This document summarizes Steve Boyle's presentation at the Raymond James 38th Annual Institutional Investors Conference in March 2017. The key points are:

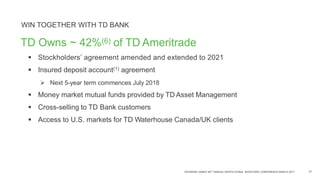

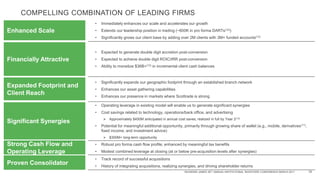

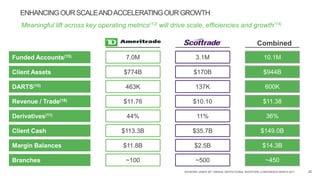

1) TD Ameritrade has evolved through four phases and is entering a new phase focused on achieving $1 trillion in assets with the planned acquisition of Scottrade.

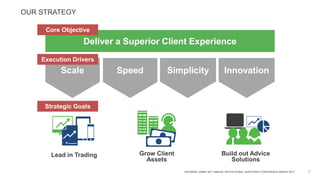

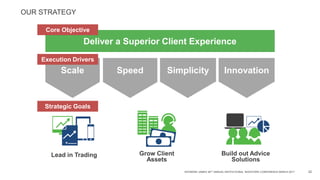

2) The company's strategy is to deliver a superior client experience through scale, speed, simplicity and innovation.

3) Key 2017 goals include improving the client experience, building out advice solutions, growing client assets, leading in trading, increasing speed to market, and simplifying processes.

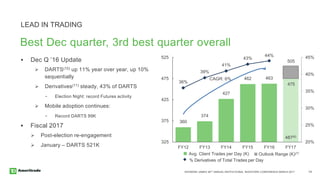

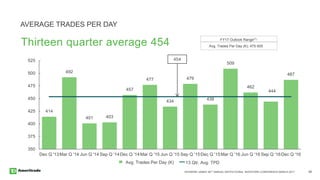

4) Metrics show strong growth in interest-earning assets, investment product fees, client assets, and daily