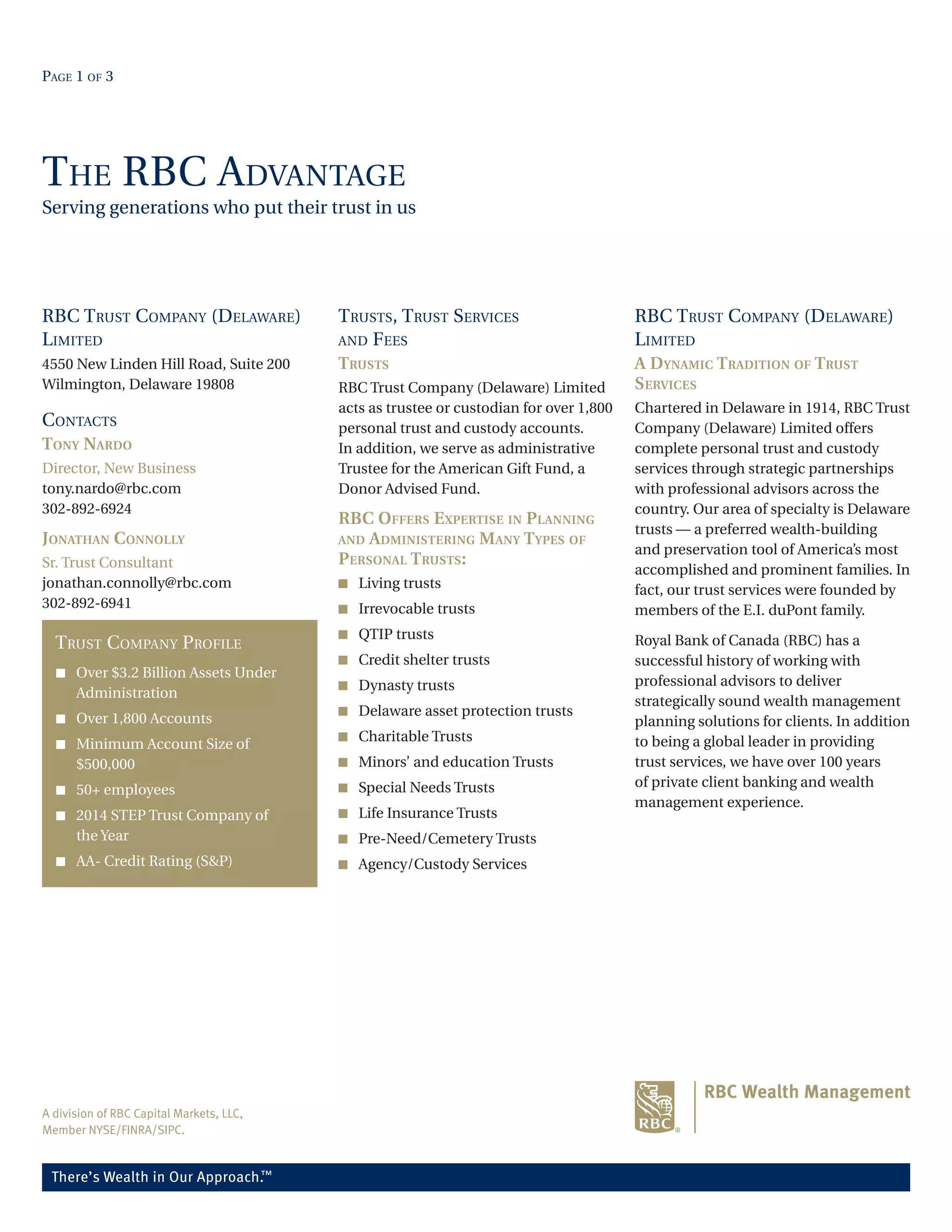

RBC Trust Company (Delaware) Limited offers personal trust and custody services through partnerships with financial advisors. It acts as trustee for over 1,800 accounts worth over $3.2 billion. RBC provides expertise in many types of trusts including living trusts, irrevocable trusts, and charitable trusts. The company was chartered in Delaware in 1914 and offers Delaware trusts, which are preferred estate planning tools. RBC prides itself on superior customer service, knowledge and experience to help clients take advantage of trusts, and commitment to clients through dedicated professionals.