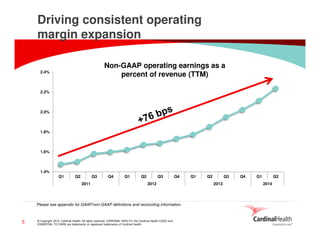

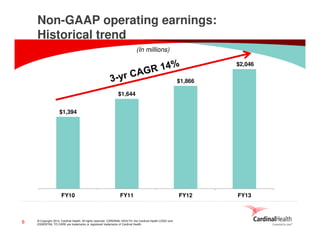

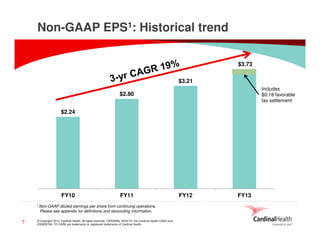

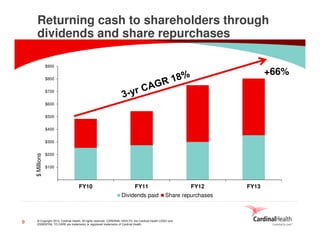

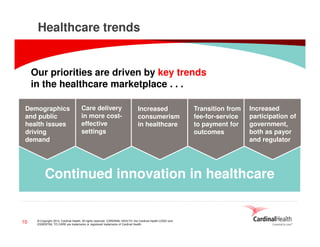

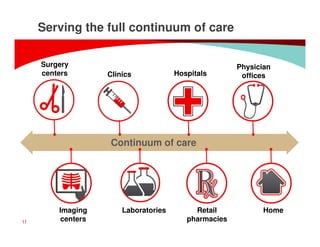

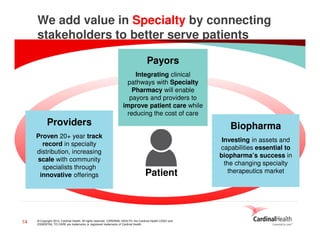

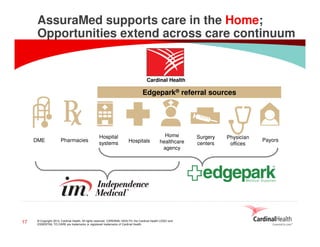

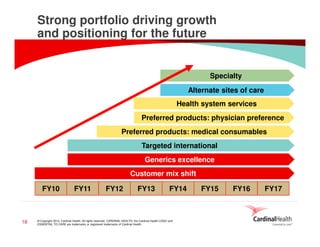

Cardinal Health is a well-balanced, well-prepared, and well-focused healthcare services company. It has demonstrated a strong track record of consistent financial growth and returning substantial value to shareholders. Cardinal Health provides solutions across the full healthcare continuum and is well-positioned for future growth given key trends in healthcare. It focuses on strategic priorities like generics, specialty pharmaceuticals, international expansion, and solutions for health systems.