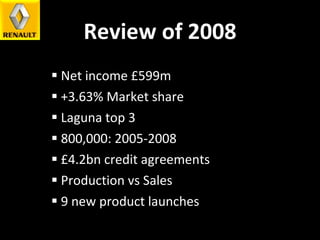

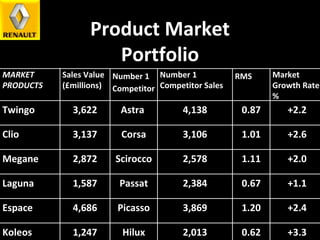

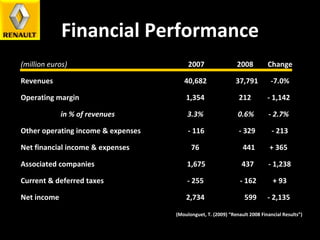

Louis Renault created the Renault company in 1898. Over the next century, Renault grew to become one of the largest automakers in the world, producing over 800,000 vehicles in 2008 across 118 countries. Renault aims to be one of the top 3 car and commercial vehicle brands in Western Europe through maintaining a high level of profitability. However, Renault faced financial difficulties in 2008 with a 7% drop in revenue and 2.1 billion euro drop in net income compared to 2007.