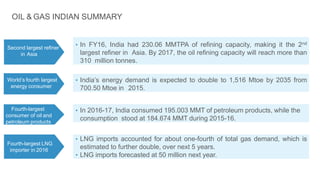

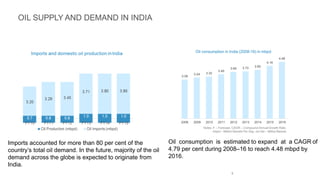

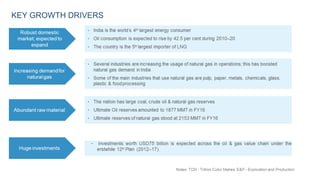

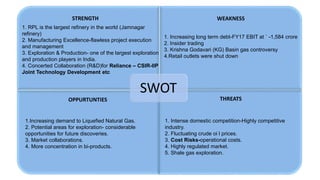

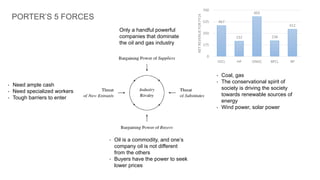

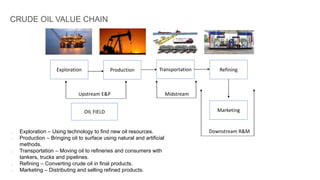

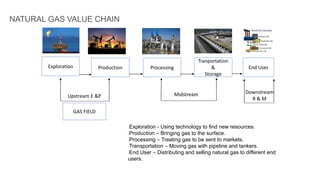

The document provides an overview of India's oil and gas industry, noting that it is the world's fourth-largest energy consumer, with expectations for energy demand to double by 2035. It highlights Reliance Petroleum Limited as a key player in the sector, discussing its refining capacity and strategic partnerships, along with a SWOT analysis that identifies strengths, weaknesses, opportunities, and threats in the market. Furthermore, it outlines the oil and gas value chain, including exploration, production, refining, and marketing, while also indicating projected growth in oil and gas consumption driven by economic growth and the transition to cleaner fuels.