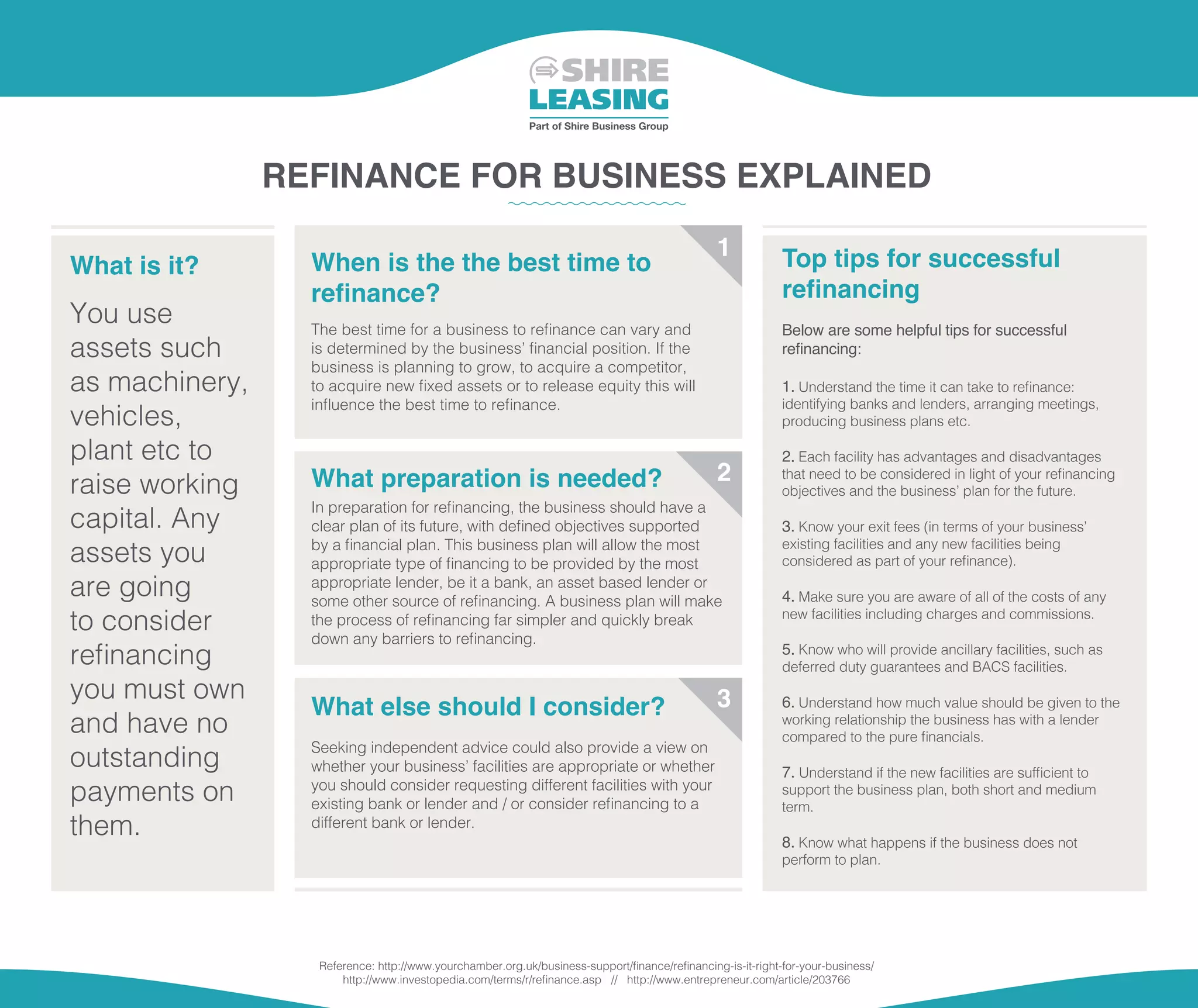

Refinancing involves using business assets like equipment, vehicles, and property to raise working capital. It is best done when planning business growth, acquisitions, new assets, or releasing equity. Proper preparation includes understanding timelines, costs, exit fees, and ensuring new facilities support business plans short and long term. A clear business plan outlining future objectives and finances makes refinancing simpler by demonstrating the need and use of funds to lenders. Independent advice can help evaluate if current facilities are suitable or if refinancing with a new lender would be preferable.