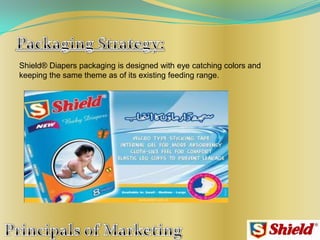

Shield Corporation is re-launching its baby diaper brand Shield Diaper after its initial decline. Shield Diaper aims to be a total solution provider in the baby care category. The Pakistani disposable diaper market is growing at 8-10% annually and is highly seasonal. Shield Diaper will face major competition from established brands like Pampers and Diapy. For success, Shield Diaper will require significant promotion and an innovative product to gain market share from competitors and create a strong brand identity. The target consumer is children aged 0-3 years, while the target purchasing agent is young-to-middle aged mothers who are influenced by family in their buying decisions.