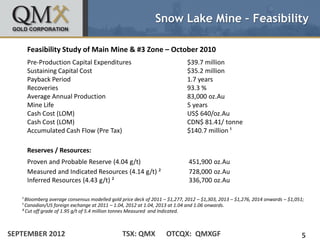

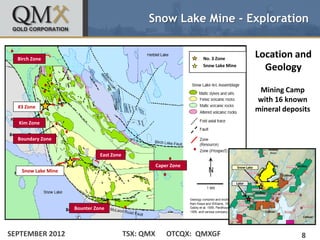

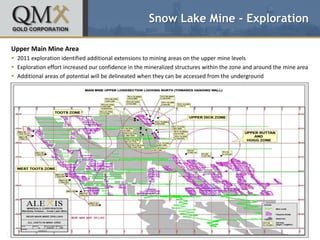

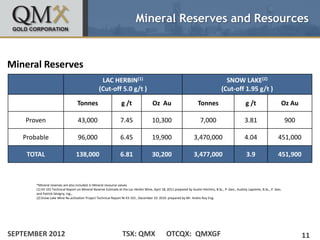

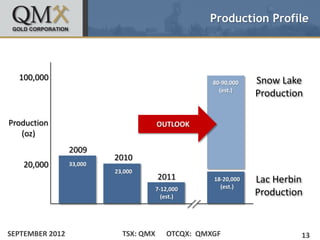

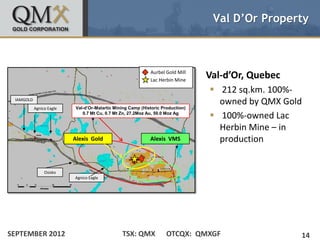

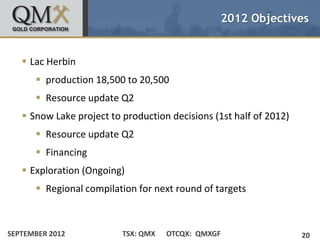

QMX Gold Corporation owns the Snow Lake gold mine in Manitoba, Canada. A 2010 feasibility study outlined a 5-year mine plan to produce 83,000 ounces of gold per year at a cash cost of $640/ounce with total proven and probable reserves of 451,900 ounces. The mine was previously operated until 2005 and all necessary infrastructure is in place. Exploration is also underway at other properties in Manitoba and Quebec that have the potential to contain gold and volcanic massive sulfide deposits.