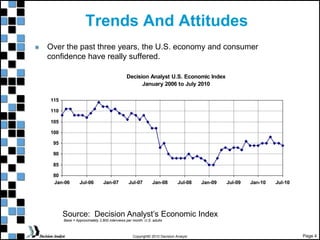

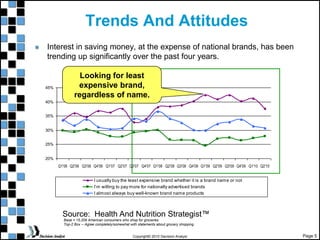

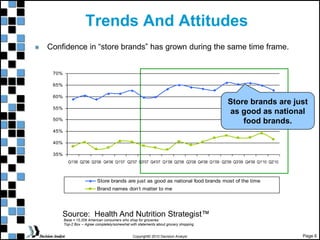

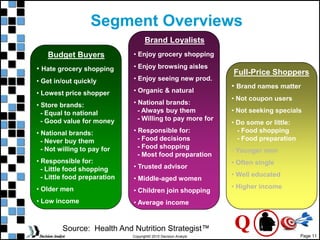

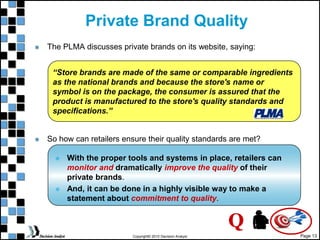

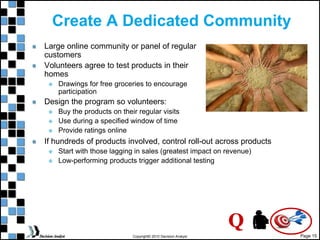

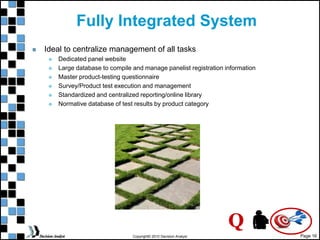

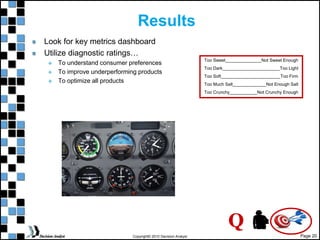

The document outlines the growth and strategic importance of private brands in retail, highlighting their increasing acceptance among consumers and the need for quality improvement. It discusses trends in consumer behavior focusing on cost-savings and evolving perceptions of store brands over recent years. A proposed 'Quality Promise' program aims to enhance private brand quality through rigorous testing and consumer feedback, ultimately driving market share and improving retailer brand images.