This document discusses research from a study on modern viewing habits called "The Multi-Screen Marketer". The study found that multi-tasking across devices while watching TV has become common, with over 60% of smartphone users and 65% of tablet owners reporting doing so. Younger age groups are more likely to multi-task. Tablet owners are more likely to take actions like purchasing in response to ads. However, consumers find mobile apps and sites from media companies unsatisfying. The rise of smartphones and tablets indicates multi-screen behavior will continue to increase as these devices become more prevalent.

![The Multi-Screen Marketer in association with the Interactive Advertising Bureau (IAB) Page 17

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage

and retrieval system, without prior permission in writing from the publisher. Copyright © Econsultancy.com Ltd 2012

4.2.

As consumers diversify how they watch, w

could be directly connected through a cable provider, or the

Internet, or might simply be

television programming that might be watched in its complete form when broadcast, or be time

shifted with commercials curtailed or accessed via a service such as iTunes, with no advertising.

The television set its potential. As with many

new offerings ures of so- onnected Over time, that

will change, and we asked consumers about their vision for how television will operate.

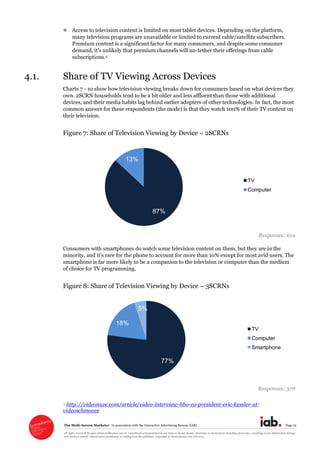

Figure 11: Impact of Features Expected in Future Televisions

Responses: 955

The top preference is for a change in how media providers do business;; consumers naturally

want to be able to watch anything at any time.

effective voice recognition is

expected to have a significant impact. Complexity is a major factor in the slow adoption of

connected

to use voice and motion controls to access the more powerful functions of connected TVs may

well unlock their use for the mass market.

The multi-screen experience is also important to consumers. Among the top three most

lowed by the ability to

They also see a world where devices talk to one another where tablets act as remotes ( Siri,

Bill Murray, before he went meta ) and where they can identify

products of interest using a mobile device to point at them.

The implication is that consumers expect to use multiple, complementary d

not doing so now. Smartphones are headed to ubiquity and tablets are rapidly moving beyond

young, early adopter to becoming a household staple, so the market for this movable feast of

content will only expand.

25%

36%

42%

47%

50%

56%

61%

77%

0% 30% 60% 90%

[Ability to] use the television to easily access

and interact with social media

[Ability to] use the television to easily access

and interact with websites

[Ability to] buy anything I see on TV by

pointing at it with mobile device

[Ability to] use tablet/mobile device as a

remote control for everything

[Ability to] move programming from one

device to another mid-show

[Ability to] watch on any device

[Ability to] talk to my TV and accessories and

tell them what to do

[Ability to] watch anything I want when I want

it

(% responding feature will have an impact on them)](https://image.slidesharecdn.com/5eb43cca-18ce-4370-8800-dbf486660c8f-150313085127-conversion-gate01/85/Research-Survey-Multi-Screens-FINAL-5-17-12-17-320.jpg)

![The Multi-Screen Marketer in association with the Interactive Advertising Bureau (IAB) Page 29

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage

and retrieval system, without prior permission in writing from the publisher. Copyright © Econsultancy.com Ltd 2012

30. , Econsultancy, April 2012

31. The big tip for 2012: convergence is here, Econsultancy, January 2012

32.The Magic of Doing One Thing at a Time, Harvard Business Review, March 2012

33.The Tablet-TV Connection, Forrester Blogs, April 2012

34.Time Inc. Study Reveals That "Digital Natives" Switch Between Devices and Platforms Every

Two Minutes, Use Media to Regulate Their Mood, Time Inc, April 2012

35. Time Warner Cable, Comcast and the End of TV as We Know It, Ad Age, April 2011

36.Toluna C&M Social Media Marketing Best Practice Guide, Constant Motion / Toluna,

February 2012

37. TV and search: associative marketing in a two-screen world, Econsultancy, November 2011

38.TV's Digital Age Will (Truly) Arrive In 2017, Ad Age, January 2012

39.Video Perceptions Survey, Discovery Research, January 2012

40.Welcome to the Digital Living Room, [Infographic] High Table, January 2012

41. What is social TV? Not Google TV or YouTube says NBC rep, Econsultancy, February 2012

42.What you need to know about interactive TV, Ad Age, February 2012](https://image.slidesharecdn.com/5eb43cca-18ce-4370-8800-dbf486660c8f-150313085127-conversion-gate01/85/Research-Survey-Multi-Screens-FINAL-5-17-12-29-320.jpg)