Quotation 19.12.2014

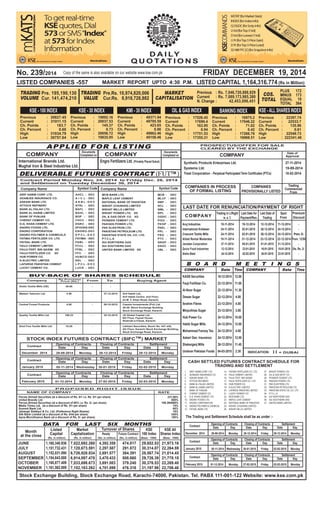

- 1. FRIDAY DECEMBER 19, 2014No. 239/2014 LISTED COMPANIES -557 LISTED CAPITAL 1,164,316.774 (Rs in Million)MARKET REPORT UPTO 4:30 P.M. D A I LY Q U O TAT I O N S Copy of the same is also available on our website www.kse.com.pk Stock Exchange Building, Stock Exchange Road, Karachi-74000, Pakistan. Tel. PABX 111-001-122 Website: www.kse.com.pk PROSPECTUS/OFFER FOR SALE CLEARED BY THE EXCHANGE COMPANY Date of Approval COMPANIES PROVISIONALLY LISTED Trading Commenced From COMPANIES IN PROCESS OF FORMAL LISTING LAST DATE FOR RENUNCIATION/PAYMENT OF RIGHT Last Date for Payment/Ren.COMPANY Spot From Premium/ Discount Trading in L/Right w. e. f. Synthetic Products Enterprises Ltd. 27-11-2014 Systems Ltd. 19-09-2014 Treet Corporation - Perpetual Participated Term Certificates (PTCs) 18-02-2014 B O A R D M E E T I N G S COMPANY TimeDate COMPANY TimeDate APPLIED FOR LISTING COMPANY Documents Completed on COMPANY Documents Completed on Last Date of Trading Engro Powergen Qadirpur Ltd. 17-09-2014 KASB Securities 18-12-2014 12.00 Fauji Fertilizer Co. 22-12-2014 11.00 Al-Noor Sugar 22-12-2014 11.30 Dewan Sugar 22-12-2014 4.00 Ibrahim Fibres 23-12-2014 4.00 Mirpurkhas Sugar 23-12-2014 3.00 Hub Power Co. 24-12-2014 10.00 Habib Sugar Mills 24-12-2014 12.00 Mohammad Farooq Tex. 24-12-2014 4.00 Askari Gen. Insurance 24-12-2014 12.00 Shakarganj Mills 26-12-2014 11.45 Unilever Pakistan Foods 04-03-2015 2.30 (FUT )TMDELIVERABLE FUTURES CONTRACT Company Name Company Name Symbol CodeSymbol Code Aruj Industries 10-11-2014 19-12-2014 12-12-2014 11-12-2014 - International Knitwear 24-11-2014 02-01-2015 26-12-2014 24-12-2014 - Crescent Textile Mills 24-11-2014 02-01-2015 26-12-2014 24-12-2014 Prem.5/- Allied Rental Modaraba 19-11-2014 31-12-2014 23-12-2014 22-12-2014 Prem. 12/50 Javedan Corporation 27-11-2014 08-01-2015 01-01-2015 31-12-2014 - Quice Food Industries 12-12-2014 23-01-2015 16-01-2015 15-01-2015 Dis. Rs. 2/- Aisha Steel 24-12-2014 02-02-2015 26-01-2015 23-01-2015 - Hascol Petroleum Ltd.Saif Power Ltd. P R O P O S E D R I G H T I S S U E Pervez Ahmed Securities (at a discount of Rs. 5/= i.e. Rs. 5/= per share) 231.08% United Brands Ltd. 800% Pervez Ahmed Securities (at a discount of 80% i.e. Rs. 2/- per share) 189.394068% Media Times Ltd. (at a discount of Rs. 5/= per share) 14% Summit Bank Ltd. 65% Jahangir Siddiqui & Co. Ltd. (Preference Right Shares) 15% Silk Bank Limited (at a discount of Rs. 8/44 per share) 240% Apna Microfinance Bank (at a discount of Rs. 5/- per share) 100% NAME OF COMPANY RATE JUNE JULY AUGUST SEPTEMBER OCTOBER NOVEMBER 1,160,340.936 1,151,732.431 1,152,031.090 1,154,843.888 1,160,877.409 1,161,562.889 7,022,692.260 7,120,673.591 6,726,928.834 6,914,097.478 7,033,698.673 7,152,183.262 4,392.359 2,297.587 2,691.577 3,470.433 3,691.083 4,701.899 29,652.53 30,314.07 28,567.74 29,726.39 30,376.53 31,197.98 21,973.16 22,264.59 21,014.45 21,778.18 22,269.40 22,706.46 474.817 291.872 364.391 508.660 379.240 476.316 DATA FOR LAST SIX MONTHS Month at the close Listed Capital Market Capitalization Turnover of Shares KSE 100 Index (Rs. in million) (Rs. in million) KSE All Shares IndexReady Future Contract (No. in million) (No. in million) (Base : 1000) (Base : 1000) International Brands Ltd. Mughal Iron & Steel Industries Ltd. CASH SETTLED FUTURES CONTRACT SCHEDULE FOR TRADING AND SETTLEMENT The Trading and Settlement Schedule shall be as under :- 1. ARIF HABIB CORP. LTD. 2. ADAMJEE INSURANCE CO. 3. ASKARI BANK LTD. 4. ATTOCK REFINERY 5. BANK AL-FALAH LIMITED 6. BANK AL-HABIB LIMITED 7. BANK OF PUNJAB 8. CHERAT CEMENT CO. 9. D.G. KHAN CEMENT LTD. 10. ENGRO FOODS LTD. 11. ENGRO CORPORATION 12. ENGRO POLYMER & CHEMICAL 13. FAYSAL BANK LTD. 14. FATIMA FERTILIZER CO. LTD. 15. FAUJI CEMENT LIMITED 16. FAUJI FERT. BIN QASIM 17. FAUJI FERTILIZER CO. LTD. 18. HUB POWER CO. 19. K-ELECTRIC LIMITED 20. LAFARGE PAKISTAN LIMITED 21. LUCKY CEMENT CO. 22. MCB BANK LTD. 23. MAPLE LEAF CEMENT 24. NATIONAL BANK OF PAKISTAN 25. NISHAT (CHUNIAN) LIMITED 26. NISHAT MILLS LIMITED 27. NISHAT POWER LTD. 28. OIL & GAS DEVP. CO. 29. PIONEER CEMENT LTD. 30. PAKGEN POWER LTD. 31. PAK ELEKTRON LTD. 32. PAKISTAN PETROLEUM LTD. 33. PAKISTAN STATE OIL CO. LTD. 34. P.T.C.L.A 35. SUI NORTHERN GAS 36. SUI SOUTHERN GAS 37. UNITED BANK LIMITED Contract Period Monday Nov. 24, 2014 to Friday Dec. 26, 2014 and Settlement on Tuesday December 30, 2014 ARIF HABIB CORP. LTD. AHCL - DEC ADAMJEE INSURANCE CO. A I C L - DEC ASKARI BANK LTD. A K B L - D E C ATTOCK REFINERY ATRL - DEC BANK AL-FALAH LTD. BAFL - DEC BANK AL-HABIB LIMITED BAHL - DEC BANK OF PUNJAB BOP - DEC CHERAT CEMENT CO. CHCC - DEC D.G. KHAN CEMENT LTD. DGKC - DEC ENGRO FOODS LTD. EFOODS-DEC ENGRO CORPORATION ENGRO-DEC ENGRO POLYMER & CHEMICALS E P C L - D E C FATIMA FERTILIZER CO. LTD. FATIMA - DEC FAYSAL BANK LTD. FABL - DEC FAUJI CEMENT LIMITED FCCL - DEC FAUJI FERT. BIN QASIM XD FFBL - DEC FAUJI FERTILIZER CO. XD FFC - DEC HUB POWER CO. HUBCO-DEC K-ELECTRIC LIMITED KEL - DEC LAFARGE PAKISTAN CEMENT L P C L - D E C LUCKY CEMENT CO. LUCK - DEC Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 29-09-2014 Monday 26-12-2014 Friday 29-12-2014 MondayDecember 2014 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 05-11-2014 Wednesday 30-01-2015 Friday 02-02-2015 MondayJanuary 2015 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 01-12-2014 Monday 27-02-2015 Friday 02-03-2015 MondayFebruary 2015 BUY-BACK OF SHARES SCHEDULE Re-Purchase Price (Rs.)Company Buying AgentFrom To Globe Textile Mills (OE) 40.00 - - Wateen Telecom Ltd. 4.50 - 27-12-2014 Arif Habib Ltd., Arif Habib Centre, 2nd Floor, 23 M. T. Khan Road, Karachi. Central Forest Products 4.00 - 09-10-2015 Cassim Investments (Pvt) Ltd. 26-28, Stock Exchange Building Stock Exchange Road, Karachi. Quality Textile Mills Ltd. 106.23 - 25-10-2015 JS Global Capital Ltd. 6th Floor, Faysal House Shahrah-e-Faisal, Karachi. Sind Fine Textile Mills Ltd. 10.29 - - Lakhani Securities: Room No. 437-438, 4th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi. H = DUBAIINDICATION: STOCK INDEX FUTURES CONTRACT (SIFC ) MARKETTM Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 29-09-2014 Monday 26-12-2014 Friday 29-12-2014 MondayDecember 2014 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 05-11-2014 Wednesday 30-01-2015 Friday 02-02-2015 MondayJanuary 2015 Contract Date Day Date Day Date Day Opening of Contracts Closing of Contracts Settlement 01-12-2014 Monday 27-02-2015 Friday 02-03-2015 MondayFebruary 2015 MCB BANK LTD. MCB - DEC MAPLE LEAF CEMENT MLCF - DEC NATIONAL BANK OF PAKISTAN NBP - DEC NISHAT (CHUNIAN) LIMITED NCL - DEC NISHAT MILLS LIMITED NML - DEC NISHAT POWER LTD. XD NPL - DEC OIL & GAS DEVP. CO. XD OGDC - DEC PIONEER CEMENT LTD. PIOC - DEC PAKGEN POWER LTD. PKGP - DEC PAK ELEKTRON LTD. PAEL - DEC PAKISTAN PETROLEUM LTD. PPL - DEC PAKISTAN STATE OIL CO. LTD. PSO - DEC P.T.C.L.A PTC - DEC SUI NORTHERN GAS SNGP - DEC SUI SOUTHERN GAS SSGC - DEC UNITED BANK LIMITED XD UBL - DEC Engro Fertilizers Ltd. (Privately Placed Sukuk)

- 2. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 2 COMPANY / SECTOR D I S T R I B U T I O N S FOR D A I L Y Q U O T A T I O N S FRIDAY 19-12-2014 OFFER PRICE REDEM- PTION PRICE PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 2 OPEN-END MUTUAL FUNDS ABLCASHFUND 10.39 10.39 - JUNE 9.14% 8.295% 7.72% - - 20/6 2010 ABL GOVERNMENT SECURITIES FUND CLASS -A-UNITS 10.15 10.00 - JUNE 2.838% 5.511% - - 20/6 2011 CLASS- B-UNITS 10.85 10.69 - JUNE 4.905% 9.06% 8.50% - - 20/6 2011 ABLISLAMICCASHFUND 10.56 10.41 - JUNE 10.46% 9.085% 8.43% - - 20/6 2010 ABLISLAMICSTOCKFUND 11.70 11.47 - JUNE NL NIL 15.91% - - 20/6 2013 ABLINCOMEFUND 10.70 10.54 - JUNE 11.14% 6.26% 7.63% - - 20/6 2008 ABLSTOCKFUND 12.89 12.64 - JUNE 24.08% 53.30% 32.57% - - 20/6 2009 AKD AGGRESSIVE INCOME FUND 52.05 51.54 - JUNE 9.00%B 11.94% B 5.38% - - 1/7 2007 AKDCASHFUND 52.12 52.12 - JUNE 4.11591% 9.1178% B 7.46958% - - 1/7 2012 AKDINDEXTRACKERFUND 13.88 13.74 - JUNE 4.70%B 48.02% B 11.68% - - 1/7 2007 AKDOPPORTUNITYFUND 67.20 65.20 - JUNE 13.00%B 65.27% B 31.60% - - 1/7 2006 AMZPLUSINCOMEFUND N/A N/A - JUNE NIL - - - - 2/7 2006 ALFALAHGHPALPHAFUND 77.94 73.02 - JUNE 3.62% 3.62%B 32.95% 32.95%B 27.9069% - - 18/10 2008 ALFALAHGHPCASHFUND 503.69 503.69 - JUNE 9.55% 0.84%B 7.1131% 0.78%B 7.4326% - - 18/10 2010 ALFALAH GHP INCOME MULTIPLIER FUND 54.17 52.07 - JUNE NIL 8.38% 8.38%B 8.4196% 2.0547%B - - 18/10 2007 ALFALAH GHP ISLAMIC FUND 73.40 68.77 - JUNE 10.80% 10.80%B 25% 25%B 27.8751% - - 18/10 2007 ALFALAHGHPVALUEFUND 68.94 64.60 - JUNE 5.43% 5.43%B 21.21% 21.21%B 18.1966% - - 18/10 2005 ATLASINCOMEFUND 534.85 534.85 - JUNE 5.75%B 19%B 8.25%B - - 1/7 2004 BMA CHUNDRIGAR ROAD SAVINGS FUND 8.13 8.05 - JUNE NIL 10.77% 6.65% - - 27/6 2007 BMA EMPRESS CASH FUND 10.24 10.14 - JUNE 9.22% 7.559% 7.38% - - 27/6 2009 DAWOOD ISLAMIC FUND 100.18 98.70 - JUNE NIL - - - - 1/7 2007 DAWOOD INCOME FUND 72.01 71.29 - JUNE 4.95% - - - - 1/7 2003 FAYSAL BALANCED GROWTH FUND 66.56 66.56 - JUNE NIL 10.85% 7.50% - - 30/1 2004 FAYSAL INCOME & GROWTH FUND 109.16 109.16 - JUNE 11.50% 8.50% 8.98% - - 30/1 2005 FAYSAL ISLAMIC SAVINGS GROWTH FUND 105.46 105.46 - JUNE 10.35% 7.80% 7.42% - - 30/1 2010 FAYSAL MONEY MARKET FUND 104.58 104.58 - JUNE 10.60% 8.45% 8.05% - - 30/1 2011 FAYSAL SAVINGS GROWTH FUND 106.29 106.29 - JUNE 10.75% 7.85% 8.57% - - 30/1 2007 FAYSAL FINANCIAL SECTOR OPPORTUNITY FUND 105.93 104.10 - JUNE NL - 6.32% - - 30/1 2013 IGI AGGRESSIVE INCOME FUND 43.77 43.19 - JUNE 7.2019% 3.6968% 2.6623% 3.308%B - - 18/10 2007 KASB ASSETALLOCATION FUND 43.96 43.53 - JUNE 0.07% 21% 26.30% - - 13/8 2007 KASBCASHFUND 105.50 104.45 - JUNE 2.60% 9.26% 7.55% - - 13/8 2009 KASBISLAMICINCOMEOPPORTUNITYFUND 98.53 97.54 - JUNE 2.75% 4.50% 7.31% - - 13/8 2008 KASBINCOMEOPPORTUNITYFUND 77.45 77.45 - JUNE 0.30% 10% 14.25% - - 13/8 2006 MEEZANISLAMICFUND 55.67 54.09 - JUNE 16.50% 35% 15.30% - - 1/7 2003 MEEZAN ISLAMIC INCOME FUND 52.37 52.02 - JUNE 7.94% 13.50% 9.00% - - 1/7 2007 NI(U)T FUND 66.90 64.93 - JUNE Rs. 3.50 Rs. 3.75 Rs. 4.10 - - 1/7 1964 NITINCOMEFUND 11.06 10.95 - JUNE Rs. 1.1065 Rs. 1.0590 Rs. 0.72 - - 1/7 2010 NIT GOVERNMENT BOND FUND 10.90 10.80 - JUNE Rs. 1.1094 Rs. 0.8803 Rs. 0.75 - - 1/7 2010 NAMCOINCOMEFUND 110.70 110.70 - JUNE 16.8% B - - - - 28/2 2008 PAK OMAN ADVANTAGE ISLAMIC INCOME FUND 53.52 52.98 - JUNE 3.4806% 2.936604% 3.454% - - 24/6 2008 PAK OMAN ADVANTAGE ISLAMIC FUND 58.76 57.29 - JUNE 11.68% 20.36% 18.144% - - 24/6 2009 PAK OMAN ADVANTAGE STOCK FUND 55.43 54.04 - JUNE NIL 30.36% 9.2392% - - 24/6 2009 PAKISTAN CAPITAL MARKET FUND 7.73 7.58 - JUNE 0.6078% B 12.76% B 1.51%B - - 29/1 2004 PAKISTAN INCOME FUND 53.29 52.57 - JUNE 4.34% 3.6%B 6.55% B 6.807%B - - 29/1 2002 PAKISTAN INT. ELEMENT ISLAMIC FUND 40.30 39.49 - JUNE 4.3335% B 10.63% B 5%B - - 29/1 2006 PAKISTAN STOCK MARKET FUND 55.34 54.23 - JUNE 7.907% B 37.24%B 16.71%B - - 29/1 2002 PAKISTAN STRATEGIC ALLOCATION FUND 8.72 8.55 - JUNE 0.9475% B 20.25% B 2.57%B - - 29/1 2011 PRIMUS INCOME FUND 102.76 102.76 - JUNE 3.532% 3.9385% 6.4765B 2.2889% - - 27/6 2012 PIML - ISLAMIC EQUITY FUND 105.00 102.94 - JUNE NL NL 1.27% 1.25%B - - 27/6 2014 PRIMUS STRATEGIC MULTI - ASSET FUND 108.97 106.83 - JUNE NL - 3.82% 4.4402%B - - 27/6 2013 UNITED GROWTH & INCOME FUND INCOME UNIT 78.49 76.93 - JUNE NIL NIL NIL - - 28/6 2006 GROWTH UNIT 77.54 77.54 - JUNE 13% B 10.12% B 16.23% - - 28/6 2006 UNITED STOCK ADVANTAGE FUND 48.77 47.18 - JUNE - 26.55% B 24.93% - - 28/6 2006 UTP 111.62 108.36 - JUNE - - - - - 1/7 2002 UTP - INCOME FUND 103.20 102.17 - JUNE - - - - - 1/7 2002 UTP - ISLAMIC FUND 370.51 359.71 - JUNE - - - - - 1/7 2002

- 3. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 3 OIL AND GAS Attock Petroleum NC APL 519.28 515.75 829.440 JUNE 500% 450%20%B 475% 10 50 09/09 2005 610.00 495.50 9880350 52.16 Attock Refinery NC ATRL 187.33 187.5 852.930 JUNE 75% 50% NIL 10 100 10/09 1980 242.05 173.80 192583500 29.82 Burshane LPG (Pakistan) NC BPL 58.94 58.2 226.400 JUNE 25% 28% 18% 10 500 15/10 1982 62.44 30.75 6585000 1.24 Byco Petroleum Pakistan NC BYCO 9.28 9.34 9778.587 JUNE NIL NIL NIL 10 500 12/01 2002 13.35 8.59 867824000 (5.01) Hascol Petroleum NC HASCOL 72.69 72.48 906.000 DEC NL NL 32%(III) 10 500 14/11 2014 90.34 59.32 294721000 - Mari Petroleum Company NC MARI 511.40 496.95 1102.500 JUNE 33.68% 37.06% 37.84%20%B 10 500 25/10 1994 802.53 190.30 206015400 42.92 National Refinery NC NRL 192.81 192.32 799.666 JUNE 150% 150% NIL 10 100 19/09 1964 249.00 174.11 35528700 12.02 Oil & Gas Development Co. XD NC OGDC 204.61 201.99 43009.284 JUNE 72.50% 82.50% 92.50% 10 100 16/12 2004 289.99 212.98 169984500 28.81 Pakistan Oilfields NC POL 370.11 370.37 2365.459 JUNE 525% 450% 525% 10 50 09/09 1979 602.99 445.00 53039300 54.48 Pakistan Petroleum NC PPL 177.38 176.57 19717.156 JUNE 115%25%B 105%20%B 125% 10 100 17/10 2004 248.02 188.11 351486300 26.07 Pakistan Petroleum (Preference) - PPLPS NT - .144 JUNE 30% 30% 30% 0 0 17/10 2004 .00 .00 0 - Pakistan Refinery NC PRL 141.00 140.9 350.000 JUNE NIL 28.50% NIL 10 100 15/10 1960 195.00 74.00 17448300 (24.68) Pakistan State Oil Co. NC PSO 360.59 361.85 2716.859 JUNE 55% 20%B 50% 20%B 80%10%B 10 100 08/10 1977 456.99 322.10 463335200 80.30 Shell (Pakistan) NC SHEL 254.28 253.83 1070.123 DEC NIL 40% 25%B - 10 100 09/04 1970 362.72 171.00 141490500 12.39 83724.548 2809922050 CHEMICALS Agritech Limited NC AGL 7.80 7.8 3924.300 DEC NIL NIL - 10 500 19/08 2010 14.44 7.01 4128500 (4.15) Agritech Non-Voting (Pref) NC AGLNCPS 4.02 - 1593.342 DEC - - 10 500 - 2012 9.00 4.02 21500 - Arif Habib Corporation NC AHCL 23.27 23.08 4537.500 JUNE 20% 10%B 25% 25% 10 500 17/10 2001 32.09 22.10 141047500 5.08 Archroma Pakistan XD NC ARPL 616.61 617.94 341.182 SEP 200% 500% 250% 10 100 19/12 1997 714.90 267.00 11734200 55.83 Bawany Air Products NC BAPL 7.19 - 75.025 JUNE NIL NIL NIL 10 500 23/10 1983 18.90 5.85 9957000 (2.82) Biafo Industries NC BIFO 186.36 186.41 200.000 JUNE 80% 130% 140% 10 100 14/11 1994 204.87 94.00 7201500 15.93 Dawood Hercules Corporation NC DAWH 82.02 82.69 4812.871 DEC 10% 10% - 10 500 15/04 1971 96.00 54.51 86280500 0.89 Descon Chemicals NC DCH 4.77 4.77 997.789 JUNE NIL NIL NIL 5 500 21/10 1992 6.25 2.40 128632000 (0.34) Descon Oxychem NC DOL 5.88 5.89 1020.000 JUNE NIL NIL NIL 10 500 21/10 2008 8.51 4.72 92153500 (0.60) Dewan Salman Fibre NC DSFL 1.95 1.95 3663.212 JUNE NIL NIL NIL 10 500 24/10 1991 3.19 1.50 174506500 (2.74) Dynea Pakistan NC DYNO 55.00 - 94.362 JUNE 30% 50% 25% 5 500 23/09 1984 65.11 37.51 7535000 6.61 Engro Fertilizers NC EFERT 65.38 65.16 13183.417 DEC NL NIL - 10 500 14/03 2014 73.47 29.66 912064000 4.49 Engro Corporation NC ENGRO 212.49 212.59 5169.697 DEC NIL 10%SD 20%(I) 10 100 26/09 1968 218.60 154.99 732098300 6.09 Engro Polymer & Chemicals NC EPCL 12.36 12.32 6634.688 DEC NIL NIL - 10 500 02/04 2008 17.25 10.65 224214000 1.08 Fatima Fertilizer Company NC FATIMA 32.80 32.79 21000.000 DEC 20% 25% - 10 500 24/04 2010 34.85 25.52 319868500 3.82 Fauji Fertilizer Bin Qasim XD NC FFBL 43.10 43.16 9341.100 DEC 45% 50% 17.50%(II) 10 500 12/12 1996 45.10 36.95 184835500 6.00 Fauij Fertilizer Company XD NC FFC 116.60 116.36 12722.382 DEC 155% 153.50% 101.50%(III) 10 100 08/12 1992 120.99 106.51 266401300 15.82 Gatron (Industries) NC GATI 163.00 163 383.645 JUNE 95% 40% 55% 10 500 11/10 1992 205.00 156.00 22300 3.79 Ghani Gases NC GGL 29.21 29.29 742.745 JUNE NIL 5% 2.5%B NIL 10 500 21/10 2010 33.48 21.90 71260000 0.98 I. C. I. Pakistan NC ICI 462.13 465.19 923.590 JUNE 55% NIL 80% 10 100 16/10 1957 610.00 252.23 18338700 18.43 Ittehad Chemicals NC ICL 29.40 29.4 500.000 JUNE 15% 15%38.88%B 10% 10 500 25/10 2003 43.05 27.10 3584500 4.00 Linde Pakistan NC LINDE 203.77 203.26 250.387 DEC 70% 55% 12.50%(I) 10 100 12/09 1958 242.75 145.00 1458900 7.24 Lotte Chemical Pakistan NC LOTCHEM 6.85 6.83 15142.072 DEC NIL NIL - 10 500 20/03 2001 8.40 6.15 526088500 (0.361) Leiner Pak Gelatine NC LPGL 26.61 26.59 75.000 JUNE 7.50% NIL NIL 10 500 24/10 1984 19.90 12.95 27000 (7.06) Mandviwala Mauser NC MWMP 4.50 - 73.554 JUNE NIL NIL - 10 500 05/04 1991 5.34 2.50 5579500 0.42 Nimir Industrial Chemicals NC NICL 26.03 26.13 1105.905 JUNE NIL NIL NIL 10 500 24/10 1996 30.34 7.40 65814500 1.76 Pakistan Gum & Chemicals NC PGCL 346.50 342.56 42.486 DEC 100% 50% - 10 100 16/04 1982 339.88 129.00 469300 17.99 Pakistan PVC NC PPVC 5.69 5.69 149.580 JUNE NIL NIL NIL 10 500 18/10 1965 8.89 3.20 7007500 (1.62) Sardar Chemical NC SARC 9.20 9.2 60.000 JUNE 5% NIL NIL 10 500 19/10 1994 12.05 5.21 3842000 0.69 Shaffi Chemical Industries NC SHCI 3.61 - 120.000 JUNE NIL NIL NIL 10 500 24/10 1996 5.30 2.42 5271500 2.80 Sitara Chemical Industries NC SITC 309.00 309.1 214.295 JUNE 80% 100% 105% 10 100 21/10 1987 381.42 241.00 4579800 40.18 Sitara Peroxide NC SPL 13.58 13.6 551.000 JUNE NIL NIL NIL 10 500 21/10 2007 20.13 11.30 108888500 0.09

- 4. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 4 United Distributors (Pakistan) NC UDPL 34.30 - 183.678 JUNE NIL NIL 100%R NIL 10 500 19/10 1989 46.20 17.00 4890500 6.00 Wah-Noble Chemicals NC WAHN 61.90 - 90.000 JUNE 50% 55% 40% 10 500 25/10 1985 81.90 60.00 1294000 7.41 109918.804 4131096300 FORESTRY (PAPER AND BOARD) Century Paper & Board Mills NC CEPB 53.89 53.68 1470.183 JUNE NIL 20%B25%R 15%B 10 500 04/10 1990 78.45 37.51 58580500 4.28 Pakistan Paper Products NC PPP 74.30 74.3 60.000 JUNE 20%B 30% 30% 10 500 13/10 1964 75.50 43.70 2036500 6.46 Security Papers NC SEPL 75.43 74.99 592.560 JUNE 60% 40% 20%B 50%20%B 10 500 21/08 1967 87.40 59.00 5809000 8.34 2122.743 66426000 INDUSTRIAL METALS AND MINING Aisha Steel NC ASL 7.76 - 2709.555 JUNE NIL NIL 50%(R)NIL 10 500 24/10 2012 10.36 6.90 19510500 (1.62) Aisha Steel (Convt Pref) NC ASLPS 7.50 7.5 728.644 JUNE NIL NIL 50%R NIL 10 500 24/10 2012 9.50 5.85 775000 - Crescent Steel & Allied Prod. NC CSAP 50.67 50.74 621.060 JUNE 20% 35% 10%B 25% 10 500 17/10 1987 61.10 34.20 98475000 5.80 Huffaz Seamless Pipe NC HSPI 25.48 24.99 554.843 JUNE 15% NIL NIL 10 500 23/10 1986 26.13 14.51 3002000 (0.65) International Industries NC INIL 63.94 64.42 1198.926 JUNE 20% 32.50% 32.50% 10 500 05/09 1984 74.94 44.51 67925000 4.19* International Steels NC ISL 24.49 24.52 4350.000 JUNE NIL NIL 10% 10 500 03/09 2011 29.15 17.06 114001500 1.58 Siddiqsons Tin Plate NC STPL 7.44 7.28 785.201 JUNE NIL NIL NIL 10 500 22/10 2005 11.73 5.60 30999500 (1.93) 10948.229 334688500 CONSTRUCTIONANDMATERIALS(CEMENT) Attock Cement NC ACPL 198.55 198.21 1145.225 JUNE 85%15%B 130% 15%B 130% 10 100 23/09 2002 187.60 123.00 11634000 17.58 Akzo Nobel Pakistan NC AKZO 367.10 365.47 464.433 DEC 786% 25% 140%(I) 10 100 01/05 2012 498.00 104.10 32911100 13.04 Berger Paints Pakistan NC BERG 109.69 108.68 181.864 JUNE NIL 5% 10% 10 500 21/10 1974 92.44 43.00 30700000 5.36 Balochistan Glass NC BGL 5.47 5.27 1716.000 JUNE NIL NIL NIL 10 500 24/10 1982 8.74 4.40 7491500 (3.31) Buxly Paints NC BUXL 46.00 - 14.400 JUNE NIL NIL NIL 10 500 20/10 1986 52.00 15.50 813500 0.47 Bestway Cement NC BWCL 123.00 125.25 5793.849 JUNE NIL 40% 70% 10 500 15/11 2001 127.32 66.50 294000 14.75 Cherat Cement NC CHCC 68.34 66.84 1051.381 JUNE 20% 25% 30%10%B68%R10 500 19/09 1985 91.50 50.10 203872000 12.51 Cherat Cement ( R ) NC CHCCR .00 - 714.938 JUNE NL NL - 10 500 - 2014 32.84 24.65 8254000 - Dadex Eternit NC DADX 45.30 45.3 107.640 JUNE 583% NIL NIL 10 500 15/10 1960 46.99 23.70 667500 (17.59) Dewan Cement NC DCL 7.95 7.99 3891.133 JUNE NIL NIL NIL 10 500 23/10 1989 10.04 5.49 419000500 1.12 D.G. Khan Cement NC DGKC 109.06 108.91 4381.191 JUNE 15% 30% 35% 10 500 21/10 1992 97.75 69.57 914942500 13.61 Dandot Cement NC DNCC 10.30 10.15 948.400 JUNE NIL NIL NIL 10 500 23/11 1989 15.89 7.76 2895000 (5.55) Emco Industries NC EMCO 4.29 4.23 350.000 JUNE NIL NIL NIL 10 500 23/10 1984 7.65 3.11 16130500 (2.96) Fauji Cement NC FCCL 24.29 24.21 13311.158 JUNE NIL 12.50% 15% 10 500 17/09 1996 23.28 15.261622266000 1.80 Fecto Cement NC FECTC 81.03 82.21 501.600 JUNE 10% 15% 25% 10 500 18/10 1993 69.02 41.00 39022000 11.86 Flying Cement NC FLYNG 7.18 7.14 1760.000 JUNE NIL NIL NIL 10 500 24/10 2007 8.35 5.01 88380500 0.57 Frontier Ceramics NC FRCL 6.50 - 378.738 JUNE 865%RNIL NIL 389.25%RNIL 10 500 24/10 1992 10.55 3.30 5279500 7.12 Gammon Pakistan NC GAMON 17.20 16.82 282.662 JUNE NIL NIL NIL 10 500 13/10 1956 19.79 3.02 5150000 0.11 Gharibwal Cement NC GWLC 22.50 22.33 4002.740 JUNE NIL NIL NIL 10 500 10/10 1962 21.25 15.60 9280000 2.12 Haydari Construction NC HADC 2.22 2.22 32.000 JUNE NIL NIL NIL 5 500 18/10 1949 3.99 1.80 12789000 (0.32) Javedan Corporation NC JVDC 24.99 - 583.263 JUNE NIL NIL NIL100%R 10 500 14/11 1962 77.37 26.08 15511500 14.44 Javedan Corp Preference NC JVDCPS 14.42 - 1120.213 JUNE - - 10 500 - 2012 14.42 10.50 19000 - Javedan Corporation ( R ) NC JVDCR 14.01 14 583.263 JUNE NL NL - 10 500 - 2014 19.00 16.24 183000 - Karam Ceramics NC KCL 17.10 - 145.487 JUNE NIL NIL 10% 10 500 19/09 1993 24.67 12.66 539500 1.15 Kohat Cement NC KOHC 183.41 182.79 1545.086 JUNE 30% 50% 20%B 20% 10 100 03/10 1996 160.75 95.75 119865600 20.41 Lafarge Pakistan Cement NC LPCL 17.30 17.32 14561.090 DEC 3% 3% - 10 500 23/04 1995 17.52 8.322596687000 1.37 Lucky Cement NC LUCK 485.12 482.23 3233.750 JUNE 60% 80% 90% 10 100 03/10 1995 502.50 295.00 154451900 35.08 Maple Leaf Cement NC MLCF 41.83 41.61 5277.339 JUNE NIL NIL NIL 10 500 23/10 1994 36.65 24.311809207000 5.36 Pioneer Cement NC PIOC 82.15 81.19 2271.488 JUNE NIL 40% 42.50% 10 500 22/10 1992 76.34 35.75 332534000 7.78 Power Cement NC POWER 6.76 6.76 3656.900 JUNE NIL NIL NIL 10 500 17/10 1988 8.75 4.70 135554000 (0.20) Safe Mix Concrete Products XR NC SMCPL 7.85 7.75 200.000 JUNE NIL NIL NIL 25%R 10 500 14/11 2010 11.00 7.01 4632000 0.61

- 5. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 5 Shabbir Tiles & Ceramics NC STCL 10.83 10.96 757.344 JUNE NIL 10% 5%B NIL 58%R 5 500 22/01 1979 14.40 6.70 67920500 (0.17) Thatta Cement NC THCCL 30.20 29.24 997.181 JUNE NIL 5% 11% 10 500 14/10 2008 32.90 22.81 3086500 2.99 Zeal-Pak Cement NC ZELP NT - 4278.385 JUNE NIL NIL - 10 500 17/12 1957 .00 .00 0 (0.74) 80240.141 8671964600 GENERAL INDUSTRIALS Balochistan Particle Board NC BPBL 6.60 6.68 30.000 JUNE NIL NIL NIL 5 500 18/10 1980 10.30 3.99 4795000 0.14 Cherat Packaging NC CPPL 154.16 155.19 275.400 JUNE 15% 60%R 20% 30% 10 500 17/10 1991 149.00 47.75 23449000 9.13 EcoPack Ltd. NC ECOP 15.85 15.72 229.770 JUNE NIL NIL NIL 10 500 12/10 1994 25.90 14.50 31798500 2.50 Ghani Glass NC GHGL 65.10 64.63 1232.190 JUNE 50% 15%B NIL 10 500 22/10 1994 77.50 47.20 13821500 7.43 Ghani Value Glass NC GVGL 18.00 17.78 188.375 JUNE NIL 150%R 5% NIL 10 500 21/10 1969 25.00 14.52 2327000 1.27 MACPAC Films NC MACFL 21.00 20.74 388.860 JUNE 10% 5% NIL 10 500 24/10 2004 25.75 13.65 8349000 (0.62) Merit Packaging NC MERIT 20.96 21.01 403.141 JUNE NIL NIL 750%R NIL 10 500 04/10 1985 24.70 14.76 52217000 (0.27) Packages Limited NC PKGS 648.89 650.58 843.795 DEC 45% 80% - 10 50 20/03 1965 688.00 270.00 20914950 18.33 Siemens (Pakistan) Engineering NC SIEM 1176.00 1168.78 82.470 SEP 1200% 200% 100% 10 20 16/01 1978 1599.00 933.00 384200 (118.21) Thal Limited NC THALL 285.71 288.98 405.150 JUNE 140% 10%B 200% 150% 5 500 22/09 1967 294.00 135.10 19519600 16.80 Tri-Pack Films NC TRIPF 251.83 250.74 300.000 DEC 100% NIL - 10 100 01/04 1995 272.60 144.86 16641100 6.97 4379.151 194216850 ELECTRONICANDELECTRICALGOODS Climax Engineering NC CECL 18.00 - 33.120 JUNE NIL NIL NIL 10 500 22/10 1971 23.46 11.50 180000 (8.57) Johnson & Phillips (Pakistan) NC JOPP 33.54 33.53 54.500 JUNE NIL NIL NIL 10 500 24/10 1961 43.65 21.35 857500 (6.08) Pakistan Cables NC PCAL 161.00 - 284.624 JUNE 32.50% 40% 45% 10 100 16/10 1955 149.00 71.50 849200 7.81 372.244 1886700 ENGINEERING Ados Pakistan NC ADOS 49.40 47.59 65.826 JUNE NIL 25% NIL 10 500 23/10 1994 73.50 34.20 2086000 1.00 Al-Ghazi Tractors NC AGTL 395.90 391.33 289.820 DEC 450% 500%35%B 200%(I) 5 100 12/11 1985 464.24 195.00 6179600 31.94 AL-Khair Gadoon NC AKGL 11.95 - 100.000 JUNE 15% NIL NIL 10 500 24/10 1996 16.50 11.00 158000 (2.62) Bolan Castings NC BCL 60.36 60.41 114.725 JUNE 20% 10%B NIL 10 500 15/10 1985 74.45 30.02 1998500 (9.19) Ghandhara Industries NC GHNI 47.38 47.59 213.044 JUNE NIL NIL NIL 10 500 20/10 1963 51.75 17.70 32152000 1.13 Hinopak Motors NC HINO 825.00 813.4 124.006 MAR 15.50% 16.38% 377.4% 10 500 21/06 1988 1000.00 191.00 3429600 50.31 K.S.B.Pumps Co. NC KSBP 150.01 - 132.000 DEC 40% 40% - 10 500 18/04 1979 177.00 73.20 5386500 11.97 Millat Tractors NC MTL 647.07 646.05 442.925 JUNE 650% 550%20%B 400% 10 100 23/10 1965 700.00 445.00 9166500 33.45 Pakistan Engineering Company NC PECO 115.00 114.97 56.902 JUNE NIL NIL NIL 10 500 24/10 1955 133.32 51.45 341500 (12.11) 1539.248 60898200 INDUSTRIAL TRANSPORTATION Pakistan Int Bulk Terminal NC PIBTL 24.29 24.34 7586.145 JUNE NL NIL 1290%RNIL 10 500 08/10 2013 145.99 19.30 394720500 (0.30) Pakistan Int. Container Terminal NC PICT 300.00 300 1091.532 DEC 125% 445% 100%(III) 10 100 13/11 2003 347.00 223.15 937800 20.62 P.N.S.C. NC PNSC 157.13 153.83 1320.634 JUNE 5% 10% 15% 10 500 23/10 1980 135.55 56.68 34216000 6.08 9998.311 429874300 SUPPORT SERVICES TRG Pakistan NC TRG 13.78 13.64 4453.906 JUNE NIL NIL 15.57%RNIL 10 500 18/11 2003 18.60 8.901213387000 (0.06) 4453.906 1213387000 AUTOMOBILE AND PARTS Agriauto Industries NC AGIL 149.00 148.76 144.000 JUNE 150% 110% 100% 5 500 23/09 1984 169.00 68.00 9894000 10.70 Atlas Battery NC ATBA 847.01 852.1 173.996 JUNE 100% 20%B 100%20%B 100% 10 100 12/09 1968 965.00 372.00 1261500 42.59 Atlas Honda NC ATLH 302.72 303.92 1034.065 MAR 65% 15%B 75% 25%B 100% 10 100 17/06 1965 355.57 209.00 2317800 19.35 Baluchistan Wheels NC BWHL 60.30 60.3 133.343 JUNE 15% 15% 22.50% 10 500 18/10 1994 68.36 33.30 2269000 5.13 Dewan Farooque Motors NC DFML 9.17 9.15 1087.352 JUNE NIL NIL NIL 10 500 23/10 2000 11.03 4.51 515405500 (0.96) Exide Pakistan NC EXIDE 1967.00 1989.46 77.686 MAR 60% 60% 10%B 75% 10 100 30/06 1982 2127.00 317.00 1871000 51.63

- 6. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 6 Ghani Automobile Industries NC GAIL 5.88 5.92 500.000 JUNE NIL NIL 150%R 10 500 16/10 1992 7.65 3.68 295488000 (0.20) Ghandhara Nissan Ltd. NC GHNL 53.99 53.47 450.025 JUNE NIL NIL 20% 10 500 24/10 1993 72.98 12.15 95972500 3.86 General Tyre & Rubber Co. NC GTYR 136.49 137.62 597.713 JUNE 20% 45% 65% 10 500 22/09 1982 160.45 46.60 70842500 8.59 Honda Atlas Cars (Pakistan) NC HCAR 201.37 202.54 1428.000 MAR NIL 3% 30% 10 500 17/06 1994 271.80 42.00 197090000 7.519 Indus Motor Company NC INDU 870.82 885.41 786.000 JUNE 320% 250% 295% 10 50 07/10 1992 943.01 329.99 7447100 49.28 Pak Suzuki Motor Company NC PSMC 362.25 358.74 822.999 DEC 25% 40% - 10 500 19/04 1985 401.00 147.51 77269600 22.47 Sazgar Engineering Works NC SAZEW 34.40 34.24 179.724 JUNE 20% 10% 20% 10 500 12/10 1996 43.85 19.70 6672000 3.36 7414.903 1283800500 BEVERAGES Murree Brewery Company NC MUREB 1095.00 1096.67 230.530 JUNE 50% 10%B 60% 10%B 60% 10 20 20/10 1949 1276.27 390.00 3192480 41.76 Nirala MSR Foods NC NMFL 20.68 20.57 165.895 JUNE NIL NIL NIL 10 500 23/11 1991 34.56 12.55 63516500 (0.06) Shezan International NC SHEZ 1205.00 1205 79.860 JUNE 90% 10%B 100%10%B 100%10%B 10 100 23/10 1989 1100.00 649.80 453500 35.74 476.285 67162480 FOOD PRODUCERS AL-Abbas Sugar NC AABS 134.74 - 173.623 SEP 80% 50% - 10 100 23/01 1992 141.75 91.00 1309700 16.56 Adam Sugar NC ADAMS 24.00 23.84 172.910 SEP 25% 25%200%R - 10 500 23/01 1967 79.68 18.10 4638000 14.62 Abdullah Shah Ghazi Sugar NC AGSML 9.90 - 792.617 SEP NIL NIL - 10 500 22/02 1990 10.85 4.66 136500 (1.24) AL-Noor Sugar NC ALNRS 37.00 - 204.737 SEP 5% 5%B 5% 5%B - 10 500 23/01 1970 52.15 31.25 2085000 1.23 Ansari Sugar NC ANSM 10.01 10.01 244.073 SEP NIL - 10 500 24/01 1991 33.75 9.50 3530000 (3.58) Baba Farid Sugar NC BAFS 23.50 - 94.500 SEP NIL NIL - 10 500 24/01 1984 29.16 21.05 6000 (13.98) Chashma Sugar NC CHAS 25.80 - 286.920 SEP NIL NIL - 10 500 21/01 1991 37.75 9.10 5215500 1.14 Clover Pakistan NC CLOV 170.28 169.64 94.349 JUNE 100% 60% 135% 10 500 17/10 1989 167.32 67.55 2315000 4.74 Colony Sugar NC CSUML 8.00 8 990.200 SEP NIL NIL - 10 500 25/01 2008 12.90 5.51 17551500 2.64 Data Agro NC DAAG 12.50 12.5 40.000 JUNE NIL NIL NIL 10 500 24/10 1994 20.90 11.00 1226000 0.87 Dewan Sugar NC DWSM 3.91 3.91 365.120 SEP NIL NIL - 10 500 24/01 1987 5.49 2.27 19714500 (2.58) Engro Foods NC EFOODS 103.20 104 7665.960 DEC NIL NIL - 10 100 16/04 2011 126.25 89.80 384178300 0.27 Faran Sugar NC FRSM 40.07 40.03 250.071 SEP 10% 10%B 7.50% 5%B - 10 500 22/01 1984 44.95 29.60 10377500 9.78 Goodluck Industries NC GIL 497.00 - 3.000 JUNE 20% 20% 20% 10 100 13/10 1970 .00 .00 0 18.63 Habib Sugar NC HABSM 44.14 44.54 750.000 SEP 50% 50% - 5 500 18/01 1963 49.99 28.00 20339000 5.18 Habib-ADM NC HAL 32.70 32.86 200.000 JUNE 80% 70% 40% 5 500 14/10 1982 39.57 27.95 1026000 3.87 Husein Sugar NC HUSS 12.50 - 170.000 SEP NIL NIL - 10 500 25/01 1967 15.90 10.50 36500 (11.22) Haseeb Waqas Sugar NC HWQS 5.98 5.98 324.000 SEP NIL NIL - 10 500 17/01 1994 9.96 4.81 7686000 (14.21) Ismail Industries NC ISIL 199.10 - 505.208 JUNE 20% 22.50% 22.50% 10 500 16/10 1990 290.00 160.05 232800 9.94 JDW Sugar NC JDWS 321.53 322.11 597.766 SEP 60% 60% 20%(I) 10 100 08/08 1992 355.00 162.80 1043200 15.46 Jauharabad Sugar NC JSML 10.51 - 109.098 SEP NIL NIL NIL 10 500 24/01 1973 18.00 7.00 273500 27.11 Khairpur Sugar NC KPUS 21.85 - 160.175 SEP NIL NIL - 10 500 29/01 1993 26.00 8.00 3097000 (20.79) Mitchells Fruit Farms NC MFFL 726.74 720.22 78.750 SEP 75% 25% 75% 25%B - 10 50 23/01 1993 1015.00 501.00 367650 21.00 Mirpurkhas Sugar NC MIRKS 68.89 68.89 122.682 SEP 15%B 10%B - 10 500 20/12 1964 82.50 41.30 5303000 12.65 Mehran Sugar NC MRNS 93.12 92.46 320.314 SEP 25%20%B 25% 25%B 16%(III)10%B 10 100 18/08 1968 131.99 68.50 2271900 15.69 National Foods NC NATF 349.68 348.67 518.034 JUNE 60% 75% 25%B 80% 5 50 01/12 1989 828.00 408.00 2115800 13.67 Nestle Pakistan NC NESTLE 8500.00 8500 453.496 DEC 700% 1250% 800%(II) 10 20 04/11 1980 13120.00 6949.25 99260 129.36 Noon Sugar NC NONS 30.89 31.47 165.175 SEP 20% NIL - 10 500 25/01 1966 35.13 21.95 777500 (9.68) Noon Pakistan NC NOPK 45.18 44.88 117.612 JUNE NIL NIL 125%RNIL 10 500 24/10 1970 80.08 27.11 1212500 (24.47) Noon Pakistan Non- Voting NC NOPKNV 25.25 24.75 196.020 JUNE NIL NIL 125%RNIL 10 500 24/10 2009 42.25 13.50 1732000 - Premier Sugar NC PMRS 100.00 - 37.500 SEP NIL NIL - 10 500 21/01 1955 106.05 58.90 262000 (10.75) Pangrio Sugar NC PNGRS 2.95 2.95 108.500 SEP NIL NIL - 10 500 21/01 1987 5.45 2.35 4874500 (10.38) Punjab Oil Mills NC POML 84.00 84.42 53.906 JUNE NIL 25% 35% 10 500 23/10 1984 142.99 80.00 381000 15.49 Quice Food Industries NC QUICE 7.62 7.68 784.618 JUNE 30%R NIL NIL 25.49%R 10 500 27/11 1994 9.20 5.71 133892500 0.44 Quice Food Industries ( R ) NC QUICER1 .76 .81 200.000 JUNE NL NL - 10 500 - 2014 .00 .00 0 -

- 7. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 7 Rafhan Maize Products NC RMPL 10275.00 10000.32 92.364 DEC 1250% 1350% 550%(II) 10 20 28/08 1987 12600.00 6365.00 42920 301.14 Sanghar Sugar NC SANSM 22.05 - 119.460 SEP NIL NIL - 10 500 22/01 1989 26.60 21.00 230000 0.57 Sindh Abadgar’s Sugar NC SASML 10.50 10.5 104.250 SEP NIL NIL - 10 500 23/12 1987 17.79 8.30 239000 (13.00) Shakarganj Mills NC SGML 17.29 16.75 695.238 SEP NIL NIL - 10 500 21/01 1979 24.95 13.31 20804000 3.84 Shakarganj (R.C.Pref) 8.50% NC SGMLPS 7.00 - 345.756 SEP - - 10 500 19/02 2004 8.00 5.95 9000 - Shahtaj Sugar NC SHJS 72.75 - 120.112 SEP 70% NIL - 10 500 23/01 1967 89.20 65.21 59500 (0.06) Shahmurad Sugar NC SHSML 54.00 54.93 211.188 SEP 15% 15% 20% 10 500 23/01 1984 64.25 17.40 6710500 4.33 Sakrand Sugar NC SKRS 2.93 - 223.080 SEP NIL NIL - 10 500 24/01 1990 5.30 2.02 3088000 (6.05) S.S.Oil Mills NC SSOM 47.00 - 56.584 JUNE NIL NIL NIL 10 500 28/10 1994 56.93 8.45 492500 4.30 Thal Industries Corporation NC TICL 87.00 87 150.232 SEP 10% 15% - 10 500 19/01 1955 91.85 44.65 162500 13.63 Tandlianwala Sugar NC TSML 38.50 - 1177.063 SEP NIL NIL - 10 500 21/02 1992 85.00 33.44 21000 (3.25) Unilever Pakistan Foods NC UPFL 8111.00 - 61.576 DEC 1160% 1629.80% 940%(I) 10 20 18/11 1998 10150.00 7676.00 6000 163.17 20707.837 671172030 HOUSEHOLD GOODS AL-Abid Silk NC AASM 12.00 - 134.096 JUNE NIL NIL NIL 10 500 18/10 1989 17.00 11.00 34000 (42.35) Diamond Industries NC DIIL 32.40 - 90.000 JUNE NIL NIL NIL 10 500 24/10 1995 39.68 14.51 678000 (4.98) Feroze1888 Mills NC FML 59.01 - 3768.010 JUNE 20% 30% 45% 10 500 21/10 1975 83.26 35.00 49000 4.50 Gauhar Engineering NC GAEL 8.95 - 22.392 JUNE NIL NIL NIL 10 500 22/10 1996 .00 .00 0 - Hala Enterprises NC HAEL 10.80 10.64 68.040 JUNE NIL NIL NIL 10 500 24/10 1991 40.23 8.15 8337000 (2.48) Pak Elektron NC PAEL 36.91 36.84 2949.223 DEC NIL 120%R10%B 35%R 10 500 10/10 1988 34.39 18.701073912000 1.36 Pak Elektron ( R ) NC PAELR1 .00 - 1032.228 DEC NL NL - 10 500 - 2014 8.14 6.60 44279000 - Singer Pakistan XR NC SING 22.52 22.5 454.056 DEC 40%R 10%B NIL - 10 500 16/04 1985 28.73 17.00 2785000 0.79 Tariq Glass Industries NC TGL 55.16 56.94 734.580 JUNE NIL NIL 5% 10 500 23/10 1984 49.88 24.70 117319500 0.22 Towellers Ltd NC TOWL 42.00 - 170.000 JUNE NIL NIL NIL 10 500 20/10 1995 42.00 16.00 1000 (22.12) 9422.625 1247394500 LESIURE GOODS (MISCELLANEOUS) Grays of Cambridge NC GRAYS 75.00 75 73.493 JUNE NIL NIL NIL 10 500 23/10 1987 92.34 45.05 1419500 1.80 73.493 1419500 PERSONAL GOODS (TEXTILE) Ali Asghar Textile NC AATM 5.53 - 222.133 JUNE NIL NIL NIL 5 500 23/10 1968 9.00 4.11 2807000 (0.47) Artistic Denim NC ADMM 123.28 122.44 840.000 JUNE 10% 10% 10% 10 500 17/10 1995 128.99 69.50 6246000 10.14 Ahmad Hassan Textile NC AHTM 26.25 - 144.083 JUNE 12.50% 15% NIL 10 500 24/10 1992 40.37 20.80 51000 6.67 AL-Qadir Textile NC ALQT 29.50 - 75.600 JUNE NIL NIL NIL 10 500 25/10 1991 30.30 24.62 13000 (9.36) Amtex Limited NC AMTEX 2.66 2.66 2594.301 JUNE NIL NIL NIL 10 500 24/10 2010 5.24 2.33 182132500 (7.58) Azgard Nine NC ANL 5.93 5.96 4493.494 JUNE NIL NIL NIL 10 500 23/10 1996 10.65 4.44 788514000 (4.73) Azgard Nine (Non-Voting) NC ANLNV 7.00 - 55.224 JUNE - - 10 500 12/05 2008 .00 .00 0 - Azgard Nine (Pref) 8.95% NC ANLPS NT - 661.251 JUNE - - 10 500 21/11 2009 .00 .00 0 - Apollo Textile XD NC APOT 58.23 - 82.847 JUNE NIL NIL - 10 500 22/10 1990 69.19 11.55 250500 4.19 Aruj Industries NC ARUJ 16.06 - 61.517 JUNE NIL NIL 25% 70%R 10 500 25/10 1994 30.24 11.30 1885500 4.92 Aruj Industries ( R ) NC ARUJR .00 - 43.062 JUNE NL NL - 10 500 - 2014 11.55 6.00 114500 - Ashfaq Textile NC ASHT 10.77 - 349.850 JUNE 200%R NIL 58.33%B NIL 10 500 24/10 1991 23.10 12.75 207000 1.18 Associated Services NC ASRL 8.00 - 35.574 JUNE NIL NIL NIL 10 500 24/10 1979 13.49 5.80 1442500 2.60 Asim Textile NC ASTM 11.95 11.95 151.770 JUNE NIL NIL NIL 10 500 25/10 1991 28.00 13.20 1013000 1.88 Allawasaya Textile NC AWTX 365.10 - 8.000 JUNE 102.50% 202.50% 102.50% 10 100 25/10 1968 382.00 313.37 2600 46.16 Ayesha Textile NC AYTM 170.98 - 14.000 JUNE NIL NIL NIL 10 100 17/10 1968 .00 .00 0 (62.14) Bata (Pakistan) NC BATA 3311.00 3261.01 75.600 DEC 530% 1000% 430%(I) 10 50 07/11 1979 3940.00 2651.00 145040 163.01 Babri Cotton NC BCML 49.46 49.55 36.522 JUNE NIL NIL NIL 10 500 20/10 1972 150.00 50.72 946000 22.45 Bhanero Textile NC BHAT 482.00 - 30.000 JUNE 200% 200% 200% 10 50 20/10 1989 874.50 430.01 21550 136.08 Bilal Fibres NC BILF 6.80 6.8 141.000 JUNE NIL NIL NIL 10 500 24/10 1991 17.88 4.76 8332500 (1.24)

- 8. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 8 Bannu Woollen NC BNWM 55.63 55.5 95.062 JUNE 30% 25%B NIL 10 500 22/10 1992 88.72 56.12 3355500 13.84 Brothers Textile NC BROT 8.60 8.6 98.010 JUNE NIL NIL NIL 10 500 25/10 1990 26.60 6.00 15063000 (0.52) Blessed Textile NC BTL 172.91 171.25 64.320 JUNE 50% 50% 25% 10 500 20/10 1991 280.00 134.90 600000 36.30 Crescent Cotton NC CCM 43.25 - 213.775 JUNE 12.50% 20% - 10 500 24/10 1965 60.58 45.00 685500 11.97 Crescent Fibres NC CFL 33.50 - 124.178 JUNE 10% 15% 10% 10 500 22/10 1979 48.70 25.30 270000 14.14 Chenab Limited NC CHBL 5.31 5.34 1150.000 JUNE NIL NIL NIL 10 500 24/10 2005 11.48 3.87 85701000 (3.47) Crescent Jute Products NC CJPL 4.03 4.07 237.635 JUNE NIL NIL NIL 10 500 25/10 1965 6.13 2.50 15409000 6.94 Chenab Limited (Preference) NC CLCPS 1.87 1.87 800.000 JUNE NIL NIL NIL 10 500 24/10 2004 4.59 1.50 151964000 - Colgate-Palmolive NC COLG 1885.91 1881.17 479.549 JUNE 140%20%B 140%10%B 170% 10 1 11/09 1984 1875.00 1377.99 125460 35.30 Crescent Textile NC CRTM 17.40 17.4 492.099 JUNE NIL NIL 12.5%25%R 10 500 21/10 1959 28.32 17.04 44295500 4.77 Crescent Textile ( R ) NC CRTMR 2.40 2.33 123.024 JUNE NL NL - 10 500 - 2014 .00 .00 0 - Colony Textile NC CTM 4.95 4.94 4980.100 JUNE NL NL NIL 10 500 24/10 2014 7.45 3.88 18656500 (0.47) Chakwal Spinning NC CWSM 11.00 11 200.000 JUNE NIL 15% 15% 5 500 22/11 1990 16.90 8.50 1485000 1.30 Dewan Farooque Spinning NC DFSM 3.65 3.65 977.507 JUNE NIL NIL NIL 10 500 23/10 2005 6.44 2.30 47014000 (0.55) Din Textile NC DINT 82.95 - 224.216 JUNE NIL 50% 10%B 25% 10 100 22/10 1991 155.90 79.10 336900 (4.96) Dewan Khalid Textile NC DKTM 8.43 - 56.825 JUNE NIL NIL NIL 10 500 23/10 1979 21.52 7.49 667000 (11.38) Dawood Lawrencepur NC DLL 125.13 125.74 590.579 DEC 50% 10% - 10 100 03/04 1953 140.30 71.24 6330700 (5.76) Dewan Mushtaq Textile NC DMTM 8.25 - 34.340 JUNE NIL NIL NIL 10 500 23/10 1971 24.00 7.55 472000 (6.97) D. M. Textile NC DMTX 18.00 - 30.524 JUNE NIL NIL NIL 10 500 24/10 1966 20.00 11.25 72000 45.67 D. S. Industries NC DSIL 4.49 4.4 600.000 JUNE NIL NIL NIL 10 500 25/10 2005 7.70 3.00 68319000 (0.80) Dar-es-Salaam Textile NC DSML 6.00 - 80.000 JUNE NIL NIL NIL 10 500 24/10 1992 12.25 5.00 192000 (13.77) Dewan Textile NC DWTM 7.00 - 135.046 JUNE NIL NIL NIL 10 500 23/10 1971 18.98 7.95 2848500 (20.35) Ellcot Spinning NC ELSM 84.00 - 109.500 JUNE 50% 100% 70% 10 500 21/10 1990 150.07 66.98 1638000 13.37 Faisal Spinning NC FASM 157.00 - 100.000 JUNE 50% 50% 50% 10 500 20/10 1992 246.02 119.99 805400 59.72 Fateh Industries NC FIL 185.88 - 20.000 JUNE NIL NIL NIL 10 500 24/10 1992 185.88 18.00 2000 (41.34) Fateh Sports Wear NC FSWL 85.18 - 20.000 JUNE NIL NIL NIL 10 500 24/10 1991 62.34 19.74 7500 76.38 Fazal Cloth NC FZCM 173.51 173.51 299.999 JUNE 20%10.619%B 25% 20%B 25% 10 500 26/10 1970 206.75 113.43 128600 29.26 Fazal Textile NC FZTM 772.30 - 61.875 JUNE 40% 50% 50% 10 50 29/10 1970 1000.00 402.00 88950 19.12 Gadoon Textile NC GADT 271.97 273.37 234.375 JUNE 75% 125% 50% 10 500 22/10 1994 332.44 179.00 18945800 24.78 Gul Ahmed Textile NC GATM 63.51 63.42 2285.233 JUNE NIL 20%R 20%B 15% 25%B 10 500 23/10 1970 73.25 45.50 148435000 6.75 Ghazi Fabrics International NC GFIL 9.10 9.18 326.356 JUNE NIL NIL NIL 10 500 21/10 1992 16.00 6.40 1726000 0.32 Glamour Textile NC GLAT 77.20 74.5 266.400 JUNE 10% NIL NIL 10 100 24/10 1993 150.50 66.79 138500 (1.23) Gillette Pakistan NC GLPL 390.00 390 192.000 JUNE NIL 5% NIL 10 500 01/10 1988 462.89 290.00 100100 3.00 Gulshan Spinning NC GSPM 3.14 - 222.250 JUNE NIL NIL NIL 10 500 24/10 1989 6.72 2.26 2902500 (9.12) Gulistan Spinning NC GUSM 2.75 2.75 146.410 JUNE NIL NIL NIL 10 500 24/10 1994 6.90 2.51 2028500 (6.64) Hafiz Limited NC HAFL 73.50 - 12.000 JUNE 15% 20% 15% 10 500 20/10 1954 90.15 64.96 10500 15.75 Hira Textile NC HIRAT 11.80 11.82 787.072 JUNE 10% 10%B NIL 10 500 24/10 2007 19.16 8.62 164512500 1.69 Haji Mohammad Ismail NC HMIM 3.00 - 119.750 JUNE NIL NIL NIL 10 500 23/10 1994 6.23 2.00 4164500 0.12 Ibrahim Fibres NC IBFL 96.00 93.75 3105.070 JUNE 30% 35% NIL 10 500 22/10 1995 105.10 55.60 1442500 2.81 I.C.C.Textiles NC ICCT 3.70 - 300.011 JUNE NIL NIL NIL 10 500 22/10 1991 9.10 3.31 4327500 (2.44) Idrees Textile NC IDRT 14.19 14.77 180.480 JUNE 10% 10% 10% 10 500 24/10 1992 25.37 13.00 788000 1.73 Ideal Spinning NC IDSM 14.75 - 99.200 JUNE NIL NIL NIL 10 500 22/10 1991 26.12 14.60 1117500 2.88 Indus Dyeing & Mfg Co XD NC IDYM 800.00 - 180.737 JUNE 350% 9%SD100% 150% 10 50 26/11 1963 1259.00 624.10 22160 65.72 Island Textile NC ILTM 910.00 - 5.000 JUNE 100% 50% 50% 10 100 21/10 1973 1745.00 817.00 42050 204.80 International Knitwear NC INKL 12.70 12.7 32.250 JUNE 5% NIL NIL 100%R 10 500 07/11 1994 17.50 9.25 704000 (1.15) International Knitwear ( R ) NC INKLR 2.20 - 32.250 JUNE NL NL - 10 500 - 2014 5.00 2.99 164000 - Ishaq Textile NC ISTM 15.00 15.19 96.600 JUNE NIL 10% NIL 10 500 22/10 1989 70.35 14.05 1676500 0.84 J.A.Textile NC JATM 5.00 - 126.012 JUNE NIL NIL NIL 10 500 25/10 1992 14.94 4.11 1069000 (3.41) Janana De Malucho Textile NC JDMT 90.00 90.45 47.848 JUNE NIL NIL 30% 10 500 20/10 1962 205.44 78.00 534000 37.74

- 9. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate 9 J.K.Spinning NC JKSM 25.05 25.05 609.032 JUNE 25% 50% NIL 10 500 15/10 1990 46.29 25.84 1517500 4.81 Jubilee Spinning & Weaving NC JUBS 5.60 - 324.912 JUNE NIL NIL NIL 10 500 21/11 1975 9.40 3.10 941000 (1.16) Khyber Textile NC KHYT 75.00 - 12.275 JUNE NIL NIL NIL 10 500 21/10 1962 84.85 49.53 49500 2.14 Kohinoor Mills NC KML 13.30 - 509.110 JUNE NIL NIL NIL 10 500 23/10 1990 27.32 10.40 6438500 3.96 Kohat Textile NC KOHTM 16.80 16.8 208.000 JUNE 10% 12.50% 12.50% 10 500 18/10 1970 27.90 11.00 6366000 3.53 Kohinoor Industries NC KOIL 3.13 3.14 303.026 JUNE NIL NIL NIL 10 500 25/10 1957 6.90 2.20 21346000 (0.02) Kohinoor Spinning NC KOSM 24.50 24.51 650.000 JUNE NIL 40% 15% 5 500 25/10 1984 26.15 11.80 53453000 0.93 Khalid Siraj Textile NC KSTM 4.05 4.31 107.000 JUNE NIL NIL NIL 10 500 25/10 1990 8.76 3.25 1013000 (5.84) Kohinoor Textile NC KTML 34.09 34.08 2455.262 JUNE NIL NIL NIL 10 500 23/10 1971 30.70 20.85 160690500 4.76 Leather-Up NC LEUL 12.00 11.87 60.000 JUNE NIL NIL NIL 10 500 27/10 1994 20.75 6.20 11339000 0.90 Libaas Textile NC LIBT 12.75 13.4 40.000 JUNE NIL NIL NIL 10 500 25/10 1995 29.70 7.80 1698500 (0.01) LandMark Spinning NC LMSM 15.75 15.52 121.237 JUNE NIL NIL NIL 10 500 18/10 1992 11.45 3.30 1712500 (1.44) Mahmood Textile NC MEHT 261.35 - 150.000 JUNE 100% 100% 100% 10 100 20/10 1973 288.75 135.50 252100 31.44 Muhammad Farooq Textile NC MFTM 6.50 6.58 188.892 JUNE NIL NIL NIL 10 500 22/11 1968 10.61 2.41 35632000 51.26 Maqbool Textile NC MQTM 23.50 23.5 168.000 JUNE 22.50% 27.50% NIL 10 500 25/10 1992 42.75 17.21 3832000 2.14 Masood Textile NC MSOT 134.15 134.68 600.000 JUNE 17.50% 17.50% 15% 10 100 29/10 1988 162.22 84.96 6670500 14.95 Mian Textile Industries NC MTIL 3.26 3.26 221.052 JUNE NIL NIL NIL 10 500 22/10 1989 9.23 1.90 9896500 (2.33) Mubarak Textile NC MUBT 5.90 - 54.000 JUNE NIL NIL NIL 10 500 27/10 1994 9.75 3.30 1935000 (0.27) Mukhtar Textile NC MUKT 2.07 2.11 145.000 JUNE NIL NIL NIL 10 500 25/10 1994 4.20 1.20 9258500 (0.22) Nagina Cotton NC NAGC 66.63 - 187.000 JUNE 50% 100% 60% 10 500 23/10 1988 111.75 59.26 720500 13.57 Nadeem Textile XR NC NATM 36.94 - 120.150 JUNE 50%R NIL NIL NIL 10 500 23/10 1995 36.94 21.03 0 4.70 Nishat (Chunian) NC NCL 43.39 43.76 2001.846 JUNE 20% 10%B 20% 10%B 10% 10 500 22/10 1991 66.95 36.50 389322500 3.80 Nishat Mills NC NML 118.10 119.49 3515.998 JUNE 35% 40% 40% 10 500 23/10 1961 141.70 96.80 489801000 15.67 N.P.Spinning NC NPSM 40.38 - 147.000 JUNE NIL NIL NIL 10 500 24/10 1994 64.00 16.00 224000 1.29 National Silk & Rayon NC NSRM 25.30 - 155.531 JUNE NIL 10% 1300%RNIL 10 500 23/10 1962 70.60 15.31 74000 0.57 Olympia Spinning NC OLSM 4.90 4.98 120.000 JUNE NIL NIL NIL 10 500 22/11 1971 11.50 3.18 4258000 (30.13) Olympia Textile NC OLTM 8.22 - 108.040 JUNE NIL NIL NIL 10 500 22/10 1991 16.36 6.00 1464000 (14.23) Paramount Spinning NC PASM 5.00 4.98 173.523 JUNE NIL NIL NIL 10 500 24/10 1991 8.85 4.35 3856500 (28.76) Premium Textile NC PRET 126.00 - 61.630 JUNE 60% 125% 35% 10 500 17/10 1989 194.11 80.18 1046900 10.84 Prosperity Weaving NC PRWM 39.65 39.52 184.800 JUNE 25% 60% 50% 10 500 21/10 1995 62.30 35.11 3488500 9.85 Pakistan Synthetics NC PSYL 15.75 15.43 560.400 JUNE NIL NIL 10% 10 500 04/10 1990 20.67 12.42 871500 0.88 Quetta Textile NC QUET 51.23 - 130.000 JUNE NIL 15% NIL 10 500 25/10 1971 77.70 34.20 824000 5.43 Ravi Textile NC RAVT 3.60 3.55 250.000 JUNE NIL NIL NIL 10 500 24/10 1989 8.35 2.10 23294500 (1.79) Reliance Cottton Spinning NC RCML 85.41 85.41 102.920 JUNE 12.50% 20% 15% 10 500 18/10 1993 131.71 58.00 1191500 12.20 Redco Textiles NC REDCO 4.68 4.52 492.926 JUNE NIL NIL NIL 10 500 24/10 1993 7.92 3.20 20880000 0.11 Resham Textile NC REST 25.37 - 360.000 JUNE 20% 20% 15% 10 500 25/10 1993 58.09 26.20 100000 2.65 Reliance Weaving NC REWM 34.43 34.93 308.109 JUNE 10% SD 20% 15% 10 500 24/10 1992 64.00 32.01 4003500 7.11 Ruby Textile NC RUBY 6.36 - 522.144 JUNE NIL NIL NIL 10 500 23/10 1992 18.15 5.32 1558000 (3.08) Rupali Polyester NC RUPL 14.15 - 340.685 JUNE 10% NIL NIL 10 500 22/10 1990 23.55 13.50 1161500 (11.83) Saif Textile NC SAIF 27.24 27.17 264.129 JUNE 20% 25% 25% 10 500 18/10 1992 48.01 21.60 9342500 5.99 Salfi Textile NC SALT 148.02 155.51 33.426 JUNE 30% 118.7%SD20% 15% 10 500 29/10 1970 314.75 109.73 139200 10.41 Salman Noman Enterprises NC SANE 5.00 - 44.670 JUNE NIL NIL NIL 10 500 30/10 1991 12.90 3.40 1472500 (10.63) Sapphire Textile NC SAPT 401.00 - 200.831 JUNE 50% 210% 100% 10 100 18/10 1974 514.50 270.75 360100 48.96 Shield Corporation NC SCL 291.00 - 39.000 JUNE 15% 15% 15% 10 100 23/10 1976 357.00 157.02 55900 5.93 Service Textiles NC SERT 18.00 - 44.492 JUNE NIL NIL NIL 10 500 23/10 1970 22.38 1.61 667500 6.01 Safa Textiles NC SFAT 15.45 - 40.000 JUNE NIL NIL NIL 10 500 15/11 1994 21.99 12.90 2521000 (2.05) Sapphire Fibres NC SFL 425.00 - 196.875 JUNE 50% 120% 125% 10 100 18/10 1990 472.00 266.00 2224000 66.70 Sind Fine Textile NC SFTM 10.29 - 23.000 JUNE NIL NIL NIL 10 500 23/10 1968 17.00 5.35 43500 0.034

- 10. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Shadman Cotton NC SHCM 15.24 - 176.367 JUNE NIL NIL NIL 10 500 20/11 1990 26.00 13.00 25500 (3.84) Shadab Textile NC SHDT 35.21 - 30.000 JUNE 10% 15% 10% 10 500 25/10 1985 84.00 35.21 89500 14.45 Sajjad Textile NC SJTM 15.56 - 212.678 JUNE NIL 5% NIL 10 500 23/10 1990 22.73 9.21 214000 (0.20) Sally Textile NC SLYT 17.00 17 87.750 JUNE NIL 20% NIL 10 500 30/10 1970 47.49 15.60 4181000 (2.53) Samin Textiles NC SMTM 13.90 13.72 267.280 JUNE NIL NIL NIL 10 500 20/10 1994 18.55 7.16 18203500 (5.52) Sana Industries NC SNAI 78.00 - 85.937 JUNE 65% 50% 25%B 75% 10 500 18/10 1988 99.14 64.01 820500 9.28 Sargodha Spinning NC SRSM 12.46 - 312.000 JUNE NIL NIL NIL 10 500 25/10 1992 21.00 10.80 201000 (1.17) Service Industries NC SRVI 927.58 929.05 120.288 DEC 75% 175% 100%(I) 10 50 12/09 1970 1094.90 455.00 3428150 51.48 Saritow Spinning NC SSML 10.09 10.02 298.406 JUNE NIL 10% NIL 10 500 25/10 1990 18.35 9.00 48783500 1.41 Shahtaj Textile NC STJT 99.00 99 96.600 JUNE 35% 40% 25% 10 500 24/10 1992 157.90 50.00 423000 7.36 Shams Textile NC STML 32.60 - 86.400 JUNE 12.50% 30% NIL 10 500 23/10 1970 87.47 24.04 596500 (6.44) Suhail Jute NC SUHJ 17.30 - 37.450 JUNE NIL NIL NIL 10 500 25/10 1984 23.29 7.25 357000 (12.74) Suraj Cotton NC SURC 105.22 105.5 239.580 JUNE 40% 60% 10%B 50% 10%B 10 100 23/10 1988 158.75 93.00 1049100 29.95 Sunrays Textile XD NC SUTM 211.50 - 69.000 JUNE 100% 200% 150% 10 500 26/11 1992 315.00 198.55 119100 41.20 Shahzad Textile NC SZTM 25.40 - 179.714 JUNE 10% 15% 15% 10 500 22/10 1983 48.82 19.00 128000 12.11 Tata Textile NC TATM 37.20 38.11 173.248 JUNE 10% 20% 10% 10 500 17/10 1991 76.50 34.00 6839000 5.83 Treet Corporation (PTCs) NC TCLTC 46.00 46.27 895.832 JUNE - - 21.42 500 11/10 2012 63.19 43.00 3803500 - Taha Spinning NC THAS 10.00 - 40.500 JUNE NIL NIL NIL 10 500 23/10 1994 23.57 8.04 2677000 17.94 Treet Corporation NC TREET 133.55 133.5 539.507 JUNE 100%PTC20% 15%R 20% 20% 10 100 24/10 1978 154.04 97.00 111667500 4.22 Tri-Star Polyester NC TRPOL 1.50 1.5 214.657 JUNE NIL NIL NIL 10 500 18/10 1992 4.50 .86 53394000 (0.46) United Brands XD NC UBDL 82.65 - 108.000 JUNE NIL 10% 10% 10 500 21/10 1970 105.00 42.75 71500 1.23 Zahidjee Textile NC ZAHT 15.00 14.98 1274.865 JUNE 20%B 20%B 160%RNIL 10 500 24/10 1991 34.03 12.05 5048500 2.76 ZIL Limited NC ZIL 98.55 95.66 61.226 DEC 45% 15%15%B - 10 100 12/04 1987 165.02 85.00 485500 8.418 Zephyr Textile NC ZTL 8.29 8.41 594.287 JUNE NIL NIL NIL 10 500 18/10 2005 15.30 7.05 8297500 1.06 55168.790 3385419860 TOBACCO Khyber Tobacco Company NC KHTC 376.00 367.33 12.018 JUNE 50% 50% 100% 10 500 25/10 1968 615.00 223.25 200300 118.38 Pakistan Tobacco Co. NC PAKT 809.09 - 2554.938 DEC 63% 100% 30%(I) 10 20 21/11 1956 1538.99 555.00 2287380 12.22 Philip Morris (Pakistan) NC PMPK 995.00 - 615.803 DEC NIL NIL - 10 50 15/04 1971 1060.00 395.00 603500 (7.16) 3182.759 3091180 HEALTHCAREEQUIPMENTANDSERVICES Shifa International Hospitals NC SHFA 203.14 201.43 505.138 JUNE 15% 30% 30% 10 100 18/10 1995 211.00 104.00 8368400 9.19 505.138 8368400 PHARMA AND BIO TECH Abbott Lab (Pakistan) NC ABOT 742.13 732.87 979.003 DEC 70% 70% 30%(I) 10 50 08/09 1982 855.00 355.00 16006050 25.83 Ferozsons Laboratories NC FEROZ 594.19 601.69 301.868 JUNE 45% 5%B 70% 120% 10 100 21/10 1961 583.73 145.00 14217400 13.83 GlaxoSmithKline NC GLAXO 226.30 225.53 3184.672 DEC 40% 10%B 35% 10%B - 10 100 21/04 1953 243.80 136.26 139632200 3.66 Highnoon (Lab) NC HINOON 243.74 243.45 181.805 DEC 35% 45% - 10 100 15/04 1995 305.00 117.50 8477500 8.55 IBL HealthCare NC IBLHL 152.11 152.6 299.000 JUNE 25% 15% 15%B 10% 30%B 10 100 18/10 2009 174.00 70.60 12826700 6.47 Otsuka Pakistan NC OTSU 88.03 88.43 110.000 JUNE 12.50% 10%B 10%B 10 500 16/10 1989 119.50 41.91 4940000 (18.15) Sanofi-aventis NC SAPL 800.00 - 96.448 DEC 125% 100% - 10 50 18/04 1977 1129.26 542.00 252700 32.12 Searle Company NC SEARL 257.55 258.97 858.407 JUNE 10% 40%B 20% 30%B 40%B 10 100 18/10 1993 278.71 125.00 89569400 12.28 Wyeth Pakistan NC WYETH 4129.00 - 142.161 NOV 80% 20% - 100 50 20/03 1982 5250.00 2715.11 43380 23.86 6153.364 285965330 MEDIA Hum Network NC HUMNL 14.31 14.36 945.000 JUNE 20% 60% 40%B 60% 35%B 1 100 13/11 2005 177.74 14.45 79461500 6.26 Media Times NC MDTL 2.48 2.45 1788.510 JUNE NIL NIL NIL 10 500 24/10 2009 3.89 1.31 176245000 (3.16) 2733.510 255706500 10

- 11. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate TRAVEL AND LEISURE Dreamworld Limited NC DREL 270.00 - 320.000 JUNE NIL NIL 10% 10 100 24/10 1995 270.00 135.00 0 0.29 Pakistan Hotels Developers NC PHDL 67.00 67 180.000 JUNE 25% 70% 80% 10 500 08/10 1981 93.00 58.00 298000 5.11 P.I.A.C. “A” NC PIAA 7.14 7.13 28772.175 DEC NIL NIL - 10 500 21/05 1957 10.55 5.13 722542500 (15.477) P.I.A.C. “B” NC PIAB 6.00 - 7.500 DEC NIL NIL - 5 500 21/05 1957 6.42 5.50 500 - Pakistan Services NC PSEL 509.00 - 325.242 JUNE NIL NIL NIL 10 100 24/10 1964 575.00 250.00 72100 43.14 29604.917 722913100 FIXED LINE TELECOMMUNICATION Pak Datacom NC PAKD 72.40 72.4 98.010 JUNE 50% 25%B 50% 60% 10 500 15/10 1995 90.85 60.80 1143000 10.17 P.T.C.L. “A” NC PTC 21.73 21.73 37740.000 DEC NIL 20% 10%(I) 10 500 11/08 1996 33.50 20.64 855369000 2.48 P.T.C.L. “B” - PTCB .00 - 13260.000 DEC NIL 10% - 10 0 12/08 1996 .00 .00 0 0.00 Telecard Limited NC TELE 3.40 3.41 3000.000 JUNE NIL NIL NIL 10 500 24/11 1995 5.99 2.81 414262500 0.23 WorldCall Telecom NC WTL 1.78 1.82 8605.715 DEC NIL NIL - 10 500 22/04 2005 3.11 1.51 238790000 (2.67) 62703.725 1509564500 ELECTRICITY Altern Energy NC ALTN 31.15 31.05 3633.800 JUNE NIL NIL 20% 10 500 22/10 1998 32.60 18.00 10718000 5.14 Engro Powergen Qadirpur XD NC EPQL 40.08 40.1 3238.000 DEC NL NL 15%(I) 10 500 09/12 2014 44.40 38.11 24715500 - Hub Power Company NC HUBC 75.03 74.66 11571.544 JUNE 60% 80% 65% 10 500 30/09 1994 72.50 51.50 346734500 5.66 Ideal Enegy NC IDEN 7.98 7.78 80.000 JUNE NIL NIL NIL 10 500 24/10 1996 12.35 4.00 8080000 (3.82) Japan Power Generation NC JPGL 3.30 3.31 1560.376 JUNE NIL NIL NIL 10 500 22/10 1996 3.97 1.60 248196000 (5.63) Kot Addu Power Company NC KAPCO 76.93 75.59 8802.532 JUNE 69% 75% 65% 10 500 14/10 2005 71.50 55.90 107055500 8.78 K-Electric Ltd NC KEL 8.74 8.82 96653.179 JUNE 9.20%RNIL NIL NIL 3.5 500 16/10 1949 9.25 5.511913092000 0.46 Kohinoor Energy NC KOHE 48.60 48.69 1694.586 JUNE 35% 117.50% 65% 10 500 10/09 1996 48.00 33.20 22608000 6.30 Kohinoor Power Company NC KOHP 2.71 - 126.000 JUNE NIL NIL NIL 10 500 25/10 1993 3.99 1.80 6447500 (4.16) Lalpir Power NC LPL 28.96 28.89 3798.387 DEC NL 25% - 10 500 14/04 2013 27.40 16.11 203478500 1.67 Nishat Chunian Power NC NCPL 47.96 46.18 3673.469 JUNE 35% 60% 65% 10 500 13/11 2009 49.50 34.50 73377000 7.89 Nishat Power XD NC NPL 45.75 44.99 3540.885 JUNE 20% 30% 40% 10 500 13/12 2009 47.75 29.45 98494500 8.23 Pakgen Power NC PKGP 26.47 26.52 3720.815 DEC 30% 25% - 10 500 19/04 2011 24.65 16.61 236390500 2.98 Sitara Energy NC SEL 38.25 37.58 190.920 JUNE 10% 10% 20% 10 500 21/10 1995 42.64 33.00 1164500 10.71 Southern Electric Power Company NC SEPCO 2.30 2.33 1366.758 JUNE NIL NIL NIL 10 500 24/10 1996 3.10 1.40 158328000 (11.66) Saif Power NC SPWL 34.11 34.16 3864.717 DEC NL NL - 10 500 - 2014 .00 .00 0 - Tri-Star Power NC TSPL 1.67 1.67 150.000 JUNE NIL NIL NIL 10 500 18/10 1994 2.85 1.12 19776000 0.06 147665.968 3478656000 MULTIUTILITIES (GAS AND WATER) Sui Northern Gas NC SNGP 28.81 28.9 6342.166 JUNE 25%10%B - 10 500 09/03 1964 25.35 18.50 279400000 5.28 Sui Southern Gas NC SSGC 38.23 37.85 8809.164 JUNE 22.50% - 10 500 13/03 1956 38.20 24.00 439005500 2.93 15151.330 718405500 COMMERCIAL BANKS Allied Bank Ltd. NC ABL 112.92 112.59 11450.738 DEC 65%10%B 52.50%10%B 45%(III) 10 100 07/11 2005 138.00 83.00 43039500 14.06 Askari Bank Ltd. NC AKBL 21.89 21.84 12602.601 DEC NIL 55%R NIL 10%(I) 10 500 13/08 1992 23.38 13.33 559998500 (4.34) Apna Microfinance Bank NC AMBL 5.20 5.2 1100.000 DEC NIL NIL266.67%R - 10 500 18/04 2005 15.00 4.91 1739000 (1.77) Bank Alfalah Ltd. NC BAFL 30.64 30.82 13491.563 DEC 20% 20% - 10 500 21/03 2004 32.10 24.91 743809000 3.46 Bank ALHabib Ltd. NC BAHL 45.75 45.87 11114.254 DEC 30% 20% 10%B - 10 500 15/03 1992 50.60 34.40 144508500 5.10 BankIslami Pakistan Ltd. NC BIPL 9.95 10.02 5279.679 DEC NIL NIL 9.07315%R 10 500 12/09 2006 12.00 6.88 181151500 0.78 BankIslami Pakistan (R) NC BIPLR .00 - 479.041 DEC NL NL - 10 500 - 2014 3.25 .90 487500 - Bank of Khyber NC BOK 9.50 9.24 10003.711 DEC 9.40%B NIL 11.12%B - 10 500 22/03 2006 11.17 6.75 7861500 1.15 Bank of Punjab NC BOP 9.88 9.88 15551.131 DEC NIL 146.918%R - 10 500 13/01 1991 12.74 7.001678967000 1.83 Faysal Bank Ltd. NC FABL 17.10 17.05 10432.696 DEC 12.50%B 12.50%B - 10 500 21/03 1995 19.44 11.401051045000 1.77 Habib Bank Ltd. NC HBL 215.13 213.37 14668.525 DEC 75% 10% B 80% 10%B 65%(III) 10 100 08/11 2007 218.71 156.00 57300900 16.43 11

- 12. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Habib Metropolitan Bank NC HMB 35.50 35.5 10478.314 DEC 20% 20% - 10 500 18/03 1992 39.50 23.01 91176500 3.36 JS Bank Ltd. NC JSBL 7.08 7 10724.643 DEC NIL NIL - 10 500 22/03 2007 7.30 4.00 439110500 0.32 KASB Bank Ltd NC KASBB 2.08 2.09 19508.616 DEC NIL NIL - 10 500 12/06 1995 2.44 1.06 111761000 (0.81) MCB Bank Ltd. NC MCB 280.61 282.4 11130.307 DEC 130%10%B 140%10%B 100%(III) 10 100 10/11 1992 311.00 234.51 101905000 21.24 Meezan Bank Ltd. NC MEBL 47.00 47.27 10027.379 DEC 15% 11%B 15% 15%(I) 10 500 12/08 2000 53.70 36.15 72675000 3.94 National Bank of Pakistan NC NBP 65.15 65.32 21275.128 DEC 70% 15%B 20% - 10 500 20/03 2002 64.45 49.80 768598500 2.58 NIB Bank Ltd. NC NIB 2.08 2.1 103028.512 DEC NIL NIL - 10 500 20/03 2003 3.05 1.70 593731000 0.12 Samba Bank Ltd. NC SBL 6.90 6.9 10082.386 DEC NIL 24.745%RNIL - 10 500 22/03 2003 9.89 4.25 106874000 0.104 Standard Chartered Bank NC SCBPL 23.50 23.5 38715.850 DEC 20% 24% 7.50%(I) 10 500 18/09 2007 25.65 19.45 11595000 2.71 Silkbank Ltd. NC SILK 2.15 2.16 26716.048 DEC NIL NIL - 10 500 21/03 1995 2.75 1.70 297057000 (0.433) Summit Bank Ltd NC SMBL 4.16 4.12 10779.796 DEC 20%R NIL NIL - 10 500 31/03 2008 4.93 2.11 478726000 (1.69) Summit Bank Pref Class “A” NC SMBLCPSA 10.00 - 1109.424 DEC NL - 10 500 - 2013 .00 .00 0 - Summit Bank Pref Class “B” NC SMBLCPSB 10.00 - 1046.534 DEC NL - 10 500 - 2013 10.00 10.00 9500000 - Soneri Bank Ltd. NC SNBL 12.52 12.54 11024.635 DEC 11%B 10%B - 10 500 21/03 1992 16.73 9.50 121838000 0.940 United Bank Ltd. XD NC UBL 163.09 163.73 12241.797 DEC 85% 100% 75%(III) 10 500 05/12 2005 202.00 128.10 296166600 15.20 404063.308 7970622000 NON LIFE INSURANCE Askari General Insurance NC AGIC 26.20 26.7 388.344 DEC 20%B NIL - 10 500 24/04 1996 30.90 17.00 18408000 3.066 Adamjee Insurance NC AICL 49.31 49.24 3500.000 DEC 25% 35%182.93%B 12.50%(I) 10 500 10/10 1961 52.90 36.85 641414600 5.61 Asia Insurance NC ASIC 20.00 - 300.000 DEC NIL NIL - 10 500 24/04 1980 .00 .00 0 0.65 Atlas Insurance NC ATIL 73.37 73.45 701.614 DEC 40% 20%B 50% 10%B - 10 500 03/04 1957 87.85 55.50 4203500 7.14 Century Insurance NC CENI 24.00 23.95 457.244 DEC 12.50% 15% - 10 500 24/04 1989 24.00 14.41 19338000 3.22 Crescent Star Insurance NC CSIL 4.80 4.8 620.125 DEC NIL 412.50%R - 10 500 02/01 1957 8.18 3.80 7924000 0.12 Cyan Limited NC CYAN 85.64 85.46 586.276 DEC 40% 50%B 100% 250%(I) 10 500 26/09 1960 138.50 71.79 10411000 20.06 EFU General Insurance NC EFUG 142.58 142.94 1600.000 DEC 50% 50% 28%B 10%(I) 10 100 04/09 1949 166.50 91.00 19793100 11.13 East West Insurance NC EWIC 166.09 - 401.502 DEC 10%B 10%10%B 10%(I)10%B 10 100 21/09 1983 .00 .00 0 3.46 Habib Insurance NC HICL 22.40 22.16 495.499 DEC 35% 25%25%B - 5 500 17/04 1949 26.20 14.20 11515000 2.46 IGI Insurance NC IGIIL 245.00 245.46 1226.895 DEC 30% 25%10%B - 10 500 11/04 1987 257.97 154.99 35895500 7.28 Jubilee General Insurance NC JGICL 103.70 103.37 1569.101 DEC 30% 15%B 30% 15%B - 10 500 15/04 1955 122.37 71.01 2167500 7.66 Pakistan Reinsurance NC PAKRI 30.44 30.27 3000.000 DEC 25% 25% - 10 500 23/05 1959 37.50 22.69 90096000 4.40 PICIC Insurance NC PIL 10.51 - 350.000 DEC NIL - 10 500 09/05 2006 16.00 7.30 958000 0.26 Premier Insurance NC PINL 25.19 - 302.821 DEC 20% 20% - 10 500 20/04 1952 25.90 7.20 5499500 (2.75) Pakistan General Insurance NC PKGI 10.05 - 375.000 DEC 25%B NIL - 10 500 23/04 1995 16.90 7.70 1114000 0.72 Reliance Insurance NC RICL 12.16 12.16 403.458 DEC 15%B 5% 10%B - 10 500 19/04 1983 13.35 8.01 4631500 2.03 Shaheen Insurance NC SHNI 5.99 6 450.000 DEC 20%R NIL 50%R NIL - 10 500 23/04 1996 12.30 4.06 4025500 (3.54) Silver Star Insurance NC SSIC 9.57 - 305.648 DEC NIL NIL - 10 500 20/04 1987 13.10 5.90 4779000 0.04 TPL Direct Insurance NC TDIL 25.75 - 460.000 DEC NIL NIL - 10 500 20/12 2011 28.00 8.50 10100000 0.94 United Insurance NC UNIC 28.50 28.96 920.000 DEC 23%B 31.064811%B - 10 500 22/04 1960 30.45 12.71 4730000 3.66 Universal Insurance NC UVIC 4.13 4.13 370.000 DEC NIL NIL - 10 500 22/04 1969 8.34 2.70 3739500 (2.97) 18783.527 900743200 LIFE INSURANCE EFU Life Assurance NC EFUL 149.45 151.27 1000.000 DEC 55%17.647%B 65% 15%(I) 10 100 04/09 1995 177.99 80.60 3123900 9.29 East West Life Assurance NC EWLA 10.50 10.73 594.291 DEC NIL 18.75%RNIL - 10 500 28/03 1994 7.60 4.01 831500 0.084 IGI Life Insurance NC IGIL 179.99 - 500.000 DEC NIL NIL - 10 500 19/03 1995 205.00 37.00 1794500 1.477 Jubilee Life Insurance NC JLICL 433.25 432.48 721.188 DEC 45% 60%15%B 25%(I) 10 100 27/08 1996 364.90 159.00 1017900 15.01 2815.479 6767800 REALESTATEINVESTMENTANDSERVICES AKD Capital Limited NC AKDCL 60.50 - 25.073 JUNE 15% 20% 10% 10 500 17/10 1957 80.19 59.00 132500 0.53 12

- 13. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Pace (Pakistan) NC PACE 3.26 3.27 2788.766 JUNE NIL NIL NIL 10 500 24/10 2007 5.44 3.03 407520500 (0.68) 2813.839 407653000 FINANCIAL SERVICES Arif Habib Limited NC AHL 50.61 50.4 550.000 JUNE 30%11.11%B 30% 10%B 50% 10 500 20/09 2007 69.40 32.02 38931000 14.88 Arpak International Investments NC ARPAK 11.76 12.7 40.000 JUNE NIL NIL NIL 10 500 21/10 1978 26.56 9.10 627500 0.15 Capital Assets Leasing Corporation NC CPAL 6.00 - 107.444 JUNE NIL NIL NIL 10 500 18/10 1993 10.45 5.00 1958000 1.22 Dawood Equities NC DEL 2.40 2.4 250.000 JUNE NIL NIL NIL 10 500 23/10 2008 4.35 2.10 10519000 0.43 Escorts Investment Bank NC ESBL 2.20 2.14 441.000 JUNE NIL NIL NIL 10 500 24/10 1996 3.74 1.95 2903500 (0.40) First Credit & Investment Bank NC FCIBL 5.50 5.73 650.000 JUNE NIL NIL NIL 10 500 19/10 2008 10.35 2.99 3415000 0.04 First Capital Securities Corp. NC FCSC 2.10 2.1 3166.101 JUNE NIL NIL NIL 10 500 24/10 1994 3.94 1.80 29466500 (0.12) First Dawood Investment Bank NC FDIBL 1.20 1.19 684.441 JUNE NIL NIL NIL 10 500 24/10 1994 2.20 1.11 7147500 (2.25) Grays Leasing Ltd NC GRYL 5.44 5.15 215.000 JUNE NIL NIL NIL 10 500 21/10 1997 7.94 3.60 2262000 0.05 Invest Capital Investment Bank NC ICIBL 1.67 1.66 2848.669 JUNE NIL NIL NIL 10 500 24/10 1993 2.50 1.30 56381500 0.34 Invest & Finance Securities NC IFSL 18.15 18.15 200.156 JUNE 10%B NIL NIL 10 500 22/08 2008 19.95 14.10 1190500 4.78 IGI Investment Bank Ltd. NC IGIBL 2.01 2.02 2121.026 JUNE NIL NIL NIL 10 500 25/10 1990 2.16 1.12 102911500 (0.64) Jahangir Siddiqui & Co. Ltd NC JSCL 14.30 14.36 7632.853 DEC 7.5% NIL - 10 500 03/04 1993 17.20 7.501969772000 0.23 JS Global Capital NC JSGCL 33.28 33.28 500.000 DEC 65% 35% 40%(II) 10 500 14/11 2005 50.00 30.40 1380500 3.00 JS Investments Ltd NC JSIL 12.11 12.08 1000.000 DEC 10% 10% - 10 500 01/04 2007 14.40 10.11 261686000 5.98 KASB Securities Ltd NC KASBSL 8.00 7.24 1000.000 DEC 5% 5% - 10 500 16/04 2008 8.00 5.00 8771000 0.81 KASB Corporation XR NC KCORP 21.00 - 5577.730 DEC 2.5% NIL 17.95%R 10 500 30/09 1997 22.79 21.00 0 (1.09) MCB-Arif Habib Savings & Inv. NC MCBAH 22.51 22.53 720.000 JUNE 22.50% 25% 27.50% 10 500 17/10 2008 19.50 14.02 6775500 2.53 Next Capital Ltd NC NEXT 5.75 5.75 200.000 JUNE NIL NIL NIL 10 500 23/10 2012 6.40 3.62 2676500 0.37 Orix Leasing Pakistan NC OLPL 48.10 48.07 820.529 JUNE 15% 22% 35% 10 500 14/10 1988 54.50 24.70 17993500 6.29 Pervez Ahmed Securities Ltd NC PASL 3.07 3.08 1865.685 JUNE NIL NIL NIL 10 500 25/10 2007 6.60 2.77 323819000 2.66 Pak- Gulf Leasing Company NC PGLC 9.00 8.59 253.698 JUNE NIL NIL NIL 10 500 17/10 1996 20.95 10.22 1020000 1.15 Standard Chartered Leasing NC SCLL 8.99 - 978.355 JUNE 8% 8% 8% 10 500 18/10 1994 10.86 7.00 3080500 1.12 SFL Limited NC SFLL 67.00 - 200.914 JUNE NL 10% NIL 10 500 18/10 2013 67.12 40.90 30500 3.24 Security Investment Bank Ltd NC SIBL 2.84 2.72 514.336 DEC NIL NIL - 10 500 22/04 1992 4.69 2.05 1019500 0.06 Security Leasing Corporation NC SLCL 3.38 - 363.000 JUNE NIL NIL NIL 10 500 21/11 1995 8.00 2.50 2337000 (3.71) Security Leasing Corp.(Pref) 9.1% NC SLCPA NT - 112.500 JUNE - - 10 500 19/08 2003 .00 .00 0 - Saudi Pak Leasing Company NC SPLC 2.77 2.55 451.605 JUNE NIL NIL NIL 10 500 19/12 1991 4.16 2.04 24074500 3.12 Trust Investment Bank Ltd NC TRIBL 1.23 1.22 585.530 JUNE NIL NIL NIL 10 500 24/10 1992 2.29 1.02 9411500 0.05 Trust Securities & Brokerage NC TSBL 3.00 - 100.000 JUNE NIL NIL NIL 10 500 23/10 1994 4.44 1.25 609000 (0.53) 34150.572 2892170000 EQUITYINVESTMENTINSTRUMENTS Allied Rental Modaraba NC ARM 51.50 49.26 1218.750 JUNE 30%10%B20%R30%5%B20%R 30% 20%R 10 500 23/10 2007 68.95 39.50 425000 5.34 Allied Rental Modaraba ( R ) NC ARMR2 27.00 - 243.750 JUNE NL NL - 10 500 - 2014 27.55 26.18 7000 - B.F. Modaraba NC BFMOD 6.83 - 75.151 JUNE 5% NIL NIL 10 500 23/10 1989 8.40 3.60 991000 0.59 B.R.R. Guardian Modaraba NC BRR 6.90 6.8 780.463 JUNE 1.8% 3.1% 2.4% 10 500 25/10 1985 6.55 4.75 56013500 0.53 Crescent Standard Modaraba NC CSM 2.11 2.09 200.000 JUNE 1.50% 1.50% 1.50% 10 500 25/10 1994 3.68 1.31 25838000 0.29 AL-Noor Modaraba 1st NC FANM 5.00 5 210.000 JUNE 8% 5% 7.50% 10 500 28/10 1992 7.80 4.55 28088000 1.01 Constellation Modaraba 1st NC FCONM NT - 64.625 JUNE - - 10 500 21/10 1991 .00 .00 0 0.37 First Dawood Mutual Fund NC FDMF NT - 580.750 JUNE NIL NIL NIL 10 500 01/10 2005 .00 .00 0 (0.60) Elite Capital Modaraba 1st NC FECM 4.00 4 113.400 JUNE 5.50% 5.50% 5.50% 10 500 25/10 1992 5.70 3.20 6074500 0.80 Equity Modaraba 1st NC FEM 4.85 4.8 524.400 JUNE NIL NIL 3.75% 10 500 15/11 1992 7.86 3.80 7127500 0.47 First Fidelity Leasing Modaraba NC FFLM 3.50 - 264.138 JUNE 5% NIL NIL 10 500 24/10 1992 7.00 2.45 8418500 0.14 Habib Modaraba 1st NC FHAM 9.02 9.03 1008.000 JUNE 20% 20% 22% 5 500 10/09 1985 10.49 8.50 9598000 1.41 IBL Modaraba 1st NC FIBLM 3.40 3.37 201.875 JUNE NIL 3.35% 3.31% 10 500 16/10 1990 5.00 1.81 5003000 0.45 13

- 14. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate Imrooz Modaraba 1st NC FIMM 52.32 - 30.000 JUNE 65% 100% 50% 10 500 10/10 1994 80.14 52.32 6000 5.50 National Bank Modaraba 1st NC FNBM 3.51 - 250.000 JUNE 10% NIL NIL 10 500 23/10 2003 5.65 2.45 2768000 (1.36) Punjab Modaraba 1st NC FPJM 4.14 4.22 340.200 JUNE NIL NIL 5% 10 500 24/10 1993 5.35 1.82 39054000 2.18 Paramount Modaraba 1st NC FPRM 15.32 - 92.230 JUNE 21% 30%R 11% 10%B 13% 10%B 10 500 24/10 1995 20.93 12.50 176000 1.47 Tri-Star Modaraba 1st NC FTSM 5.77 - 211.631 JUNE NIL NIL NIL 10 500 18/10 1990 8.50 5.81 20500 (0.07) U.D.L. Modaraba 1st NC FUDLM 26.23 26.29 263.866 JUNE 15% 20% 21% 10 500 16/10 1991 31.90 13.50 19986500 2.59 Golden Arrow Selected Stocks Fund NC GASF 10.50 10.5 760.492 JUNE 24% 42% 86% 5 500 20/10 1983 11.50 8.15 82132500 4.83 KASB Modaraba XD NC KASBM 3.85 - 480.664 JUNE 6.50% NIL 70%R 2.4% 10 500 21/11 1990 5.10 2.20 6386000 0.84 Modaraba Al-Mali NC MODAM 2.50 2.5 184.240 JUNE NIL 1.25% NIL 10 500 19/10 1987 3.75 1.56 8979500 (1.34) Pak Modaraba 1st NC PAKMI 1.90 1.93 125.400 JUNE 1.20% 1.20% 1.50% 10 500 24/10 1991 4.35 1.51 4536500 0.20 PICIC Growth Fund NC PGF 25.62 25.73 2835.000 JUNE 17.50% 45% 45% 10 500 18/09 1980 34.80 24.20 57625500 6.42 PICIC Investment Fund NC PIF 12.21 12.14 2841.250 JUNE 8% 22% 22% 10 500 18/09 2004 16.00 11.35 60796000 3.32 Prudential Modaraba 1st NC PMI 1.75 1.74 872.177 JUNE 3% 2.30% 1.40% 10 500 24/10 1990 2.90 1.52 16376000 0.29 Pak Oman Advantage Fund NC POAF 9.50 10.49 1000.000 JUNE 10.18% 7.43% 7.66% 10 500 24/10 2007 10.74 6.52 1022500 0.80 Standard Chartered Modaraba NC SCM 25.25 - 453.835 JUNE 17.50% 20% 30% 10 500 20/10 1987 28.65 17.00 3488000 4.00 Trust Modaraba NC TRSM 4.06 4.06 298.000 JUNE NIL 6% 5% 10 500 18/10 1991 4.85 3.45 490500 0.67 Tri-Star Mutual Fund NC TSMF 4.73 4.61 50.000 JUNE NIL NIL NIL 10 500 26/08 1994 7.49 3.00 15100000 (2.69) Unicap Modaraba NC UCAPM 1.75 1.75 136.400 JUNE NIL NIL NIL 10 500 18/10 1991 3.00 1.39 5469000 0.03 16710.687 471997000 SOFTWAREANDCOMPUTERSERVICES NetSol Technologies NC NETSOL 35.16 35.09 889.699 JUNE NIL 10% 10%B NIL 10 500 17/10 2005 51.15 22.50 134484500 (6.95) 889.699 134484500 TECHNOLOGYHARDWAREANDEQUIPMENT Avanceon Limited NC AVN 30.64 30.76 1056.993 DEC NL NL - 10 500 15/04 2014 41.19 15.00 271083500 5.80 TPL Trakker Limited NC TPL 8.30 8.27 2172.490 JUNE NIL NIL NIL 10 500 16/10 2012 11.30 6.33 69455500 0.40 3229.483 340539000 1152118.563 44678376380 DEFAULTERS SEGMENT** FORESTRY (PAPER AND BOARD) Abson Industries 5.11.1.(b)(d)(e)(g) T2 ABSON NT - 31.000 JUNE - - 10 500 22/12 1993 .00 .00 0 - 31.000 0 INDUSTRIAL METALS AND MINING Dost Steels 5.11.1.(a) NC DSL 3.61 3.62 674.645 JUNE NIL NIL NIL 10 500 20/10 2007 6.20 2.65 17791000 (0.19) Metropolitan Steel Corp. 5.11.1.(b)(e) NC MSCL NT - 309.776 JUNE NIL NIL - 10 500 25/05 1960 .00 .00 0 (4.03) Quality Steel Works5.11.1.(b)(c)(e)(g) T2 QUSW NT - 17.718 JUNE - - 10 500 15/02 1970 .00 .00 0 0.56 1002.139 17791000 CONSTRUCTIONANDMATERIALS(CEMENT) Dadabhoy Cement 5.11.1.(e) NC DBCI 4.08 4.08 982.366 JUNE NIL NIL NIL 10 500 05/10 1992 9.48 3.03 32421500 (1.18) Dadabhoy Construction 5.11.1.(e)(g) T2 DCTL NT - 23.228 JUNE NIL NIL NIL 10 500 05/10 1990 .00 .00 0 0.79 Mineral Grinding 5.11.1.(b)(d)(e)(g) T2 MIGM NT - 36.000 JUNE - - 10 500 01/06 1991 .00 .00 0 - 1041.594 32421500 GENERAL INDUSTRIALS Dadabhoy Sack (*) 5.11.1.(e)(g) NC DBSL NT - 40.000 JUNE NIL NIL NIL 10 500 05/10 1996 .00 .00 0 (1.30) Hashimi Can Co. 5.11.1.(b)(e)(g) T2 HACC NT - 16.335 JUNE - - 10 500 18/10 1962 .00 .00 0 (9.48) 56.335 0 ENGINEERING Dewan Automotive Engineering5.11.1.(b)(e) NC DWAE NT - 214.000 JUNE NIL - 10 500 17/10 1986 5.30 2.31 1688000 (9.01) 214.000 1688000 14 SUB TOTAL SUB TOTAL

- 15. D A I L Y Q U O T A T I O N S C O M P A N Y / S E C T O R D I S T R I B U T I O N S FOR FRIDAY 19-12-2014 Symbol Code TODAY'S RATES RS. PAID-UP CAPITAL (RS.INMILLION) YEAR ENDING 2012 2013 2014 MKT. LOT PREVIOUS BOOK CLOSURE YEAR OF LISTING PAID -UP- VALUE RS. HIGH RATE RS. LOW RATE RS. TURNOVER JAN - NOV 2014 EPS (Rs) 2013/14 Daily Weighted Avg. Rate INDUSTRIAL TRANSPORTATION Pan Islamic Steamship5.11.1.(b)(d)(e)(g)T2 PANI NT - 50.000 JUNE - - 10 500 24/12 1952 .00 .00 0 - 50.000 0 AUTOMOBILE AND PARTS Bela Automotives 5.11.1.(e)(g) T2 BELA NT - 58.000 JUNE NIL - 10 500 01/05 1994 .00 .00 0 0.06 Transmission Engineering 5.11.1.(b) NC TREI NT - 117.000 JUNE - - 10 500 22/10 1989 .00 .00 0 (2.37) 175.000 0 FOOD PRODUCERS Extraction (Pakistan)5.11.1.(b)(d)(e)(g)T2 EXTR NT - 10.000 SEP - - 10 500 - 1968 .00 .00 0 - Morafco Industries 5.11.1.(g) T2 MOIL NT - 5.683 JUNE - - 10 500 21/09 1966 .00 .00 0 (4.20) Mirza Sugar 5.11.1.(e) NC MZSM 2.99 - 141.000 SEP NIL NIL - 10 500 21/01 1994 5.60 2.13 9747000 (8.63) Saleem Sugar (O) 5.11.1.(b)(e)(g) T2 SLSO NT - 11.216 SEP - - 10 500 29/01 1957 .00 .00 0 (4.13) Saleem Sugar (PP) 5.11.1.(e)(g) T2 SLSOPP NT - .800 SEP - - 5 500 29/01 1957 .00 .00 0 - Saleem Sugar (P) 6% 5.11.1.(e)(g) T2 SLSOPVI NT - 5.000 SEP - - 100 25 29/01 1957 .00 .00 0 - Suraj Ghee Industries5.11.1.(b)(c)(e)(g)T2 SURAJ NT - 9.581 JUNE - - 10 500 23/12 1971 .00 .00 0 - 183.280 9747000 HOUSEHOLD GOODS Casspak Industries5.11.1.(b)(d)(e)(g) T2 CASS NT - 22.000 JUNE - - 10 500 16/12 1992 .00 .00 0 - Husein Industries 5.11.1.(b) NC HUSI NT - 106.259 JUNE NIL - 10 500 04/01 1953 .00 .00 0 (18.02) Nina Industries (*) 5.11.1.(b)(e)(g) NC NINA NT - 242.000 JUNE NIL - 10 500 23/10 1997 .00 .00 0 0.80 Regal Ceramics 5.11.1.(b)(d)(e)(g) T2 REGAL NT - 73.000 JUNE - - 10 500 17/12 1988 .00 .00 0 - 443.259 0 PERSONAL GOODS (TEXTILE) Adil Textile (*) 5.11.1.(g) T2 ADTM NT - 77.258 JUNE NIL NIL - 10 500 08/10 1994 .00 .00 0 (2.50) Annoor Textile 5.11.1.(e)(g) T2 ANNT NT - 8.712 JUNE NIL - 5 500 20/10 1970 .00 .00 0 (0.96) Al-Qaim Textile 5.11.1.(b)(e)(g) T2 AQTM NT - 74.530 JUNE - - 10 500 24/10 1991 .00 .00 0 5.86 Ayaz Textile 5.11.1.(b)(c)(e)(g) T2 AYZT NT - 85.342 SEP - - 10 500 23/10 1992 .00 .00 0 (5.10) Azmat Textile 5.11.1.(b)(d)(e)(g) T2 AZMT NT - 9.500 SEP - - 10 500 31/03 1968 .00 .00 0 - AL-Azhar Textile 5.11.1.(e) NC AZTM NT - 85.504 JUNE NIL NIL NIL 10 500 22/10 1992 .00 .00 0 1.52 Caravan East Fabrics5.11.1.(b)(d)(e)(g)T2 CARF NT - 100.000 JUNE - - 10 500 13/10 1996 .00 .00 0 0.72 (Colony) Sarhad Textile 5.11.1.(g) T2 COST NT - 40.000 JUNE NIL NIL NIL 10 500 25/10 1962 .00 .00 0 (4.30) (Colony) Thal Textile 5.11.1.(b)(e) NC COTT NT - 55.688 JUNE NIL NIL NIL 10 500 23/10 1961 18.00 3.82 9131500 (22.53) Data Textiles 5.11.1.(e) NC DATM NT - 99.096 JUNE NIL NIL - 10 500 24/10 1991 .00 .00 0 (0.04) Elahi Cotton 5.11.1.(e) NC ELCM 62.37 62.34 13.000 JUNE NIL NIL NIL 10 500 18/10 1974 76.56 30.55 47500 2.07 Fatima Enterprises 5.11.1.(g) T2 FAEL NT - 142.310 JUNE NIL NIL NIL 10 500 21/12 1977 .00 .00 0 (17.18) Fateh Textile 5.11.1.(c) NC FTHM NT - 12.500 JUNE 5% NIL - 10 100 25/05 1961 .00 .00 0 3.30 Globe Textile 5.11.1.(e)(g) T2 GLOT NT - 163.674 JUNE NIL NIL NIL 10 500 21/10 1969 .00 .00 0 (2.26) Globe (O.E) Textile 5.11.1.(g) T2 GOEM NT - 46.622 JUNE NIL NIL NIL 10 500 21/10 1982 .00 .00 0 (2.57) Gulistan Textile 5.11.1.(d)(e) NC GUTM NT - 189.838 JUNE NIL NIL NIL 10 500 24/10 1968 15.00 15.00 13000 (9.23) Hajra Textile 5.11.1.(e) NC HAJT NT - 137.500 JUNE NIL NIL - 10 500 24/12 1990 .00 .00 0 (1.50) Hamid Textile 5.11.1.(e)(g) T2 HATM NT - 132.716 JUNE NIL - 10 500 29/10 1991 .00 .00 0 (2.51) Hakkim Textile 5.11.1.(b)(c)(e)(g) T2 HKKT NT - 53.948 SEP - - 10 500 26/03 1989 .00 .00 0 - Ishtiaq Textile 5.11.1.(g) T2 ISHT NT - 42.500 JUNE NIL NIL NIL 10 500 18/10 1989 .00 .00 0 (3.96) Karim Cotton 5.11.1.(g) T2 KACM NT - 11.832 JUNE NIL NIL NIL 10 50 21/10 1970 .00 .00 0 (0.90) Kaiser Arts & Krafts5.11.1.(b)(d)(e)(g) T2 KAKL NT - 85.500 JUNE - - 10 500 25/12 1996 .00 .00 0 - 15