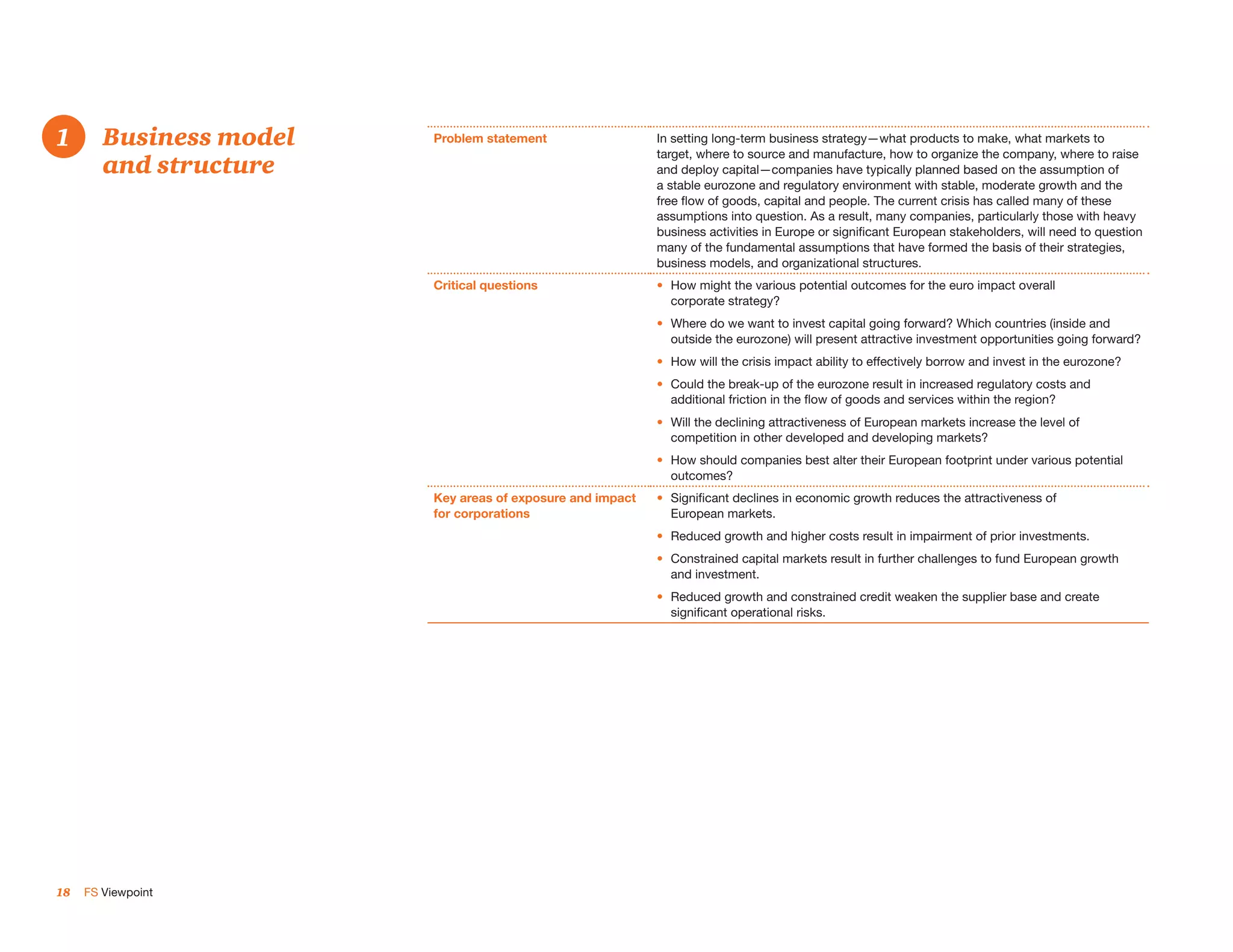

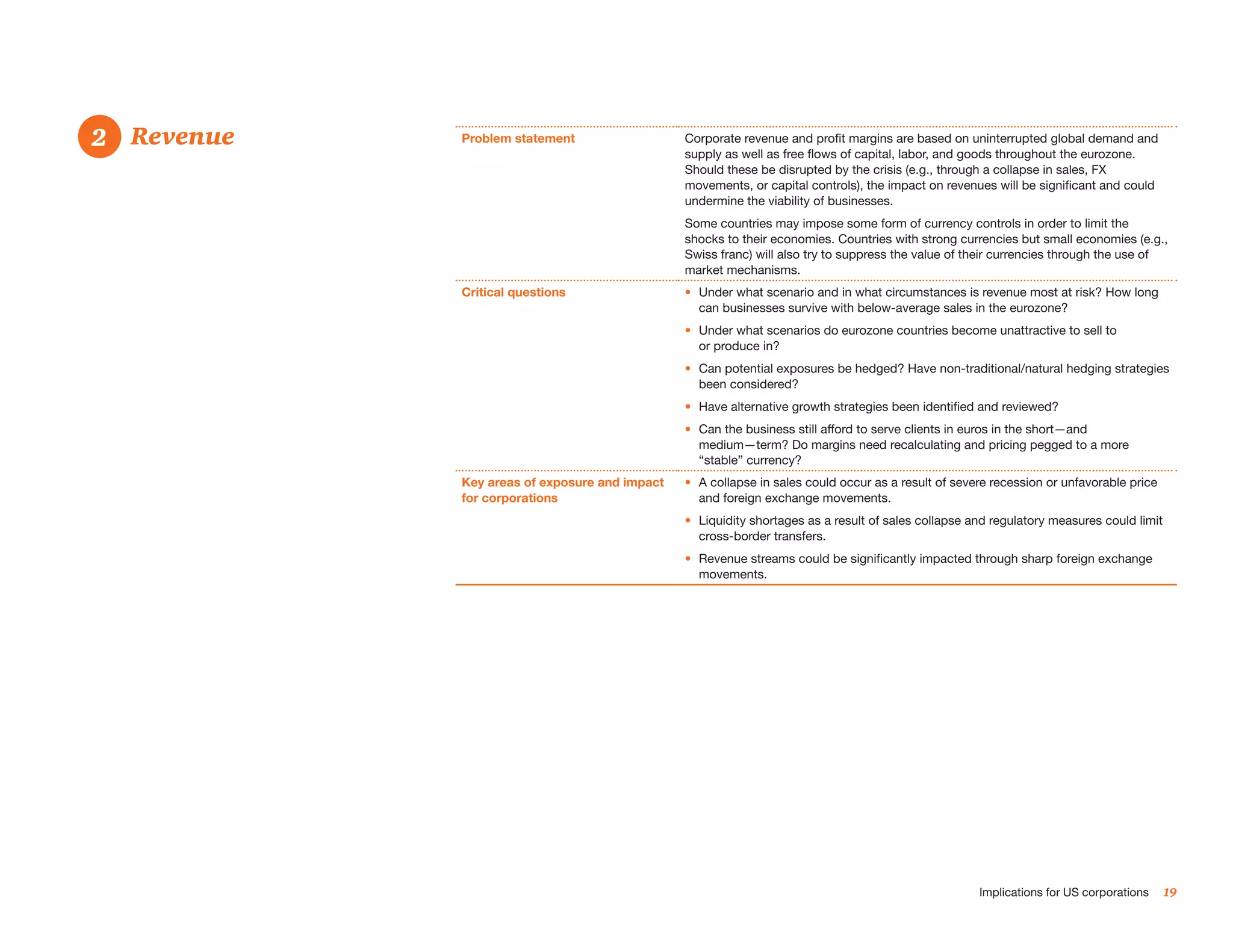

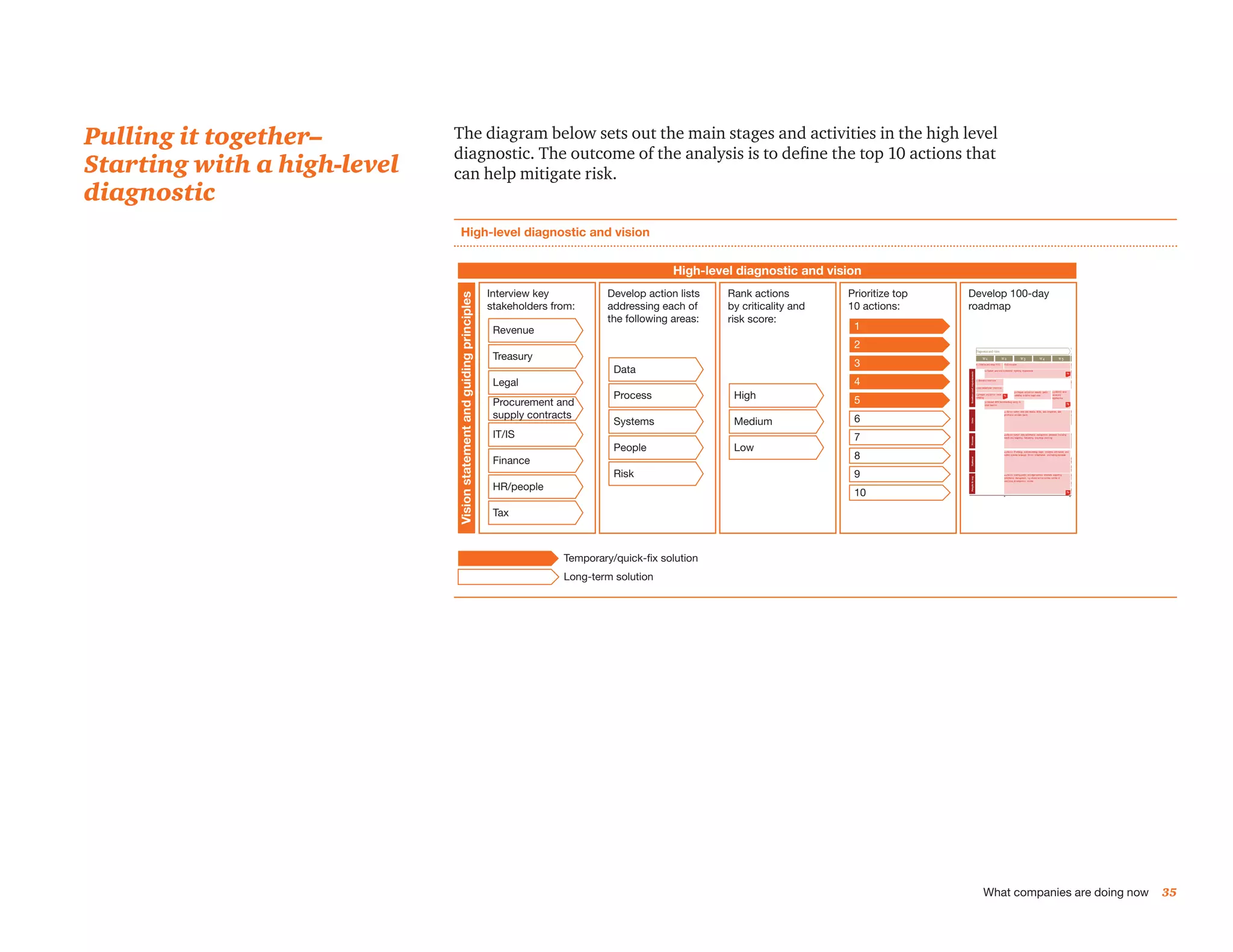

The document summarizes the ongoing eurozone debt crisis, its triggers, and implications for US corporations. It began in 2010 when Greece's budget deficit was revealed to be much larger than estimated, exceeding the EU limit of 3% of GDP. Since then, sovereign debt issues have spread to other eurozone nations as markets question their ability to repay debts. Greece, Portugal, and Ireland have received bailouts from the ECB, EC, and IMF. While reform efforts are increasing, significant risks remain for US companies operating in Europe. The document outlines four possible future scenarios for the eurozone to help guide corporate contingency planning.