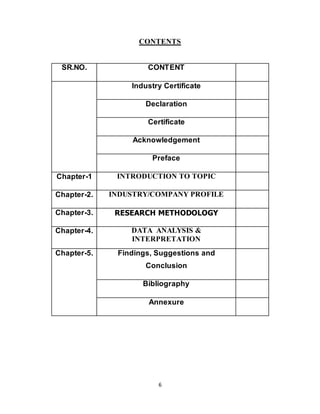

This document provides an introduction to a student's summer training report on customer perception of e-banking at HDFC Bank. It includes a declaration by the student that the work is original, a certificate from the faculty advisor, and an acknowledgement of those who helped. The introduction defines key terms like customer perception, e-banking, and provides background on the growth of e-banking in India and how it has evolved from basic information online to more advanced transactional capabilities.

![22

supports that functionality); also, from the merchant's standpoint, the merchant pays

lower fees on online debit transaction as compared to "credit" (offline).

3. Electronic purse card system:

Smart-card-based electronic purse systems (in which value is stored on the card chip, not

in an externally recorded account, so that machines accepting the card need no network

connectivity) are in use throughout Europe since the mid-1990s, most notably in

Germany (Geldkarte), Austria (Quick Wertkarte), the Netherlands (Chipknip), Belgium

(Proton), Switzerland (CASH) and France (Moneo, which is usually carried by a debit

card). In Austria and Germany, all current bank cards now include electronic purses.

4. Prepaid debit card:

Prepaid debit cards, also called reloadable debit cards, appeal to a variety of users. The

primary market for prepaid cards are unbanked people, that is, people who do not use

banks or credit unions for their financial transactions, possibly because of poor credit

ratings.

The advantages of prepaid debit cards include being safer than carrying cash, worldwide

functionality due to Visa and MasterCard merchant acceptance, not having to worry

about paying a credit card bill or going into debt, the opportunity for anyone over the age

of 18 to apply and be accepted without regard to credit quality and the option to direct

deposit paychecks and government benefits onto the card for free. The prepaid bank card,

called "Bank Gift Card" too, has been invented in 2001 by a French, Laurent GRANIER

who has two patents and copyrights (2001 and 2002), under the commercial name

"SPIDERCUARD" (Trade Mark).

8. Credit card:

A credit card is a payment card issued to users as a system of payment. It allows the

cardholder to pay for goods and services based on the holder's promise to pay for them.[1]

The issuer of the card creates a revolving account and grants a line of credit to the

consumer (or the user) from which the user can borrow money for payment to a merchant

or as a cash advance to the user. A credit card is different from a charge card: a charge

card requires the balance to be paid in full each month. In contrast, credit cards allow the

consumers a continuing balance of debt, subject to interest being charged. A credit card

also differs from a cash card, which can be used like currency by the owner of the card. A](https://image.slidesharecdn.com/report-150410082959-conversion-gate01/85/Report-finance-22-320.jpg)

![23

credit card differs from a charge card also in that a credit card typically involves a third-

party entity that pays the seller and is reimbursed by the buyer, whereas a charge card

simply defers payment by the buyer until a later date.

The size of most credit cards is 3 3⁄8 × 2 1⁄8 in (85.60 × 53.98 mm),[3] conforming to the

ISO/IEC 7810 ID-1 standard. Credit cards have a printed [4] or embossed bank card

number complying with the ISO/IEC 7812 numbering standard. Both of these standards

are maintained and further developed by ISO/IEC JTC 1/SC 17/WG 1. Before magnetic

stripe readers came into widespread use, plastic credit cards issued by many department

stores were produced on stock ("Princess" or "CR-50") slightly longer and narrower than

7810.

CHALLENGES IN E-BANKING:

The information technology in itself is not a solution and it has to be effectively utilized. The

concept of e-banking cannot work unless and until have a centralized body or institution, which

can formulate guidelines, regulate, and monitor effectively the functioning of Internet banking.

The most important requirement for the successful working of Internet banking is the adoption of

the best security methods. This presupposes the existence of a uniform and the best available

technological devices and methods to protect electronic banking transactions. In order for

computerization to take care of the emerging needs, the recommendations of the Committee on

Technology Upgradation in the Banking Sector (1999) may be considered. These are:

(1) Need for standardization of hardware, operating systems, system software, and application

software to facilitate interconnectivity of systems across branches

(2) Need for high levels of security

(3) Communication and networking - use of networks which would facilitate centralized

databases and distributed processing

(4) Technology plan with periodical up gradation

(5) Business process re-engineering

(6) Address the issue of human relations in a computerized environment](https://image.slidesharecdn.com/report-150410082959-conversion-gate01/85/Report-finance-23-320.jpg)