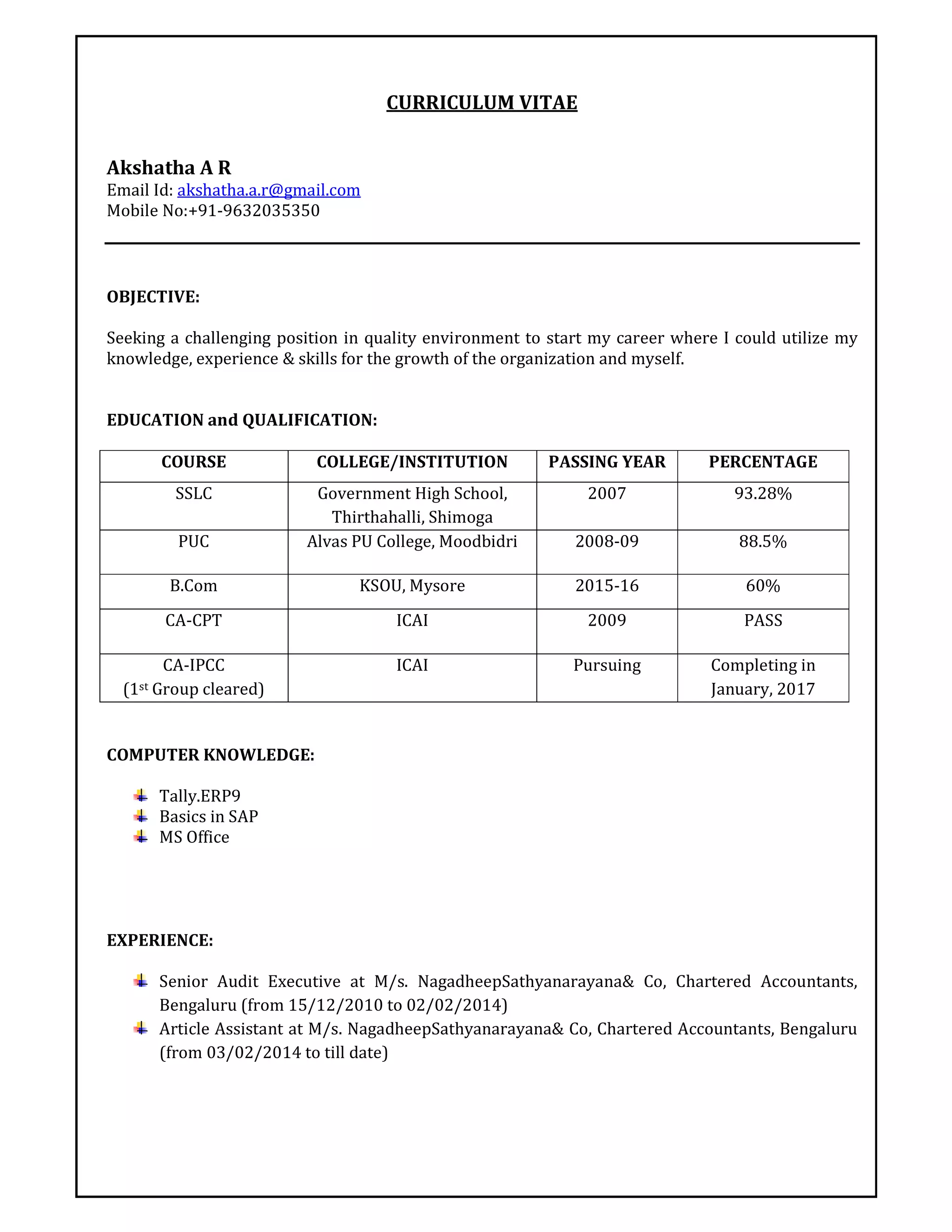

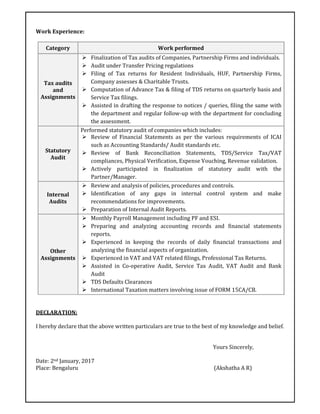

Akshatha A R is seeking a challenging position utilizing her knowledge and skills. She has a B.Com degree and is pursuing her CA-IPCC. She has over 3 years of experience as a Senior Audit Executive and Article Assistant at M/s. NagadheepSathyanarayana& Co, Chartered Accountants, Bengaluru. Her work includes tax audits, statutory audits, internal audits, payroll management, accounting, and experience with VAT, service tax, and international taxation matters.