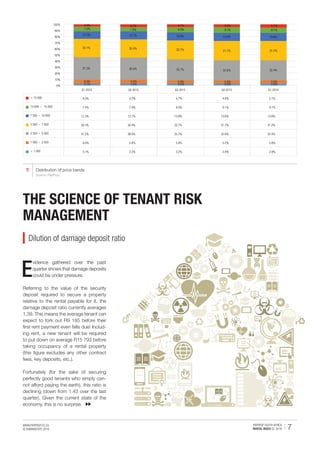

This document provides a summary of key findings from PayProp's Q1 2016 Rental Index for South Africa. It finds that average rental rates remained flat compared to Q4 2015, with only a 1% increase over the last 6 months. Year-over-year rental growth is declining significantly and dropped below 4% for the first time. The Western Cape saw strong rental growth of 10.8% while Gauteng experienced a sharp decline in growth to only 1.1%. Damage deposit ratios are declining as affordability pressures mount for tenants.