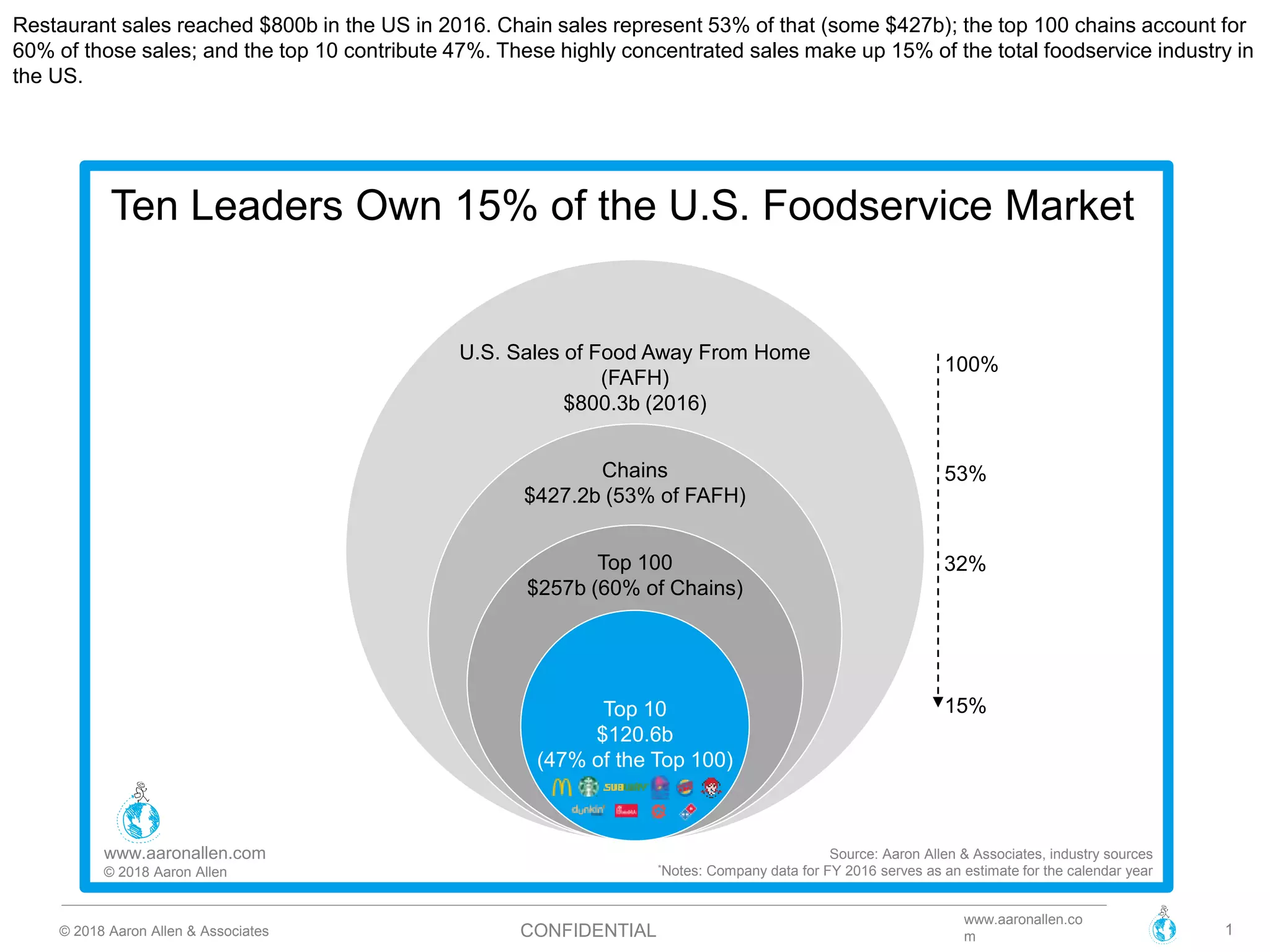

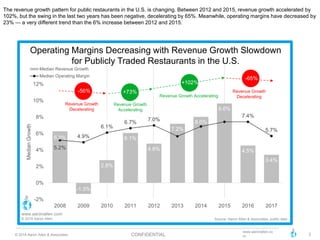

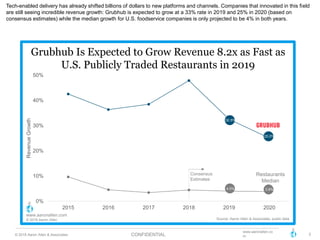

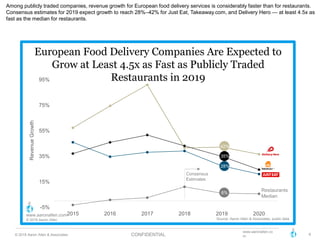

In 2016, U.S. restaurant sales reached $800 billion, with chain sales comprising 53% and the top 10 chains accounting for 47% of that. Revenue growth for publicly traded restaurants has significantly slowed from an acceleration of 102% between 2012 and 2015 to a deceleration of 65% in recent years, alongside a 23% decrease in operating margins. In contrast, tech-enabled delivery companies like Grubhub are expected to see much higher growth rates, with projections indicating 33% growth for 2019, compared to a mere 4% for traditional foodservice companies.