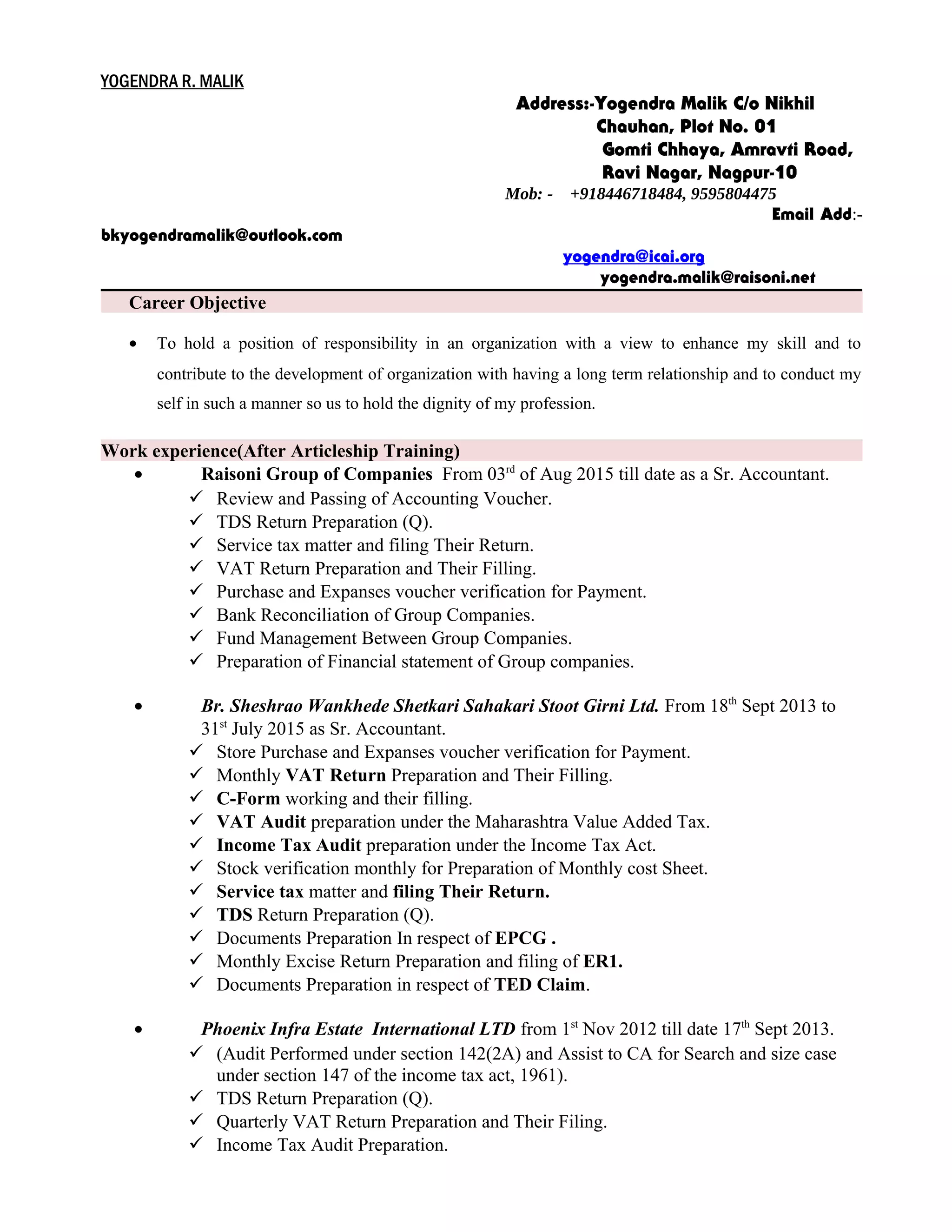

Yogendra Malik is a Chartered Accountant seeking a position of responsibility to enhance his skills and contribute to organizational development. He has over 7 years of experience working for Raisoni Group of Companies and Br. Sheshrao Wankhede Shetkari Sahakari Stoot Girni Ltd. as a Senior Accountant. His responsibilities included accounting, taxation, and financial reporting. He completed his articleship training with Ashok R. Varma and Co. Chartered Accountants, gaining exposure in audit, accounting, and tax. He holds an M.Com and BCA and is proficient in Microsoft Office, Tally, and tax software.