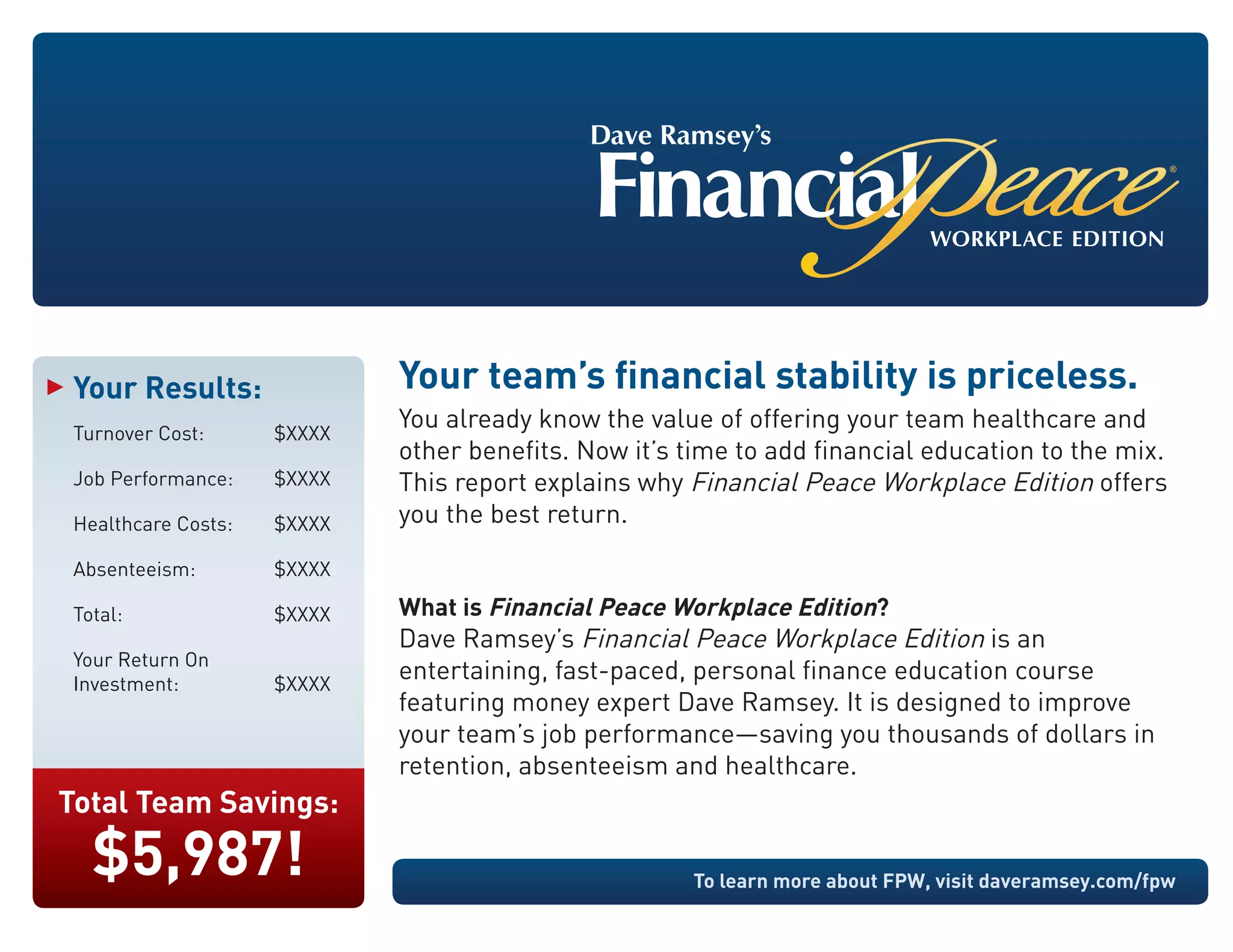

This document summarizes and promotes the Financial Peace Workplace Edition program. It explains that the program, featuring Dave Ramsey, provides financial education to employees to improve their financial well-being and job performance. This leads to savings for companies in areas like turnover, absenteeism, healthcare costs, and job performance. The document estimates that on average, for every dollar invested in the program, a company would save $X annually due to the positive impact on employees. It encourages companies to offer the program to change their workplace culture for the better and help both employees and the business succeed financially.