Quotation 09.04.2015

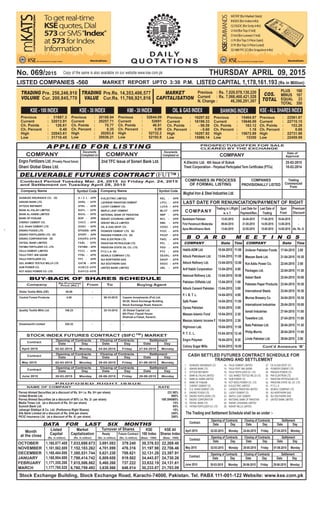

- 1. Engro Powergen Qadirpur Ltd. 17-09-2014 THURSDAY APRIL 09, 2015No. 069/2015 LISTED COMPANIES -560 LISTED CAPITAL 1,178,161.193 (Rs in Million)MARKET REPORT UPTO 3:30 P.M. D A I LY Q U O TAT I O N S Copy of the same is also available on our website www.kse.com.pk Stock Exchange Building, Stock Exchange Road, Karachi-74000, Pakistan. Tel. PABX 111-001-122 Website: www.kse.com.pk PROSPECTUS/OFFER FOR SALE CLEARED BY THE EXCHANGE COMPANY Date of Approval COMPANIES PROVISIONALLY LISTED Trading Commenced From COMPANIES IN PROCESS OF FORMAL LISTING LAST DATE FOR RENUNCIATION/PAYMENT OF RIGHT Last Date for Payment/Ren.COMPANY Spot From Premium/ Discount Trading in L/Right w. e. f. K-Electric Ltd. 4th Issue of Sukuk 25-02-2015 Treet Corporation - Perpetual Participated Term Certificates (PTCs) 18-02-2014 B O A R D M E E T I N G S COMPANY TimeDate COMPANY TimeDate APPLIED FOR LISTING COMPANY Documents Completed on COMPANY Documents Completed on Last Date of Trading Habib-ADM Ltd. 10-04-2015 11:00 Attock Petroleum Ltd. 13-04-2015 11:00 Attock Refinery Ltd. 13-04-2015 12:00 Arif Habib Corporation 13-04-2015 4:00 National Refinery Ltd. 13-04-2015 10:00 Pakistan Oilfields Ltd. 13-04-2015 1:00 Attock Cement Pakistan 13-04-2015 3:00 P. I. B. T. L. 14-04-2015 4:00 Safe Power 14-04-2015 11:00 Dynea Pakistan 15-04-2015 3:00 Meezan Islamic Fund 15-04-2015 2:30 Meezan Islamic Income F. 15-04-2015 2:30 Highnoon Lab. 15-04-2015 11:00 P. T. C. L. 15-04-2015 12:45 Engro Polymer 16-04-2015 9:30 Colony Sugar Mills 16-04-2015 10:00 Unilever Pakistan Foods 17-04-2015 3.00 Meezan Bank Ltd. 21-04-2015 10:30 Kot Addu Power Co. 22-04-2015 2:00 Packages Ltd. 22-04-2015 11:30 Askari Bank 22-04-2015 10:00 Pakistan Paper Products 23-04-2015 10:30 International Steels 23-04-2015 10:30 Murree Brewery Co. 24-04-2015 10:30 International Industries 25-04-2015 10:00 Ismail Industries 27-04-2015 11:00 Towellers Ltd. 27-04-2015 11:00 Bata Pakistan Ltd. 28-04-2015 11:30 Philip Morris 28-04-2015 11:00 Linde Pakistan Ltd. 29-04-2015 2:00 (FUT )TMDELIVERABLE FUTURES CONTRACT Company Name Company Name Symbol CodeSymbol Code BankIslami Pakistan 13-03-2015 24-04-2015 17-04-2015 16-04-2015 - First Paramount Modaraba 09-04-2015 21-05-2015 14-05-2015 13-05-2015 - Apna Microfinance Bank 13-04-2015 22-05-2015 15-05-2015 14-05-2015 dis. Rs. 5/- P R O P O S E D R I G H T I S S U E Pervez Ahmed Securities (at a discount of Rs. 5/= i.e. Rs. 5/= per share) 231.08% United Brands Ltd. 800% Pervez Ahmed Securities (at a discount of 80% i.e. Rs. 2/- per share) 189.394068% Media Times Ltd. (at a discount of Rs. 5/= per share) 14% Summit Bank Ltd. 65% Jahangir Siddiqui & Co. Ltd. (Preference Right Shares) 15% Silk Bank Limited (at a discount of Rs. 8/44 per share) 240% PICIC Insurance Ltd. (at a discount of Rs. 5/- per share) 200% NAME OF COMPANY RATE OCTOBER NOVEMBER DECEMBER JANUARY FEBRUARY MARCH 1,160,877.409 1,161,562.889 1,168,484.888 1,168,984.888 1,171,355.206 1,177,765.520 7,033,698.673 7,152,183.262 7,380,531.744 7,798,414.742 7,615,586.862 6,760,759.492 3,691.083 4,701.899 5,621.230 6,809.658 5,460.268 3,638.566 30,376.53 31,197.98 32,131.28 34,443.87 33,632.19 30,233.87 22,269.40 22,706.46 23,397.91 24,730.26 24,131.61 21,703.09 379.240 476.316 708.621 819.502 737.222 646.814 DATA FOR LAST SIX MONTHS Month at the close Listed Capital Market Capitalization Turnover of Shares KSE 100 Index (Rs. in million) (Rs. in million) KSE All Shares IndexReady Future Contract (No. in million) (No. in million) (Base : 1000) (Base : 1000) Engro Fertilizers Ltd. (Privately Placed Sukuk) CASH SETTLED FUTURES CONTRACT SCHEDULE FOR TRADING AND SETTLEMENT The Trading and Settlement Schedule shall be as under :- 1. ADAMJEE INSURANCE CO. 2. ASKARI BANK LTD. 3. ATTOCK REFINERY 4. BANK AL-FALAH LIMITED 5. BANK AL-HABIB LIMITED 6. BANK OF PUNJAB 7. CHERAT CEMENT CO. 8. D.G. KHAN CEMENT LTD. 9. ENGRO FOODS LTD. 10. ENGRO FERTILIZERS LTD. 11. ENGRO CORPORATION 12. FAYSAL BANK LTD. 13. FATIMA FERTILIZER CO. LTD. 14. FAUJI CEMENT LIMITED 15. FAUJI FERT. BIN QASIM 16. FAUJI FERTILIZER CO. LTD. 17. GULAHMED TEXTILE MILLS LTD. 18. HUB POWER CO. 19. KOT ADDU POWER CO. LTD. 20. K-ELECTRIC LIMITED 21. LAFARGE PAKISTAN LIMITED 22. LUCKY CEMENT CO. 23. MAPLE LEAF CEMENT 24. NATIONAL BANK OF PAKISTAN 25. NISHAT (CHUNIAN) LIMITED 26. NISHAT MILLS LIMITED 27. OIL & GAS DEVP. CO. 28. PIONEER CEMENT LTD. 29. PAKGEN POWER LTD. 30. PAK ELEKTRON LTD. 31. PAKISTAN PETROLEUM LTD. 32. PAKISTAN STATE OIL CO. LTD. 33. P.T.C.L.A 34. SEARLE COMPANY LTD. 35. SUI NORTHERN GAS 36. SUI SOUTHERN GAS 37. UNITED BANK LIMITED Ghani Global Glass Ltd. Mughal Iron & Steel Industries Ltd. Contract Period Tuesday Mar. 24, 2015 to Friday Apr. 24, 2015 and Settlement on Tuesday April 28, 2015 ADAMJEE INSURANCE CO. XD A I C L - APR ASKARI BANK LTD. AKBL - APR ATTOCK REFINERY ATRL - APR BANK AL-FALAH LIMITED BAFL - APR BANK AL-HABIB LIMITED BAHL - APR BANK OF PUNJAB BOP - APR CHERAT CEMENT CO. CHCC - APR D.G. KHAN CEMENT LTD. DGKC - APR ENGRO FOODS LTD. EFOODS - APR ENGRO FERTILIZERS LTD. XD EFERT - APR ENGRO CORPORATION XD ENGRO-APR FAYSAL BANK LIMITED FABL - APR FATIMA FERTILIZER CO. LTD. FATIMA - APR FAUJI CEMENT LIMITED FCCL - APR FAUJI FERT. BIN QASIM FFBL - APR FAUJI FERTILIZER CO. FFC - APR GUL AHMED TEXTILE MILLS LTD. GATM - APR HUB POWER CO. HUBCO-APR KOT ADDU POWER CO. LTD. KAPCO-APR Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 02-02-2015 Monday 24-04-2015 Friday 27-04-2015 MondayApril 2015 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 02-03-2015 Monday 29-05-2015 Friday 01-06-2015 MondayMay 2015 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 30-03-2015 Monday 26-06-2015 Friday 29-06-2015 MondayJune 2015 STOCK INDEX FUTURES CONTRACT (SIFC ) MARKETTM Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 02-02-2015 Monday 24-04-2015 Friday 27-04-2015 MondayApril 2015 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 02-03-2015 Monday 29-05-2015 Friday 01-06-2015 MondayMay 2015 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 30-03-2015 Monday 26-06-2015 Friday 29-06-2015 MondayJune 2015 K-ELECTRIC LIMITED KEL - APR LAFARGE PAKISTAN CEMENT LPCL - APR LUCKY CEMENT CO. LUCK - APR MAPLE LEAF CEMENT MLCF - APR NATIONAL BANK OF PAKISTAN NBP - APR NISHAT (CHUNIAN) LIMITED NCL - APR NISHAT MILLS LIMITED NML - APR OIL & GAS DEVP. CO. OGDC - APR PIONEER CEMENT LTD. XD PIOC - APR PAKGEN POWER LTD. XD PKGP - APR PAK ELEKTRON LTD. PAEL - APR PAKISTAN PETROLEUM LTD. PPL - APR PAKISTAN STATE OIL CO. LTD. PSO - APR P.T.C.L.A XD PTC - APR SEARLE COMPANY LTD. SEARL- APR SUI NORTHERN GAS SNGP - APR SUI SOUTHERN GAS SSGC - APR UNITED BANK LIMITED UBL - APR BUY-BACK OF SHARES SCHEDULE Re-Purchase Price (Rs.)Company Buying AgentFrom To Globe Textile Mills (OE) 40.00 - - Central Forest Products 4.00 - 09-10-2015 Cassim Investments (Pvt) Ltd. 26-28, Stock Exchange Building Stock Exchange Road, Karachi. Quality Textile Mills Ltd. 106.23 - 25-10-2015 JS Global Capital Ltd. 6th Floor, Faysal House Shahrah-e-Faisal, Karachi. Dreamworld Limited 325.32 - - - 2nd TFC Issue of Soneri Bank Ltd. Cont’d Annexure ‘B’

- 2. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 2 COMPANY / SECTOR D I S T R I B U T I O N S FOR D A I L Y Q U O T A T I O N S THURSDAY 09-04-2015 OFFER PRICE REDEM- PTION PRICE PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MARCH 2015 2 OPEN-END MUTUAL FUNDS ABLCASHFUND 10.70 10.70 - JUNE 8.295% 7.72% - - - 20/6 2010 ABL GOVERNMENT SECURITIES FUND CLASS -A-UNITS 10.15 10.00 - JUNE 5.511% - - - 20/6 2011 CLASS- B-UNITS 11.57 11.40 - JUNE 9.06% 8.50% - - - 20/6 2011 ABLISLAMICCASHFUND 10.88 10.72 - JUNE 9.085% 8.43% - - - 20/6 2010 ABLISLAMICSTOCKFUND 12.85 12.60 - JUNE NIL 15.91% - - - 20/6 2013 ABLINCOMEFUND 11.40 11.23 - JUNE 6.26% 7.63% - - - 20/6 2008 ABLSTOCKFUND 13.77 13.50 - JUNE 53.30% 32.57% - - - 20/6 2009 AKD AGGRESSIVE INCOME FUND 55.72 55.17 - JUNE 11.94% B 5.38% - - - 1/7 2007 AKDCASHFUND 53.50 53.50 - JUNE 9.1178% B 7.46958% - - - 1/7 2012 AKDINDEXTRACKERFUND 14.27 14.12 - JUNE 48.02% B 11.68% - - - 1/7 2007 AKDOPPORTUNITYFUND 62.80 60.90 - JUNE 65.27% B 31.60% - - - 1/7 2006 AMZPLUSINCOMEFUND N/A N/A - JUNE - - - - - 2/7 2006 ALFALAHGHPALPHAFUND 77.94 73.02 - JUNE 32.95% 32.95%B 27.9069% - - - 18/10 2008 ALFALAHGHPCASHFUND 503.69 503.69 - JUNE 7.1131% 0.78%B 7.4326% - - - 18/10 2010 ALFALAH GHP INCOME MULTIPLIER FUND 54.17 52.07 - JUNE 8.38% 8.38%B 8.4196% 2.0547%B - - - 18/10 2007 ALFALAH GHP ISLAMIC FUND 73.40 68.77 - JUNE 25% 25%B 27.8751% - - - 18/10 2007 ALFALAHGHPVALUEFUND 68.94 64.60 - JUNE 21.21% 21.21%B 18.1966% - - - 18/10 2005 ATLASINCOMEFUND 555.40 555.40 - JUNE 19%B 8.25%B - - - 1/7 2004 BMA CHUNDRIGAR ROAD SAVINGS FUND 8.13 8.05 - JUNE 10.77% 6.65% - - - 27/6 2007 BMA EMPRESS CASH FUND 10.24 10.14 - JUNE 7.559% 7.38% - - - 27/6 2009 DAWOOD ISLAMIC FUND 100.18 98.70 - JUNE - - - - - 1/7 2007 DAWOOD INCOME FUND 72.01 71.29 - JUNE - - - - - 1/7 2003 FAYSAL BALANCED GROWTH FUND - 69.35 - JUNE 10.85% 7.50% - - - 09/1 2004 FAYSAL INCOME & GROWTH FUND 116.13 116.13 - JUNE 8.50% 8.98% - - - 09/1 2005 FAYSAL ISLAMIC SAVINGS GROWTH FUND 108.18 108.18 - JUNE 7.80% 7.42% - - - 09/1 2010 FAYSAL MONEY MARKET FUND 107.62 107.62 - JUNE 8.45% 8.05% - - - 09/1 2011 FAYSAL SAVINGS GROWTH FUND 112.94 112.94 - JUNE 7.85% 8.57% - - - 09/1 2007 FAYSAL FINANCIAL SECTOR OPPORTUNITY FUND 108.88 107.00 - JUNE - 6.32% - - - 09/1 2013 IGI AGGRESSIVE INCOME FUND 43.77 43.19 - JUNE 3.6968% 2.6623% 3.308%B - - - 18/10 2007 KASB ASSETALLOCATION FUND 43.96 43.53 - JUNE 21% 26.30% - - - 13/8 2007 KASBCASHFUND 105.50 104.45 - JUNE 9.26% 7.55% - - - 13/8 2009 KASBISLAMICINCOMEOPPORTUNITYFUND 98.53 97.54 - JUNE 4.50% 7.31% - - - 13/8 2008 KASBINCOMEOPPORTUNITYFUND 77.45 77.45 - JUNE 10% 14.25% - - - 13/8 2006 MEEZANISLAMICFUND 56.69 55.08 - JUNE 35% 15.30% - - - 1/7 2003 MEEZAN ISLAMIC INCOME FUND 53.78 53.42 - JUNE 13.50% 9.00% - - - 1/7 2007 NI(U)T FUND 64.65 63.72 - JUNE Rs. 3.75 Rs. 4.10 - - - 1/7 1964 NITINCOMEFUND 11.56 11.45 - JUNE Rs. 1.0590 Rs. 0.72 - - - 1/7 2010 NIT GOVERNMENT BOND FUND 11.40 11.29 - JUNE Rs. 0.8803 Rs. 0.75 - - - 1/7 2010 NAMCOINCOMEFUND 110.70 110.70 - JUNE - - - - - 28/2 2008 PAK OMAN ADVANTAGE ISLAMIC INCOME FUND 54.40 53.85 - JUNE 2.936604% 3.454% - - - 24/6 2008 PAK OMAN ISLAMIC ASSET ALLOCATION FUND 58.72 57.25 - JUNE 20.36% 18.144% - - - 24/6 2009 PAK OMAN ADVANTAGE ASSET ALLOCATION FUND 55.29 53.91 - JUNE 30.36% 9.2392% - - - 24/6 2009 PAKISTAN CAPITAL MARKET FUND 7.73 7.58 - JUNE 12.76% B 1.51%B - - - 29/1 2004 PAKISTAN INCOME FUND 53.29 52.57 - JUNE 6.55% B 6.807%B - - - 29/1 2002 PAKISTAN INT. ELEMENT ISLAMIC FUND 40.30 39.49 - JUNE 10.63% B 5%B - - - 29/1 2006 PAKISTAN STOCK MARKET FUND 55.34 54.23 - JUNE 37.24%B 16.71%B - - - 29/1 2002 PAKISTAN STRATEGIC ALLOCATION FUND 8.72 8.55 - JUNE 20.25% B 2.57%B - - - 29/1 2011 PRIMUS INCOME FUND 116.02 116.02 - JUNE 3.9385% 6.4765B 2.2889% - - - 27/6 2012 PIML - ISLAMIC EQUITY FUND 120.27 117.91 - JUNE NL 1.27% 1.25%B - - - 27/6 2014 PRIMUS STRATEGIC MULTI - ASSET FUND 127.73 125.22 - JUNE - 3.82% 4.4402%B - - - 27/6 2013 UNITED GROWTH & INCOME FUND INCOME UNIT 78.49 76.93 - JUNE NIL NIL - - - 28/6 2006 GROWTH UNIT 77.54 77.54 - JUNE 10.12% B 16.23% - - - 28/6 2006 UNITED STOCK ADVANTAGE FUND 48.77 47.18 - JUNE 26.55% B 24.93% - - - 28/6 2006 UTP 111.62 108.36 - JUNE - - - - - 1/7 2002 UTP - INCOME FUND 103.20 102.17 - JUNE - - - - - 1/7 2002 UTP - ISLAMIC FUND 370.51 359.71 - JUNE - - - - - 1/7 2002

- 3. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate CLOSE - END MUTUAL FUND First Dawood Mutual Fund NC FDMF NT - 580.750 JUNE NIL NIL - 10 500 01/10 2005 .00 .00 0 (0.60) Golden Arrow Selected Stocks Fund XDNC GASF 9.40 9.46 760.492 JUNE 42% 86% 44%(I) 5 500 12/03 1983 13.30 7.85 43815000 4.83 PICIC Growth Fund NC PGF 25.49 25.51 2835.000 JUNE 45% 45% - 10 500 18/09 1980 31.10 22.74 59612500 6.42 PICIC Investment Fund NC PIF 11.89 11.77 2841.250 JUNE 22% 22% - 10 500 18/09 2004 14.50 10.08 17448500 3.32 Pak Oman Advantage Fund NC POAF 9.60 - 1000.000 JUNE 7.43% 7.66% - 10 500 24/10 2007 10.39 8.90 1752500 0.80 Tri-Star Mutual Fund NC TSMF 3.89 - 50.000 JUNE NIL NIL - 10 500 26/08 1994 4.67 3.15 341500 (2.69) 8067.492 122970000 MODARABAS Allied Rental Modaraba NC ARM 41.27 - 1462.500 JUNE 30%5%B20%R 30% 20%R - 10 500 23/10 2007 51.70 39.40 65500 5.34 B.F. Modaraba NC BFMOD 6.61 - 75.151 JUNE NIL NIL - 10 500 23/10 1989 7.55 6.10 23500 0.59 B.R.R. Guardian Modaraba NC BRR 7.00 7 780.463 JUNE 3.1% 2.4% - 10 500 25/10 1985 9.33 6.01 16881000 0.53 Crescent Standard Modaraba NC CSM 1.95 1.95 200.000 JUNE 1.50% 1.50% - 10 500 25/10 1994 2.62 1.50 2021500 0.29 AL-Noor Modaraba 1st NC FANM 4.32 4.37 210.000 JUNE 5% 7.50% - 10 500 28/10 1992 5.50 4.05 1508500 1.01 Constellation Modaraba 1st NC FCONM NT - 64.625 JUNE - - 10 500 21/10 1991 .00 .00 0 0.37 Elite Capital Modaraba 1st NC FECM 3.92 3.97 113.400 JUNE 5.50% 5.50% - 10 500 25/10 1992 4.69 3.30 458000 0.80 Equity Modaraba 1st NC FEM 4.75 4.75 524.400 JUNE NIL 3.75% - 10 500 15/11 1992 5.90 4.25 839000 0.47 First Fidelity Leasing Modaraba NC FFLM 2.65 - 264.138 JUNE NIL NIL - 10 500 24/10 1992 3.93 2.50 1424000 0.14 Habib Modaraba 1st NC FHAM 9.93 9.99 1008.000 JUNE 20% 22% - 5 500 10/09 1985 11.09 9.15 2017000 1.41 IBL Modaraba 1st NC FIBLM 3.25 - 201.875 JUNE 3.35% 3.31% - 10 500 16/10 1990 3.85 2.70 217500 0.45 Imrooz Modaraba 1st NC FIMM 48.21 - 30.000 JUNE 100% 50% - 10 500 10/10 1994 49.71 47.23 1000 5.50 National Bank Modaraba 1st NC FNBM 3.79 3.79 250.000 JUNE NIL NIL - 10 500 23/10 2003 5.30 2.50 6300500 (1.36) Punjab Modaraba 1st NC FPJM 4.87 4.97 340.200 JUNE NIL 5% - 10 500 24/10 1993 6.25 4.10 7578000 2.18 Paramount Modaraba 1st NC FPRM 13.50 - 92.230 JUNE 11% 10%B 13% 10%B 30%R 10 500 30/03 1995 16.59 12.85 37000 1.47 First Paramount Mod (R) NC FPRMR1 3.00 3 27.669 JUNE NL NL - 10 500 - 2012 .00 .00 0 - Tri-Star Modaraba 1st NC FTSM 3.50 - 211.631 JUNE NIL NIL - 10 500 18/10 1990 4.84 3.40 8000 (0.07) U.D.L. Modaraba 1st XD NC FUDLM 24.32 24.51 263.866 JUNE 20% 21% 20%(I) 10 500 21/03 1991 36.00 20.05 8526000 2.59 KASB Modaraba NC KASBM 4.18 - 480.664 JUNE NIL 70%R 2.4% - 10 500 21/11 1990 4.98 3.60 18500 0.84 Modaraba Al-Mali NC MODAM 2.73 2.73 184.240 JUNE 1.25% NIL - 10 500 19/10 1987 3.07 2.10 1410000 (1.34) Pak Modaraba 1st NC PAKMI 1.60 - 125.400 JUNE 1.20% 1.50% - 10 500 24/10 1991 2.28 1.50 538500 0.20 Prudential Modaraba 1st NC PMI 1.74 1.74 872.177 JUNE 2.30% 1.40% - 10 500 24/10 1990 1.98 1.49 2540500 0.29 Standard Chartered Modaraba NC SCM 26.00 26 453.835 JUNE 20% 30% - 10 500 20/10 1987 28.50 24.15 500500 4.00 Sindh Modaraba NC SINDM 6.81 - 450.000 JUNE NL NL - 10 500 - 2015 10.25 6.00 121500 - Trust Modaraba NC TRSM 13.22 13.18 298.000 JUNE 6% 5% - 10 500 18/10 1991 10.35 4.00 457000 0.67 Unicap Modaraba NC UCAPM 1.10 1.1 136.400 JUNE NIL NIL - 10 500 18/10 1991 1.90 1.00 459000 0.03 9120.864 53951500 LEASING COMPANIES Capital Assets Leasing Corporation NC CPAL 5.40 - 107.444 JUNE NIL NIL - 10 500 18/10 1993 6.75 3.50 125500 1.22 Grays Leasing Ltd NC GRYL 6.24 - 215.000 JUNE NIL NIL - 10 500 21/10 1997 7.24 4.45 39000 0.05 KASB Corporation XR NC KCORP 21.00 - 5577.730 DEC NIL 17.95%R - 10 500 30/09 1997 21.00 21.00 500 (1.09) Next Capital Ltd NC NEXT 4.50 - 200.000 JUNE NIL NIL - 10 500 23/10 2012 6.78 4.06 208500 0.37 Orix Leasing Pakistan NC OLPL 63.00 63.73 820.529 JUNE 22% 35% - 10 500 14/10 1988 73.75 47.00 5523000 6.29 Pak- Gulf Leasing Company NC PGLC 13.80 - 253.698 JUNE NIL NIL - 10 500 17/10 1996 15.50 8.50 143500 1.15 Standard Chartered Leasing NC SCLL 9.00 - 978.355 JUNE 8% 8% - 10 500 18/10 1994 9.56 8.50 255000 1.12 Security Leasing Corporation NC SLCL 2.00 1.91 363.000 JUNE NIL NIL - 10 500 21/11 1995 4.24 1.76 783000 (3.71) Security Leasing Corp.(Pref) 9.1% NC SLCPA NT - 112.500 JUNE - - 10 500 19/08 2003 .00 .00 0 - Saudi Pak Leasing Company NC SPLC 1.53 1.54 451.605 JUNE NIL NIL - 10 500 19/12 1991 2.70 1.15 2058500 0.16 9079.861 9136500 INV.BANKS/INV.COS./SECURITIESCOS. Arif Habib Limited NC AHL 56.81 56.86 550.000 JUNE 30% 10%B 50% - 10 500 20/09 2007 65.25 53.38 8207500 14.88 Apna Microfinance Bank XR NC AMBL 5.10 5.1 1100.000 DEC NIL266.67%R NIL 100%R 10 500 03/04 2005 6.19 4.35 454500 0.05 Dawood Equities NC DEL 3.04 2.96 250.000 JUNE NIL NIL - 10 500 23/10 2008 3.65 2.22 634500 0.43 Escorts Investment Bank NC ESBL 2.35 2.35 441.000 JUNE NIL NIL - 10 500 24/10 1996 2.99 1.63 1203000 (0.40) First Credit & Investment Bank NC FCIBL 6.86 7.23 650.000 JUNE NIL NIL - 10 500 19/10 2008 17.24 3.60 557500 0.04 First Capital Securities Corp. NC FCSC 1.94 1.94 3166.101 JUNE NIL NIL - 10 500 24/10 1994 2.39 1.42 3201500 (0.12) First Dawood Investment Bank NC FDIBL 1.13 1.14 684.441 JUNE NIL NIL - 10 500 24/10 1994 1.70 .78 1815500 (2.25) First National Equities Ltd NC FNEL 2.26 2.24 1418.098 JUNE 242%R NIL NIL - 10 500 24/10 2004 3.24 1.86 1929500 0.80 3

- 4. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Invest Capital Investment Bank NC ICIBL 1.35 1.35 2848.669 JUNE NIL NIL - 10 500 24/10 1993 1.83 .81 1432000 0.34 Invest & Finance Securities NC IFSL 19.77 19.7 200.156 JUNE NIL NIL - 10 500 22/08 2008 19.10 17.26 143500 4.78 IGI Investment Bank Ltd. NC IGIBL 1.72 1.73 2121.026 JUNE NIL NIL - 10 500 25/10 1990 2.70 1.20 35050000 (0.64) Jahangir Siddiqui & Co. Ltd NC JSCL 21.75 21.42 7632.853 DEC NIL NIL - 10 500 01/04 1993 24.17 14.09 984349000 0.24 JS Global Capital NC JSGCL 37.47 37.22 500.000 DEC 35% 40% - 10 500 20/03 2005 43.78 30.50 276500 5.65 JS Investments Ltd NC JSIL 14.14 14.17 1000.000 DEC 10% NIL - 10 500 03/04 2007 16.65 11.70 63500000 6.49 KASB Securities Ltd NC KASBSL 8.34 - 1000.000 DEC 5% NIL - 10 500 22/04 2008 11.74 7.67 1113500 0.81 MCB-Arif Habib Savings & Inv. NC MCBAH 28.00 27.99 720.000 JUNE 25% 27.50% 15%(I) 10 500 17/02 2008 32.39 22.10 3674500 2.53 Pervez Ahmed Securities Ltd NC PASL 2.09 2.09 1865.685 JUNE NIL NIL - 10 500 25/10 2007 3.49 1.60 139863500 2.66 Security Investment Bank Ltd NC SIBL 2.08 - 514.336 DEC NIL NIL - 10 500 15/04 1992 3.93 1.67 688000 0.23 Trust Investment Bank Ltd NC TRIBL 1.12 1.12 685.903 JUNE NIL NIL - 10 500 24/10 1992 1.47 1.01 882000 0.05 Trust Securities & Brokerage NC TSBL 3.06 - 100.000 JUNE NIL NIL - 10 500 23/10 1994 5.25 2.12 485500 (0.53) 27448.268 1249461500 COMMERCIAL BANKS Allied Bank Ltd. XD NC ABL 102.99 102.83 11450.738 DEC 52.50%10%B 65% - 10 100 20/03 2005 115.97 88.73 30263200 13.11 Askari Bank Ltd. XD NC AKBL 19.12 19.24 12602.601 DEC 55%R NIL 20% - 10 500 24/03 1992 25.54 16.26 139736000 3.18 Bank Alfalah Ltd. XD NC BAFL 26.20 25.96 15872.427 DEC 20% 20% - 10 500 20/03 2004 35.05 24.00 143255000 3.55 Bank ALHabib Ltd. NC BAHL 44.85 45 11114.254 DEC 20% 10%B 30% - 10 500 09/03 1992 51.87 40.92 33047000 5.71 BankIslami Pakistan Ltd. NC BIPL 9.49 9.47 5758.721 DEC NIL 9.073%RNIL 75.0236%R 10 500 25/03 2006 10.49 8.15 14321500 0.54 BankIslami Pakistan ( R ) NC BIPLR1 .09 .09 4320.400 DEC NL NL - 10 500 - 2015 1.28 .13 22933000 - Bank of Khyber XD NC BOK 9.35 9.44 10003.711 DEC 11.12%B 10% - 10 500 04/04 2006 11.90 9.31 160669500 1.30 Bank of Punjab NC BOP 8.07 8.04 15551.131 DEC 146.918%R NIL - 10 500 23/04 1991 11.18 6.82 495597500 1.83 Faysal Bank Ltd. XB NC FABL 15.10 15.01 11997.601 DEC 12.50%B 15%B - 10 500 20/03 1995 20.30 13.37 100380500 2.37 Habib Bank Ltd. XD NC HBL 181.68 178.95 14668.525 DEC 80% 10%B 120% - 10 100 17/03 2007 221.90 167.48 6006500 21.21 Habib Metropolitan Bank XD NC HMB 32.50 32.42 10478.314 DEC 20% 25% - 10 500 19/03 1992 40.00 27.30 20270000 4.70 JS Bank Ltd. NC JSBL 6.76 6.75 10724.643 DEC NIL NIL - 10 500 20/03 2007 8.10 5.13 59399500 0.98 KASB Bank Ltd NC KASBB 1.88 1.87 19508.616 DEC NIL NIL - 10 500 21/04 1995 2.07 .91 37382000 (0.81) MCB Bank Ltd. XD NC MCB 254.23 250.03 11130.307 DEC 140%10%B 140% - 10 100 18/03 1992 343.00 226.77 22984200 21.85 Meezan Bank Ltd. XD NC MEBL 45.00 45 10027.379 DEC 15% 27.50% - 10 500 19/03 2000 55.01 41.62 7656500 4.55 National Bank of Pakistan XD NC NBP 58.56 58.58 21275.128 DEC 20% 55% - 10 500 20/03 2002 72.00 48.16 224065000 7.06 NIB Bank Ltd. NC NIB 1.90 1.91 103028.512 DEC NIL NIL - 10 500 19/03 2003 2.85 1.70 187650000 (0.04) Samba Bank Ltd. NC SBL 6.25 - 10082.386 DEC 24.745%RNIL NIL - 10 500 21/03 2003 7.63 5.30 2932000 0.22 Standard Chartered Bank XD NC SCBPL 23.41 - 38715.850 DEC 24% 22.50% - 10 500 23/03 2007 28.30 23.00 3109500 2.51 Silkbank Ltd. NC SILK 1.81 1.85 26716.048 DEC NIL NIL - 10 500 18/03 1995 2.40 1.51 48320500 0.03 Summit Bank Ltd NC SMBL 3.84 3.8 10779.796 DEC NIL NIL - 10 500 24/03 2008 4.81 3.19 78636500 0.21 Summit Bank Pref Class “A” NC SMBLCPSA 10.00 - 1109.424 DEC - - 10 500 - 2013 .00 .00 0 - Summit Bank Pref Class “B” NC SMBLCPSB 10.00 - 1046.534 DEC - - 10 500 - 2013 .00 .00 0 - Soneri Bank Ltd. XD NC SNBL 11.65 11.56 11024.635 DEC 10%B 10% - 10 500 20/03 1992 14.30 10.06 33782500 1.43 United Bank Ltd. XD NC UBL 156.71 155.9 12241.797 DEC 100% 115% - 10 500 19/03 2005 186.00 141.25 67472400 17.91 411229.478 1939870300 INSURANCE Askari General Insurance NC AGIC 27.21 - 388.344 DEC NIL NIL - 10 500 24/04 1996 35.20 25.61 3067500 3.066 Adamjee Insurance NC AICL 46.58 46.8 3500.000 DEC 35%182.93%B 27.50% - 10 500 21/04 1961 57.10 37.93 150137000 5.61 Asia Insurance NC ASIC 20.00 - 300.000 DEC NIL NIL - 10 500 24/04 1980 .00 .00 0 0.65 Atlas Insurance XD NC ATIL 66.99 66.68 701.614 DEC 50% 10%B 60% - 10 500 03/04 1957 81.98 62.89 731500 7.14 Century Insurance NC CENI 23.60 24.86 457.244 DEC 15% 15% - 10 500 24/04 1989 29.97 19.50 1418000 3.22 Crescent Star Insurance NC CSIL 4.15 - 620.125 DEC 412.50%R NIL - 10 500 02/01 1957 5.99 3.41 1116000 0.12 Cyan Limited XD NC CYAN 98.03 98.03 586.276 DEC 100% 675% - 10 500 23/03 1960 150.50 65.17 11802500 15.33 EFU General Insurance XD NC EFUG 141.30 142.63 1600.000 DEC 50% 28%B 60% - 10 100 03/04 1949 171.24 134.98 5540400 11.43 EFU Life Assurance XD NC EFUL 150.00 - 1000.000 DEC 65% 75% - 10 100 03/04 1995 197.00 140.00 564700 9.50 East West Insurance NC EWIC 166.09 - 401.502 DEC NIL NIL - 10 100 02/04 1983 .00 .00 0 3.54 East West Life Assurance NC EWLA 13.48 12.78 594.291 DEC 18.75%RNIL NIL - 10 500 27/03 1994 18.68 10.50 2548000 0.48 Habib Insurance NC HICL 17.79 17.7 619.374 DEC 25%25%B 40% - 5 500 13/03 1949 23.70 15.90 2107000 2.09 IGI Insurance XD NC IGIIL 219.00 220.15 1226.895 DEC 25%10%B 30% - 10 500 10/04 1987 282.90 191.59 8707700 1.10 IGI Life Insurance NC IGIL 119.01 122.69 500.000 DEC NIL NIL - 10 100 14/04 1995 170.78 119.55 64900 1.477 Jubilee General Insurance XD NC JGICL 78.30 79.25 1569.101 DEC 30% 15%B 40% - 10 500 10/04 1955 111.00 76.00 247000 6.87 Jubilee Life Insurance XD NC JLICL 400.00 400.12 721.188 DEC 60%15%B 95% - 10 100 25/03 1996 460.00 376.00 186500 18.87 Pakistan Reinsurance NC PAKRI 29.51 29.59 3000.000 DEC 25% 25% - 10 500 23/04 1959 35.25 26.69 40539000 4.40 PICIC Insurance NC PIL 12.54 12.54 350.000 DEC NIL NIL - 10 500 23/04 2006 13.60 9.54 260500 0.26 4

- 5. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Premier Insurance NC PINL 25.96 25.88 302.821 DEC 20% 10% 15%B - 10 500 19/04 1952 26.00 20.41 155000 (2.75) Pakistan General Insurance NC PKGI 9.00 8.79 375.000 DEC NIL 6.67%B - 10 500 23/04 1995 13.00 9.01 911500 0.72 Reliance Insurance NC RICL 13.05 13.01 403.458 DEC 5% 10%B 5% 15%B - 10 500 18/04 1983 14.50 11.65 1730000 2.03 Shaheen Insurance NC SHNI 5.00 - 450.000 DEC 50%R NIL NIL - 10 500 21/04 1996 9.11 4.61 4176500 (3.54) Silver Star Insurance NC SSIC 8.60 8.6 305.648 DEC NIL - 10 500 20/04 1987 11.50 8.50 264500 0.04 TPL Direct Insurance NC TDIL 18.75 18.75 460.000 DEC NIL NIL - 10 500 22/04 2011 24.50 18.00 317500 0.94 United Insurance XB NC UNIC 23.38 23.49 1288.000 DEC 31.064811%B 40%B - 10 500 07/04 1960 42.55 26.60 3187500 5.01 Universal Insurance NC UVIC 4.08 - 370.000 DEC NIL NIL - 10 500 23/04 1969 7.98 3.20 831000 (2.97) 22090.881 240611700 TEXTILE SPINNING Ali Asghar Textile NC AATM 3.40 - 222.133 JUNE NIL NIL - 5 500 23/10 1968 5.15 3.10 302500 (0.47) AL-Qadir Textile NC ALQT 27.96 - 75.600 JUNE NIL NIL - 10 500 25/10 1991 29.43 27.96 1500 (9.36) Amtex Limited NC AMTEX 2.27 2.28 2594.301 JUNE NIL NIL - 10 500 24/10 2010 3.39 1.85 24294500 (7.58) Apollo Textile XD NC APOT 51.30 52.9 82.847 JUNE NIL - 10 500 22/10 1990 55.90 41.10 31000 4.19 Asim Textile NC ASTM 10.40 10.5 151.770 JUNE NIL NIL - 10 500 25/10 1991 13.61 8.06 447000 1.88 Allawasaya Textile NC AWTX 350.00 - 8.000 JUNE 202.50% 102.50% - 10 100 25/10 1968 350.00 350.00 0 46.16 Ayesha Textile NC AYTM 170.98 - 14.000 JUNE NIL NIL - 10 100 17/10 1968 .00 .00 0 (62.14) Babri Cotton NC BCML 45.99 47.7 36.522 JUNE NIL NIL - 10 500 20/10 1972 61.24 40.00 132500 22.45 Bilal Fibres NC BILF 4.50 - 141.000 JUNE NIL NIL - 10 500 24/10 1991 7.00 4.00 171000 (1.24) Brothers Textile NC BROT 6.15 6.45 98.010 JUNE NIL NIL - 10 500 25/10 1990 10.85 5.55 1526500 (0.52) Crescent Cotton NC CCM 37.05 - 213.775 JUNE 20% - 10 500 24/10 1965 45.00 40.50 6500 11.97 Crescent Fibres NC CFL 40.95 - 124.178 JUNE 15% 10% - 10 500 22/10 1979 44.10 32.50 78500 14.14 Colony Textile NC CTM 2.92 2.92 4980.100 JUNE NL NIL - 10 500 24/10 2014 5.22 2.02 7739000 (0.47) Chakwal Spinning NC CWSM 7.90 - 200.000 JUNE 15% 15% 5%(I) 5 500 22/11 1990 10.60 7.90 52500 1.30 Dewan Farooque Spinning NC DFSM 2.59 2.54 977.507 JUNE NIL NIL - 10 500 23/10 2005 4.75 2.00 5388000 (0.55) Din Textile NC DINT 124.80 - 224.216 JUNE 50% 10%B 25% - 10 500 22/10 1991 141.73 90.70 143500 (4.96) Dewan Khalid Textile NC DKTM 7.70 - 56.825 JUNE NIL NIL - 10 500 23/10 1979 8.94 5.95 26000 (11.38) Dewan Mushtaq Textile NC DMTM 6.66 - 34.340 JUNE NIL NIL - 10 500 23/10 1971 9.95 6.75 44000 (6.97) D. M. Textile NC DMTX 34.52 - 30.524 JUNE NIL NIL - 10 500 24/10 1966 59.90 17.00 45500 45.67 D. S. Industries NC DSIL 3.56 3.59 600.000 JUNE NIL NIL - 10 500 25/10 2005 5.50 2.40 8466500 (0.80) Dar-es-Salaam Textile NC DSML 6.60 - 80.000 JUNE NIL NIL - 10 500 24/10 1992 7.15 5.25 22500 (13.77) Dewan Textile NC DWTM 7.20 - 135.046 JUNE NIL NIL - 10 500 23/10 1971 8.45 6.26 194500 (20.35) Ellcot Spinning NC ELSM 60.00 60 109.500 JUNE 100% 70% - 10 500 21/10 1990 87.00 62.70 50500 13.37 Fazal Cloth NC FZCM 132.10 132 299.999 JUNE 25% 20%B 25% - 10 500 26/10 1970 167.93 109.76 39600 29.26 Fazal Textile NC FZTM 374.11 374.11 61.875 JUNE 50% 50% - 10 50 29/10 1970 664.02 333.14 43100 19.12 Gadoon Textile NC GADT 202.61 200.88 234.375 JUNE 125% 50% - 10 500 22/10 1994 282.00 154.99 1535800 24.78 Glamour Textile NC GLAT 56.01 56.01 266.400 JUNE NIL NIL - 10 500 24/10 1993 76.50 58.90 12500 (1.23) Gulshan Spinning NC GSPM 2.17 - 222.250 JUNE NIL NIL - 10 500 24/10 1989 3.00 1.60 581000 (9.12) Gulistan Spinning NC GUSM 2.24 - 146.410 JUNE NIL NIL - 10 500 24/10 1994 2.90 1.50 177000 (6.64) Hira Textile NC HIRAT 10.82 10.66 787.072 JUNE 10%B NIL - 10 500 24/10 2007 14.50 8.42 36053000 1.69 Haji Mohammad Ismail NC HMIM 3.89 - 119.750 JUNE NIL NIL - 10 500 23/10 1994 3.47 2.56 300500 0.12 Idrees Textile NC IDRT 14.05 14.03 180.480 JUNE 10% 10% - 10 500 24/10 1992 17.00 13.10 83000 1.73 Ideal Spinning NC IDSM 12.25 - 99.200 JUNE NIL NIL - 10 500 22/10 1991 14.50 11.50 4000 2.88 Indus Dyeing & Mfg Co. XD NC IDYM 691.67 691.67 180.737 JUNE 9%SD100% 150% 150%(II) 10 50 02/04 1963 964.89 664.24 900 65.72 Island Textile NC ILTM 828.99 - 5.000 JUNE 50% 50% - 10 100 21/10 1973 918.98 787.08 3050 204.80 J.A.Textile NC JATM 4.00 - 126.012 JUNE NIL NIL - 10 500 25/10 1992 6.79 4.25 49000 (3.41) Janana De Malucho Textile NC JDMT 141.99 139.76 47.848 JUNE NIL 30% - 10 500 20/10 1962 133.11 86.17 533500 37.74 J.K.Spinning XD NC JKSM 24.74 - 609.032 JUNE 50% NIL 10%(I) 10 500 21/03 1990 28.98 23.66 126000 4.81 Kohat Textile NC KOHTM 11.00 11.07 208.000 JUNE 12.50% 12.50% - 10 500 18/10 1970 17.95 10.00 902000 3.53 Kohinoor Spinning NC KOSM 13.00 12.49 650.000 JUNE 40% 15% - 5 500 25/10 1984 26.00 11.10 1401500 0.93 Khalid Siraj Textile NC KSTM 3.00 - 107.000 JUNE NIL NIL - 10 500 25/10 1990 9.45 2.20 193500 (5.84) LandMark Spinning NC LMSM 11.38 11.44 121.237 JUNE NIL NIL - 10 500 18/10 1992 14.25 8.00 1399500 (1.44) Maqbool Textile NC MQTM 22.40 - 168.000 JUNE 27.50% NIL - 10 500 25/10 1992 26.19 19.40 127500 2.14 Mukhtar Textile NC MUKT 1.81 1.8 145.000 JUNE NIL NIL - 10 500 25/10 1994 2.94 1.40 1587500 (0.22) Nagina Cotton NC NAGC 52.00 52.5 187.000 JUNE 100% 60% - 10 500 23/10 1988 71.75 56.50 110500 13.57 Nadeem Textile XR NC NATM 36.94 - 120.150 JUNE NIL NIL - 10 500 23/10 1995 .00 .00 0 4.70 Nazir Cotton NC NAZC NT - 230.000 JUNE NIL NIL - 10 500 24/10 1994 .00 .00 0 (0.14) N.P.Spinning NC NPSM 31.17 - 147.000 JUNE NIL NIL - 10 500 24/10 1994 38.58 31.92 500 1.29 Olympia Spinning NC OLSM 4.00 4 120.000 JUNE NIL NIL - 10 500 22/11 1971 5.36 3.00 49000 (30.13) 5

- 6. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Olympia Textile NC OLTM 9.11 - 108.040 JUNE NIL NIL - 10 500 22/10 1991 10.00 9.00 2000 (14.23) Premium Textile NC PRET 89.33 - 61.630 JUNE 125% 35% - 10 500 17/10 1989 125.10 80.00 154400 10.84 Ravi Textile NC RAVT 3.38 - 250.000 JUNE NIL NIL - 10 500 24/10 1989 6.20 2.55 4089500 (1.79) Reliance Cottton Spinning NC RCML 70.10 - 102.920 JUNE 20% 15% - 10 500 18/10 1993 93.90 70.10 27000 12.20 Resham Textile NC REST 29.42 - 360.000 JUNE 20% 15% - 10 500 25/10 1993 29.42 25.50 2000 2.65 Ruby Textile NC RUBY 5.90 - 522.144 JUNE NIL NIL - 10 500 23/10 1992 7.00 3.70 104500 (3.08) Saif Textile NC SAIF 21.93 - 264.129 JUNE 25% 25% - 10 500 18/10 1992 32.66 20.14 2245500 5.99 Salfi Textile NC SALT 142.50 - 33.426 JUNE 118.7%SD20% 15% - 10 500 29/10 1970 160.00 135.41 2000 10.41 Salman Noman Enterprises NC SANE 4.88 - 44.670 JUNE NIL NIL - 10 500 30/10 1991 9.51 4.25 1107500 (10.63) Service Textiles NC SERT 14.88 - 44.492 JUNE NIL NIL - 10 500 23/10 1970 17.74 13.80 296500 6.01 Sind Fine Textile NC SFTM 10.29 - 23.000 JUNE NIL NIL - 10 500 23/10 1968 10.29 10.29 58000 0.034 Shadman Cotton NC SHCM 12.00 - 176.367 JUNE NIL NIL - 10 500 20/11 1990 14.00 12.00 2000 (3.84) Shadab Textile NC SHDT 37.90 - 30.000 JUNE 15% 10% - 10 500 25/10 1985 40.75 33.75 4000 14.45 Sajjad Textile NC SJTM 17.53 - 212.678 JUNE 5% NIL - 10 500 23/10 1990 16.50 13.21 90000 (0.20) Sally Textile NC SLYT 16.44 16.42 87.750 JUNE 20% NIL - 10 500 30/10 1970 19.95 12.52 253500 (2.53) Sana Industries NC SNAI 72.00 71.27 85.937 JUNE 50% 25%B 75% - 10 500 18/10 1988 96.00 64.10 125000 9.28 Sargodha Spinning NC SRSM 10.85 - 312.000 JUNE NIL NIL - 10 500 25/10 1992 11.99 10.00 11500 (1.17) Saritow Spinning NC SSML 9.09 9 298.406 JUNE 10% NIL - 10 500 25/10 1990 11.10 7.75 3759500 1.41 Sunrays Textile XD NC SUTM 192.00 - 69.000 JUNE 200% 150% 200%(II) 10 500 02/04 1992 246.50 200.00 8800 41.20 Shahzad Textile NC SZTM 26.37 - 179.714 JUNE 15% 15% - 10 500 22/10 1983 27.75 23.00 9000 12.11 Tata Textile NC TATM 28.00 27.77 173.248 JUNE 20% 10% - 10 500 17/10 1991 38.50 26.05 192000 5.83 Taha Spinning NC THAS 9.53 9.53 40.500 JUNE NIL NIL - 10 500 23/10 1994 12.50 7.70 132500 17.94 20260.072 107154150 TEXTILE WEAVING Ashfaq Textile NC ASHT 11.65 - 349.850 JUNE 58.33%B NIL - 10 500 24/10 1991 13.49 10.00 18500 1.18 Feroze1888 Mills NC FML 60.00 - 3768.010 JUNE 30% 45% - 10 500 21/10 1975 60.00 60.00 500 4.50 I.C.C.Textiles NC ICCT 3.59 - 300.011 JUNE NIL NIL - 10 500 22/10 1991 5.49 2.60 378500 (2.44) Prosperity Weaving NC PRWM 35.00 - 184.800 JUNE 60% 50% - 10 500 21/10 1995 42.50 35.00 309000 9.85 Samin Textiles NC SMTM 9.75 9.79 267.280 JUNE NIL NIL - 10 500 20/10 1994 15.40 6.89 3352000 (5.52) Shahtaj Textile NC STJT 71.00 - 96.600 JUNE 40% 25% - 10 100 24/10 1992 93.50 70.00 3400 7.36 Zephyr Textile NC ZTL 7.68 - 594.287 JUNE NIL NIL - 10 500 18/10 2005 10.24 7.30 902000 1.06 5560.838 4963900 TEXTILE COMPOSITE Artistic Denim NC ADMM 92.00 92.07 840.000 JUNE 10% 10% - 10 100 17/10 1995 123.79 80.70 1417800 10.14 Ahmad Hassan Textile NC AHTM 31.00 - 144.083 JUNE 15% NIL - 10 500 24/10 1992 31.00 26.00 12500 6.67 Azgard Nine NC ANL 4.60 4.66 4493.494 JUNE NIL NIL - 10 500 23/10 1996 6.69 3.60 90680500 (4.73) Azgard Nine (Non-Voting) NC ANLNV 7.00 - 55.224 JUNE - - 10 500 12/05 2008 .00 .00 0 - Azgard Nine (Pref) 8.95% NC ANLPS NT - 661.251 JUNE - - 10 500 21/11 2009 .00 .00 0 - Aruj Industries NC ARUJ 16.75 16.75 104.578 JUNE NIL 25% 70%R - 10 500 25/10 1994 18.79 14.13 126500 4.92 Bhanero Textile NC BHAT 420.06 - 30.000 JUNE 200% 200% - 10 50 20/10 1989 534.95 403.00 22850 136.08 Blessed Textile NC BTL 136.50 - 64.320 JUNE 50% 25% - 10 500 20/10 1991 171.99 125.65 48900 36.30 Chenab Limited NC CHBL 3.52 3.51 1150.000 JUNE NIL NIL - 10 500 24/10 2005 5.98 2.50 6724000 (3.47) Chenab Limited (Preference) NC CLCPS 1.47 1.45 800.000 JUNE NIL NIL - 10 500 24/10 2004 2.09 1.00 8460500 - Crescent Textile NC CRTM 17.50 17.63 615.124 JUNE NIL 12.5%25%R - 10 500 21/10 1959 23.15 16.07 6727000 4.77 Dawood Lawrencepur NC DLL 107.02 108.55 590.579 DEC 10% NIL - 10 100 03/04 1953 148.00 101.89 3012400 (1.50) Faisal Spinning NC FASM 133.67 - 100.000 JUNE 50% 50% - 10 500 20/10 1992 186.72 131.50 119500 59.72 Fateh Sports Wear NC FSWL 78.85 - 20.000 JUNE NIL NIL - 10 500 24/10 1991 85.00 78.85 0 76.38 Gul Ahmed Textile NC GATM 51.56 51.74 2285.233 JUNE 20%B 15% 25%B - 10 500 23/10 1970 68.00 44.65 21920500 6.75 Ghazi Fabrics International NC GFIL 6.80 - 326.356 JUNE NIL NIL - 10 500 21/10 1992 9.50 5.40 73500 0.32 Hala Enterprises NC HAEL 10.86 10.93 68.040 JUNE NIL NIL - 10 500 24/10 1991 17.89 9.40 1389500 (2.48) Hafiz Limited NC HAFL 73.50 - 12.000 JUNE 20% 15% - 10 500 20/10 1954 .00 .00 0 15.75 International Knitwear NC INKL 12.50 - 64.500 JUNE NIL NIL 100%R - 10 500 07/11 1994 13.85 11.01 139500 (1.15) Ishaq Textile NC ISTM 10.50 10.25 96.600 JUNE 10% NIL - 10 500 22/10 1989 19.01 7.61 1323500 0.84 Jubilee Spinning & Weaving NC JUBS 5.10 5.5 324.912 JUNE NIL NIL - 10 500 21/11 1975 6.60 3.21 170500 (1.16) Khyber Textile NC KHYT 38.56 - 12.275 JUNE NIL NIL - 10 500 21/10 1962 74.81 38.56 2000 2.14 Kohinoor Mills NC KML 15.98 15.66 509.110 JUNE NIL NIL - 10 500 23/10 1990 22.09 13.35 2273000 3.96 Kohinoor Industries NC KOIL 2.62 2.62 303.026 JUNE NIL NIL - 10 500 25/10 1957 3.59 2.00 2324500 (0.02) 6

- 7. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Kohinoor Textile NC KTML 56.16 56 2455.262 JUNE NIL NIL 10%(I) 10 500 17/02 1971 58.90 35.70 41350000 4.76 Libaas Textile NC LIBT NT - 40.000 JUNE NIL NIL - 10 500 26/02 1995 17.84 11.00 186000 (0.01) Mahmood Textile NC MEHT 253.98 - 150.000 JUNE 100% 100% - 10 100 20/10 1973 273.52 237.00 15700 31.44 Muhammad Farooq Textile NC MFTM 3.80 3.88 188.892 JUNE NIL NIL - 10 500 22/11 1968 7.50 2.72 4872000 51.26 Masood Textile NC MSOT 132.98 131.99 600.000 JUNE 17.50% 15% - 10 100 29/10 1988 154.70 113.01 1396900 14.95 Mian Textile Industries NC MTIL 2.62 - 221.052 JUNE NIL NIL - 10 500 22/10 1989 4.80 1.70 1361000 (2.33) Mubarak Textile NC MUBT 4.50 4.65 54.000 JUNE NIL NIL - 10 500 27/10 1994 7.34 4.00 174500 (0.27) Nishat (Chunian) NC NCL 41.10 41.28 2001.846 JUNE 20% 10%B 10% - 10 500 22/10 1991 52.00 34.60 131864500 3.80 Nishat Mills NC NML 113.51 113.32 3515.998 JUNE 40% 40% - 10 500 23/10 1961 137.90 97.00 59088000 15.67 Paramount Spinning NC PASM 4.30 - 173.523 JUNE NIL NIL - 10 500 24/10 1991 5.50 3.75 45000 (28.76) Quetta Textile NC QUET 51.30 - 130.000 JUNE 15% NIL - 10 500 25/10 1971 62.76 50.00 9500 5.43 Redco Textiles NC REDCO 3.54 - 492.926 JUNE NIL NIL - 10 500 24/10 1993 5.70 2.50 2471000 0.11 Reliance Weaving NC REWM 27.50 27.5 308.109 JUNE 20% 15% - 10 500 24/10 1992 43.44 28.18 430000 7.11 Sapphire Textile NC SAPT 454.00 - 200.831 JUNE 210% 100% - 10 100 18/10 1974 580.00 450.00 53800 48.96 Safa Textiles NC SFAT 14.48 - 40.000 JUNE NIL NIL - 10 500 15/11 1994 16.00 15.20 4000 (2.05) Sapphire Fibres NC SFL 545.00 - 196.875 JUNE 120% 125% - 10 100 18/10 1990 660.00 438.00 143200 66.70 SFL Limited NC SFLL 71.83 - 200.914 JUNE 10% NIL - 10 500 18/10 2013 82.64 65.00 5000 3.24 Shams Textile NC STML 31.90 - 86.400 JUNE 30% NIL - 10 500 23/10 1970 33.49 30.30 20000 (6.44) Suraj Cotton NC SURC 120.00 - 239.580 JUNE 60% 10%B 50% 10%B - 10 100 23/10 1988 147.89 105.00 313900 29.95 Towellers Ltd NC TOWL 42.00 - 170.000 JUNE NIL NIL - 10 500 20/10 1995 .00 .00 0 (22.12) Zahidjee Textile NC ZAHT 12.05 - 1274.865 JUNE 20%B 160%RNIL - 10 500 24/10 1991 16.74 9.86 1469000 2.76 26411.778 392241950 WOOLLEN Bannu Woollen NC BNWM 42.01 42.24 95.062 JUNE 25%B NIL - 10 500 22/10 1992 65.95 37.64 6369000 13.84 95.062 6369000 SYNTHETIC & RAYON AL-Abid Silk NC AASM 11.90 - 134.096 JUNE NIL NIL - 10 500 18/10 1989 11.90 11.90 0 (42.35) Dewan Salman Fibre NC DSFL 1.72 1.72 3663.212 JUNE NIL NIL - 10 500 24/10 1991 2.25 1.30 21372500 (2.74) Gatron (Industries) NC GATI 148.20 - 383.645 JUNE 40% 55% - 10 500 11/10 1992 172.72 148.20 8100 3.79 Ibrahim Fibres NC IBFL 74.89 71.45 3105.070 JUNE 35% NIL - 10 500 22/10 1995 98.70 68.15 164500 2.81 National Silk & Rayon NC NSRM 20.60 - 155.531 JUNE 10% 1300%RNIL - 10 500 23/10 1962 24.04 20.62 2000 0.57 Pakistan Synthetics NC PSYL 14.89 14.89 560.400 JUNE NIL 10% - 10 500 04/10 1990 15.99 14.00 2541000 0.88 Rupali Polyester NC RUPL 12.20 - 340.685 JUNE NIL NIL - 10 500 22/10 1990 16.95 11.20 108500 (11.83) Tri-Star Polyester NC TRPOL 1.11 1.09 214.657 JUNE NIL NIL - 10 500 18/10 1992 1.59 .65 2806500 (0.46) 8557.296 27003100 JUTE Associated Services NC ASRL 9.00 8.94 35.574 JUNE NIL NIL - 10 500 24/10 1979 8.44 7.20 6500 2.60 Crescent Jute Products NC CJPL 3.16 3.2 237.635 JUNE NIL NIL - 10 500 25/10 1965 6.59 2.70 7196000 6.94 Suhail Jute NC SUHJ 19.62 19.62 37.450 JUNE NIL NIL - 10 500 25/10 1984 23.95 14.30 185500 (12.74) Thal Limited XD NC THALL 280.37 279.93 405.150 JUNE 200% 150% 75%(I) 5 500 18/03 1967 336.98 231.78 2952800 16.80 715.809 10340800 SUGAR & ALLIED INDUSTRIES AL-Abbas Sugar NC AABS 170.03 - 173.623 SEP 50% 100% 25%(I) 10 100 02/03 1992 217.65 154.00 2402100 17.17 Adam Sugar NC ADAMS 18.50 18.5 172.910 SEP 25%200%R NIL - 10 500 22/01 1967 24.48 16.18 1666500 1.75 Abdullah Shah Ghazi Sugar NC AGSML 13.90 13.9 792.617 SEP NIL - 10 500 22/02 1990 13.24 8.75 47000 0.86 AL-Noor Sugar NC ALNRS 29.99 29.99 204.737 SEP 5% 5%B 10% - 10 500 23/01 1970 37.79 28.01 276500 1.53 Ansari Sugar NC ANSM 4.86 - 244.073 SEP NIL NIL - 10 500 24/01 1991 11.20 5.40 99000 (9.50) Baba Farid Sugar NC BAFS 25.00 - 94.500 SEP NIL NIL - 10 500 25/01 1984 25.00 24.00 1500 0.92 Chashma Sugar NC CHAS 19.00 19.17 286.920 SEP NIL NIL - 10 500 21/01 1991 30.90 21.00 202500 (4.48) Colony Sugar NC CSUML 4.80 4.8 990.200 SEP NIL NIL - 10 500 24/01 2008 8.00 3.31 1889500 (1.33) Dewan Sugar NC DWSM 3.25 3.38 665.120 SEP NIL NIL - 10 500 23/01 1987 4.24 2.60 2289500 (3.00) Faran Sugar NC FRSM 48.90 48.04 250.071 SEP 7.50% 5%B 10% - 10 500 22/01 1984 47.45 37.50 1027000 6.32 Habib Sugar NC HABSM 33.01 33.01 750.000 SEP 50% 50% - 5 500 17/01 1963 45.94 29.11 3184500 5.31 Habib-ADM NC HAL 28.90 - 200.000 JUNE 70% 40% - 5 500 14/10 1982 34.40 26.13 356000 3.87 Husein Sugar NC HUSS 10.00 - 170.000 SEP NIL NIL - 10 500 24/01 1967 11.50 10.00 10000 (17.33) Haseeb Waqas Sugar NC HWQS 5.05 5.05 324.000 SEP NIL NIL - 10 500 24/01 1994 6.45 4.54 1132000 (19.29) 7

- 8. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate JDW Sugar XD NC JDWS 241.55 239.4 597.766 SEP 60% 70% - 10 100 24/01 1992 316.20 223.27 160800 16.38 Jauharabad Sugar NC JSML 7.90 - 109.098 SEP NIL NIL - 10 500 24/01 1973 12.50 6.75 20500 (3.56) Khairpur Sugar NC KPUS 18.50 - 160.175 SEP NIL NIL - 10 500 29/01 1993 21.75 17.59 4000 1.78 Mirpurkhas Sugar NC MIRKS 53.00 53 122.682 SEP 10%B NIL - 10 500 19/01 1964 72.00 52.51 484000 6.69 Mehran Sugar NC MRNS 102.00 102 320.314 SEP 25% 25%B 26% 10%B 10%(I) 10 100 11/02 1968 110.25 79.01 548600 8.40 Mirza Sugar NC MZSM 2.30 - 141.000 SEP NIL - 10 500 21/01 1994 3.29 1.93 644000 (2.57) Noon Sugar NC NONS 25.65 26.1 165.175 SEP NIL NIL - 10 500 25/01 1966 30.50 23.10 221500 (6.72) Premier Sugar NC PMRS 95.80 - 37.500 SEP NIL NIL - 10 500 21/01 1955 104.78 91.90 29000 (20.93) Pangrio Sugar NC PNGRS 2.59 - 108.500 SEP NIL - 10 500 21/01 1987 3.66 1.70 380000 (4.03) Sanghar Sugar NC SANSM 24.70 - 119.460 SEP NIL NIL - 10 500 22/01 1989 26.50 22.00 28500 0.73 Sindh Abadgar’s Sugar NC SASML 10.40 - 104.250 SEP NIL NIL - 10 500 19/01 1987 11.66 9.75 23000 (8.20) Shakarganj Limited NC SGML 13.26 13.25 695.238 SEP NIL NIL - 10 500 22/01 1979 17.59 12.39 991500 (9.18) Shakarganj (R.C.Pref) 8.50% NC SGMLPS 7.00 - 345.756 SEP - - 10 500 19/02 2004 .00 .00 0 - Shahtaj Sugar NC SHJS 67.85 - 120.112 SEP NIL 20% - 10 500 23/01 1967 105.00 67.85 41000 3.00 Shahmurad Sugar NC SHSML 33.00 33 211.188 SEP 15% 20% - 10 500 23/01 1984 50.75 29.03 482000 10.73 Sakrand Sugar NC SKRS 2.40 - 223.080 SEP NIL NIL - 10 500 24/01 1990 3.13 2.03 247500 (8.35) Thal Industries Corporation NC TICL 98.83 - 150.232 SEP 15% 7.50% - 10 500 21/01 1955 105.79 74.15 15000 4.15 Tandlianwala Sugar NC TSML 29.92 29.92 1177.063 SEP NIL NIL - 10 500 23/02 1992 37.85 28.60 31000 2.09 10227.360 18935500 CEMENT Attock Cement NC ACPL 202.40 201.61 1145.225 JUNE 130% 15%B 130% 45%(I) 10 100 13/02 2002 219.00 171.25 6633000 17.58 Bestway Cement XD NC BWCL 119.99 - 5793.849 JUNE 40% 70% 50%(II) 10 100 14/03 2001 134.50 115.90 176100 14.75 Cherat Cement NC CHCC 79.43 79.41 1766.319 JUNE 25% 30%10%B68%R - 10 500 19/09 1985 91.00 65.11 179732500 12.51 Dewan Cement NC DCL 6.33 6.34 3891.133 JUNE NIL NIL - 10 500 23/10 1989 8.54 5.10 79260500 1.12 D.G. Khan Cement NC DGKC 125.56 125.26 4381.191 JUNE 30% 35% - 10 500 21/10 1992 134.75 106.59 329478500 13.61 Dandot Cement NC DNCC 9.22 9.22 948.400 JUNE NIL NIL - 10 500 23/11 1989 12.70 9.00 378000 (5.55) Fauji Cement XD NC FCCL 31.61 31.8 13311.158 JUNE 12.50% 15% 10%(I) 10 500 13/03 1996 32.70 25.92 487186000 1.80 Fecto Cement NC FECTC 75.98 76.3 501.600 JUNE 15% 25% - 10 500 18/10 1993 108.95 56.25 25826000 11.86 Flying Cement NC FLYNG 6.15 6.15 1760.000 JUNE NIL NIL - 10 500 24/10 2007 8.50 5.90 7201000 0.57 Gharibwal Cement NC GWLC 27.31 27 4002.740 JUNE NIL NIL - 10 500 10/10 1962 33.42 21.00 1410500 2.12 Javedan Corporation NC JVDC 26.00 25.98 1166.526 JUNE NIL NIL100%R - 10 500 14/11 1962 29.50 23.15 1505000 14.44 Javedan Corp Preference NC JVDCPS 15.41 - 1120.213 JUNE - - 10 500 - 2012 15.41 15.41 0 - Kohat Cement NC KOHC 195.86 192.77 1545.086 JUNE 50% 20%B 20% - 10 100 03/10 1996 220.00 156.35 8116800 20.41 Lafarge Pakistan Cement NC LPCL 14.89 14.88 14561.090 DEC 3% NIL - 10 500 09/04 1995 18.47 14.28 278809000 0.37 Lucky Cement NC LUCK 471.79 470.06 3233.750 JUNE 80% 90% - 10 100 03/10 1995 557.75 424.79 53302200 35.08 Maple Leaf Cement XD NC MLCF 59.13 59.73 5277.339 JUNE NIL NIL 10%(I) 10 500 13/03 1994 58.70 44.60 627577500 5.36 Pioneer Cement T1 PIOC 84.06 83.93 2271.488 JUNE 40% 42.50% 22.50%(I) 10 500 13/04 1992 93.74 73.88 113220000 7.78 Power Cement NC POWER 8.02 8.08 3656.900 JUNE NIL NIL - 10 500 17/10 1988 8.95 6.13 136835000 (0.20) Safe Mix Concrete Products NC SMCPL 6.96 - 200.000 JUNE NIL NIL 25%R - 10 500 14/11 2010 9.96 7.00 2483500 0.61 Safe Mix Concrete ( R ) NC SMCPLR .00 - 50.000 JUNE NL NL - 10 500 - 2015 2.01 .40 2449500 - Thatta Cement NC THCCL 27.30 - 997.181 JUNE 5% 11% - 10 500 14/10 2008 34.50 23.76 1977000 2.99 Zeal-Pak Cement NC ZELP NT - 4278.385 JUNE NIL - 10 500 17/12 1957 .00 .00 0 (0.74) 75859.573 2343557600 TOBACCO Khyber Tobacco Company NC KHTC 280.00 280 12.018 JUNE 50% 100% - 10 500 25/10 1968 423.00 286.05 10300 118.38 Pakistan Tobacco Co. SPOT T1 PAKT 897.00 896.5 2554.938 DEC 100% 150% - 10 50 14/04 1956 1120.00 758.34 70300 18.98 Philip Morris (Pakistan) NC PMPK 1103.61 - 615.803 DEC NIL NIL - 10 20 15/04 1971 1145.00 988.00 50760 (7.16) 3182.759 131360 REFINERY Attock Refinery NC ATRL 180.60 180.66 852.930 JUNE 50% NIL - 10 100 10/09 1980 220.50 146.48 23839900 29.82 Byco Petroleum Pakistan NC BYCO 9.37 9.33 9778.587 JUNE NIL NIL - 10 500 12/01 2002 10.69 6.80 95414500 (6.07) National Refinery NC NRL 207.66 205.18 799.666 JUNE 150% NIL - 10 100 19/09 1964 214.00 180.00 5670400 12.02 Pakistan Refinery T1 PRL 180.35 181.89 350.000 JUNE 28.50% NIL 800%R 10 100 11/04 1960 182.44 139.00 5057800 (24.68) 11781.183 129982600 POWER GENERATION & DISTRIBUTION Altern Energy Ltd NC ALTN 32.95 32.56 3633.800 JUNE NIL 20% - 10 500 22/10 1998 40.10 28.12 30728000 5.14 8

- 9. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Engro Powergen Qadirpur NC EPQL 39.08 39.19 3238.000 DEC NL 15% - 10 500 11/03 2014 46.50 35.00 44090500 6.24 Hub Power Company Ltd XD NC HUBC 88.47 87.75 11571.544 JUNE 80% 65% 40%(I) 10 500 15/03 1994 91.20 78.69 66505000 5.66 Ideal Enegy Ltd NC IDEN 5.60 5.69 80.000 JUNE NIL NIL - 10 500 24/10 1996 7.80 4.54 1392000 (3.82) Japan Power Generation Ltd NC JPGL 3.38 3.46 1560.376 JUNE NIL NIL - 10 500 22/10 1996 3.70 1.60 35615000 (5.63) Kot Addu Power Company XD NC KAPCO 82.11 82.11 8802.532 JUNE 75% 65% 40%(I) 10 500 14/03 2005 87.00 73.83 42036500 8.78 K-Electric Ltd NC KEL 7.54 7.53 96653.179 JUNE NIL NIL - 3.5 500 16/10 1949 10.55 6.01 848475000 0.46 Kohinoor Energy Ltd NC KOHE 46.00 46.01 1694.586 JUNE 117.50% 65% 20%(I) 10 500 05/03 1996 50.25 42.75 3257000 6.30 Kohinoor Power Company NC KOHP 2.85 2.85 126.000 JUNE NIL NIL - 10 500 25/10 1993 4.22 2.11 2430000 (4.16) Lalpir Power Ltd NC LPL 34.93 34.72 3798.387 DEC 25% 10% - 10 500 23/04 2013 40.00 28.50 42412500 1.67 Nishat Chunian Power Ltd XD NC NCPL 57.04 57 3673.469 JUNE 60% 65% 35%(II) 10 500 10/03 2009 56.70 47.80 33756000 7.89 Nishat Power Ltd NC NPL 55.49 55.5 3540.885 JUNE 30% 40% 27.50%(II) 10 500 14/03 2009 54.94 42.10 27645000 8.23 Pakgen Power Ltd NC PKGP 30.56 30.63 3720.815 DEC 25% 10% - 10 500 23/04 2011 35.15 26.50 81477000 2.98 Sitara Energy Ltd NC SEL 38.40 - 190.920 JUNE 10% 20% - 10 500 21/10 1995 46.35 35.00 356000 10.71 Saif Power Ltd NC SPWL 37.63 37.53 3864.717 DEC NL 15% - 10 500 14/01 2014 42.00 33.01 33594000 - Tri-Star Power Ltd NC TSPL 1.61 1.62 150.000 JUNE NIL NIL - 10 500 18/10 1994 1.85 1.00 2545000 0.06 146299.210 1296314500 OIL & GAS MARKETING COMPANIES Attock Petroleum NC APL 540.06 540.05 829.440 JUNE 450%20%B 475% 125%(I) 10 50 13/02 2005 600.00 494.12 3123250 52.16 Burshane LPG (Pakistan) NC BPL 98.02 98.02 226.400 JUNE 28% 18% - 10 500 15/10 1982 96.49 54.20 2701500 1.24 Hascol Petroleum NC HASCOL 104.45 104.97 906.000 DEC NL 32% 11%B - 10 500 23/04 2014 108.00 74.10 161455000 - Pakistan State Oil Co. NC PSO 370.81 372.29 2716.859 JUNE 50% 20%B 80%10%B - 10 100 08/10 1977 415.40 328.00 112113700 80.30 Shell (Pakistan) XD NC SHEL 234.04 235.19 1070.123 DEC 40% 25%B 80% - 10 100 09/04 1970 280.30 209.99 12120300 12.39 Sui Northern Gas NC SNGP 24.09 24.23 6342.166 JUNE - - 10 500 09/03 1964 29.75 21.99 94725500 5.28 Sui Southern Gas NC SSGC 36.67 37.18 8809.164 JUNE - - 10 500 13/03 1956 42.08 34.77 149996500 2.93 20900.152 536235750 OIL & GAS EXPLORATION COMPANIES Mari Petroleum Company NC MARI 564.88 548.09 1102.500 JUNE 37.06% 37.84%20%B - 10 50 25/10 1994 641.00 460.55 26550400 42.92 Oil & Gas Development Co. XD NC OGDC 177.11 176.16 43009.284 JUNE 82.50% 92.50% 45%(II) 10 100 17/03 2004 226.65 173.15 44450500 28.81 Pakistan Oilfields NC POL 345.53 344.39 2365.459 JUNE 450% 525% 150%(I) 10 100 12/02 1979 400.50 305.57 45246500 54.48 Pakistan Petroleum NC PPL 164.09 163.43 19717.156 JUNE 105%20%B 125% 45%(I) 10 100 16/03 2004 186.70 145.56 79670300 26.07 Pakistan Petroleum (Preference) - PPLPS NT - .144 JUNE 30% 30% 30%(I) 0 0 16/03 2004 .00 .00 0 - 66194.543 195917700 ENGINEERING Ados Pakistan NC ADOS 46.21 46.31 65.826 JUNE 25% NIL - 10 500 23/10 1994 58.58 38.34 476000 1.00 Aisha Steel NC ASL 7.25 7.24 2709.555 JUNE NIL 50%(R)NIL - 10 500 24/10 2012 11.27 6.15 19039500 (1.62) Aisha Steel (Convt Pref) NC ASLPS 8.82 - 728.644 JUNE NIL 50%R NIL - 10 500 24/10 2012 10.58 7.23 620000 - Aisha Steel (Convt Pref) ( R ) NC ASLPSR .00 - 1719.100 JUNE NL - 10 500 - 2014 .00 .00 0 - Bolan Castings NC BCL 52.00 52.01 114.725 JUNE 10%B NIL - 10 500 15/10 1985 80.85 51.30 2662500 (9.19) Crescent Steel & Allied Prod. NC CSAP 48.95 48.79 621.060 JUNE 35% 10%B 25% - 10 500 17/10 1987 65.40 41.36 22037500 5.80 Dadex Eternit NC DADX 39.01 39.01 107.640 JUNE NIL NIL - 10 500 15/10 1960 55.94 35.50 412000 (17.59) Gauhar Engineering NC GAEL 16.60 16.72 22.392 JUNE NIL NIL - 10 500 22/10 1996 25.62 13.00 2626000 - Huffaz Seamless Pipe NC HSPI 20.50 20.75 554.843 JUNE NIL NIL - 10 500 23/10 1986 26.30 17.25 2223000 (0.65) International Industries NC INIL 70.50 70.39 1198.926 JUNE 32.50% 32.50% 15%(I) 10 500 09/02 1984 86.90 61.00 23272500 4.19* International Steels NC ISL 26.55 26.83 4350.000 JUNE NIL 10% - 10 500 03/09 2011 32.24 22.73 34957000 1.58 K.S.B.Pumps Co. NC KSBP 140.48 140.27 132.000 DEC 40% 50% - 10 100 21/04 1979 160.50 125.00 763700 11.97 Pakistan Engineering Company NC PECO 114.50 108.78 56.902 JUNE NIL NIL - 10 100 24/10 1955 136.50 109.25 51600 (12.11) 12381.613 109141300 AUTOMOBILE ASSEMBLER Al-Ghazi Tractors SPOT T1 AGTL 364.68 365.85 289.820 DEC 500%35%B 500% - 5 100 15/04 1985 414.98 295.60 1391200 27.16 Atlas Honda NC ATLH 386.94 388.46 1034.065 MAR 75% 25%B 100% - 10 100 17/06 1965 405.30 311.37 911300 19.35 Dewan Farooque Motors NC DFML 6.19 6.32 1087.352 JUNE NIL NIL - 10 500 23/10 2000 9.13 4.05 49593500 (0.96) Ghani Automobile Industries NC GAIL 5.00 5 500.000 JUNE NIL 150%R - 10 500 16/10 1992 6.30 3.57 42734000 (0.20) Ghandhara Industries NC GHNI 40.15 40.62 213.044 JUNE NIL NIL - 10 500 20/10 1963 57.50 33.25 6538500 1.13 Ghandhara Nissan Ltd. NC GHNL 55.01 54.88 450.025 JUNE NIL 20% - 10 500 24/10 1993 74.00 42.28 24872500 3.86 Honda Atlas Cars (Pakistan) NC HCAR 206.58 209.34 1428.000 MAR 3% 30% - 10 100 17/06 1994 220.85 169.99 48320900 7.519 Hinopak Motors NC HINO 930.38 932.6 124.006 MAR 16.38% 377.4% - 10 50 21/06 1988 1025.00 769.71 791900 50.31 9

- 10. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Indus Motor Company NC INDU 1037.00 1039.63 786.000 JUNE 250% 295% 200%(I) 10 50 09/03 1992 1139.00 865.00 4196450 49.28 Millat Tractors NC MTL 584.99 580.14 442.925 JUNE 550%20%B 400% 250%(I) 10 50 11/03 1965 693.50 527.01 1586900 33.45 Pak Suzuki Motor Company NC PSMC 391.02 392.24 822.999 DEC 40% 50% - 10 500 18/04 1985 450.85 330.00 13313500 22.47 Sazgar Engineering Works NC SAZEW 44.10 43.25 179.724 JUNE 10% 20% 10%(I) 10 500 10/03 1996 50.49 34.10 3270500 3.36 7357.960 197521150 AUTOMOBILE PARTS & ACCESSORIES Agriauto Industries NC AGIL 162.49 160.71 144.000 JUNE 110% 100% - 5 100 23/09 1984 182.50 150.00 779900 10.70 Atlas Battery NC ATBA 744.00 741.54 173.996 JUNE 100%20%B 100% - 10 50 12/09 1968 953.00 631.32 192700 42.59 Baluchistan Wheels NC BWHL 51.40 51.4 133.343 JUNE 15% 22.50% - 10 500 18/10 1994 64.98 47.50 146000 5.13 Exide Pakistan NC EXIDE 1223.17 1222.16 77.686 MAR 60% 10%B 75% - 10 20 30/06 1982 2230.00 930.00 78740 51.63 General Tyre & Rubber Co. NC GTYR 138.49 138.79 597.713 JUNE 45% 65% - 10 100 22/09 1982 159.39 111.00 9620700 8.59 1126.738 10818040 CABLE & ELECTRICAL GOODS Climax Engineering NC CECL 16.99 - 33.120 JUNE NIL NIL - 10 500 22/10 1971 17.99 16.99 2500 (8.57) Johnson & Phillips (Pakistan) NC JOPP 20.50 20.42 54.500 JUNE NIL NIL - 10 500 24/10 1961 34.66 19.00 1344500 (6.08) Pak Elektron NC PAEL 55.31 55.89 3981.451 DEC 120%R10%B 35%R NIL - 10 500 21/04 1988 61.84 40.30 929366500 1.36 Pakistan Cables NC PCAL 147.70 145.2 284.624 JUNE 40% 45% - 10 100 16/10 1955 213.50 131.25 428200 7.81 Siemens (Pakistan) Engineering NC SIEM 1200.00 1207 82.470 SEP 200% 100% - 10 20 16/01 1978 1360.00 838.18 103560 (63.51) Singer Pakistan XR NC SING 17.14 17.02 454.056 DEC NIL NIL - 10 500 20/04 1985 32.26 13.37 24568000 0.79 TPL Trakker Limited NC TPL 7.15 - 2172.490 JUNE NIL NIL - 10 500 16/10 2012 9.07 6.06 15196000 0.40 7062.711 971009260 TRANSPORT P.I.A.C. “A” NC PIAA 8.54 8.59 28772.175 DEC NIL - 10 500 21/05 1957 10.42 6.69 389152500 (15.477) P.I.A.C. “B” NC PIAB 6.00 - 7.500 DEC NIL - 5 500 21/05 1957 .00 .00 0 - Pakistan Int Bulk Terminal NC PIBTL 35.21 35.48 7586.145 JUNE NIL 1290%RNIL - 10 500 08/10 2013 42.85 24.70 583172000 (0.30) Pakistan Int. Container Terminal NC PICT 250.00 245 1091.532 DEC 445% 135% - 10 100 18/02 2003 360.51 226.00 139400 19.11 P.N.S.C. NC PNSC 154.00 153.04 1320.634 JUNE 10% 15% - 10 100 23/10 1980 187.90 142.00 4798800 6.08 38777.986 977262700 TECHNOLOGY & COMMUNICATION Avanceon Limited XD NC AVN 35.25 35.47 1056.993 DEC NL 22.50% - 10 500 08/04 2014 46.50 29.95 60445000 5.80 Hum Network XD NC HUMNL 14.55 14.69 945.000 JUNE 60% 40%B 60% 35%B 17.50%(I) 1 500 31/03 2005 18.35 12.02 234509500 6.26 Media Times NC MDTL 1.91 1.92 1788.510 JUNE NIL NIL - 10 500 24/10 2009 3.16 1.31 50957500 (3.16) NetSol Technologies NC NETSOL 37.93 38.37 890.464 JUNE 10% 10%B NIL - 10 500 17/10 2005 50.54 30.66 59401500 (6.95) Pak Datacom Ltd XD NC PAKD 73.90 - 98.010 JUNE 50% 60% 20%(I) 10 500 27/03 1995 88.99 69.32 113000 10.17 P.T.C.L. “A” NC PTC 23.29 23.35 37740.000 DEC 20% 25% - 10 500 20/04 1996 27.25 20.00 201631500 2.48 P.T.C.L. “B” - PTCB .00 - 13260.000 DEC 10% - 10 0 12/08 1996 .00 .00 0 0.00 Systems Limited NC SYS 53.54 54.49 1001.653 DEC NL 10% 10%B - 10 500 18/04 2015 59.85 41.99 30334000 - Telecard Limited NC TELE 3.13 3.08 3000.000 JUNE NIL NIL - 10 500 24/11 1995 3.92 2.10 52448500 0.23 TRG Pakistan NC TRG 17.60 17.42 4453.906 JUNE NIL 15.57%RNIL - 10 500 18/11 2003 17.25 13.50 374637500 (0.06) WorldCall Telecom Ltd NC WTL 1.36 1.36 8605.715 DEC NIL NIL - 10 500 24/04 2005 1.89 1.03 38658500 (2.67) 72840.251 1103136500 FERTILIZER Dawood Hercules Corporation NC DAWH 103.11 103.61 4812.871 DEC 10% 10% - 10 500 17/04 1971 119.85 85.15 12400000 0.89 Engro Fertilizers SPOT T1 EFERT 85.06 85.38 13309.323 DEC NIL 30% - 10 500 15/04 2014 93.00 71.50 372845000 4.49 Engro Corporation XD NC ENGRO 278.13 277.47 5237.847 DEC 10%SD 60% - 10 100 09/04 1968 310.75 222.10 421814600 4.73 Fatima Fertilizer Company NC FATIMA 39.76 39.8 21000.000 DEC 25% 27.50% - 10 500 24/04 2010 42.50 35.15 127749500 3.82 Fauji Fertilizer Bin Qasim NC FFBL 49.89 50.13 9341.100 DEC 50% 40% - 10 500 20/03 1996 57.25 43.79 294635000 4.30 Fauij Fertilizer Company XD NC FFC 136.64 136.48 12722.382 DEC 153.50% 136.50% - 10 100 11/03 1992 147.10 117.11 172120400 14.28 66423.523 1401564500 PHARMACEUTICALS Abbott Lab (Pakistan) SPOT T1 ABOT 544.99 544.99 979.003 DEC 70% 78% - 10 50 16/04 1982 729.50 473.19 705750 28.76 Ferozsons Laboratories NC FEROZ 488.65 490.46 301.868 JUNE 70% 120% 40%(I) 10 50 13/03 1961 648.88 475.05 3972050 13.83 GlaxoSmithKline SPOT T1 GLAXO 191.00 191.23 3184.672 DEC 35% 10%B 50% - 10 100 16/04 1953 228.40 160.99 9788000 3.66 Highnoon (Lab) NC HINOON 255.00 255.67 181.805 DEC 45% 65% 12%B - 10 100 17/04 1995 257.99 203.00 2578200 14.95 Otsuka Pakistan NC OTSU 85.93 85.93 110.000 JUNE 10%B 10%B - 10 500 16/10 1989 121.54 67.78 1089500 (18.15) 10

- 11. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Sanofi-aventis NC SAPL 650.00 650 96.448 DEC 100% 70% - 10 50 21/04 1977 825.00 636.10 39550 32.12 Searle Company NC SEARL 231.24 231.51 858.407 JUNE 20% 30%B 40%B - 10 100 18/10 1993 273.89 194.00 32491000 12.28 Wyeth Pakistan NC WYETH 2415.00 - 142.161 NOV 20% NIL - 100 50 18/03 1982 4010.00 2414.28 640 (59.47) 5854.364 50664690 CHEMICAL Agritech Limited NC AGL 7.30 7.34 3924.300 DEC NIL - 10 500 19/08 2010 8.80 7.01 1361500 (4.15) Agritech Non-Voting (Pref) NC AGLNCPS 4.00 - 1593.342 DEC - - 10 500 - 2012 8.02 4.00 10500 - Arif Habib Corporation NC AHCL 32.91 32.91 4537.500 JUNE 25% 25% - 10 500 17/10 2001 38.90 26.90 78786500 5.08 Akzo Nobel Pakistan NC AKZO 394.70 393.22 464.433 DEC 25% 190% - 10 100 21/04 2012 473.99 267.13 5739600 13.04 Archroma Pakistan NC ARPL 506.69 501.46 341.182 SEP 500% 250% - 10 50 19/12 1997 654.00 430.00 1534000 30.87 Bawany Air Products NC BAPL 6.05 - 75.025 JUNE NIL NIL - 10 500 23/10 1983 8.90 5.01 1103500 (2.82) Berger Paints Pakistan NC BERG 113.51 113.94 181.864 JUNE 5% 10% - 10 500 21/10 1974 147.00 89.62 13789000 5.36 Biafo Industries XD NC BIFO 187.70 183.87 200.000 JUNE 130% 140% 62.50%(II) 13 100 13/03 1994 224.90 152.10 1880400 15.93 Buxly Paints NC BUXL 38.00 38 14.400 JUNE NIL NIL - 10 500 20/10 1986 50.00 38.01 390500 0.47 Colgate-Palmolive NC COLG 1648.49 1648.9 479.549 JUNE 140%10%B 170% - 10 1 11/09 1984 2241.00 1610.00 30820 35.30 Data Agro NC DAAG 13.82 13.6 40.000 JUNE NIL NIL - 10 500 24/10 1994 21.52 10.52 3323500 0.87 Descon Chemicals NC DCH 4.73 4.78 997.789 JUNE NIL NIL - 5 500 21/10 1992 7.45 3.52 82527000 (0.34) Descon Oxychem NC DOL 4.38 4.43 1020.000 JUNE NIL NIL - 10 500 21/10 2008 6.98 3.50 14255000 (0.60) Dynea Pakistan NC DYNO 56.00 56 94.362 JUNE 50% 25% - 5 500 23/09 1984 65.90 49.00 1296000 6.61 Engro Polymer & Chemicals NC EPCL 9.55 9.49 6634.688 DEC NIL NIL - 10 500 16/04 2008 14.14 7.91 41380000 1.08 Ghani Gases XD NC GGL 32.77 33.18 742.745 JUNE 5% 2.5%B NIL 6%(I) 10 500 01/04 2010 35.50 25.15 27216500 0.98 I. C. I. Pakistan NC ICI 403.70 406.04 923.590 JUNE NIL 80% 50%(I) 10 50 07/03 1957 528.00 366.39 715950 18.43 Ittehad Chemicals NC ICL 48.58 48.43 500.000 JUNE 15%38.88%B 10% - 10 500 25/10 2003 62.36 29.92 9957500 4.00 Linde Pakistan SPOT T1 LINDE 164.41 164.59 250.387 DEC 55% 45% - 10 100 16/04 1958 219.00 152.50 615400 7.24 Lotte Chemical Pakistan NC LOTCHEM 5.85 5.85 15142.072 DEC NIL NIL - 10 500 15/04 2001 8.37 4.94 154763000 (0.72) Leiner Pak Gelatine NC LPGL 28.00 27.99 75.000 JUNE NIL NIL - 10 500 24/10 1984 29.48 21.66 173000 (7.06) Nimir Industrial Chemicals NC NICL 23.50 23.43 1105.905 JUNE NIL NIL - 10 500 24/10 1996 27.05 19.00 14093000 1.76 Pakistan Gum & Chemicals SPOT T1 PGCL 290.05 285.49 42.486 DEC 50% 50% - 10 100 16/04 1982 368.00 233.20 196600 17.99 Pakistan PVC NC PPVC 4.67 4.65 149.580 JUNE NIL NIL - 10 500 18/10 1965 6.50 3.82 924500 (1.62) Sardar Chemical NC SARC 8.51 8.51 60.000 JUNE NIL NIL - 10 500 19/10 1994 14.30 6.70 1877500 0.69 Shaffi Chemical Industries NC SHCI 3.03 3.03 120.000 JUNE NIL NIL - 10 500 24/10 1996 4.74 2.83 267000 2.80 Sitara Chemical Industries NC SITC 334.50 330.83 214.295 JUNE 100% 105% - 10 100 21/10 1987 385.00 287.86 778400 40.18 Sitara Peroxide NC SPL 12.06 12.07 551.000 JUNE NIL NIL - 10 500 21/10 2007 16.36 10.24 22081500 0.09 Wah-Noble Chemicals NC WAHN 55.50 55.5 90.000 JUNE 55% 40% - 10 500 25/10 1985 71.00 52.00 437000 7.41 40565.494 481504670 PAPER & BOARD Balochistan Particle Board NC BPBL 6.50 6.5 30.000 JUNE NIL NIL - 5 500 18/10 1980 7.45 4.45 359500 0.14 Century Paper & Board Mills NC CEPB 54.46 54.23 1470.183 JUNE 20%B25%R 15%B - 10 500 04/10 1990 70.00 51.35 13815500 4.28 Cherat Packaging NC CPPL 189.00 185.61 275.400 JUNE 60%R 20% 30% 20%(I) 10 100 03/03 1991 220.10 157.05 5050800 9.13 Merit Packaging NC MERIT 18.42 18.45 403.141 JUNE NIL 750%R NIL - 10 500 04/10 1985 28.35 15.10 13307500 (0.27) Packages Limited XD NC PKGS 579.20 566.07 873.795 DEC 80% 90% - 10 50 09/04 1965 750.00 490.39 1547750 29.36 Pakistan Paper Products NC PPP 61.07 62.57 60.000 JUNE 30% 30% - 10 500 13/10 1964 95.00 61.10 304500 6.46 Security Papers NC SEPL 71.50 71.5 592.560 JUNE 40% 20%B 50%20%B - 10 500 21/08 1967 79.95 62.60 410500 8.34 3705.079 34796050 VANASPATI & ALLIED INDUSTRIES Punjab Oil Mills XD NC POML 182.00 181.96 53.906 JUNE 25% 35% 50%(I) 10 100 15/03 1984 198.33 84.11 444600 15.49 S.S.Oil Mills NC SSOM 27.99 27.99 56.584 JUNE NIL NIL - 10 500 28/10 1994 47.50 25.73 346500 4.30 110.490 791100 LEATHER & TANNERIES Bata (Pakistan) XD NC BATA 3438.35 - 75.600 DEC 1000% 770% - 10 50 10/04 1979 4375.82 2992.50 9800 177.17 Fateh Industries NC FIL 176.59 - 20.000 JUNE NIL NIL - 10 100 24/10 1992 176.59 167.77 100 (41.34) Leather-Up NC LEUL 10.14 10.19 60.000 JUNE NIL NIL - 10 500 27/10 1994 15.59 9.50 1288500 0.90 Service Industries NC SRVI 799.63 793.7 120.288 DEC 175% 250% - 10 50 22/04 1970 1013.00 728.00 92600 51.48 275.888 1391000 FOOD & PERSONAL CARE PRODUCTS Clover Pakistan NC CLOV 93.96 93.45 94.349 JUNE 60% 135% - 10 100 17/10 1989 160.74 71.80 7615400 4.74 11

- 12. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Engro Foods NC EFOODS 131.19 130.32 7665.960 DEC NIL NIL - 10 100 16/04 2011 141.50 105.31 199863000 0.27 Goodluck Industries NC GIL 497.00 - 3.000 JUNE 20% 20% - 10 100 13/10 1970 .00 .00 0 18.63 Gillette Pakistan NC GLPL 303.05 - 192.000 JUNE 5% NIL - 10 500 01/10 1988 405.00 335.00 1500 3.00 IBL HealthCare NC IBLHL 110.60 110.52 299.000 JUNE 15% 15%B 10% 30%B - 10 100 18/10 2009 156.48 100.79 1813900 6.47 Ismail Industries NC ISIL 221.00 - 505.208 JUNE 22.50% 22.50% - 10 500 16/10 1990 240.00 201.00 24100 9.94 Mitchells Fruit Farms NC MFFL 531.46 540.1 78.750 SEP 75% 25%B 50% - 10 50 23/01 1993 940.00 446.50 192500 13.64 Murree Brewery Company NC MUREB 1000.00 1000 230.530 JUNE 60% 10%B 60% - 10 20 20/10 1949 1117.90 896.00 173920 41.76 National Foods NC NATF 370.92 373.28 518.034 JUNE 75% 25%B 80% - 5 50 01/12 1989 446.96 323.00 1286300 13.67 Nestle Pakistan SPOT T1 NESTLE 10250.00 10125 453.496 DEC 1250% 1700% - 10 20 16/04 1980 10999.00 9050.00 16780 174.84 Nirala MSR Foods NC NMFL 16.52 16.53 165.895 JUNE NIL NIL - 10 500 23/11 1991 26.30 13.90 12358000 (0.06) Noon Pakistan NC NOPK 78.25 73.92 117.612 JUNE NIL 125%RNIL - 10 500 24/10 1970 92.28 43.00 1558000 (24.47) Noon Pakistan Non- Voting NC NOPKNV 37.05 37.92 196.020 JUNE NIL 125%RNIL - 10 500 24/10 2009 57.34 24.50 1246500 - Quice Food Industries NC QUICE 6.15 6.18 984.618 JUNE NIL 25.49%R - 10 500 27/11 1994 8.98 4.97 78202000 0.44 Rafhan Maize Products XD NC RMPL 9700.00 9916.25 92.364 DEC 1350% 1400% - 10 20 20/03 1987 12000.00 9556.00 52200 272.48 Shield Corporation NC SCL 209.36 - 39.000 JUNE 15% 15% - 10 100 23/10 1976 299.98 209.36 4600 5.93 Shezan International NC SHEZ 950.10 - 79.860 JUNE 100%10%B 100%10%B - 10 100 23/10 1989 1430.00 894.10 57150 35.74 Treet Corporation (PTCs) NC TCLTC 58.63 - 895.832 JUNE - - 21.42 500 11/10 2012 61.40 46.00 1019500 - Treet Corporation NC TREET 112.11 112.74 539.507 JUNE 15%R 20% 20% - 10 100 24/10 1978 157.10 91.50 34707900 4.22 Unilever Pakistan Foods NC UPFL 8312.00 8312 61.576 DEC 1629.80% 940% - 10 20 10/04 1998 10395.00 8075.95 3120 190.30 ZIL Limited NC ZIL 55.00 54.17 61.226 DEC 15%15%B NIL - 10 500 21/04 1987 100.30 49.70 488000 8.418 13273.837 340684370 GLASS & CERAMICS Balochistan Glass NC BGL 3.51 - 1716.000 JUNE NIL NIL - 10 500 24/10 1982 6.10 2.70 4285000 (3.31) Emco Industries NC EMCO 3.45 3.4 350.000 JUNE NIL NIL - 10 500 23/10 1984 5.30 2.60 5698000 (2.96) Frontier Ceramics NC FRCL 5.57 - 378.738 JUNE NIL 389.25%RNIL - 10 500 24/10 1992 6.98 5.00 428500 7.12 Ghani Glass Ltd XD NC GHGL 73.00 72.83 1232.190 JUNE 15%B NIL 20%(I) 10 500 02/04 1994 92.50 66.00 3600500 7.43 Ghani Value Glass NC GVGL 16.20 16.2 188.375 JUNE 150%R 5% NIL - 10 500 21/10 1969 25.20 15.25 969500 1.27 Karam Ceramics NC KCL 20.85 20.85 145.487 JUNE NIL 10% - 10 500 19/09 1993 23.73 16.00 130500 1.15 Shabbir Tiles & Ceramics NC STCL 8.57 8.55 757.344 JUNE 10% 5%B NIL 58%R 5 500 31/01 1979 13.80 7.06 59549500 (0.17) Shabbir Tiles ( R ) NC STCLR1 .00 - 439.259 JUNE NL NL - 5 500 - 2015 6.90 4.10 11673000 - Tariq Glass Industries NC TGL 53.79 53.73 734.580 JUNE NIL 5% - 10 500 23/10 1984 68.89 43.25 55000500 0.22 5941.973 141335000 MISCELLANEOUS AKD Capital Limited NC AKDCL 55.10 - 25.073 JUNE 20% 10% - 10 500 17/10 1957 67.99 58.00 58500 0.53 AL-Khair Gadoon NC AKGL 10.50 - 100.000 JUNE NIL NIL - 10 500 24/10 1996 13.55 10.50 19500 (2.62) Arpak International Investments NC ARPAK 20.86 - 40.000 JUNE NIL NIL - 10 500 21/10 1978 24.95 10.90 175000 0.15 Diamond Industries NC DIIL 28.58 - 90.000 JUNE NIL NIL - 10 500 24/10 1995 33.07 28.58 6500 (4.98) Dreamworld Limited NC DREL 327.00 - 320.000 JUNE NIL 10% - 10 100 24/10 1995 257.00 257.00 100 0.29 EcoPack Ltd. NC ECOP 12.39 12.56 229.770 JUNE NIL NIL - 10 500 12/10 1994 23.73 9.93 16061500 2.50 Gammon Pakistan NC GAMON 11.25 11.46 282.662 JUNE NIL NIL - 10 500 13/10 1956 16.99 9.42 1013500 0.11 Grays of Cambridge NC GRAYS 77.61 - 73.493 JUNE NIL NIL - 10 500 23/10 1987 91.00 75.00 38000 1.80 Haydari Construction NC HADC 1.63 1.58 32.000 JUNE NIL NIL - 5 500 18/10 1949 3.00 1.25 1250500 (0.32) MACPAC Films NC MACFL 15.98 15.75 388.860 JUNE 5% NIL - 10 500 24/10 2004 23.95 13.60 2387500 (0.62) Mandviwala Mauser NC MWMP 3.17 - 73.554 JUNE NIL - 10 500 05/04 1991 5.10 2.41 1522500 0.42 Pace (Pakistan) Limited NC PACE 3.30 3.25 2788.766 JUNE NIL NIL - 10 500 24/10 2007 4.40 2.70 64138500 (0.68) Pakistan Hotels Developers NC PHDL 96.95 96.95 180.000 JUNE 70% 80% 40%(I) 10 500 25/02 1981 93.95 75.40 89000 5.11 Pakistan Services Ltd NC PSEL 450.00 - 325.242 JUNE NIL NIL - 10 50 24/10 1964 553.87 411.00 10800 43.14 Shifa International Hospitals NC SHFA 245.45 242.81 505.138 JUNE 30% 30% - 10 100 18/10 1995 301.69 219.50 3305700 9.19 Synthetic Products NC SPEL 57.17 57.19 773.500 JUNE NL NL 5%(I) 10 500 03/03 2015 65.00 31.49 27531000 - Siddiqsons Tin Plate NC STPL 8.51 8.56 785.201 JUNE NIL NIL - 10 500 22/10 2005 10.00 6.80 33985500 (1.93) Tri-Pack Films NC TRIPF 185.21 188.97 300.000 DEC NIL NIL - 10 100 20/04 1995 304.50 163.10 1883000 6.97 United Brands NC UBDL 82.65 - 108.000 JUNE 10% 10% - 10 500 21/10 1970 .00 .00 0 1.23 United Distributors (Pakistan) NC UDPL 38.32 37.89 183.678 JUNE NIL 100%R NIL - 10 500 19/10 1989 38.90 28.87 358500 6.00 7604.937 153835100 1166385.323 14660604840 12

- 13. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate DEFAULTERS SEGMENT** CLOSE - END MUTUAL FUND Dominion Stock Fund (*)5.11.1.(b)(g) NC DOMF NT - 50.000 JUNE - - 10 500 23/12 1995 .00 .00 0 0.30 Investec Mutual Fund (*)5.11.1.(b)(c)(g)NC INMF NT - 100.000 JUNE - - 10 500 15/10 1994 .00 .00 0 0.47* PrudentialStocksFund 5.11.1.(b)(d)(e)(g) T2 PUDF NT - 60.000 JUNE - - 10 500 22/10 1991 .00 .00 0 0.11 210.000 0 MODARABAS InvestecModaraba1st(*) 5.11.1.(b)(c)(g) NC FIM NT - 30.000 JUNE - - 10 500 15/10 1994 .00 .00 0 9.19 30.000 0 LEASING COMPANIES English Leasing 5.11.1.(b)(c)(e) NC ENGL NT - 80.000 JUNE - - 10 500 05/03 1992 .00 .00 0 2.63 NationalAssetLeasingCorp.(*) 5.11.1.(b)(d)(e)(g) NC NALC NT - 95.368 JUNE - - 10 500 23/10 1991 .00 .00 0 (3.55) Pak. Ind. & Comm.Leasing (*)5.11.1.(b)(e)(g)NC PICL NT - 393.989 JUNE - - 10 500 26/12 1988 .00 .00 0 (1.52) 569.357 0 INV.BANKS/INV.COS./SECURITIESCOS. Al-MalSec.&Services(*) 5.11.1.(b)(e)(g) NC AMSL NT - 50.000 JUNE - - 10 500 20/10 1994 .00 .00 0 3.56 Dawood Capital Management5.11.1.(b)NC DCM NT - 149.738 JUNE - - 10 500 10/10 1993 .00 .00 0 0.05 Investec Securities (*)5.11.1.(b)(e)(g) NC ITSL NT - 163.333 JUNE - - 10 500 15/10 1994 .00 .00 0 (3.22) J.O.V.&Co. 5.11.1.(b)(e) NC JOVC NT - 508.200 JUNE NIL NIL - 10 500 24/03 1994 .00 .00 0 (0.03) Prudential Discount & Guarantee House5.11.1.(b)(c)(e)N C PDGH NT - 100.000 JUNE - - 10 500 05/01 1992 .00 .00 0 (2.61) PrudentialInvestmentBank(*)5.11.1.(b)(c)(e)(g)T2 PRIB NT - 100.000 JUNE - - 10 500 23/10 1990 .00 .00 0 (2.99) 1071.271 0 INSURANCE Beema Pakistan 5.11.1.(b)(c)(e) NC BEEM NT - 416.837 DEC - - 10 500 22/04 1962 .00 .00 0 (0.84) Business&IndustrialInsurance5.11.1.(b)(c)(e) NC BIIC NT - 85.544 DEC - - 10 500 17/04 1996 .00 .00 0 0.17 Hallmark Insurance 5.11.1.(e)(g) T2 HMICL NT - 5.000 DEC NIL NIL - 10 500 21/04 1982 .00 .00 0 0.47 PakistanGuaranteeIns. 5.11.1.(b)(c)(e)(g) T2 PGIC NT - 25.166 DEC - - 10 500 21/06 1966 .00 .00 0 - Progressive Insurance5.11.1.(b)(c)(e)NC PRIC NT - 85.000 DEC - - 10 500 13/05 1990 .00 .00 0 1.59 Standard Insurance 5.11.1.(c)(e)(g) T2 SICL NT - 7.500 DEC - - 10 500 22/04 1968 .00 .00 0 (1.97) 625.047 0 TEXTILE SPINNING Adil Textile (*) 5.11.1.(g) T2 ADTM NT - 77.258 JUNE NIL - 10 500 08/10 1994 .00 .00 0 (2.50) Annoor Textile 5.11.1.(e)(g) T2 ANNT NT - 8.712 JUNE - - 5 500 20/10 1970 .00 .00 0 (0.96) Al-Qaim Textile 5.11.1.(b)(e)(g) T2 AQTM NT - 74.530 JUNE NIL NIL - 10 500 11/01 1991 .00 .00 0 (1.64) Azmat Textile 5.11.1.(b)(d)(e)(g) T2 AZMT NT - 9.500 SEP - - 10 500 31/03 1968 .00 .00 0 - AL-Azhar Textile 5.11.1.(e) NC AZTM NT - 85.504 JUNE NIL NIL - 10 500 22/10 1992 .00 .00 0 (0.74) Data Textiles 5.11.1.(e) NC DATM NT - 99.096 JUNE NIL - 10 500 24/10 1991 .00 .00 0 (0.04) Elahi Cotton 5.11.1.(e) NC ELCM 42.10 42.1 13.000 JUNE NIL NIL - 10 500 18/10 1974 71.25 44.39 11000 2.07 Fatima Enterprises 5.11.1.(g) T2 FAEL NT - 142.310 JUNE NIL NIL - 10 500 21/12 1977 .00 .00 0 13.31 Globe Textile 5.11.1.(e)(g) T2 GLOT NT - 163.674 JUNE NIL NIL - 10 500 21/10 1969 .00 .00 0 (2.26) Globe (O.E) Textile 5.11.1.(g) T2 GOEM NT - 46.622 JUNE NIL NIL - 10 500 21/10 1982 .00 .00 0 (2.57) Gulistan Textile 5.11.1.(d)(e) NC GUTM NT - 189.838 JUNE NIL NIL - 10 500 24/10 1968 .00 .00 0 (9.23) Hajra Textile 5.11.1.(e) NC HAJT NT - 137.500 JUNE NIL - 10 500 24/12 1990 .00 .00 0 (1.50) Ishtiaq Textile 5.11.1.(g) T2 ISHT NT - 42.500 JUNE NIL NIL - 10 500 18/10 1989 .00 .00 0 (3.96) Karim Cotton 5.11.1.(g) T2 KACM NT - 11.832 JUNE NIL NIL - 10 50 21/10 1970 .00 .00 0 (0.90) Khurshid Spinning 5.11.1.(g) T2 KHSM NT - 131.748 JUNE NIL NIL - 10 500 24/10 1989 .00 .00 0 (0.75) Mehr Dastgir Textile 5.11.1.(e)(g) T2 MDTM NT - 92.000 JUNE - - 10 500 17/10 1994 .00 .00 0 (0.06) Sunshine Cotton 5.11.1.(b)(c)(e)(g) T2 SUCM NT - 78.511 SEP - - 10 500 21/03 1969 .00 .00 0 (1.05) 1404.135 11000 TEXTILE WEAVING Ayaz Textile 5.11.1.(b)(c)(e)(g) T2 AYZT NT - 85.342 SEP - - 10 500 23/10 1992 .00 .00 0 (5.10) Hakkim Textile 5.11.1.(b)(c)(e)(g) T2 HKKT NT - 53.948 SEP - - 10 500 26/03 1989 .00 .00 0 - Mohib Exports 5.11.1.(b)(c)(e)(g) T2 MOHE NT - 151.800 SEP - - 10 500 27/06 1993 .00 .00 0 - SaleemDenimIndustries 5.11.1.(e)(g) T2 SDIL NT - 39.018 JUNE NIL NIL - 10 500 25/10 1989 .00 .00 0 (0.24) Sadoon Textile 5.11.1.(b)(c)(e)(g) T2 SDOT NT - 30.000 SEP - - 10 500 21/03 1991 .00 .00 0 - 13

- 14. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR THURSDAY 09-04-2015 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2013 2014 2015 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - MAR 2015 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Service Fabrics 5.11.1.(e)(g) T2 SERF NT - 157.548 JUNE NIL NIL - 10 500 23/10 1989 .00 .00 0 (0.007) Yousaf Weaving 5.11.1.(e) NC YOUW NT - 400.000 JUNE NIL 2.5% - 10 500 25/10 1989 5.10 3.06 529000 0.49 917.656 529000 TEXTILE COMPOSITE Caravan East Fabrics5.11.1.(b)(d)(e)(g)T2 CARF NT - 100.000 JUNE - - 10 500 13/10 1996 .00 .00 0 0.72 (Colony) Sarhad Textile 5.11.1.(g) T2 COST NT - 40.000 JUNE NIL NIL - 10 500 25/10 1962 .00 .00 0 (4.30) (Colony) Thal Textile 5.11.1.(b)(e) NC COTT NT - 55.688 JUNE NIL NIL - 10 500 23/10 1961 .00 .00 0 (22.53) Fateh Textile 5.11.1.(c) NC FTHM NT - 12.500 JUNE NIL - 10 100 25/05 1961 .00 .00 0 3.30 Hamid Textile 5.11.1.(e)(g) T2 HATM NT - 132.716 JUNE - - 10 500 29/10 1991 .00 .00 0 (2.51) Husein Industries 5.11.1.(b) NC HUSI NT - 106.259 JUNE NIL - 10 500 24/04 1953 .00 .00 0 (18.02) Kaiser Arts & Krafts5.11.1.(b)(d)(e)(g) T2 KAKL NT - 85.500 JUNE - - 10 500 25/12 1996 .00 .00 0 - Nina Industries (*) 5.11.1.(b)(e)(g) NC NINA NT - 242.000 JUNE - - 10 500 23/10 1997 .00 .00 0 0.80 Schon Textile 5.11.1.(b)(d)(e)(g) T2 SCHT NT - 119.700 JUNE - - 10 500 21/03 1991 .00 .00 0 - Taj Textile 5.11.1.(e)(g) T2 TAJT NT - 334.420 JUNE - - 10 500 22/10 1989 .00 .00 0 (1.49) Usman Textile (*) 5.11.1.(b)(g) NC USMT NT - 37.263 JUNE - - 10 500 15/10 1949 .00 .00 0 2.73 Zahur Cotton 5.11.1.(e)(g) T2 ZHCM NT - 98.600 JUNE - - 10 500 24/10 1992 .00 .00 0 (2.55) 1364.646 0 WOOLLEN Moonlite (PAK) 5.11.1.(c) NC MOON NT - 21.596 JUNE NIL - 10 500 24/10 1970 .00 .00 0 (31.81) 21.596 0 SYNTHETIC & RAYON National Fibres 5.11.1.(b)(c)(e)(g) T2 NAFL NT - 847.778 JUNE - - 10 500 12/12 1992 .00 .00 0 - Noor Silk 5.11.1.(e)(g) T2 NORS NT - 4.000 JUNE NIL NIL - 10 500 20/10 1969 .00 .00 0 (0.07) S.G.Fiber 5.11.1.(e) NC SGFL NT - 150.000 JUNE NIL - 10 100 25/10 1996 .00 .00 0 (2.35) 1001.778 0 SUGAR & ALLIED INDUSTRIES Saleem Sugar (O) 5.11.1.(b)(e)(g) T2 SLSO NT - 11.216 SEP - - 10 500 29/01 1957 .00 .00 0 (4.13) Saleem Sugar (PP) 5.11.1.(e)(g) T2 SLSOPP NT - .800 SEP - - 5 500 29/01 1957 .00 .00 0 - Saleem Sugar (P) 6% 5.11.1.(e)(g) T2 SLSOPVI NT - 5.000 SEP - - 100 25 29/01 1957 .00 .00 0 - 17.016 0 CEMENT Dadabhoy Cement 5.11.1.(e) NC DBCI 2.99 3 982.366 JUNE NIL NIL - 10 500 05/10 1992 4.50 2.20 5537500 (1.18) 982.366 5537500 POWERGENERATION&DISTRIBUTION Genertech Pakistan 5.11.1.(e) NC GENP NT - 198.000 JUNE - - 10 500 22/10 1994 .00 .00 0 (4.43) SouthernElectricPowerCompany5.11.1.(e) NC SEPCO 2.39 2.44 1366.758 JUNE NIL NIL - 10 500 24/10 1996 2.64 1.21 24750000 (11.66) S.G. Power 5.11.1.(e) NC SGPL NT - 178.332 JUNE NIL - 10 500 25/10 1995 2.22 1.31 578000 (0.24) 1743.090 25328000 ENGINEERING Dost Steels 5.11.1.(a) (d) NC DSL NT - 674.645 JUNE NIL NIL - 10 500 20/10 2007 4.71 3.40 4637500 (0.19) Metropolitan Steel Corp.5.11.1.(b)(e) NC MSCL NT - 309.776 JUNE NIL - 10 500 10/03 1960 .00 .00 0 (12.89) Quality Steel Works5.11.1.(b)(c)(e)(g) T2 QUSW NT - 17.718 JUNE - - 10 500 15/02 1970 .00 .00 0 0.56 1002.139 4637500 AUTOMOBILEPARTS&ACCESSORIES Bela Automotives 5.11.1.(e)(g) T2 BELA NT - 58.000 JUNE - - 10 500 01/05 1994 .00 .00 0 0.06 Dewan Automotive Engineering5.11.1.(b)(e) NC DWAE NT - 214.000 JUNE - - 10 500 17/10 1986 .00 .00 0 (9.01) Transmission Engineering5.11.1.(b) NC TREI NT - 117.000 JUNE - - 10 500 22/10 1989 .00 .00 0 (2.37) 389.000 0 CABLE & ELECTRICAL GOODS Casspak Industries5.11.1.(b)(d)(e)(g) T2 CASS NT - 22.000 JUNE - - 10 500 16/12 1992 .00 .00 0 - 22.000 0 TRANSPORT Pan Islamic Steamship5.11.1.(b)(d)(e)(g)T2 PANI NT - 50.000 JUNE - - 10 500 24/12 1952 .00 .00 0 - 50.000 0 PAPER & BOARD Abson Industries 5.11.1.(b)(d)(e)(g) T2 ABSON NT - 31.000 JUNE - - 10 500 22/12 1993 .00 .00 0 - 14