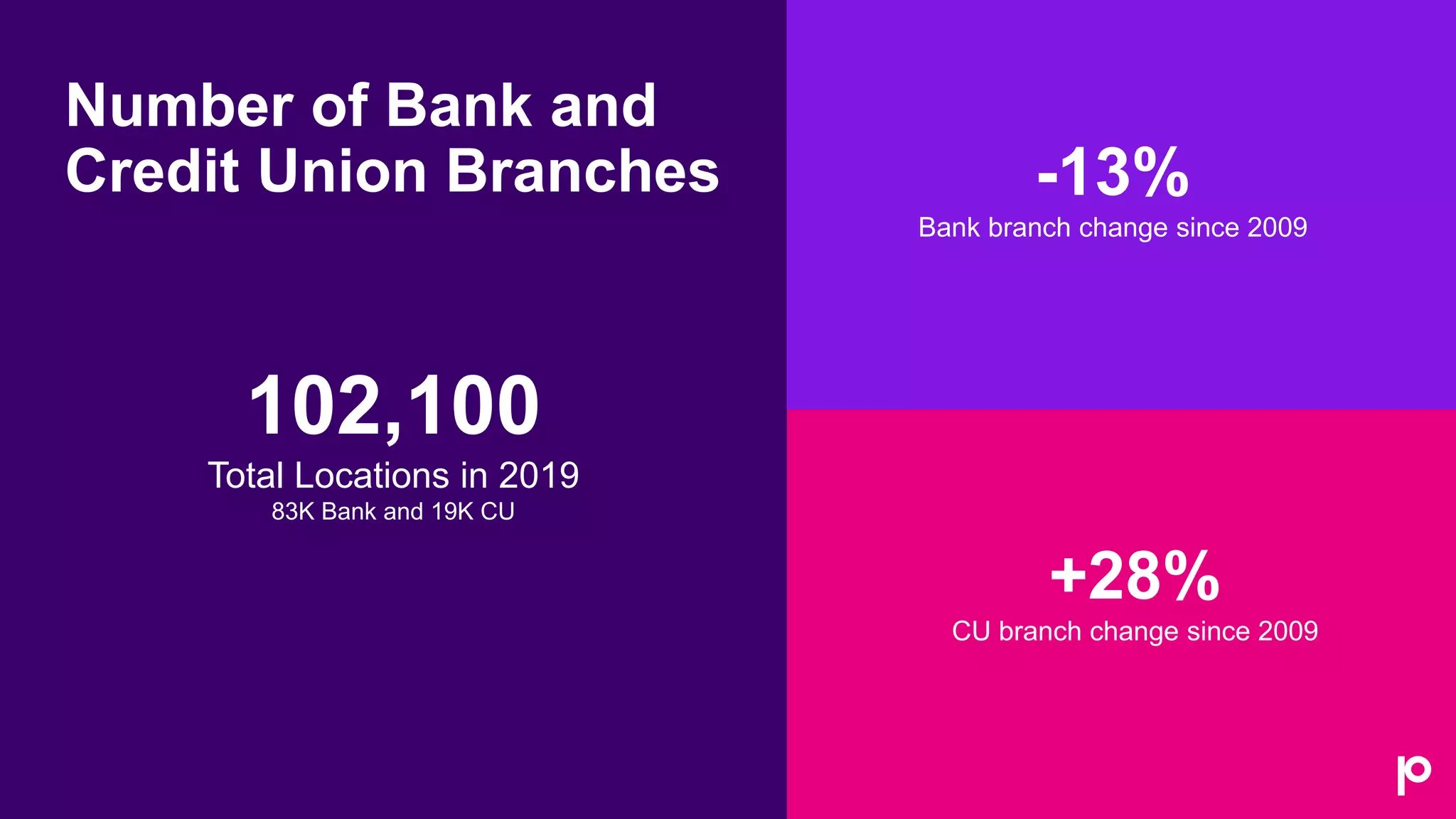

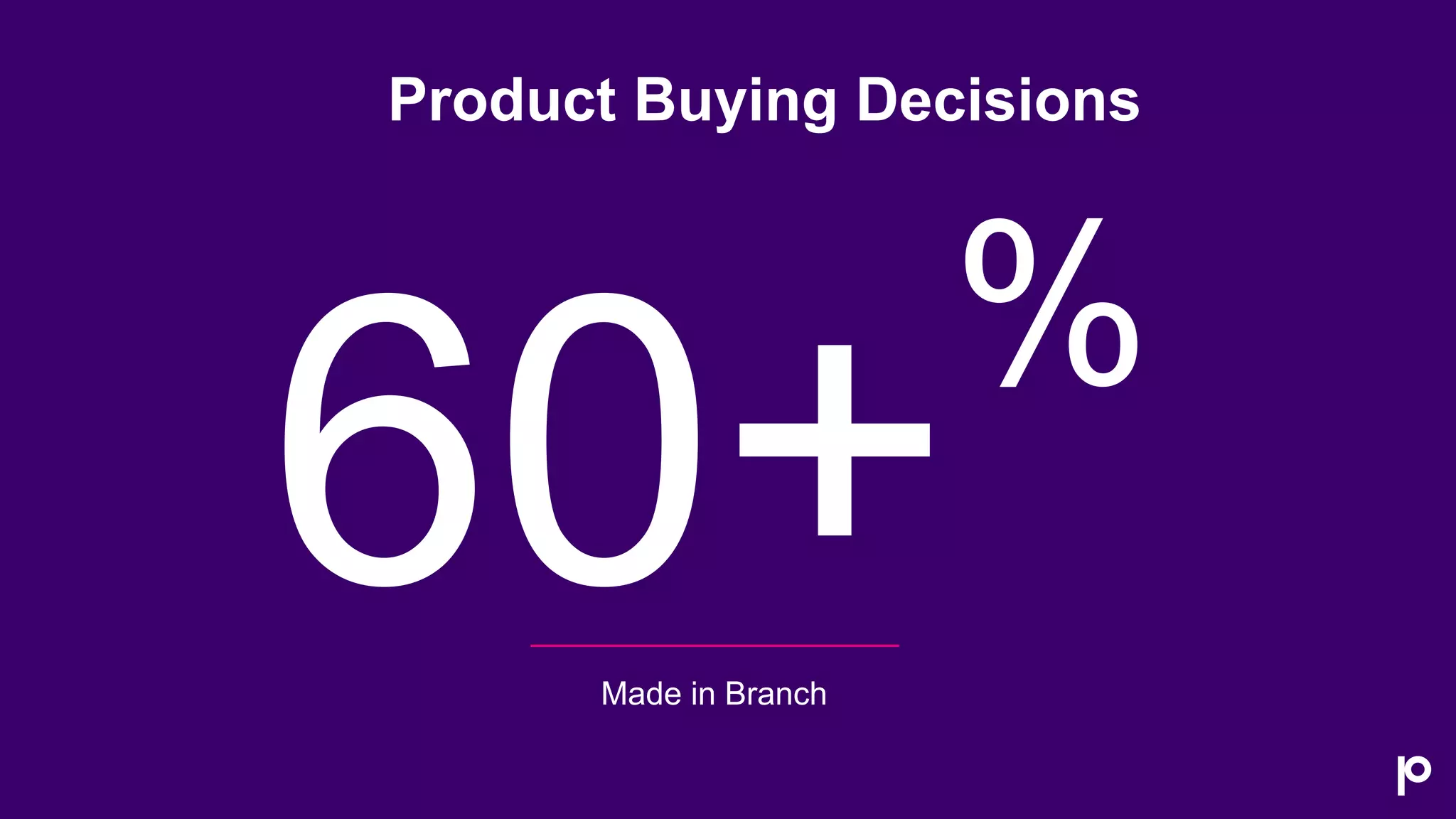

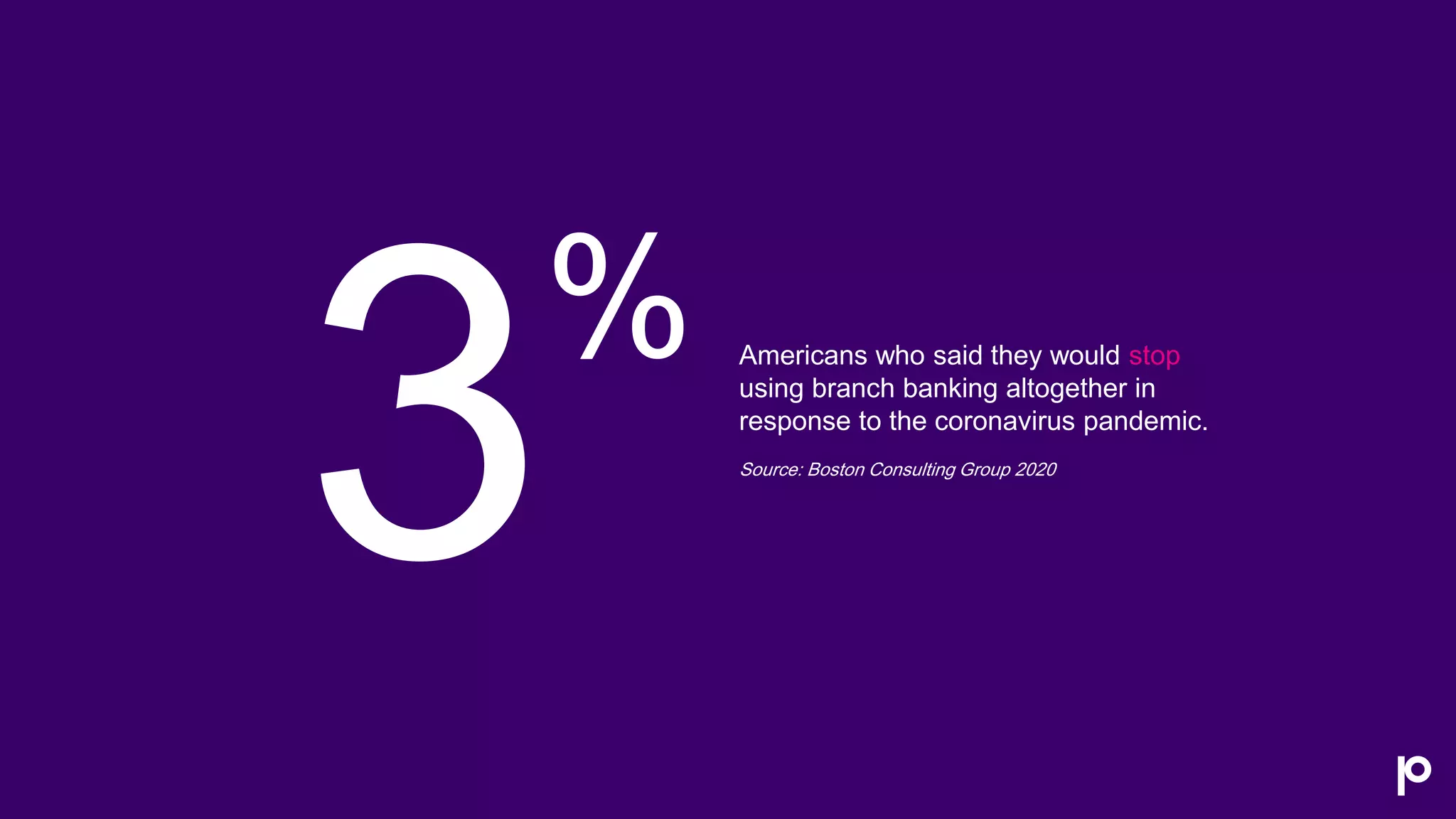

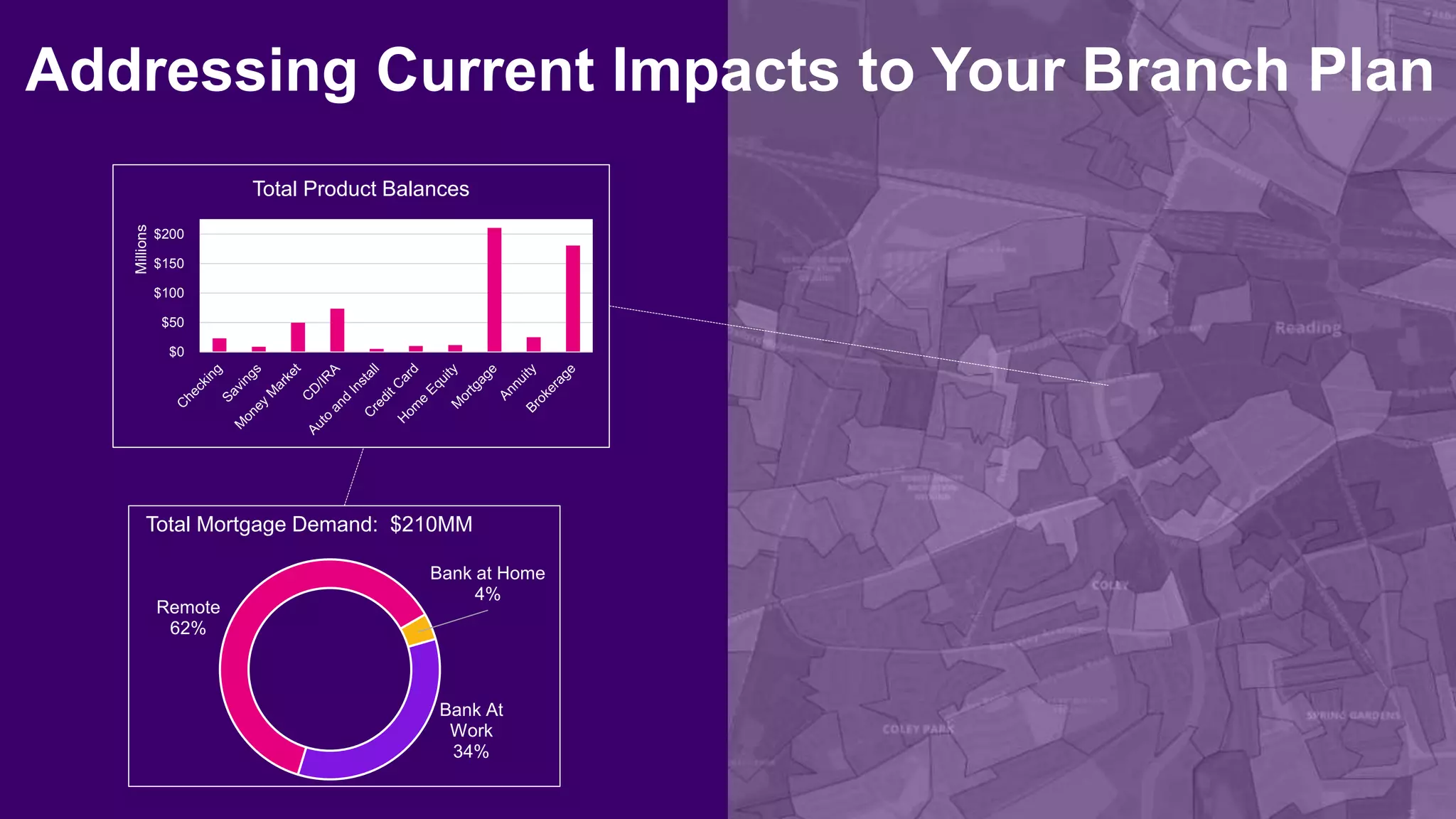

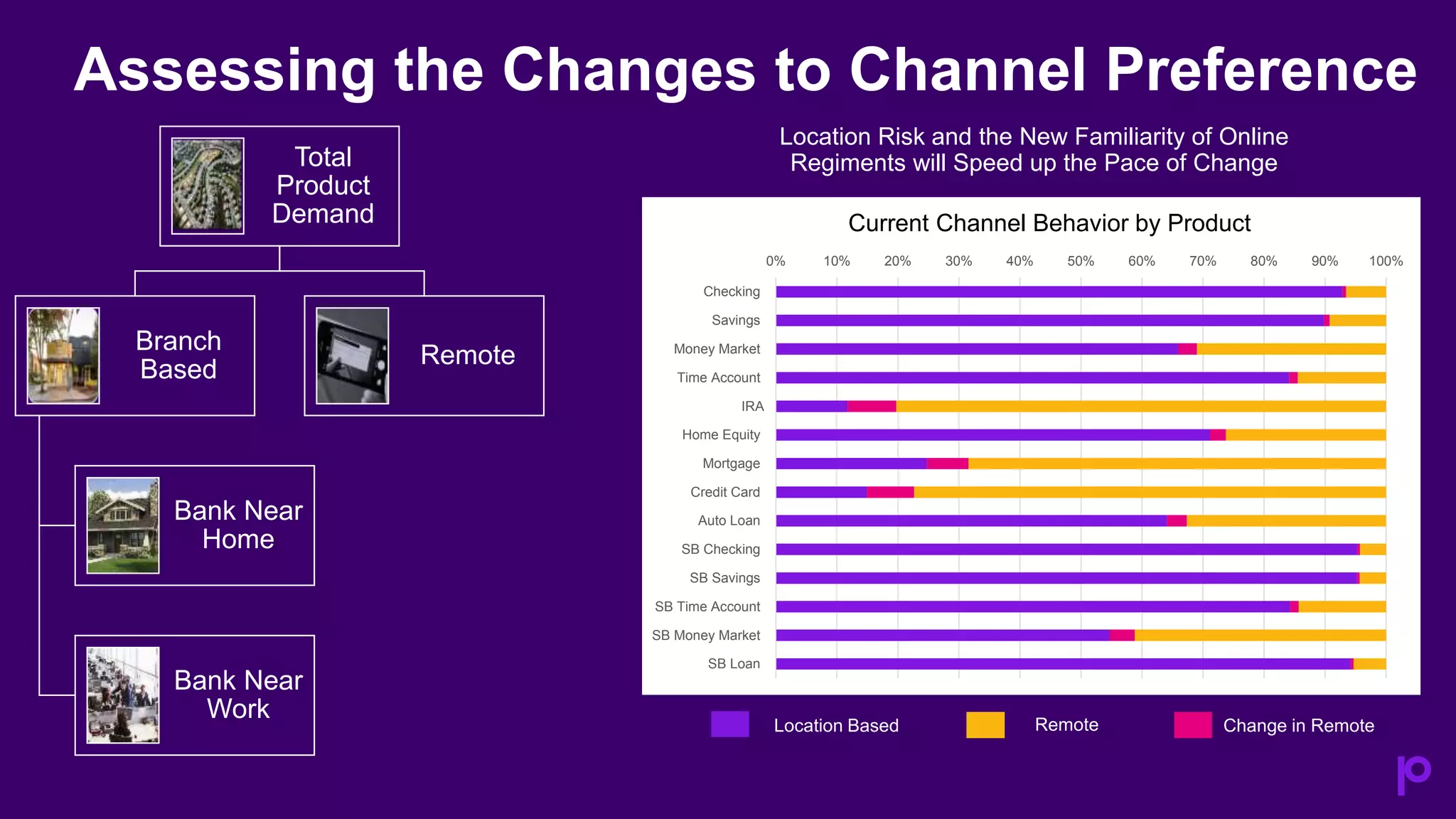

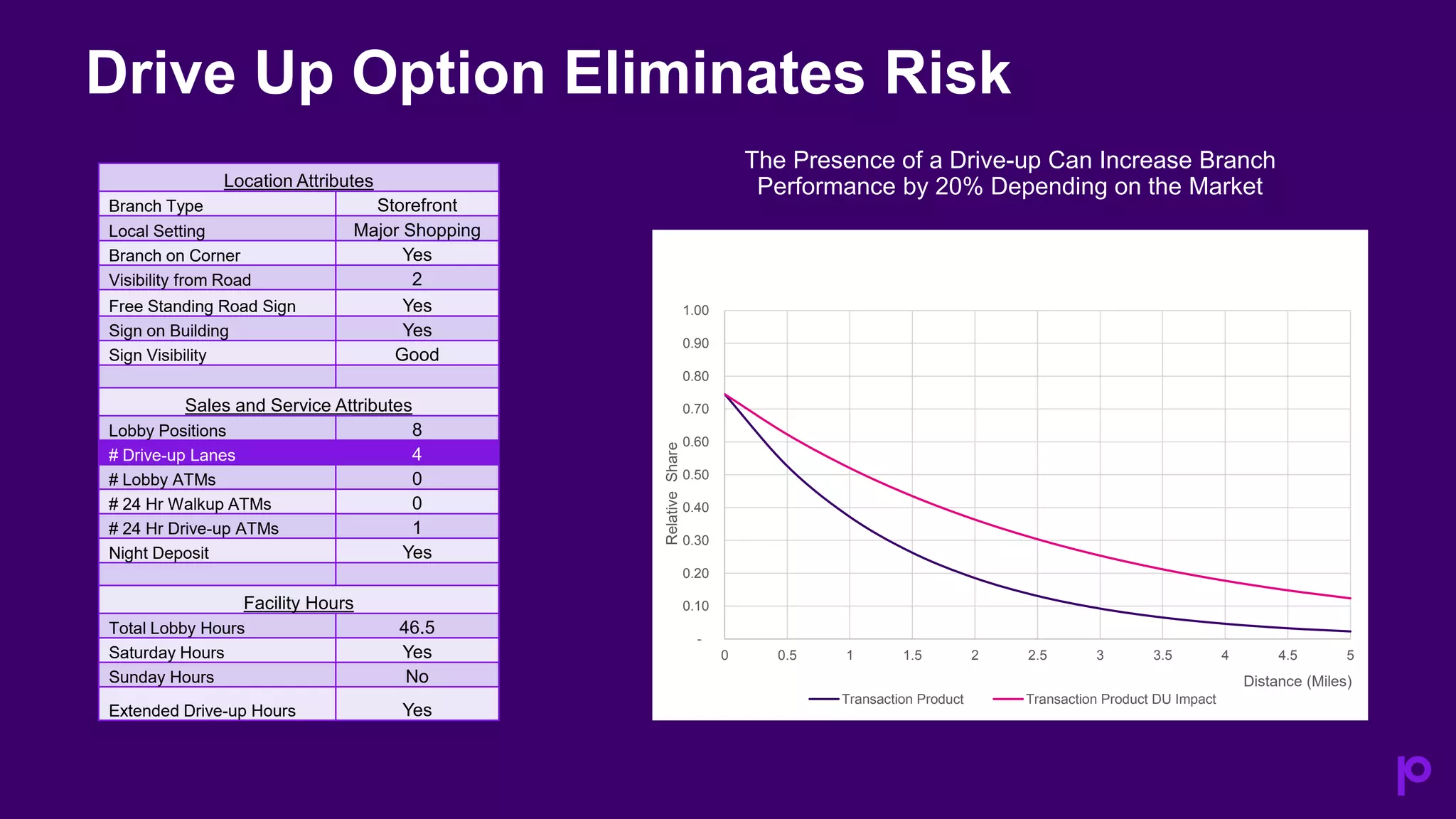

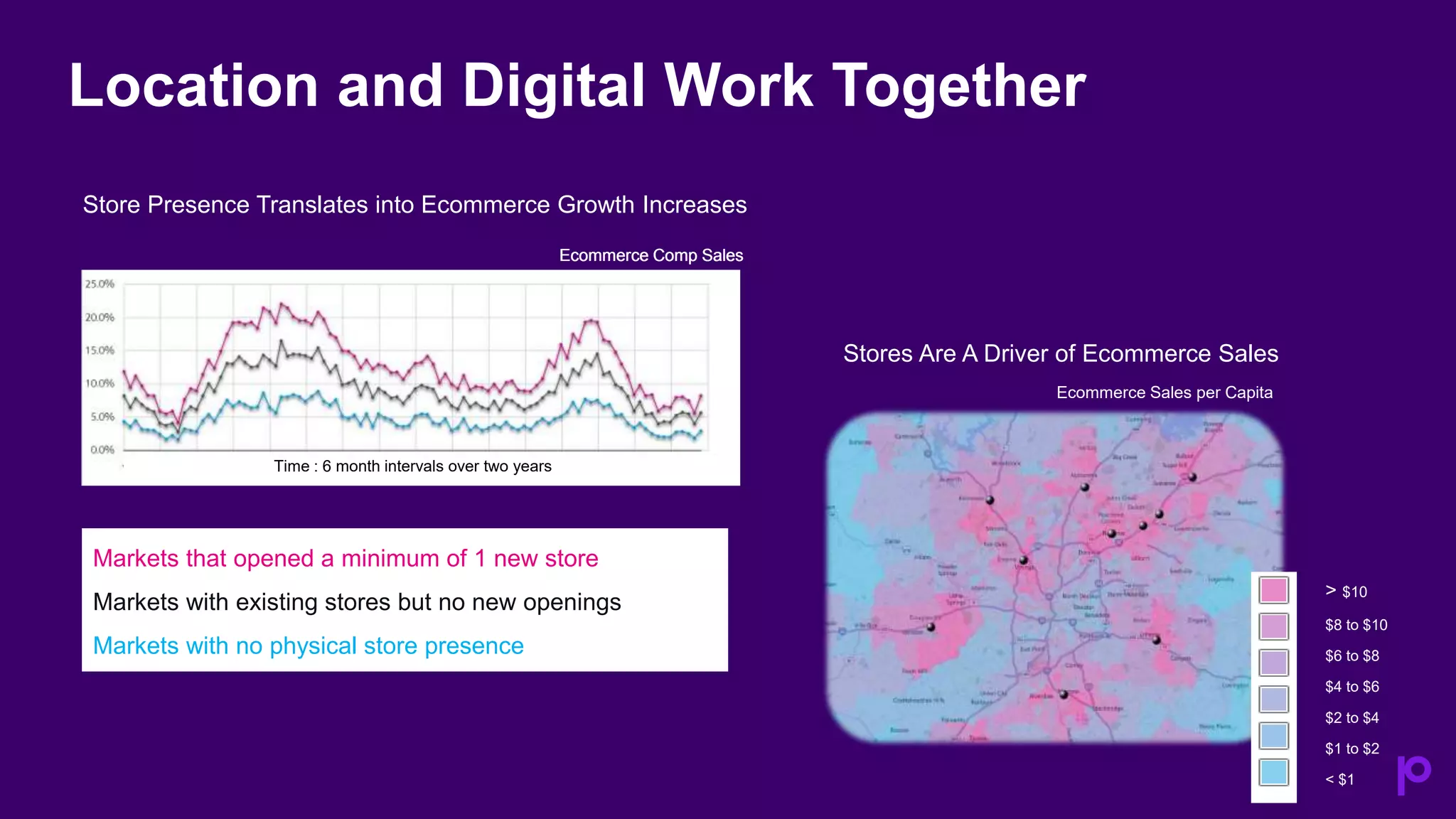

The document discusses the evolving landscape of retail banking, highlighting trends and strategies for branch transformation in response to economic challenges. It emphasizes the importance of location analytics, digital capabilities, and safety in branch design, as well as shifts in consumer behavior due to the pandemic. Key considerations include optimizing branch networks, enhancing customer experience, and adapting to changing service models.