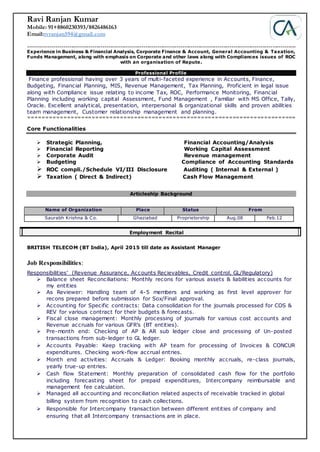

Ravi Ranjan Kumar has over 3 years of experience in finance, accounting, taxation, and compliance. He currently works as an Assistant Manager at British Telecom India, where his responsibilities include balance sheet reconciliations, accounting for contracts, fiscal close management, accounts payable, cash flow statements, and more. Previously, he worked as a proprietor at Saurabh Krishna & Co. Chartered Accountants, where he was involved in budget preparation, tax return filing, maintaining books of accounts, and providing tax advice. He holds a Diploma in IFRS from ACCA UK and is a CA finalist from the Institute of Chartered Accountants of India with expertise in accounts, finance, taxation